Author: Prathik Desai

Compiled by: Block unicorn

Billions of dollars are at stake, but the ultimate return is only about four cents. This is the annual return generated by every dollar of U.S. Treasury bonds.

For nearly a decade, decentralized finance (DeFi) protocols have relied on USDT and USDC as the pillars of their products, allowing Tether and Circle to capture the yield on their reserves. These companies have earned billions in profits through the simplest yield methods in the world. But now, DeFi protocols want to capture that yield for themselves.

Stablecoin leader Tether currently holds over $100 billion in reserves, generating over $4 billion in interest income. This is more than Starbucks' total profit of $3.761 billion from coffee sales worldwide in the last fiscal year. The issuer of USDT achieved this simply by investing its reserves in U.S. Treasury bonds. Circle adopted the same approach when it went public last year, emphasizing that its floating capital is its core source of income.

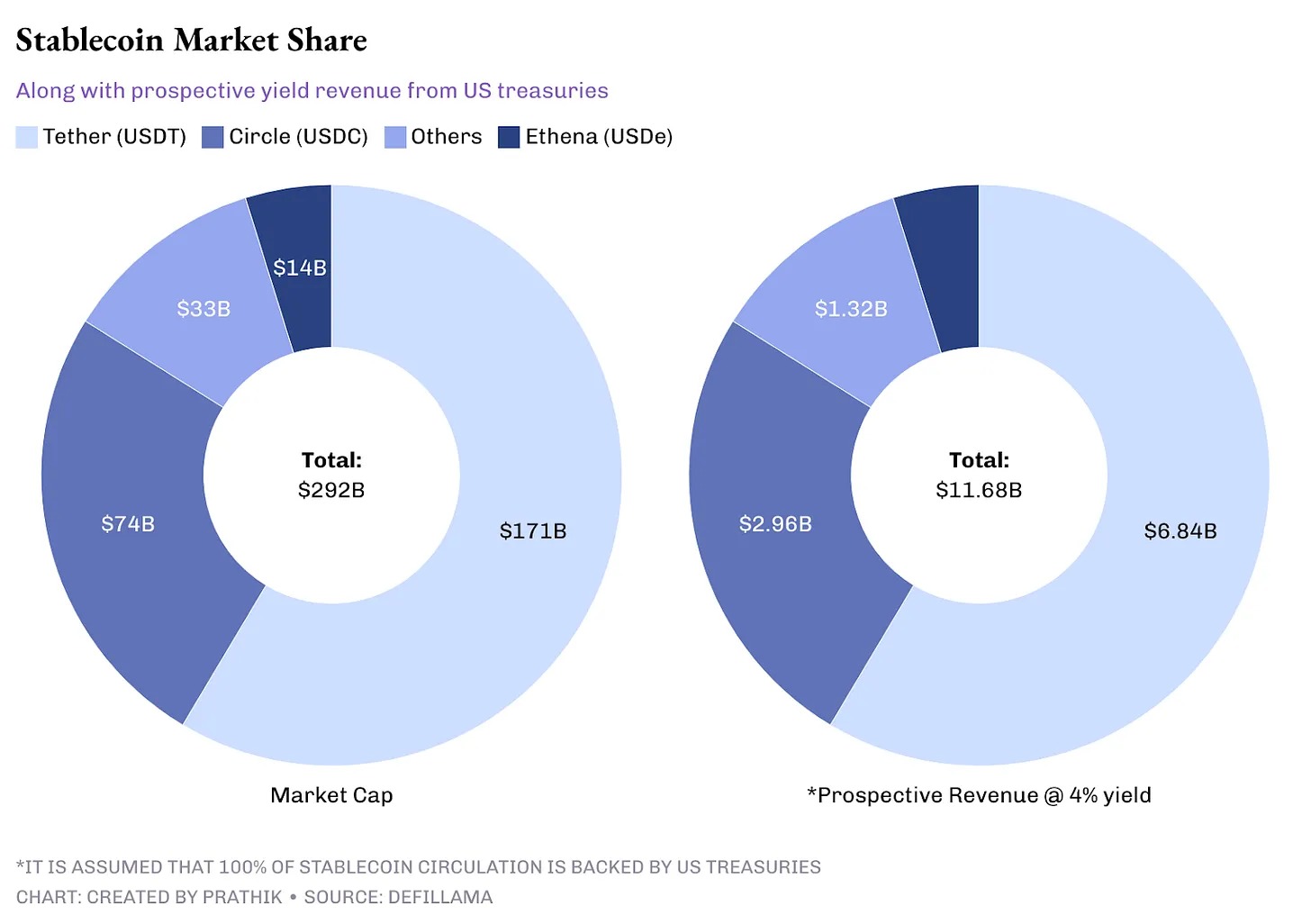

Currently, the total value of stablecoins in circulation exceeds $290 billion, generating about $12 billion in revenue annually. This is a significant amount of money. This has sparked a new war in DeFi, where protocols are no longer satisfied with letting issuers capture these yields. They now want to own the products and their underlying infrastructure.

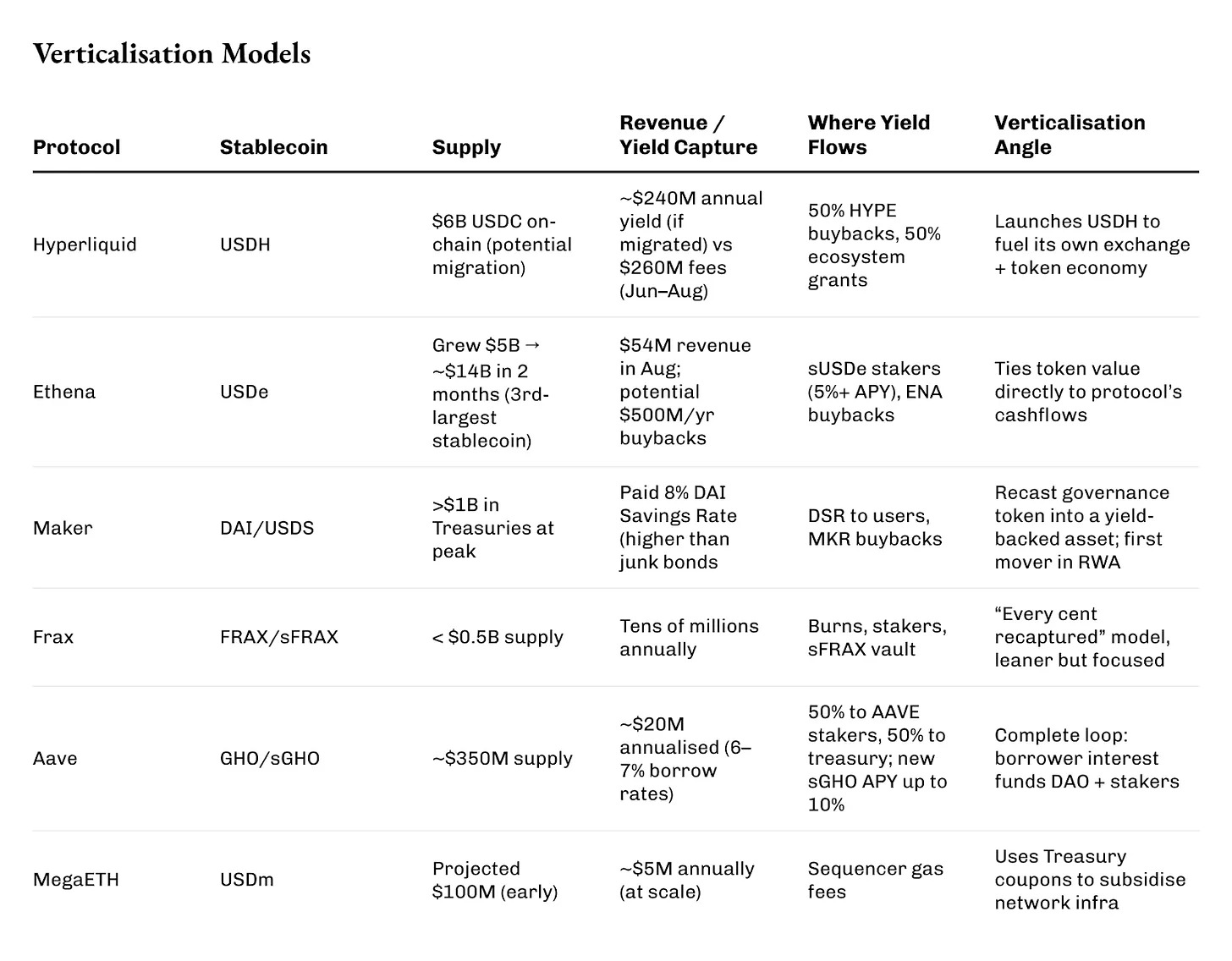

Earlier this month, Hyperliquid launched a bidding process for its native stablecoin USDH, requiring the winner to return the yield. Native Markets, Paxos, Frax, Agora, and Ethena all participated in the bidding. The eventual winner, Native Markets, promised that 100% of the treasury income from USDH would flow back to the blockchain: half for HYPE token buybacks and the other half for ecosystem funding.

Currently, Hyperliquid holds $6 billion in USDC on its Layer-1, potentially generating $240 million in revenue. This income, previously held by Circle, may now be repurposed for token burns and developer incentives. For reference, Hyperliquid generated a net income of $260 million through trading fees in June, July, and August.

Ethena is growing faster and on a larger scale.

In just two months, the circulation of its synthetic stablecoin USDe surged from $5 billion to nearly $14 billion, surpassing Maker's DAI to become the third-largest dollar-pegged stablecoin, behind USDT and USDC.

In August, Ethena's revenue reached $54 million, setting a record for 2025 so far. Now, with its long-awaited fee conversion mechanism officially launched, up to $500 million per year can be redirected for ENA buybacks, closely linking the fate of ENA tokens with the cash flow generated by the system.

Ethena's model includes going long on spot cryptocurrencies, shorting perpetual contracts, and distributing Treasury and staking yields. As a result, sUSDe stakers have enjoyed an annualized yield (APY) of over 5% in most months.

The experienced Maker was one of the first companies to utilize U.S. bonds as stablecoin reserves.

At one point, it held over $1 billion in short-term Treasury bonds, allowing it to offer an 8% DAI savings rate, which was once higher than the average yield on U.S. junk bonds. Excess funds were funneled into its surplus buffer, which was then used for buybacks, destroying tens of millions of MKR tokens. For token holders, this transformed MKR from a mere governance badge into a claim on actual income.

Frax, while smaller, has a more focused approach.

Its supply hovers below $500 million, just a small fraction of Tether's $110 billion, yet it remains a money-making machine. Founder Sam Kazemian designed FRAX to reinvest every dollar of reserve income back into the system. Part of this income is burned, part is shared with stakers, and the remainder is deposited into sFRAX, a treasury that tracks Federal Reserve rates. Even at its current scale, the system can generate tens of millions of dollars in annual income.

Aave's GHO stablecoin was built with vertical integration in mind.

Launched in 2023, it currently has a supply of $350 million. The principle is simple: each borrower pays interest directly to the DAO instead of to external lending institutions. The borrowing rate is 6-7%, which will generate about $20 million in revenue, half of which is shared with AAVE stakers, while the rest goes into the treasury. The new sGHO module will offer depositors an annual interest rate of up to 10% (subsidized by reserves), further enhancing the appeal of the transaction. In fact, the DAO is willing to use its own funds to make its stablecoin look like a savings account.

Some networks use stablecoin yields as original infrastructure.

MegaETH's USDm is backed by tokenized Treasury bonds, but its income is not paid to holders; instead, it is used to pay rollup sequencer fees. After scaling, this could mean millions of dollars annually for gas fees, effectively converting Treasury coupon payments into public goods.

The common thread among all these initiatives is vertical integration.

Each protocol is no longer satisfied with relying on someone else's dollar track. They are minting their own currencies, capturing the interest that originally belonged to issuers, and repurposing it for buybacks, Treasuries, user incentives, and even subsidizing blockchain development.

While Treasury yields may seem lackluster, they have become the spark for building self-sustaining ecosystems in DeFi.

When you compare these models, you find that each protocol is setting different valves to tap into this 4% yield stream. Buybacks, DAOs, sequencers, and users.

Yield is passive income. It makes everyone reckless. Each model has its own bottlenecks.

Ethena's peg mechanism relies on perpetual financing to maintain positive value. Maker has experienced real-world loan defaults and had to cover losses. After the collapse of Terra, Frax withdrew and reduced its supply to prove it wouldn't be next. All these institutions rely on one thing: U.S. Treasury bonds held by custodians like BlackRock. These are decentralized wrappers around highly centralized assets. And centralization also brings the risk of collapse.

At the same time, new regulations pose challenges.

The U.S. GENIUS Act completely bans interest-bearing stablecoins. Europe's MiCA regulation sets limits and licensing requirements. DeFi has found a workaround by labeling yields as "buybacks" or "sequencer subsidies," but the economic principles are the same. If regulators choose to act, they are fully capable.

However, this approach helps build sustainable business models—which is what the crypto space has long struggled with. So many models are operating, showcasing the immense potential that DeFi protocols now possess. Today, what is being contested is the world's most boring yield. Yet, the risks are high. Hyperliquid ties it to token burns, Ethena links it to savings accounts and buybacks, Maker connects it to central bank-style buffers, and MegaETH ties it to the operational costs of rollups.

I wonder if this movement will eat into the market share of the giants, siphoning liquidity from USDC and USDT. If not, it will certainly expand the market size, creating a layer of yield-bearing stablecoins that can stand alongside zero-yield stablecoins.

No one knows yet. But the war has begun, and the battlefield is vast: a stream of interest flows from U.S. government debt, redirected through protocols to tokens, DAOs, and blockchains.

The yield that once belonged to issuers is now driving the latest developments in DeFi.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。