一场关乎全球贸易格局的司法较量正在美国最高法院上演,特朗普时代的关税壁垒摇摇欲坠。

据花旗报告,市场对特朗普政府在《国际紧急经济权力法》(IEEPA)关税案中获胜的预期已大幅降温。最高法院的初步听证会风向不利,导致预测市场显示政府胜率从约40%骤降至27%。

若法院最终推翻基于IEEPA征收的“对等关税”,可能会引发一轮交易热潮,市场短期反应可能包括:通胀预期下降、股市上涨、以及特定新兴市场货币走强。

一、法庭风向突变,关税权力基石动摇

IEEPA关税案首次听证会上,法官们的初步评论被认为对政府不利。

● 这一信号迅速反映在预测市场上。数据显示,听证会当天,市场预测政府赢得该案的可能性从会议前的约40%一路下滑,至收盘时已跌至27%左右。

● Capital Economics分析师Thomas Mathews也证实了这一趋势:“在周三的口头辩论后,市场对最高法院处理特朗普总统根据《国际紧急经济权力法》征收关税的情绪发生了戏剧性转变。”

● 尽管在法庭上受挫,但特朗普政府并未用尽所有工具。花旗报告强调,即使IEEPA关税被裁定无效,政府依然可以诉诸其他法律途径来施加关税。

这些替代方案包括:

● 第122条款:允许在150天内,征收范围广泛的15%关税。

● 第338条款:允许对歧视美国商业的国家,征收高达50%的关税。

● “许可费”论:将关税重新包装为“许可费”,尽管这一想法在听证会上受到了部分法官的质疑。

二、市场预演“关税推翻”行情,资金蠢蠢欲动

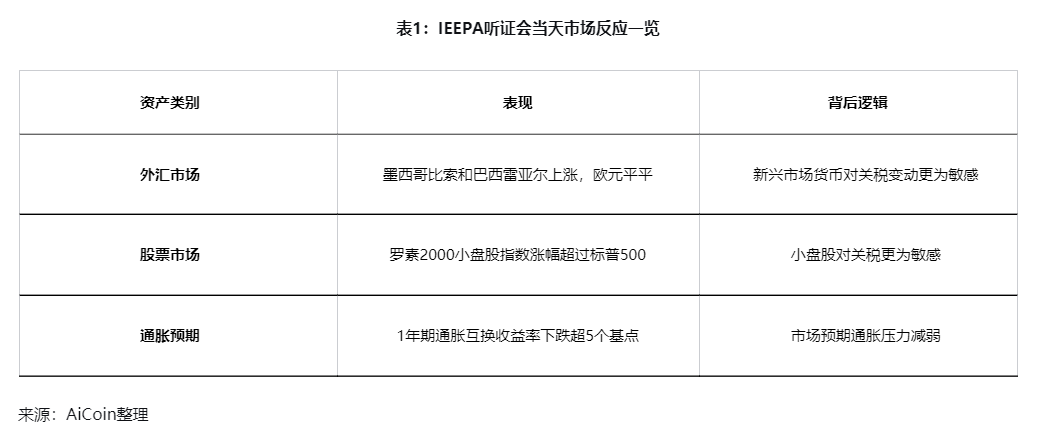

对于投资者而言,最关键的是如何交易这一预期。花旗报告通过分析听证会当天(市场预期急剧转变时)的盘中资产表现,勾勒出可能的市场反应蓝图。

在当天上午9:30至11:30,即IEEPA胜率直线下降的时段内,市场表现如下:

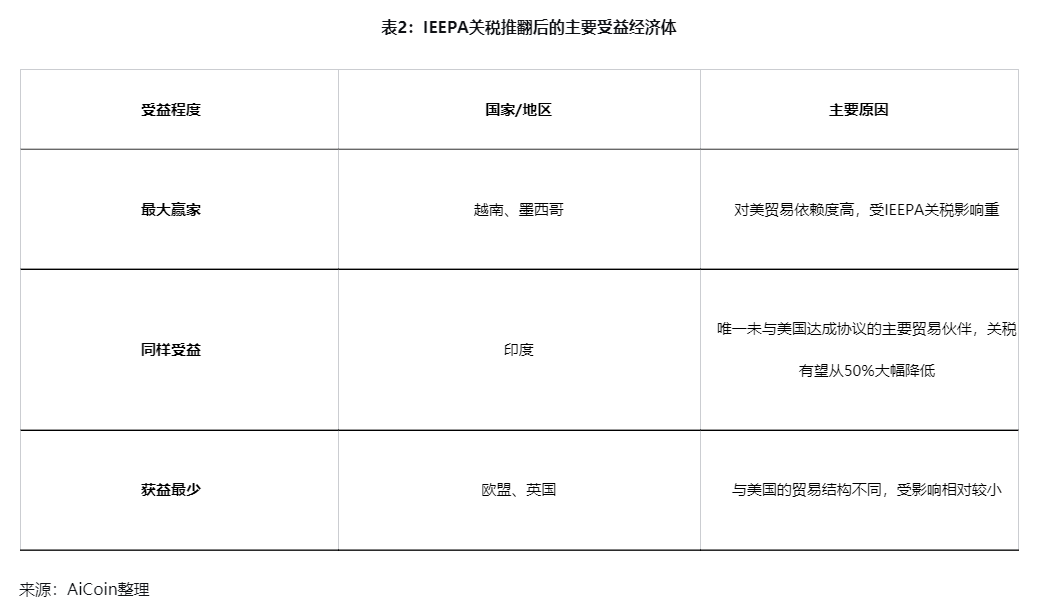

这一市场反应与花旗的“赢家”分析高度一致。花旗的分析(综合考虑了基准关税率、应税商品比例、对美出口占比及出口占GDP比重)显示:

在宏观层面,美国的实际有效关税率将从12.5%回落至9%左右,低于根据已达成的协议全面实施后的估算税率15.3%。

三、美股与加密市场的表现

尽管关税消息引发市场波动,美股三大指数近期仍创下历史新高。但在这一表面强势背后,隐藏着令人担忧的迹象。

● 10月28日,当标普500指数攀升至历史收盘高点6,890.89点时,却创造了一项不光彩的记录。“自从1990年以来,标普500指数从未在一个上涨交易日中出现如此疲弱的市场广度,”市场分析师指出。

● 与此同时,美联储在10月29日宣布降息25个基点。这是自1970年以来第五次美联储在标普500处于历史高位时降息。

● 消息宣布后,比特币24小时内上涨约1.9%,突破103,000美元;以太坊上涨约4.8%,超过3,500美元。

● 在2020-2021年的刺激计划期间,比特币从约6,000美元飙升至69,000美元,涨幅超过1000%。研究显示,近十分之一的美国人在当时用刺激支票购买了加密货币。

四、通胀与财政:关税裁决的双面刃

如果IEEPA关税被推翻,不仅影响市场情绪,更会对美国的经济基本面产生深远影响。

● 通胀预期首当其冲。在IEEPA听证会当天,1年期通胀互换收益率下跌超过5个基点,反映出投资者迅速消化了关税商品通胀压力减弱的预期。

● 实际上,通胀互换市场一直是关税影响的先行指标。早在4月份,一年期通胀互换利率曾飙升至3.07%的两年高点,而三年期利率却回落至2.42%,形成陡峭的"通胀驼峰曲线",反映市场预期关税会引发"短期物价飙升-中期经济衰退"的过山车行情。

● 更关键的是财政影响。Capital Economics指出,"废除以IEEPA为依据的关税对美国国债来说将是坏消息"。

● 关税收入的损失将引发关于赤字的棘手问题。即使采取替代关税,政府也不太可能完全抵消这一损失。

这与今年早些时候的美股表现形成鲜明对比。在特朗普4月初公布关税和贸易政策后,标普500指数和道琼斯工业平均指数曾一度跌入修正区间,而纳斯达克综合指数更是短暂进入了熊市。

五、政策不确定性的蝴蝶效应

● 投资者需保持警惕,因为政府仍有其他法律途径重新施加关税,这意味着任何因关税取消带来的市场提振都可能是短暂的。

美元的潜在反应可能会让那些期待显著反弹的人失望。Capital Economics观察到,解放日后出现的明显折价似乎大多已经消退,这意味着如果这些关税被取消,反弹的空间有限。

● 此外,美股面临额外阻力。尽管取消关税可能带来利好,但最终利率水平的新一轮不确定性,加上财政刺激受限,可能会限制股市的任何提振。

● 值得注意的是,美国国债市场对关税裁决尤为敏感。Capital Economics指出,美国国债最大的变动出现在收益率曲线的长端,表明对供需平衡的担忧可能至少与联邦基金利率路径一样重要。

这场关税博弈不仅关乎交易机会,更牵动着全球资本的流向。随着最高法院裁决日临近,市场波动性可能进一步上升,投资者需要为各种可能性做好准备。

市场仿佛已经嗅到了法律风向变化带来的交易机会。在听证会当天,随着IEEPA胜率直线下降,墨西哥比索和巴西雷亚尔双双上涨,罗素2000小盘股指数涨幅超过标普500指数,通胀预期随之降温。

任何因关税取消带来的市场提振都可能只是昙花一现,随着政府寻求替代途径,新的贸易博弈或将再次开启。

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:https://t.me/aicoincn

AiCoin中文推特:https://x.com/AiCoinzh

OKX 福利群:https://aicoin.com/link/chat?cid=l61eM4owQ

币安福利群:https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。