编译:深潮TechFlow

我非常喜欢雷·达里奥(Ray Dalio)的《变革中的世界秩序》(Changing World Order)模型,因为它让我们从宏观视角审视问题,看到大局。

与其沉迷于每日加密货币领域的“小剧场”,不如关注行业的长期趋势。这也是我们应该看待加密货币的方式。

这不仅仅是叙事的快速转变,而是整个行业秩序的根本变化。

加密货币市场已经不再是 2017 年或 2021 年的模样。

以下是我认为行业秩序已经发生变化的几个方面。

大轮换:加密行业的资产轮换

比特币和以太坊的 ETF 推出,是一个重大转变。

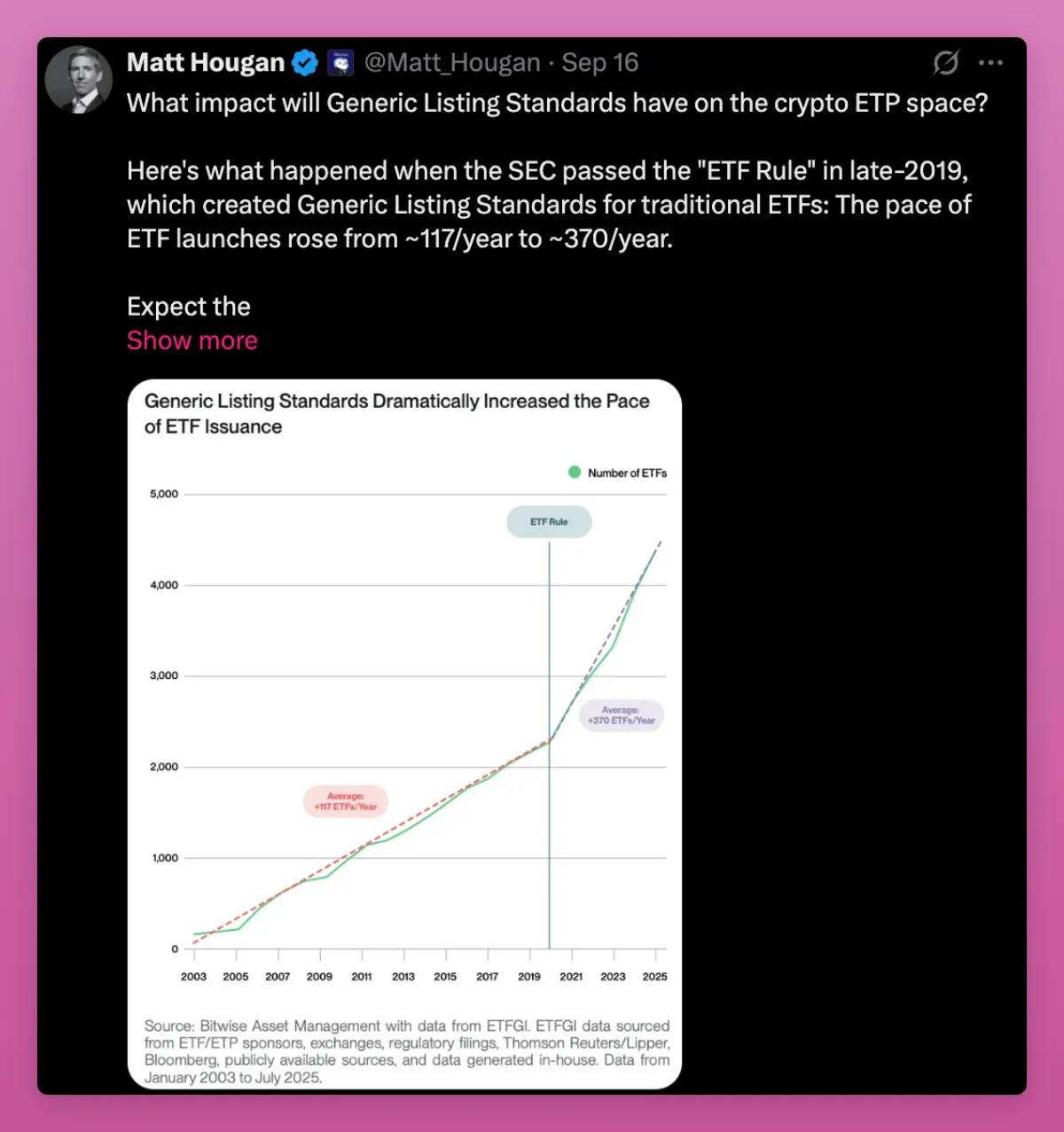

就在本月,SEC 批准了通用商品交易所交易产品(ETP)的上市标准。这意味着审批流程加快,更多资产将进入市场。灰度(Grayscale)已经基于这一变化提交了申请。

比特币 ETF 创造了历史上最成功的发行记录。以太坊 ETF 起步较慢,但即使在疲弱的市场中,现在也持有数十亿美元资产。

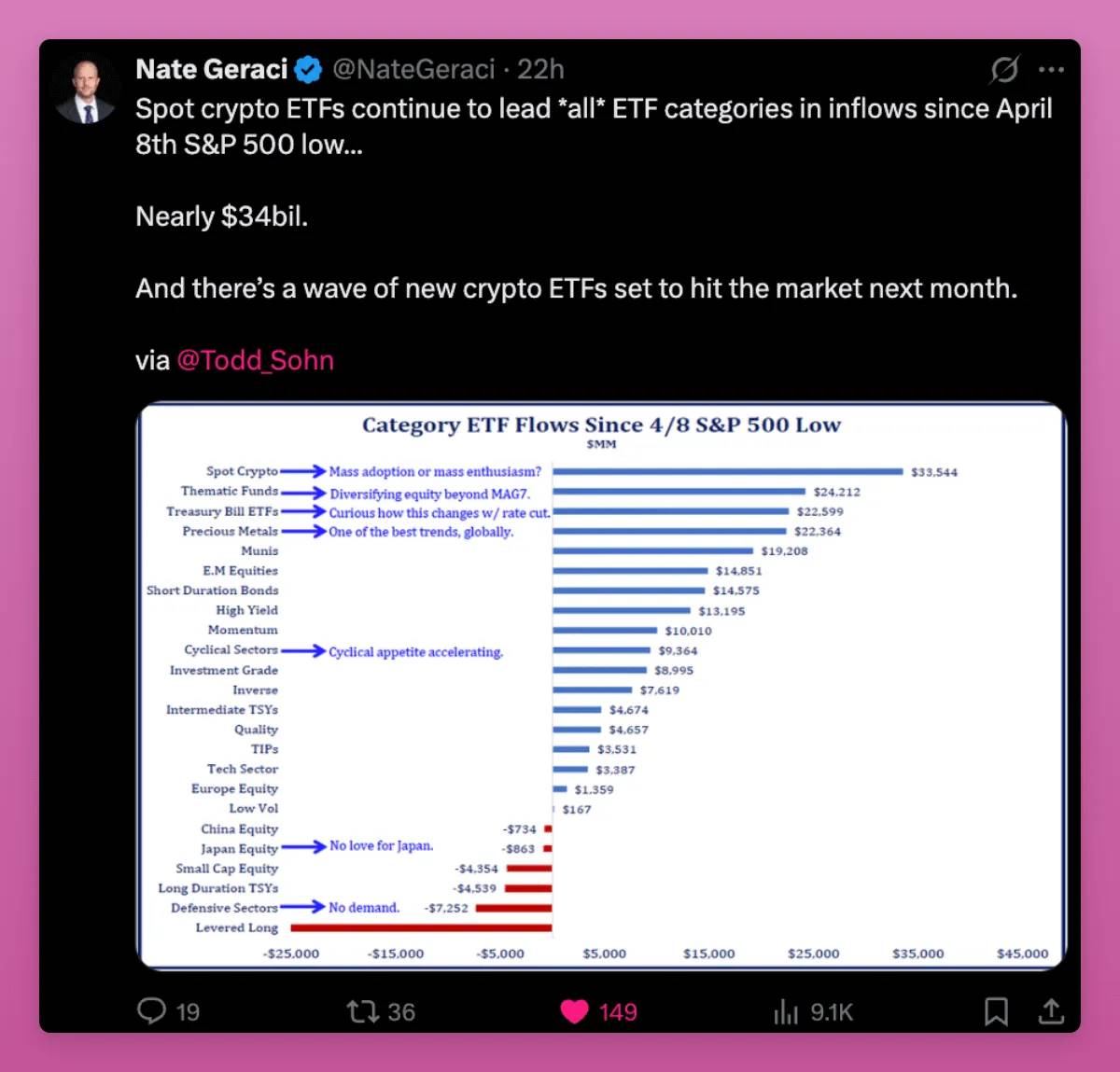

自 4 月 8 日以来,现货加密ETF在所有ETF类别中资金流入领先,达到了 340 亿美元,超过了主题类 ETF、国债和贵金属。

购买者包括养老金基金、顾问和银行。加密货币现在与黄金或纳斯达克一样,成为投资组合中的一部分。

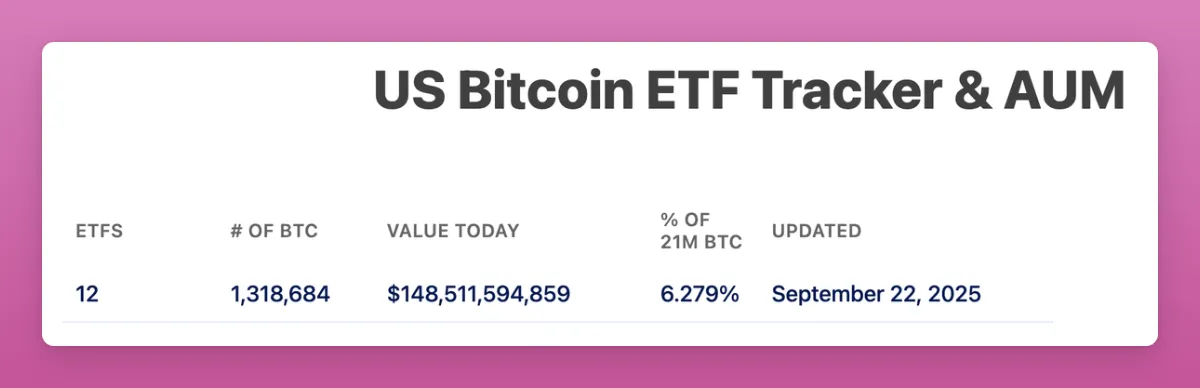

比特币 ETF 持有 1500 亿美元资产管理规模,占总供应量的 6%以上。

以太坊 ETF 则占总供应量的 5.59%。

这一切仅仅发生在一年多一点的时间内。

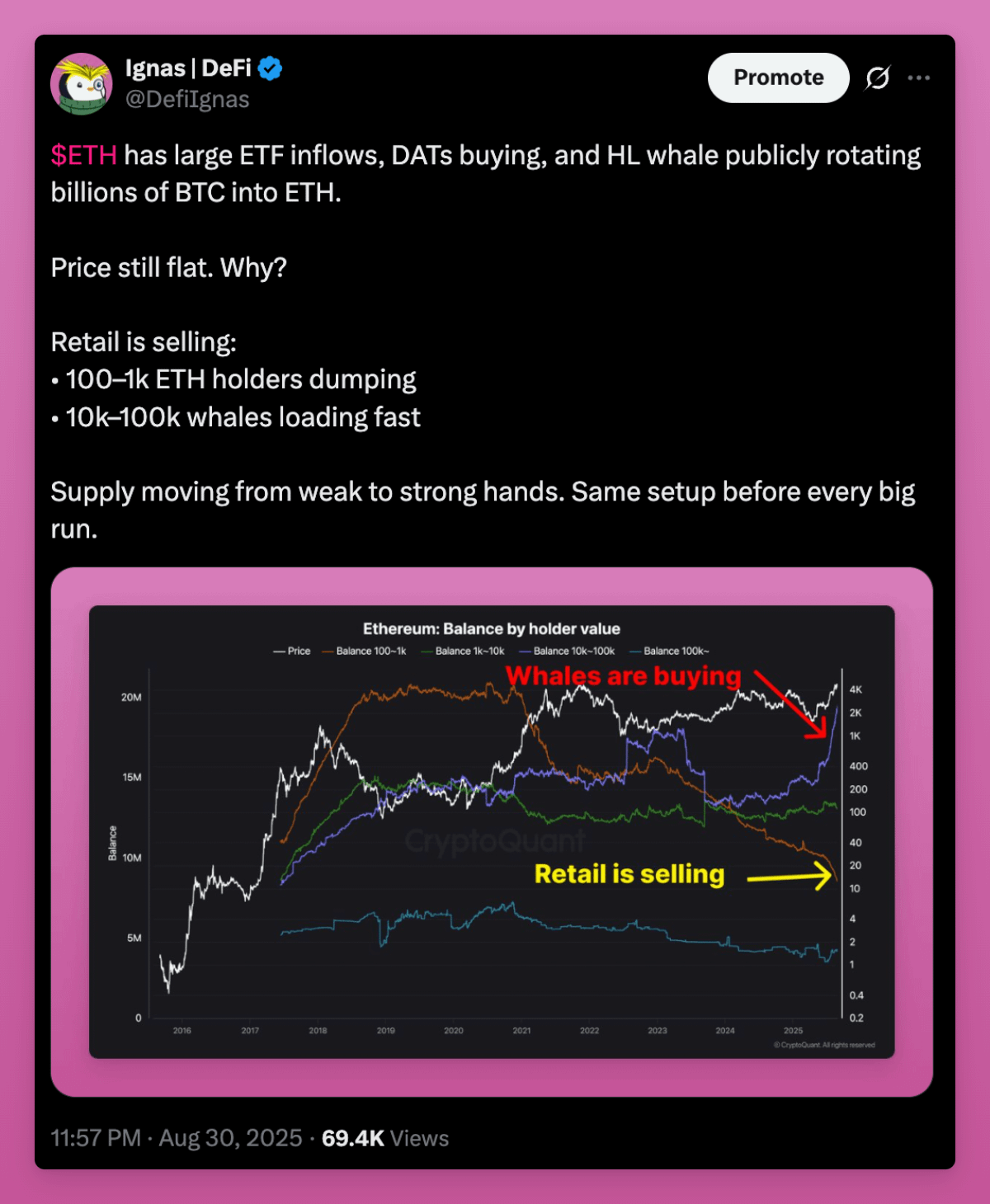

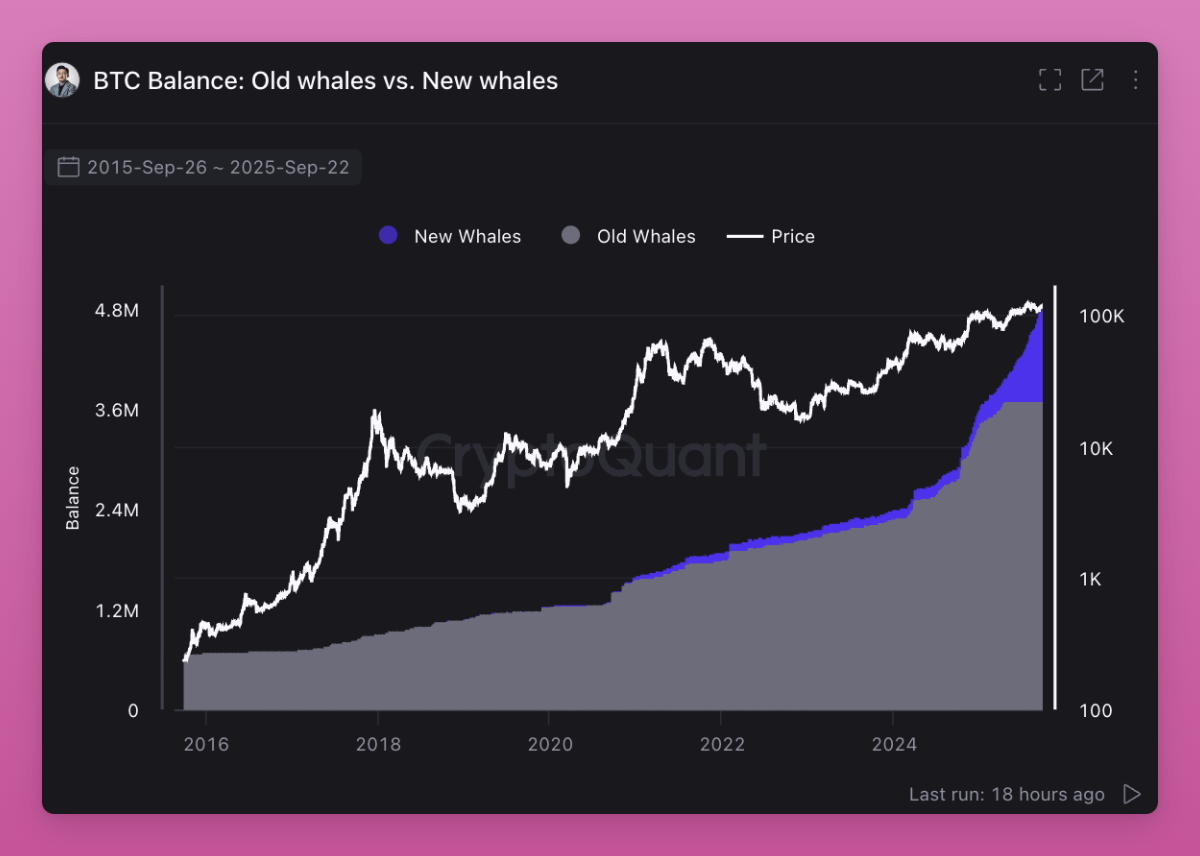

ETF 现在是比特币和以太坊的主要买家,它们将所有权基础从散户转向机构。从我的帖子中可以看到,鲸鱼正在买入,而散户在卖出。

更重要的是,“老鲸鱼”正在将资产卖给“新鲸鱼”。

所有权正在发生轮转。相信四年周期的投资者正在卖出,他们期待旧剧本的重复。然而,某些不同的事情正在发生。

低位买入的散户正在将资产卖给 ETF 和机构。这种转移将成本基准提高,同时也为未来周期抬高了底部,因为新持有者不会在小幅获利时卖出。

这就是加密行业的大轮换。加密资产正在从投机性散户手中转移到长期配置者手中。

通用上市标准开启了这一轮换的下一阶段。

2019 年,类似的规则在股票领域使 ETF 发行数量翻了三倍。预计加密领域也会出现类似情况。许多新的 ETF 即将推出,例如 SOL、HYPE、XRP、DOGE 等,为散户提供退出流动性。

关键问题仍然是:机构购买力能否平衡散户的卖压?

如果宏观环境保持稳定,我相信那些现在卖出、期待四年周期的人,将会在更高的价位买回。

大盘暴涨的终结

过去,加密市场通常是整体联动的。比特币先动,然后以太坊,随后其他资产跟随。小市值代币暴涨,因为流动性沿风险曲线下移。

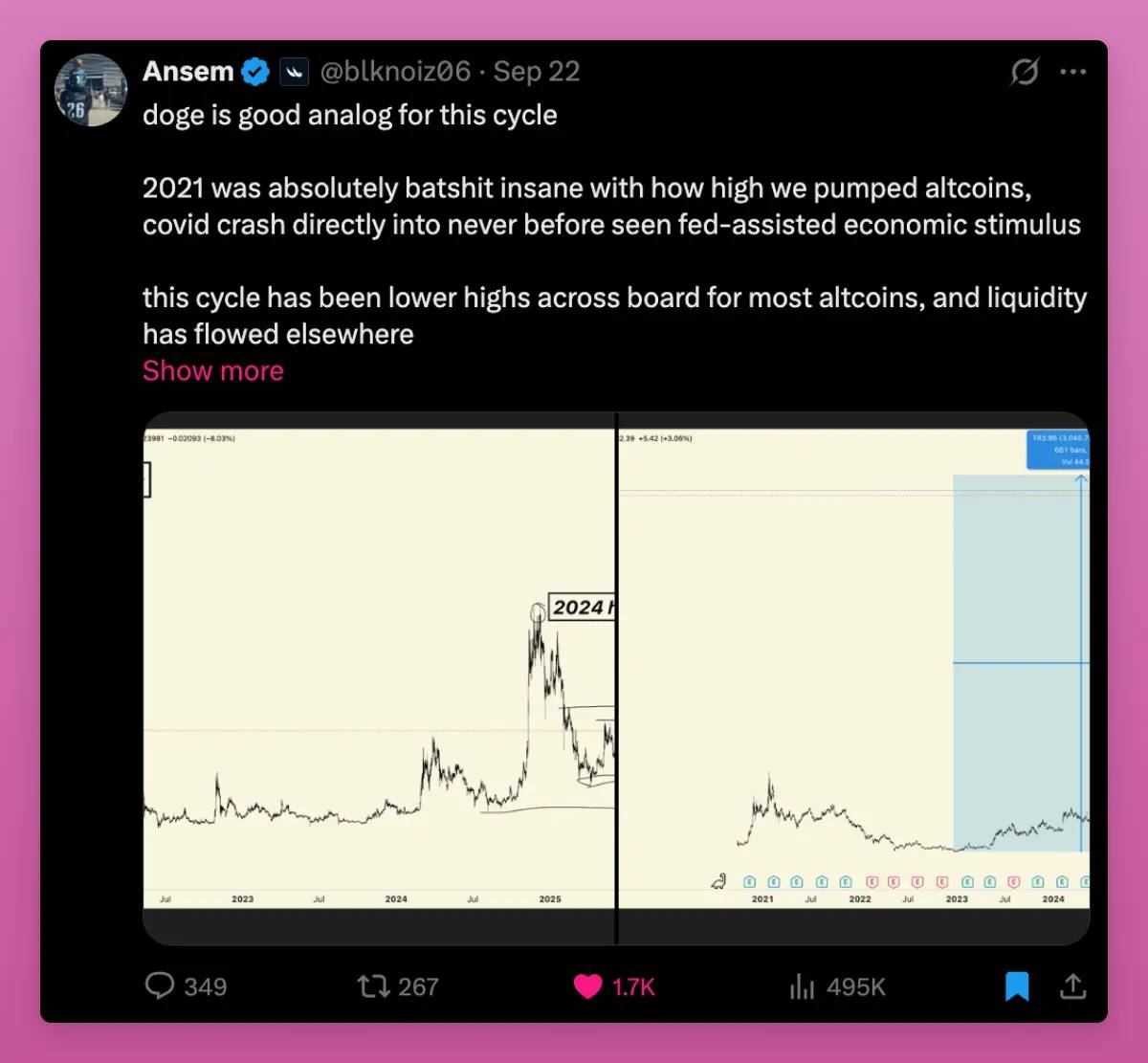

这次情况不同,并非所有代币都同步上涨。

现在市场上有数百万种代币。每天都有新币在 pump.fun 上推出,“创作者”将注意力从旧代币转移到他们自己的 Memecoin 上。供应量激增,而散户的关注度保持不变。

流动性分散在过多的资产上,因为发行新代币几乎没有成本。

过去,低流通量、高完全稀释估值(FDV)的代币曾经很热门且适合空投。但现在散户已经吸取教训。他们更倾向于选择能够带来价值回报或至少具有强文化吸引力的代币(例如$UNI尽管交易量强劲,但未能上涨)。

Ansem 的观点是正确的,我们已经触及了纯粹投机的顶峰。新的趋势是收入,因为它具有可持续性。拥有产品市场契合度和费用的应用将上涨,而其他则不会。

有两个显著点:用户为投机支付高费用,以及区块链与传统金融系统的效率对比。前者已达到峰值,而后者仍有增长空间。

Murad 提出了另一个我认为 Ansem 忽略的好观点。那些仍然能够上涨的代币通常是新的、奇怪的、容易被误解的,但却拥有强大信念的社区支撑。我也是那些喜欢新奇事物的人之一(就像我的 iPhone Air)。

文化意义决定了生存与失败之间的差距。一个清晰的使命,即使起初看起来很疯狂,也可以让社区坚持到采用雪球效应出现。我会将 Pudgy Penguins、Punk NFT和 Memecoin 归入这一类别。

然而,并非所有闪亮的新事物都能成功。Runes、ERC404 等让我体会到新颖性如何快速消退。叙事可能在达到临界质量之前就消失。

我认为这些观点共同解释了新秩序。收入筛选掉弱项目,文化支撑那些被误解的项目。

两者都重要,但方式不同。最大的赢家将是能够结合两者的少数代币。

稳定币秩序赋予加密行业可信度

最初,交易者持有 USDT 或 USDC 用于购买 BTC 和其他加密货币。新资金流入是看涨的,因为它们转化为现货买入。当时 80%到 100%的稳定币流入最终用于购买加密货币。

现在情况发生了变化。

稳定币资金进入借贷、支付、收益、金库管理和空投挖矿领域。其中一些资金从未触及 BTC 或 ETH 现货买入,但仍然提升了整个系统。更多的 L1 和 L2 交易。更多的 DEX 流动性。更多借贷市场的收入,例如 Fluid 和 Aave。整个生态系统的货币市场更深。

一个新趋势是以支付为优先的 L1。

Stripe 和 Paradigm 的 Tempo 专为高吞吐量稳定币支付设计,配备 EVM 工具和原生稳定币 AMM。

Plasma 是一个由 Tether 支持的 L1,专为 USDT 设计,拥有银行应用和面向新兴市场的支付卡。

这些区块链将稳定币推向实体经济,而不仅仅是交易。我们又回到了“用于支付的区块链”的话题。

这可能意味着什么(说实话我还是不确定)。

-

Tempo:Stripe 的分发能力巨大。这有助于加密货币的广泛采用,但可能会绕过 BTC 或 ETH 的现货需求。Tempo 最终可能会像 PayPal 一样:流量巨大,但对以太坊或其他区块链的价值积累却很少。目前尚不清楚的是,Tempo 是否会发行代币(我认为会有),以及有多少手续费收入会回流到加密货币中。

-

Plasma:Tether 已经主导了 USDT 的发行。通过连接区块链 + 发行方 + 应用,Plasma可能会将新兴市场支付的很大一部分集中在一个封闭生态系统中。这就像封闭的苹果生态系统与以太坊和 Solana 所倡导的开放互联网之间的对抗。 它引发了与 Solana、Tron 和 EVM Layer2 争夺 USDT 默认链地位的斗争。我认为 Tron 在这方面损失最大,而以太坊本来就不是支付链。然而,Aave 和其他公司在 Plasma 上发布对 ETH 来说是一个巨大的风险……

-

Base:ETH L2 的救星。由于 Coinbase 和 Base 推动通过 Base 应用进行支付并获得 USDC 收益,它们将继续推动以太坊和 DeFi 协议的费用上涨。生态系统仍然分散但竞争激烈,从而进一步扩大流动性。

监管正在配合这一转变。《GENIUS法案》正在推动其他国家在全球范围内追赶稳定币的步伐。

此外,美国商品期货交易委员会(CFTC)刚刚允许使用稳定币作为衍生品中的代币化抵押品。这为资本市场的非现货需求增加了支付需求。

总体而言,稳定币和新的稳定 L1 赋予加密行业可信度。

曾经只是一个赌博场所,现在具有了地缘政治重要性。投机仍然是第一大用途,但稳定币显然是加密领域中的第二大应用场景。

赢家是那些能够捕捉稳定币流量并将其转化为粘性用户和现金流的区块链和应用程序。最大的未知数是,像 Tempo 和 Plasma 这样的新 L1 能否成为在其生态系统内锁定价值的领导者,还是以太坊、Solana、L2 和 Tron 能够反击。

下一笔大交易将于 9 月 25 日在 Plasma 主网上进行。

DAT:非 ETF 代币的新杠杆和 IPO 模式

数字资产财库(DATs)让我感到担忧。

每一轮牛市周期我们都会找到新的方式为代币加杠杆。这推动价格上涨,远超现货买入的能力,但当市场逆转时,去杠杆化总是非常残酷。FTX 崩溃时,CeFi 杠杆的强制卖出压垮了市场。

本轮周期中的杠杆风险可能来自 DAT 。如果它们以溢价发行股份、筹集债务,并将资金投入代币,它们会放大上涨。而当市场情绪转向时,这些结构可能会加剧下跌。

强制赎回或股份回购资金枯竭可能会触发沉重的卖压。因此,尽管 DAT 扩大了市场准入并带来了机构资本,它们也增加了一个新的系统性风险层。

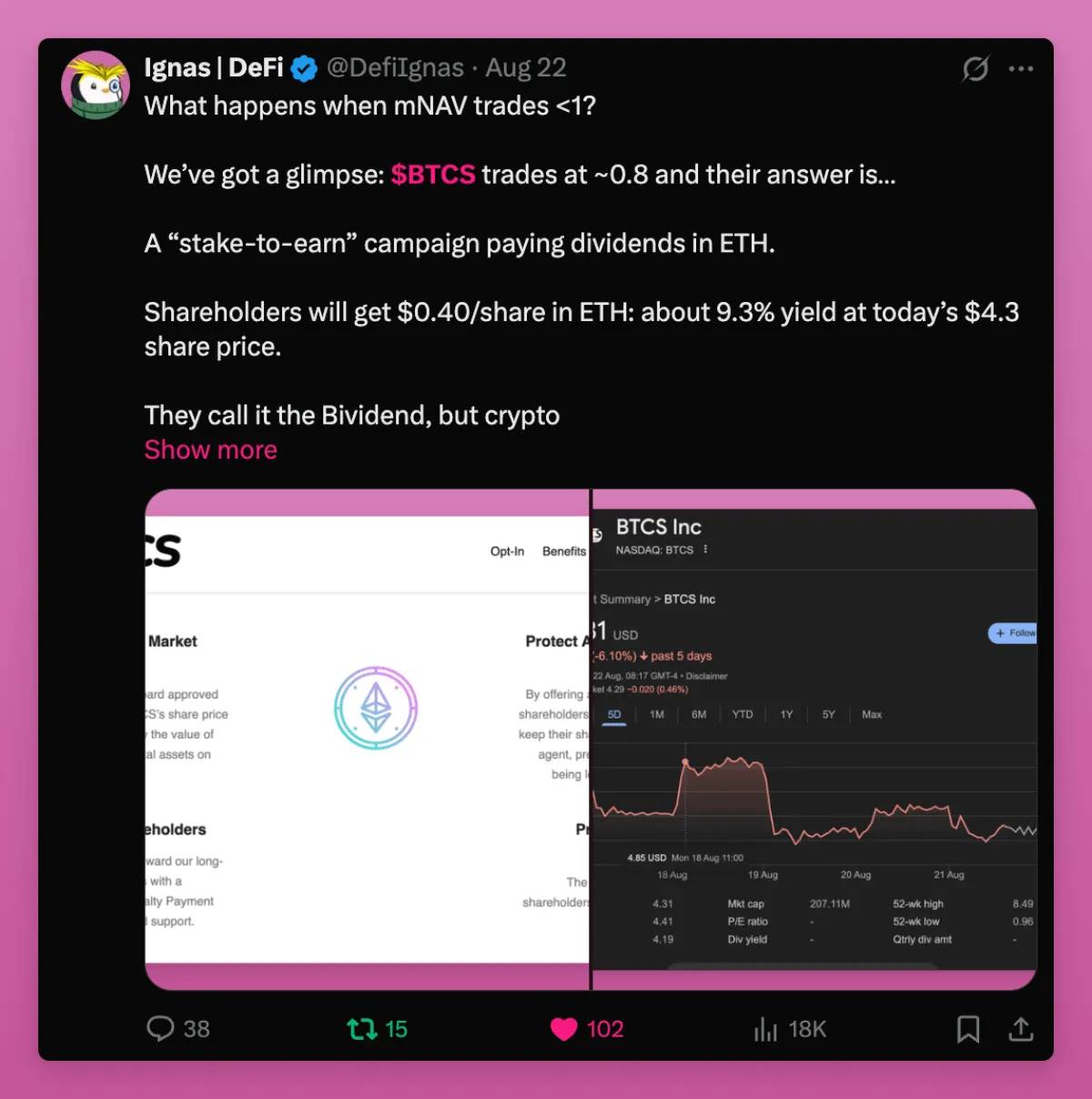

我们举了一个例子,说明当 mNAV > 1 时会发生什么。简而言之,他们将 ETH 发给股东,而这些股东很可能会抛售。然而,尽管进行了“空投”,BTCS 的交易价格仍为 0.74 mNAV。这很糟糕。

另一方面,DAT 是连接代币经济与股票市场的新桥梁。

正如 Ethena 创始人所写:

“我担心的是,我们可能已经耗尽了加密原生资本,无法将山寨币推高到超过上一轮周期的峰值。如果我们看2021年第四季度和2024年第四季度的山寨币总名义市值峰值,它们都停留在大约1.2万亿美元左右。考虑通货膨胀调整后,这两个周期的数值几乎完全相同。也许这就是全球散户资本能够为99%‘空气币’出价的极限?”

这就是 DAT 为何重要的原因。

散户资本可能已经触顶,但拥有真实业务、真实收入和真实用户的代币可以进入规模更大的股票市场。与全球股票市场相比,整个山寨币市场只是一个微不足道的数字。 DAT 为新资本流入打开了一扇门。

不仅如此,由于很少有山寨币具备推出 DAT 所需的专业知识,那些能够做到的项目将注意力从数百万种代币重新吸引到少数“谢林点”(深潮注:Schelling Point,也叫 Focal Point,博弈论重要概念,指在没有沟通的情况下,人们会自然而然地选择某个特定的解决方案或聚集点)资产。

他还提到NAV溢价套利并不重要,这本身就是利好。

大多数 DAT 无法像 Saylor 那样通过资本结构使用杠杆,持续维持 NAV 溢价。 DAT 的真正价值不在于溢价游戏,而在于获得资本的渠道。即使是稳定的 1:1 NAV 加上持续的资金流入,也比完全无法获得资本要好。

ENA 和甚至 SOL 的 DAT 遭到批评,因为它们被认为是“工具”,用于套现风险投资基金持有的代币。

尤其是 ENA,由于风险投资基金持有大量代币而特别脆弱。但正因资本配置问题,私人风险投资基金远远超过流动性二级市场需求,退出 DAT 是利好,因为风险投资基金可以将资本重新分配到其他加密资产上。

这很重要,因为风险投资基金在本轮周期中无法退出投资而遭受重创。如果他们能够卖出并获得新流动性,他们就可以为加密领域的新创新提供资金,从而推动行业向前发展。

总体而言,DAT 看好加密货币,尤其是那些无法获得 ETF 的代币。它们允许像 Aave、Fluid、Hype 等拥有真实用户和收入的项目将投资转移到股票市场。

当然,许多 DAT 会失败,并对市场产生溢出效应。但它们也为 ICO 项目带来了 IPO 的机会。

RWA 革命:链上金融生活的可能性

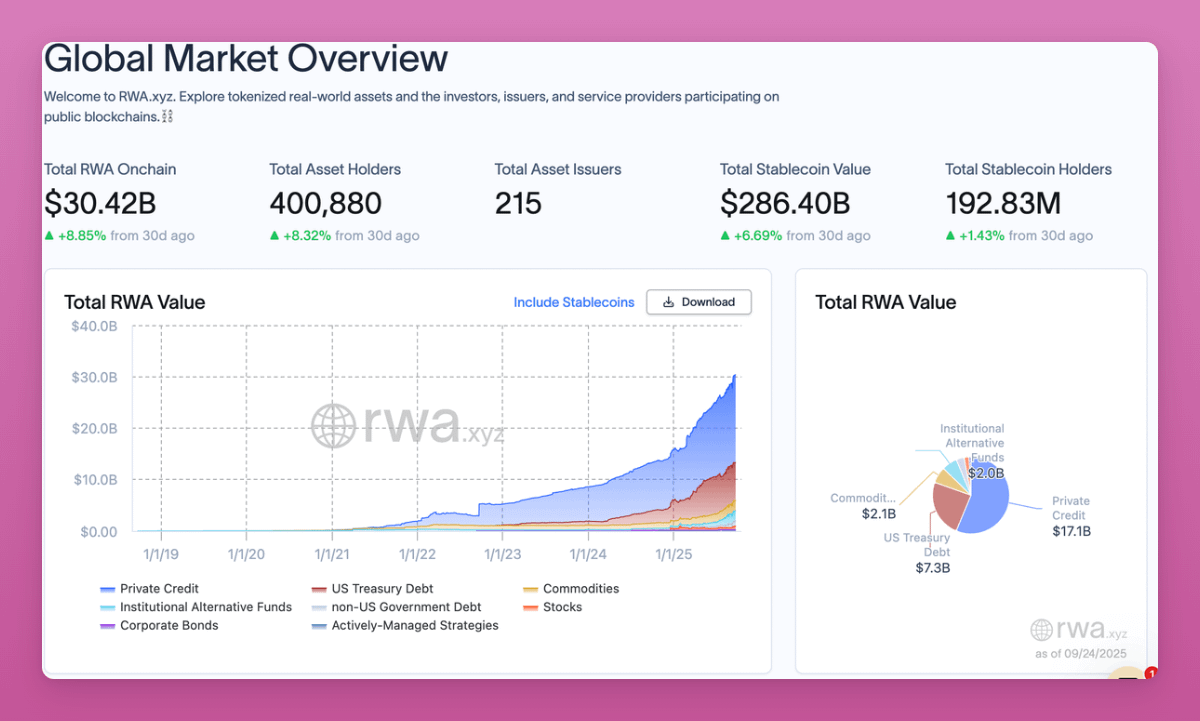

链上 RWA 市场总额刚刚突破 300 亿美元,仅一个月就增长了近 9%。趋势图持续向上。

国债、信贷、大宗商品和私募股权如今都已代币化。转变速度正在迅速上升。

RWA 将世界经济带入了链上。一些重大转变包括:

-

以前,您必须将加密货币卖出换成法币才能购买股票或债券。现在,您可以继续在链上持有 BTC 或稳定币,转入国债或股票,并自行保管。

-

DeFi 摆脱了许多协议的增长引擎——“庞氏骗局”的泥潭。它为 DeFi 和 L1/L2 基础设施带来了新的收入来源。

最重要的变化是抵押品。

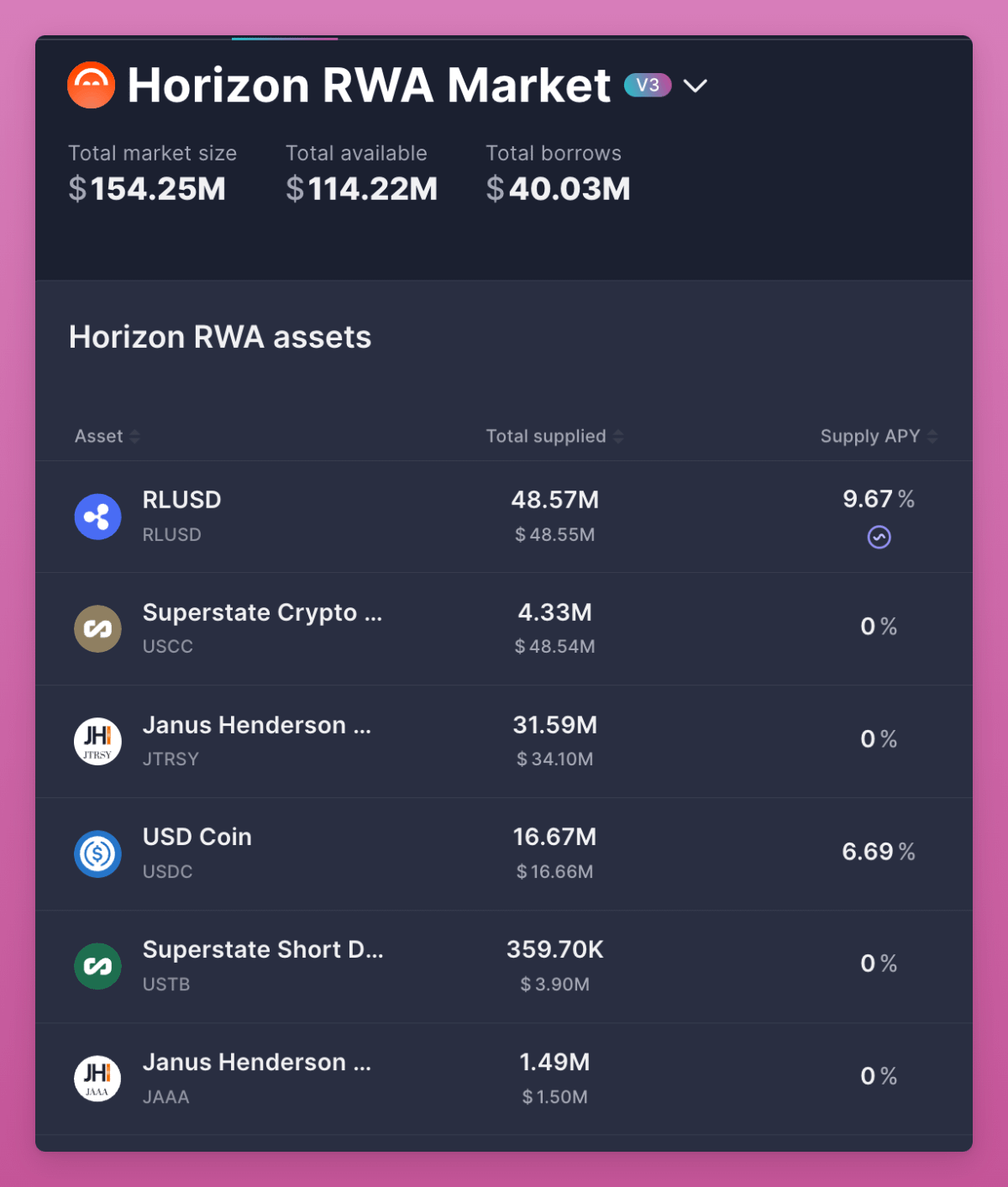

Aave 的 Horizon 允许你存入像标准普尔 500 指数这样的代币化资产,并以此作为抵押进行借贷。但其总锁定价值(TVL)仍然很小,仅为 1.14 亿美元,这意味着 RWA 仍处于相对早期阶段。(注:Centrifuge 正在努力将官方的 SPX500 RWA 上链。如果成功,CFG 可能会表现良好。我对此抱有信心。)

传统金融几乎不可能为散户实现这一点。

RWA 最终让 DeFi 成为真正的资本市场。它们通过国债和信贷设定基准利率。它们扩大了全球覆盖范围,让任何人都可以持有美国国债,无需美国银行(这正在成为全球战场)。

BlackRock 推出了 BUIDL,Franklin 推出了 BENJI。这些并非边缘项目,而是连接数万亿美元和加密货币的桥梁。

总的来说,RWA 是目前最重要的结构性革命。它们使 DeFi 与实体经济息息相关,并为一个可以完全链上运行的世界构建了基础设施。

4 年周期

对于加密货币原生市场来说,最重要的问题是四年周期是否已经结束。我听到周围的人已经在抛售,期待着它再次出现。但我相信,随着加密货币秩序的改变,四年周期将会重演。

这次有所不同。

我用自己的资产下注,因为:

-

ETF 将 BTC 和 ETH 转变为机构可分配资产。

-

稳定币成为地缘政治工具,现在进入支付和资本市场。

-

DAT 为无法获得 ETF 支持的代币开辟了进入股票市场的路径,同时让风险投资基金退出并资助新项目。

-

RWA 将全球经济带到链上,为 DeFi 创建了基准利率。

这不是 2017 年的赌场,也不是 2021 年的狂热。

这是一个新的结构和采用时代,加密货币正在与传统金融融合,同时仍然由文化、投机和信念驱动。

下一轮的赢家将不会来自于“什么都买”的策略。

许多代币可能仍会重复四年周期的暴跌。你需要谨慎选择。

真正的赢家将是那些能够适应宏观和机构变化,同时保持与散户的文化吸引力的代币。

这就是新的秩序。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。