Pyth Pro aims to provide institutions with a transparent and comprehensive data perspective, covering various asset classes and geographical regions in the global market, eliminating inefficiencies, blind spots, and rising costs in the traditional market data supply chain.

Article provided by Douro Labs

In the early days of 2021, only a few trading firms and exchanges published their trading data on the blockchain network, but this attempt has quickly evolved into the most comprehensive institutional-level market data source globally.

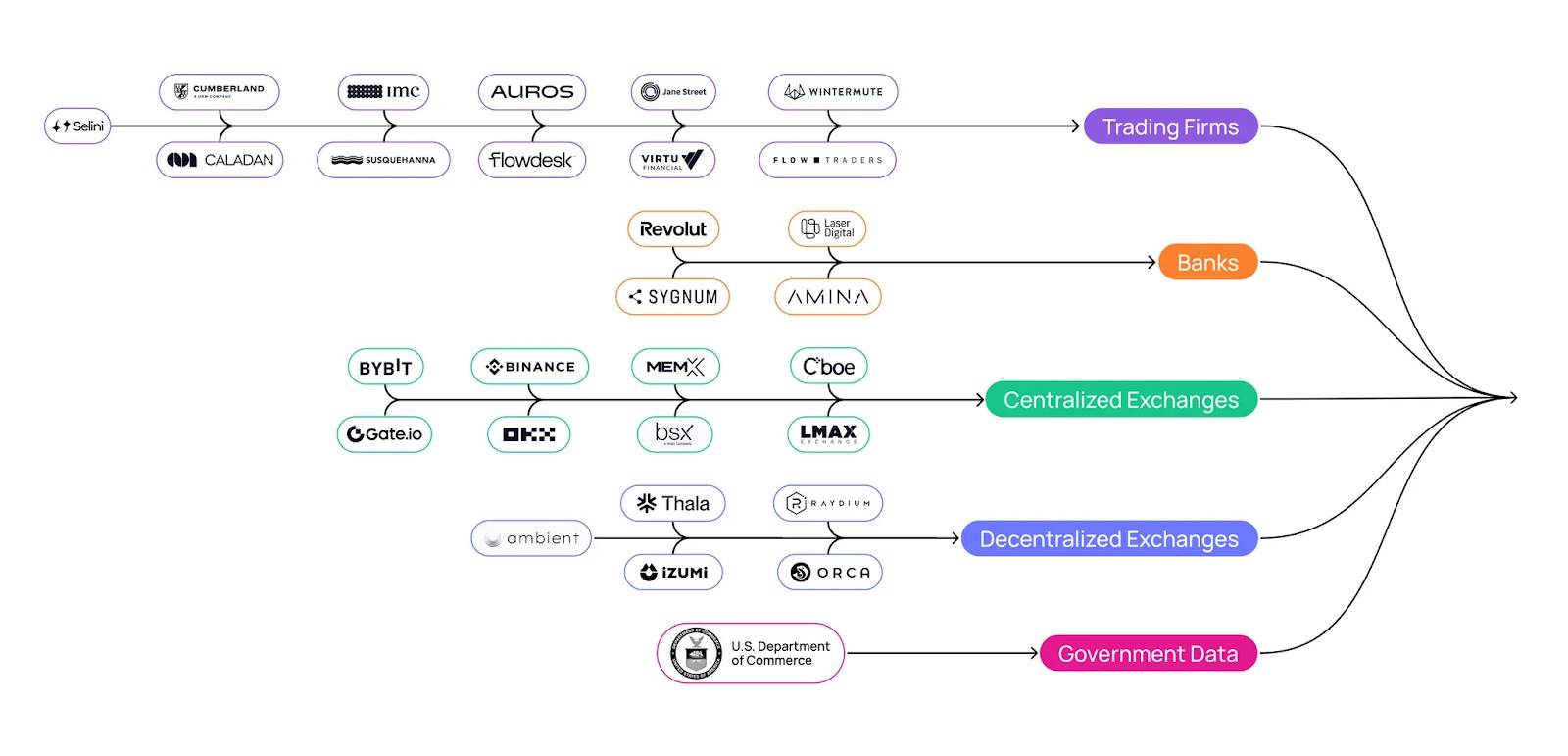

As a globally universal price layer, Pyth Network has fundamentally reshaped the market data supply chain: 125 institutions have collectively earned over $50 million by contributing their proprietary data to the network; this data supports over 600 applications with a trading volume of $1.7 trillion. Pyth has also collaborated with industry leaders and government agencies such as Cboe, Jane Street, Revolut, and the U.S. Department of Commerce to establish a new paradigm that makes market data more accessible, accurate, and transparent.

Pyth's mission has always been to establish a "single source of truth" for market data, a concept that seems simple but has profound implications. Once achieved, it will reshape the traditional financial system and expand access to global markets. Today, after achieving groundbreaking adoption in the DeFi space and rapidly extending into traditional finance, Pyth is reimagining the market data economy for global institutions.

Today, with the official launch of Pyth Pro, Pyth takes an important step towards fulfilling its mission, allowing anyone to directly access professional institutional-level data from the world's leading trading firms.

Pyth Pro aims to provide institutions with a transparent and comprehensive data perspective, covering various asset classes and geographical regions in the global market, eliminating inefficiencies, blind spots, and rising costs in the traditional market data supply chain. Several major institutions, including Jump Trading Group, are participating in the early access program for Pyth Pro, demonstrating a strong demand for new market data solutions.

Problem Analysis: Fragmented and Outdated Systems

Market data is the backbone of modern finance, powering everything from trading and risk management to clearing and reporting. As the internet continues to evolve in terms of speed and accessibility, the financial system is more interconnected and data-driven than ever, and the importance of market data is only increasing. However, the infrastructure supporting market data today is mired in the dark depths of the pre-internet era, with few alternatives available.

Statistics show that institutions spend over $50 billion annually on market data, yet the systems they rely on are ill-suited to today's global multi-asset financial environment. The scarcity of market data competitors across regions and asset classes has led to a sharp rise in data costs, even increasing by over 50% in the past three years. There are significant discrepancies in the fees institutions pay for the same products, access is restricted by geography, and new entrants still face very high barriers to entry.

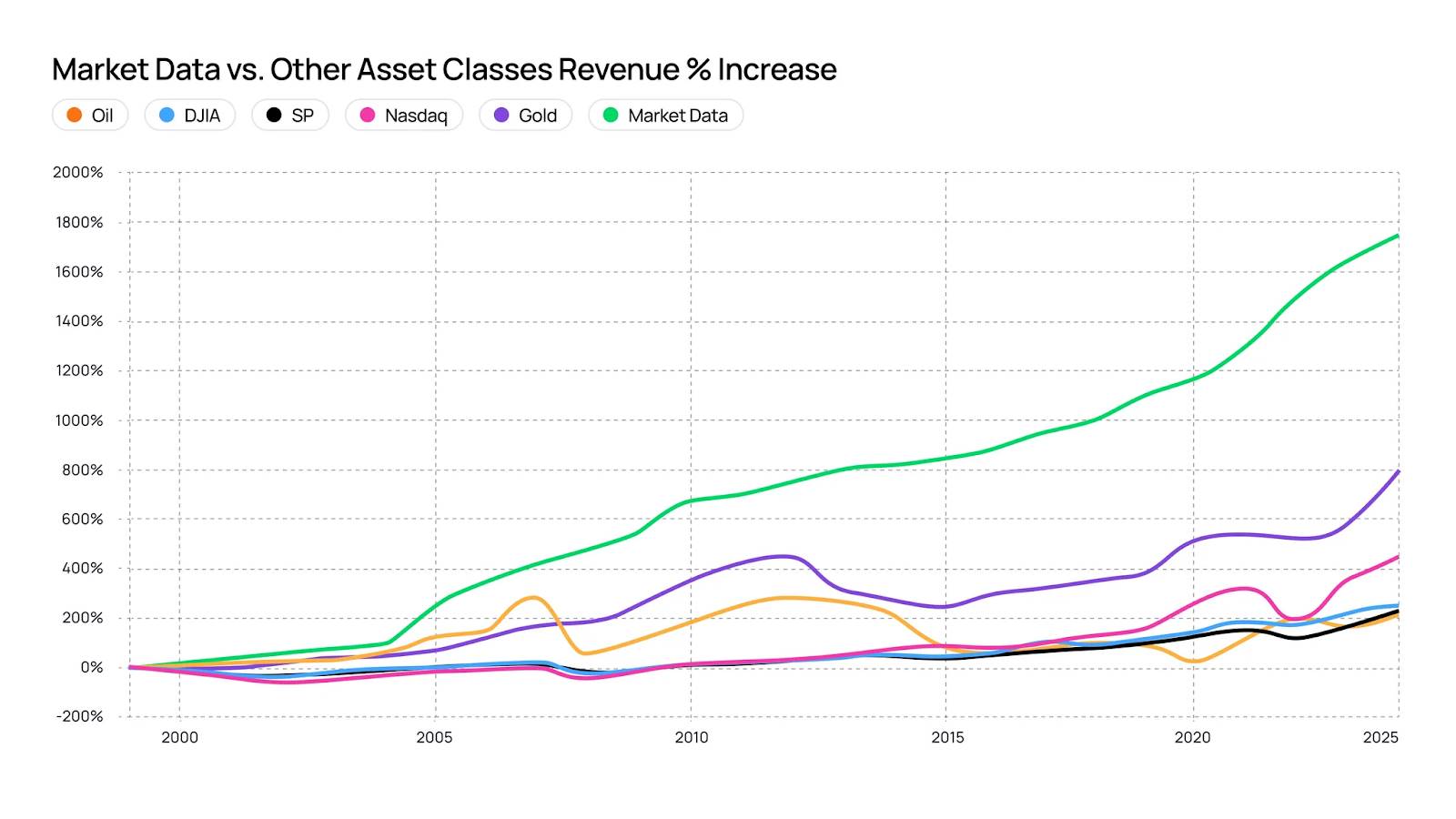

Historical trends highlight this severe imbalance: over the past 25 years, the cost of market data has outpaced nearly all major asset classes. This spiraling increase has placed an ever-greater burden on institutions that provide liquidity and efficiency to financial markets.

Structurally, the flaws are evident:

Exchanges can only see their own order books, which cover only a small portion of global trading activity.

Vendors aggregate this data, repackage it into large bundles, and sell it at high prices.

Trading firms and banks, as the institutions providing the most accurate, high-frequency prices, rarely directly participate in the value creation of data.

This means that the most valuable price data is created upstream (before it enters the exchanges), but most of the revenue flows to downstream intermediaries. This outcome is not the fault of any one party; market data is constrained by outdated systems that inadvertently reinforce the positions of existing firms, stifle competition, and limit innovation.

Solution: Pyth Pro

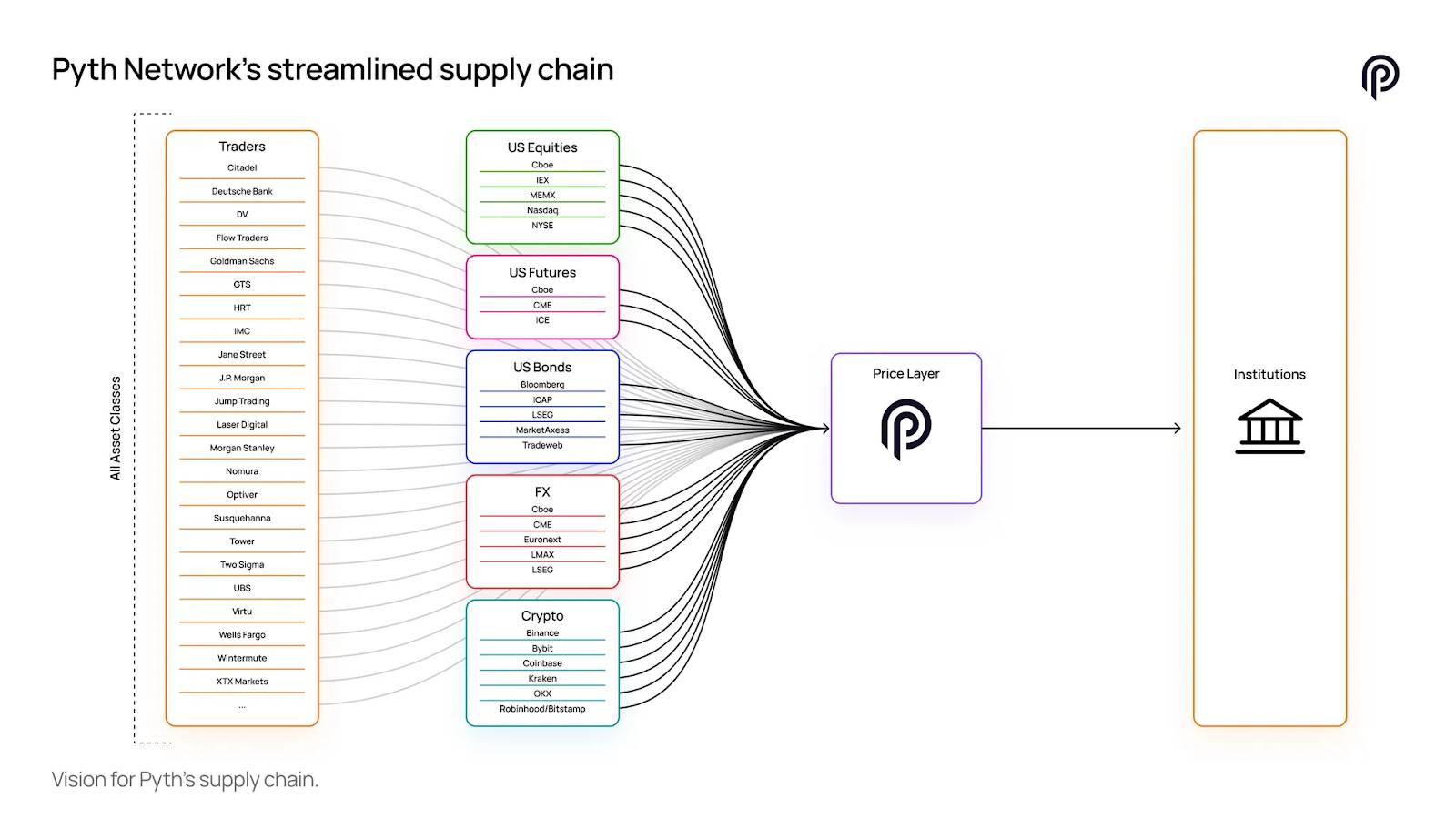

Pyth Pro addresses these systemic inefficiencies by fundamentally rebuilding the market data supply chain.

Institutions no longer need to rely on fragmented, repackaged data from downstream sources; instead, they can obtain prices directly from the companies generating them (trading firms, exchanges, and banks) through a single, unified integration platform.

Several leading institutions, including Jump Trading Group, have collaborated with Pyth Pro through early trials. As a representative from Jump Trading Group stated:

"We are honored to be long-term supporters of Pyth, which has developed one of the most comprehensive and valuable sources of market data ever. Pyth Pro enables more consumers, including traditional financial firms, to access this data and brings competition to the market data economy by providing the purest data directly from the source."

One Source: Covering All Asset Classes and Regions

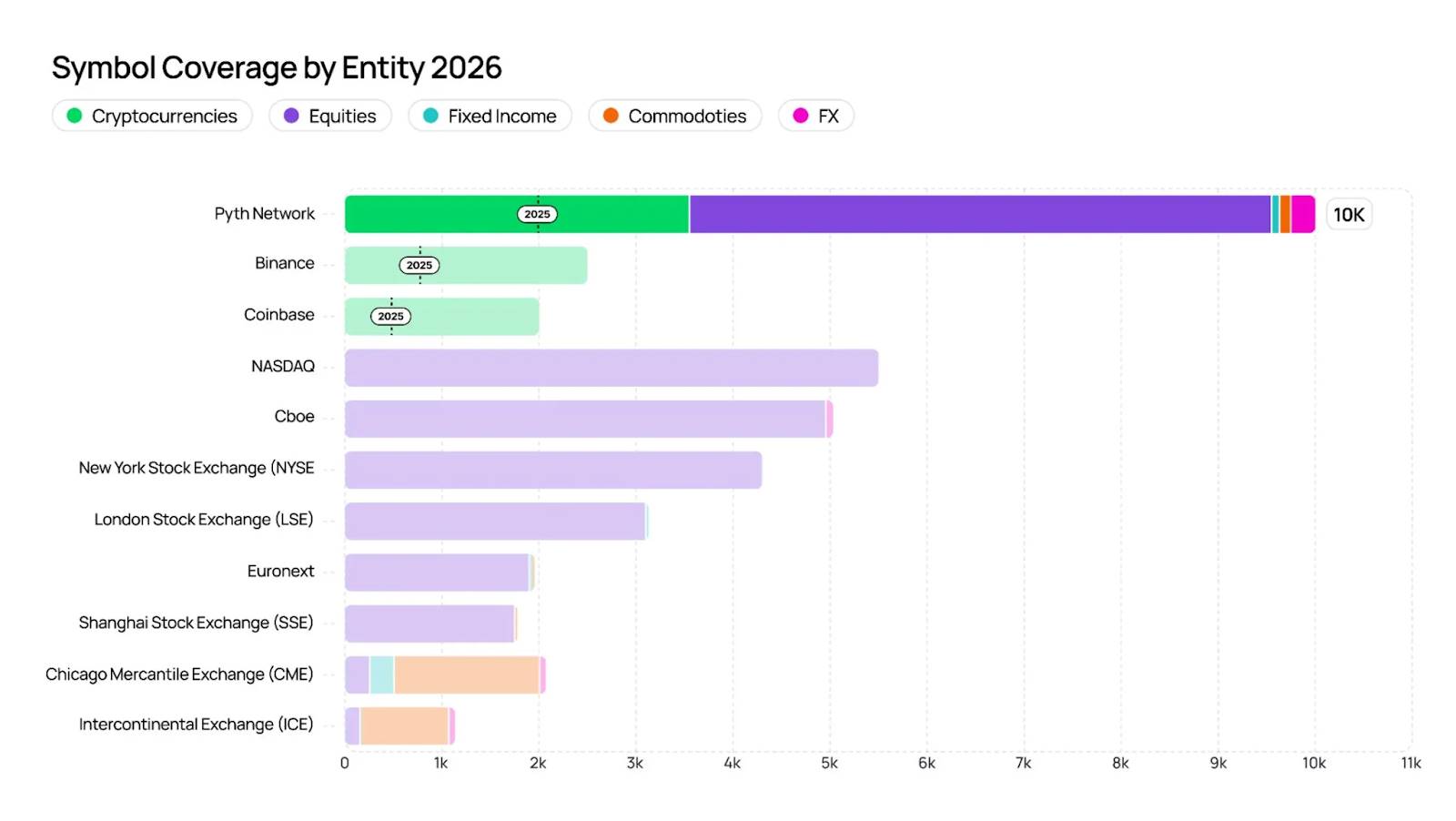

Pyth Pro integrates global data into a distribution network: over 2,000 data streams covering stocks, futures, ETFs, commodities, foreign exchange, cryptocurrencies, and fixed income. Data is updated at millisecond frequency, with uptime exceeding 99.9%, and accuracy reaching 95% relative to the NBBO, with new data categories added weekly.

Pyth Pro aims to provide comprehensive market data insights, becoming the most reliable single source of truth for financial data.

Professional Data: From Companies That Truly Drive the Market

Over 125 leading institutions have contributed proprietary price data to the Pyth network, including Jane Street, Revolut, Jump, DRW, Optiver, Cboe, and LMAX. These contributions are aggregated through cryptographic verification, with staking and penalty mechanisms in place to create a system that captures the source of price discovery while rewarding accuracy and participation.

Streamlined and Cost-Effective Model

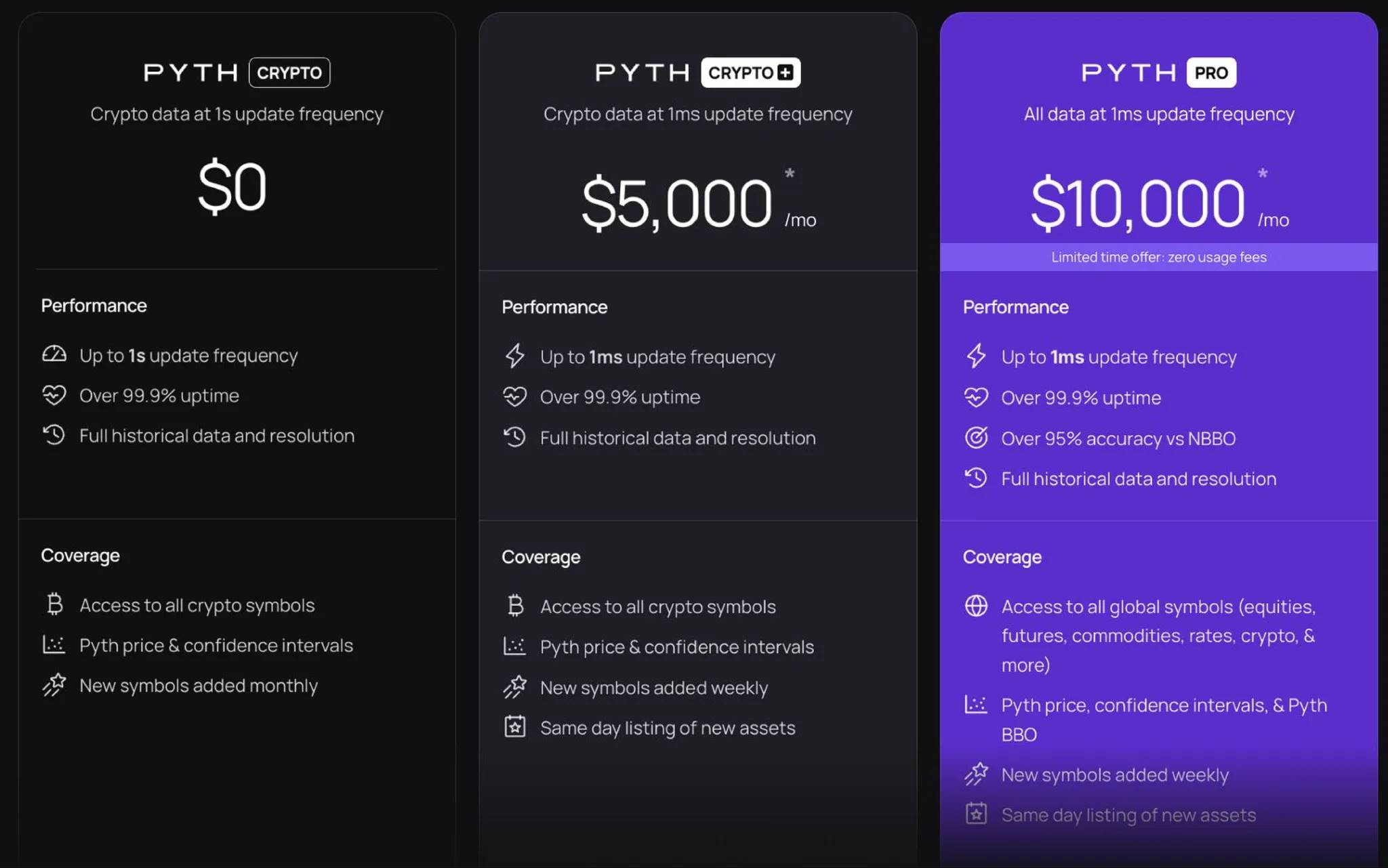

Traditional data vendors often charge up to $250,000 per month, but their data coverage is incomplete, forcing institutions to manage multiple data agreements, duplicate purchases, and integrations, leading to unpredictable costs. Pyth Pro addresses this dilemma with a transparent subscription model that can scale according to institutional needs:

Pyth Crypto (free): Cryptocurrency data updated once per second

Pyth Crypto+ ($5,000 per month): Cryptocurrency data updated once per millisecond

Pyth Pro ($10,000 per month): Global cross-asset coverage, updated once per millisecond, providing enterprise support and redistribution rights

By eliminating discriminatory pricing, isolated access, and opaque contracts, Pyth Pro not only reduces costs but also opens the market for broader participation, creating a level playing field for institutions of all sizes and allowing everyone to benefit. Exchanges, trading firms, and banks can monetize data more directly; institutions gain access to more comprehensive and accurate global market data. This will lead to a healthier and more competitive ecosystem: where data is more accessible, accurate, and transparent than ever before.

How It Works: Redesigning the Market Data Supply Chain

Pyth is able to provide functionalities that traditional vendors cannot, relying on its structural innovations. The Pyth Network is not just another aggregator repackaging downstream data flows; it fundamentally reconstructs how market data is captured, verified, and distributed globally.

Upstream Data Sources: Data is directly contributed by pricing entities such as trading firms, exchanges, and banks, even before the data is fragmented, averaged, or delayed.

Data Source Quality: Over 125 leading institutions contribute proprietary data to Pyth, including Jane Street, Jump, DRW, Optiver, Cboe, LMAX, and the U.S. Department of Commerce.

Transparent Aggregation: Data is aggregated using verifiable methods, with confidence intervals set to ensure data quality is auditable.

High-Performance Delivery: Data is distributed globally with end-to-end latency of less than 100 milliseconds, supporting co-located aggregation of low-latency data and millisecond-level precision.

Collaborative Incentives: Through staking, penalties, and the Pyth ecosystem incentive model, publishers are rewarded for their accuracy, while the system penalizes misconduct.

Sustainable Model: Subscription revenue flows back to the Pyth DAO, reinforcing the incentives for publishers and enhancing network value over time.

Pyth Pro aims to replace the fragmented and outdated infrastructure that today’s market data relies on, but it does not simply replace existing participants. Exchanges, trading firms, and banks remain at the core of it all: their data is the source of value. By creating a unified, open distribution network, Pyth Pro enables more institutions to access the data they need while allowing data publishers to directly capture the value they create, further expanding participation and eliminating structural constraints.

Pyth Pro's market data model is more inclusive, accurate, and sustainable than any existing model. Fundamentally, Pyth Pro aims to grow the pie for everyone: contributors receive fair compensation, institutions gain a more comprehensive and cost-effective understanding of global markets, and the entire financial system benefits from greater transparency and healthier competitive cycles.

The next wave of finance has arrived; Pyth Pro is just the first step.

At the core vision of Pyth's "global universal price layer," Pyth Pro aims to empower builders, innovators, institutions, and leaders by creating an open, trustworthy, and easily accessible financial system that benefits all participants.

Infrastructure is just the first layer; now everyone will have the opportunity to participate in building the next generation of financial skyscrapers.

Welcome to start your Pyth Pro journey and experience more accurate, convenient, and economical market data.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。