In the development process of the cryptocurrency market, star projects that can change the landscape emerge from time to time. Currently, in the decentralized exchange (DEX) arena, Hyperliquid has maintained its leading position, becoming the top choice for countless professional traders with its ultra-high-performance matching engine and exceptional user experience.

However, in the second half of 2025, a new force is rapidly rising, and that is Aster.

Figure 1: Aster Platform Homepage

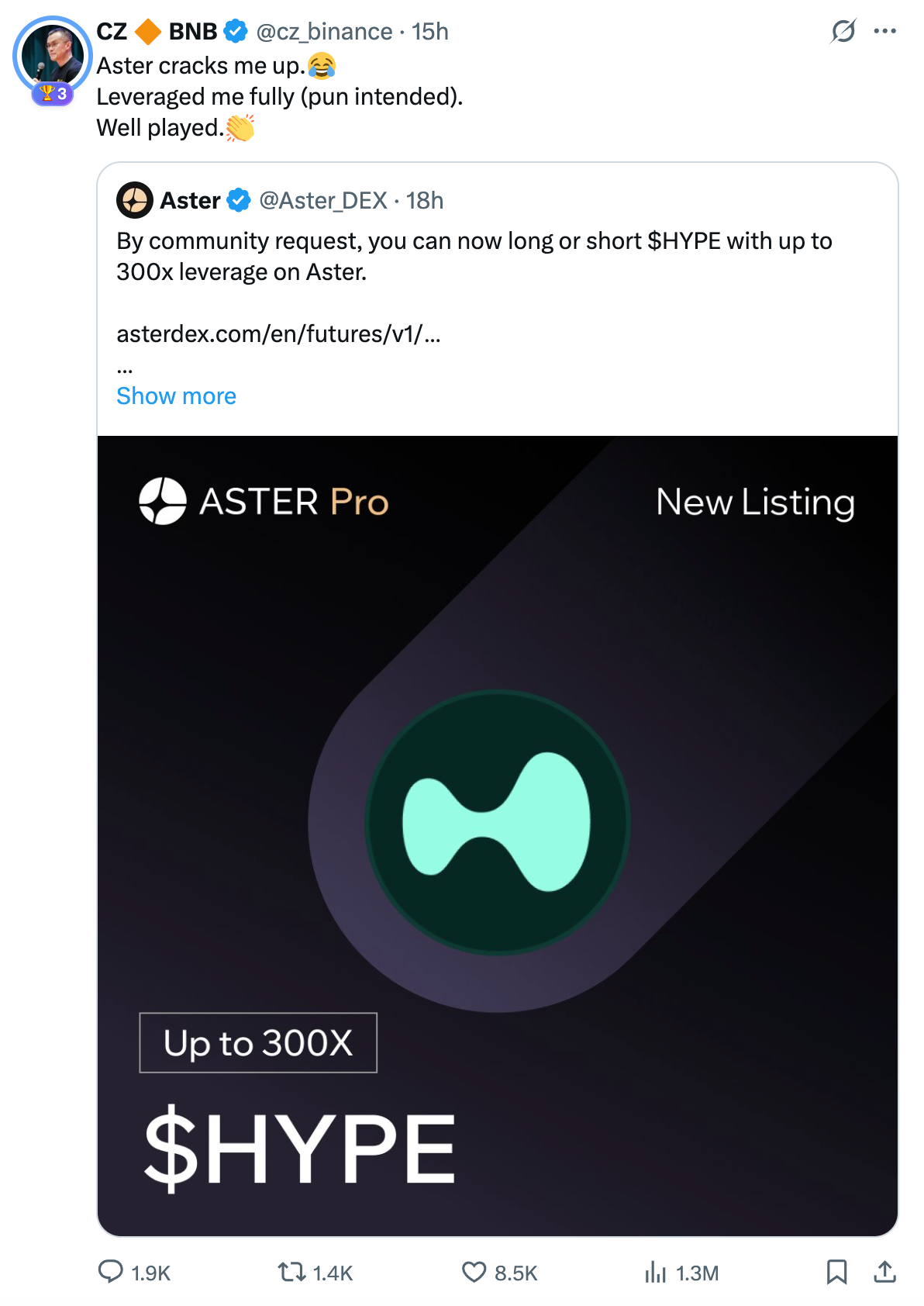

In just a few months, Aster has achieved breakthrough growth in core metrics such as perpetual contract trading volume and TVL (Total Value Locked), and has been referred to in the industry as the "Hyperliquid killer." Even more noteworthy is the platform effect brought by Binance founder CZ, which has significantly increased the attention on this new project.

So, what makes Aster regarded as a strong competitor to Hyperliquid? What are its advantages? How will the competitive landscape between the two evolve? This article will systematically analyze this new war unfolding in the Perps derivatives arena from multiple perspectives.

1. Current Status of the Perps Derivatives Arena

1. Importance of Perpetual Contracts

Perpetual contracts are the most popular derivative tools in the cryptocurrency market. Unlike traditional futures, perpetual contracts have no expiration date, allowing traders to hold positions indefinitely while maintaining the anchoring of contract prices to spot prices through a funding rate mechanism.

In centralized exchanges (CEX), the average daily trading volume of perpetual contracts is often 3 to 5 times that of spot trading. For example, in 2024, Binance's daily futures trading volume once exceeded $60 billion, far surpassing spot trading volume.

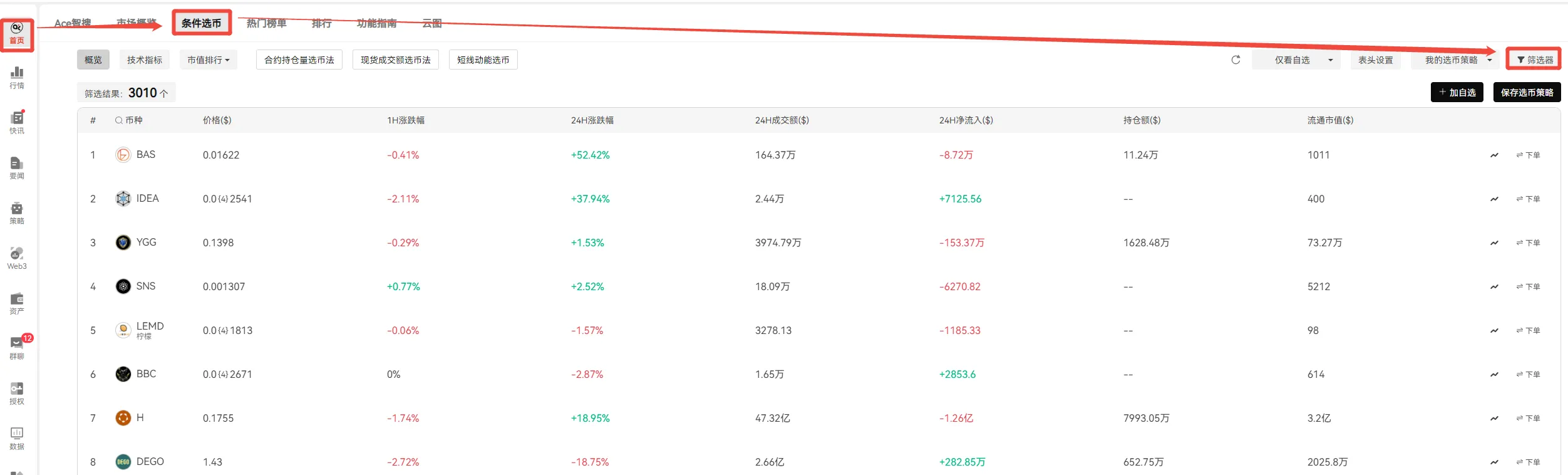

In decentralized exchanges (DEX), perpetual contracts are also seen as the most imaginative growth direction. The leverage in decentralized exchanges can be greater than that in centralized exchanges, especially for certain derivatives trading like perpetual contracts. CEX leverage is usually subject to regulatory restrictions (such as the US SEC or EU MiCA), typically maxing out around 100x-125x, while the decentralized nature of DEX allows platforms like Aster to offer leverage of up to 1001x.

Figure 2: Aster Platform 1001x Leverage Trading Page

2. Hyperliquid's Leading Position

Hyperliquid's success lies in its pioneering path: self-developed high-performance public chain + native matching engine. This means it no longer relies on existing public chains like Ethereum or BSC, but builds its own underlying network, achieving matching speeds and smoothness close to that of CEX.

Figure 3: Hyperliquid Platform Homepage

As of September 24, 2025: Hyperliquid maintains an average daily trading volume of around $1 billion, firmly holding the top position among DEX; open interest (OI) stands at $13.3 billion, with extremely high capital depth; the total number of users exceeds 700,000, far surpassing other similar projects. Hyperliquid is thus hailed as the "on-chain Binance," having established a significant moat in the eyes of many. (Data source: Defilama)

However, the crypto world has never been "monolithic." Every technological innovation and model innovation can rewrite the landscape. The emergence of Aster in the second half of 2025 is making this arena once again shrouded in uncertainty.

2. Aster's Differentiated Advantages

Rather than saying Aster is imitating Hyperliquid, it is more accurate to say it is taking a different path.

1. Innovation in Capital Efficiency

In derivative DEXs like Hyperliquid, users mostly need to use stablecoins (USDT, USDC) as collateral, while other assets (such as stETH, LSD, yield-bearing stablecoins) cannot be directly pledged, leading to low capital utilization.

Aster, however, has achieved the following innovations through a multi-asset collateral mechanism:

Supports staking assets (stETH, rETH, WBETH) as collateral;

Supports yield-bearing stablecoins (such as sDAI, USDe) as collateral;

Users can engage in leveraged trading while earning DeFi yields on their assets.

For example: A user has 1000 stETH, which can earn an annual yield of 3% when staked in Lido. In a traditional derivative DEX, if they want to open a contract, they would have to sell stETH for USDT, losing staking yields. But in Aster, they can directly deposit stETH as collateral while continuing to earn interest and open BTC/ETH perpetual contracts.

This "dual utilization" significantly enhances capital efficiency, especially suitable for DeFi veterans and large capital players.

2. Multi-Chain Expansion Strategy

Hyperliquid follows a single-chain extreme performance route, relying on its self-developed chain to ensure efficient matching. The advantage is speed and a good experience, but the downside is a closed ecosystem, requiring users to migrate assets to use it.

Aster, on the other hand, adopts a multi-chain expansion strategy:

Users can directly connect from Ethereum, BSC, Arbitrum, Optimism, etc.; through cross-chain bridges and liquidity aggregation, it ensures a seamless experience for users across different public chains.

This strategy has three benefits:

Lowers migration barriers: Users do not have to abandon their existing asset ecosystems;

Introduces multi-source liquidity: Assets from different chains can contribute to liquidity pools;

Flexible expansion: It can quickly accommodate more emerging public chains in the future;

This makes Aster's user coverage broader than that of Hyperliquid.

3. Breakthrough in Trading Volume and TVL

According to Defillama data, as of September 24, 2025: Aster's TVL is close to $1.8 billion, ranking among the top in derivative DEXs; its 24-hour trading volume has surpassed $540 million. Although this still lags behind Hyperliquid's $1 billion average daily trading volume, this achievement is quite impressive for a newcomer established only a few months ago.

4. Optimization of User Experience

Aster's product design closely resembles that of CEX:

Professional trading interface: K-line, order book, leverage multiples are similar to Binance;

Hidden orders / iceberg orders: Support large capital users to place orders without affecting the order book.

Figure 4: Aster Platform Hidden Order Promotion Page

Low-latency matching: The gap with CEX has significantly narrowed; friendly UI/UX: Lowers the learning curve for newcomers.

This allows Aster to nearly complete the leap from DEX to CEX in terms of user experience.

3. Competitive Landscape Between Aster and Hyperliquid

One of the core reasons for Aster's rise is its stark strategic contrast with Hyperliquid. To clarify the competition between the two, we can analyze three dimensions: core metrics, strategic direction, and user profiles.

1. Core Metrics Comparison

Figure 5: Core Metrics Comparison Between Aster and Hyperliquid

From the data, Hyperliquid remains the absolute leader, leading by several orders of magnitude in both trading volume and OI. However, Aster's highlight is that its TVL has reached about 20% of Hyperliquid's, indicating its strong capital attraction.

As a new platform that emerged in 2025, its ability to quickly break into the forefront shows that its model indeed possesses differentiated competitive strength.

2. User Profile Comparison

Figure 6: User Profile Comparison Between Aster and Hyperliquid

In other words: Hyperliquid is more like the Binance of the blockchain; Aster is more like the "DeFi derivatives supermarket" on-chain, emphasizing asset flexibility and capital efficiency.

3. Potential Substitution Effect

An important question is: Will Aster take away users from Hyperliquid?

In the short term: Professional traders will still stay on Hyperliquid because it has deeper liquidity and faster matching; but small to medium users, especially DeFi players, may prefer to "mine while trading" on Aster.

In the long term: If Aster can gradually improve its depth and performance, it could very well become the first choice for mainstream users; once capital efficiency becomes the mainstream narrative, Hyperliquid's "performance advantage" may not be enough to lock in users. Therefore, calling Aster the "Hyperliquid killer" is not an exaggeration, as it indeed has the potential to create a substitution effect among certain user groups.

4. CZ's Platform Effect

If Aster's product advantages are the internal factors, then CZ's platform effect is the external factor that has rapidly propelled it to fame.

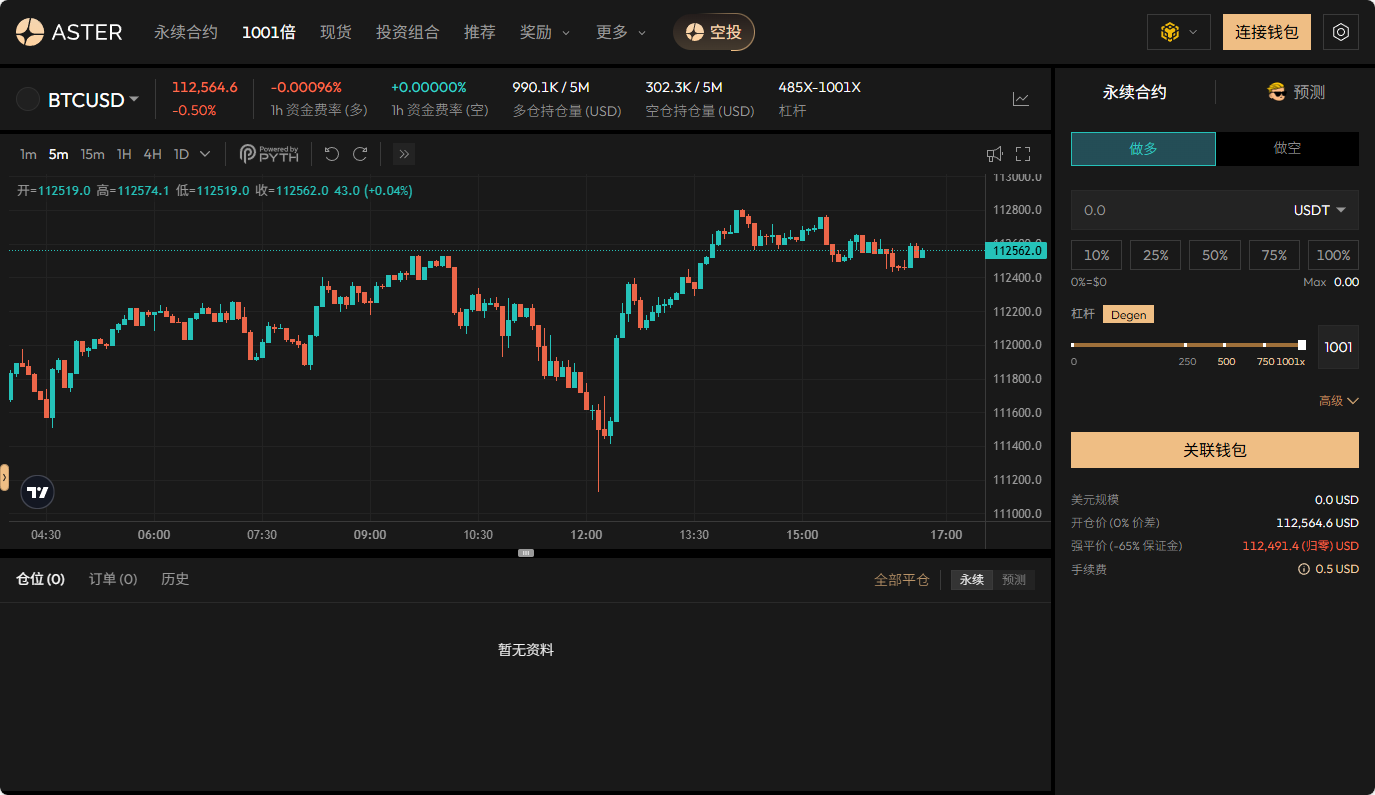

Figures 7, 8: CZ Reposts Aster's Tweet

As the founder of Binance, CZ's influence in the global crypto circle is unparalleled. His tweets, comments, or even a single like can often trigger price fluctuations. In the industry discourse, CZ is also seen as a "weather vane."

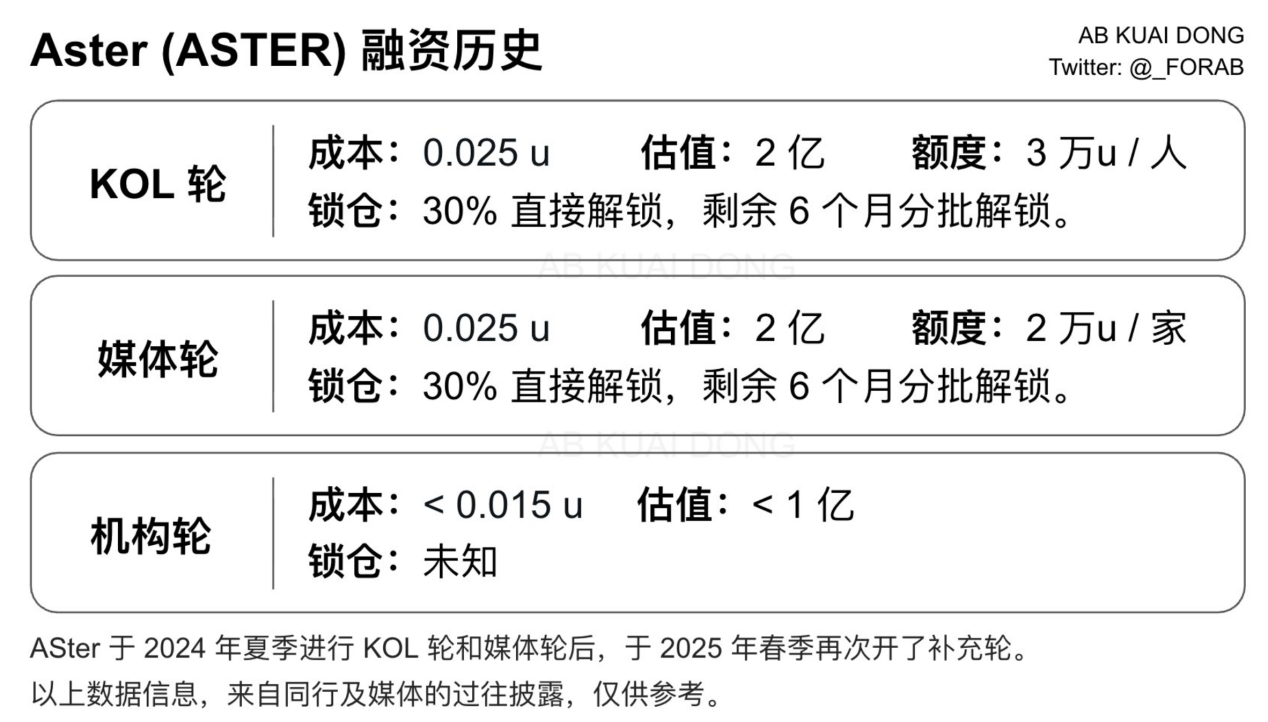

Figure 9: Aster's Funding History (Reposted from X user @_FORAB)

Figure 10: Aster Token Price

Based on Aster's funding history and market performance, YZi Labs (formerly Binance Labs), as Aster's core investor and incubation institution, should have participated in Aster's early financing. Since the token generation event (TGE) on September 17, 2025, Aster's token (ASTER) has performed exceptionally well: the price peaked at $2.30, and the current price is $2.20. If YZi Labs participated in Aster's institutional round of financing (with a cost of < $0.015), the investment return multiple has reached approximately 146 times based on the current price.

Figure 11: Aster Platform Partners

5. Future Outlook

So, can Aster truly become the ultimate challenger to Hyperliquid?

The decentralized derivatives market is still in a phase of rapid expansion and has not yet reached a saturation point of "one dominant player," allowing for the coexistence of multiple leading platforms. In this context, Aster benefits from the industry's strong demand for "capital efficiency"—as liquidity competition intensifies, users are increasingly inclined to platforms that can efficiently mobilize funds; additionally, the media attention and resource tilt brought by CZ continue to support its growth.

However, Aster also faces real challenges: there is still a significant gap in trading volume, open interest (OI), and user base compared to Hyperliquid; as a new platform, it must endure a longer period of scrutiny from the market regarding safety and stability; whether it can transition from short-term explosive growth to a long-term stable development trend is a key challenge the team must confront. As for the future landscape, there are various possibilities: perhaps Hyperliquid and Aster will form a differentiated coexistence as "dual champions" by attracting different user groups; if Aster's capital efficiency model is more favored by the market, it may even achieve a reversal against Hyperliquid in terms of trading volume; new competitors may also emerge, collectively shaping a multi-polar competitive industry landscape.

Conclusion

In the DeFi world, there are no eternal rulers. Hyperliquid has proven itself with extreme performance, while Aster has carved out a niche with capital efficiency and a multi-chain strategy.

With CZ's endorsement, Aster has been endowed with higher expectations and attention. Whether it will become the true "Hyperliquid killer" depends on its ability to maintain rapid growth over the next year and establish a solid footing in terms of safety and user trust.

What is certain is that Aster has successfully entered the spotlight of the market. The upcoming story will not only belong to it but will also determine the next chapter of the decentralized derivatives arena.

Join our community to discuss and grow stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group: https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。