Author: Valis Research

Translated by: Felix, PANews (This article has been edited)

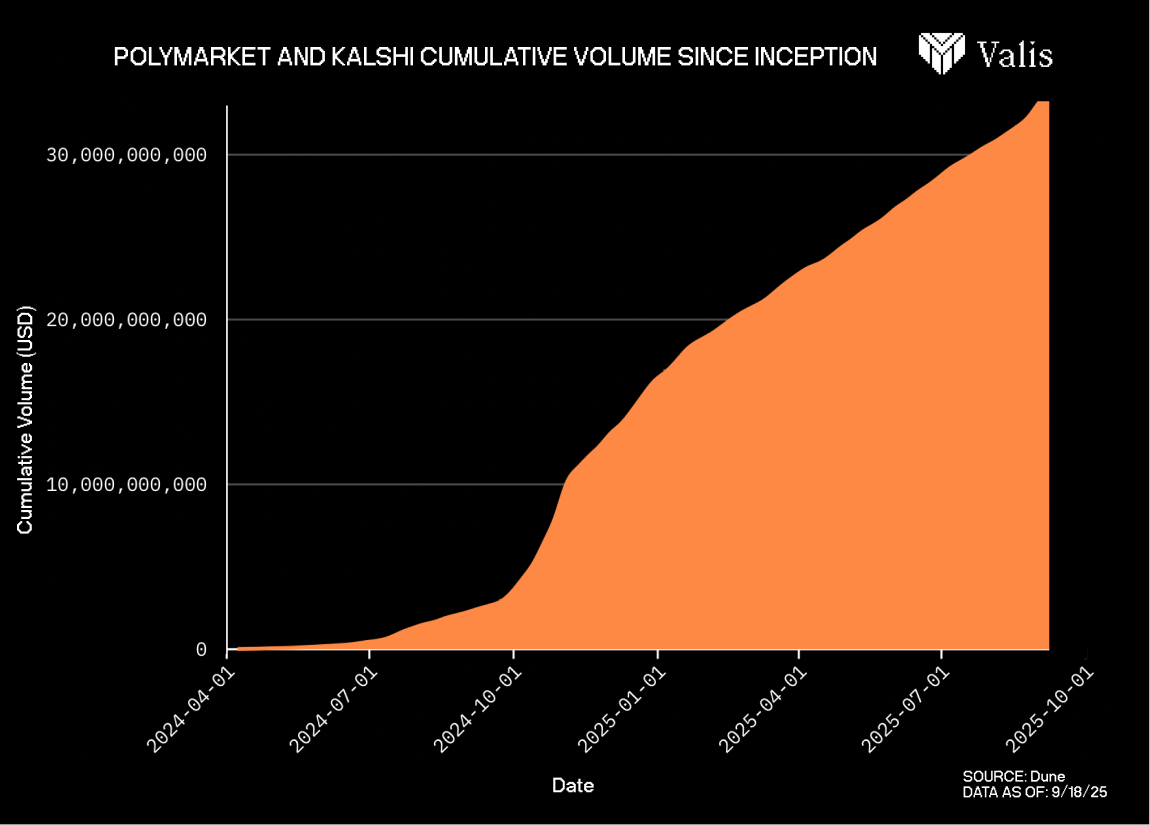

Prediction markets are everywhere. After the conclusion of the 2024 U.S. presidential election, it was expected that trading volumes on Polymarket and Kalshi would decline significantly, as they had in previous years. However, this has not happened. This article aims to analyze why they remain relevant and what expectations might arise if these trading volumes continue to slowly increase over the next 2 to 3 years. This report primarily focuses on the usage of Polymarket and Kalshi.

Analyzing Order Book and Market Making Challenges

Liquidity is at the core of any market, and one of the most important themes of this report is to explore the market making or liquidity provision of major prediction market platforms, starting with Polymarket.

Polymarket's documentation clearly states that each pair of event outcomes is fully collateralized by 1 USDC on Polymarket, and on-chain proof is conducted when both parties agree on the odds. It is important to note that there are various types of markets on each prediction market platform.

Baheet recently analyzed the types of prediction markets in an X article and explained that the platform's functionality depends on five different categories of specifications: liquidity model, outcome resolution, market type, event creation mechanism, and underlying infrastructure. Currently, the most interesting aspect is his definition of market types, as it is foundational information.

There are primarily three types of markets across platforms: binary markets, multi-outcome markets, and scalar markets.

Basic Market Making and Market Formation Scenarios

A simple example on Polymarket is when two parties have opposing views on the champion of the 2026 NBA Finals, with the Miami Heat and Golden State Warriors both priced at $0.50, indicating a 50% chance for each team to win.

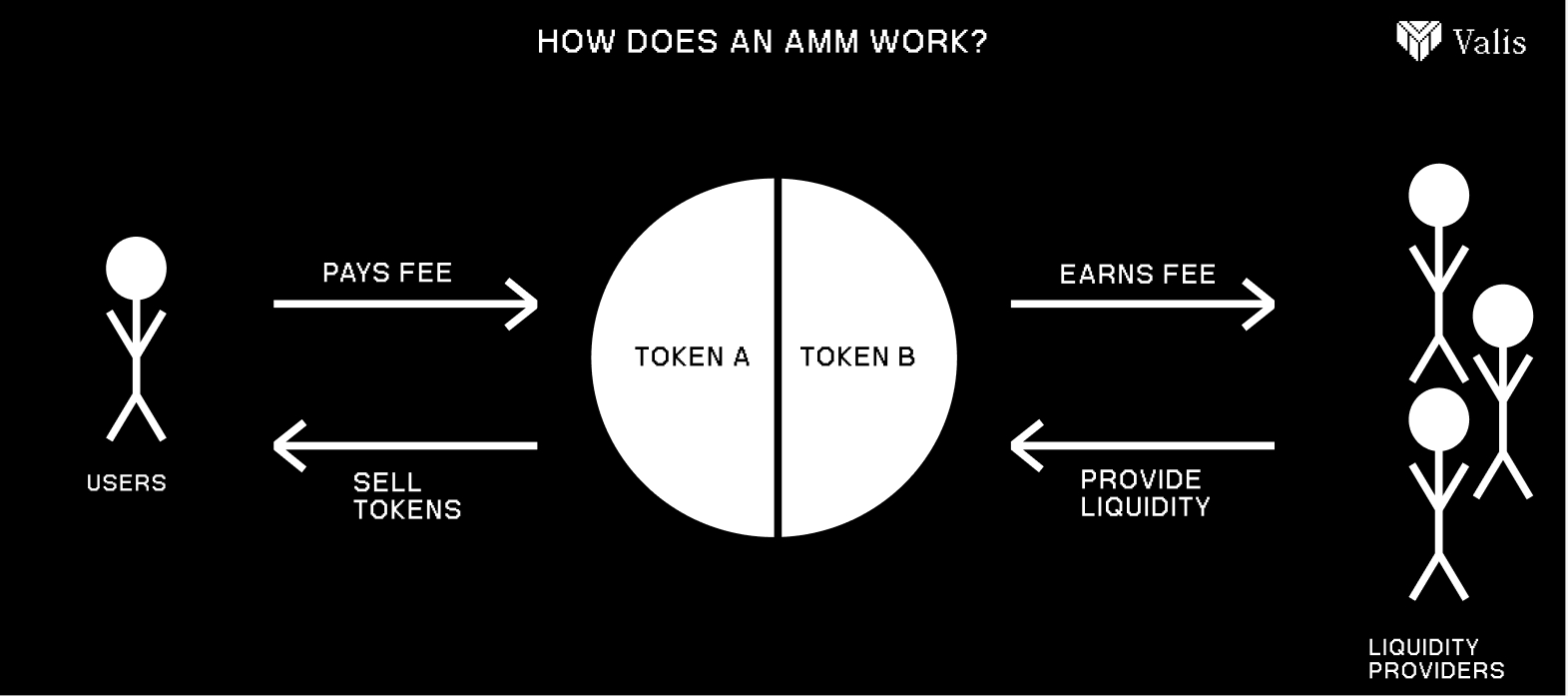

Polymarket previously offered AMM-based liquidity, meaning anyone wanting to provide liquidity could deposit their USDC into the AMM and support both sides of the market, in this case, the outcome tokens for the Miami Heat and Golden State Warriors. Specifically, an AMM is a design of a DEX where buy and sell orders are managed by smart contracts on the blockchain network, rather than being placed manually on an order book. AMMs have created wonders for cryptocurrencies, but Polymarket's brief existence symbolizes that this technology still faces flaws.

Polymarket evolved from this model, as liquidity providers (LPs) essentially take equal long positions on both sides of the market, exposing them to inventory risk and leading to more frustrating market making than expected. Since then, they have shifted to an order book model, which Kalshi and numerous other exchanges have also adopted.

Markets are formed by opinions, and liquidity subsequently joins; regardless of how liquidity is constructed, this is the core foundation that keeps event markets active.

Liquidity must first be seeded by market makers, who set their own odds. Suppose a market maker first places an order to sell 1,000 shares of Miami YES stock at $0.50 and buys 1,000 shares of Miami YES stock at $0.48. This would be the initial liquidity injection for the NBA Finals outcome, and users can subsequently execute that order. If they decide to meet the market maker's sell order and submit a buy order for 500 shares of Miami YES stock, they effectively become long 500 shares of Miami YES stock, while the market maker now becomes short 500 shares of Miami YES stock.

Suppose another market maker joins and wants to compete; this time they submit a buy order for 1,000 shares of Miami YES stock at $0.49 and a sell order for 1,000 shares of Miami YES stock at $0.51. With the additional liquidity, the order book now appears tighter, meaning users can buy another 500 shares from the original market maker at $0.50 and then pay $0.51 to purchase 1,000 shares from the second market maker.

From here, the way prediction markets operate is similar to other financial products: the more the underlying asset is bought, the higher the price goes, thereby lowering the prices of other assets. Depending on the outcome and your inventory situation, you may realize a small profit, a large profit, a small loss, or a total loss. If Miami wins the championship, anyone holding these shares will see their value rise to $1 per share; if Miami loses, these shares will trade at $0.

In terms of market making, Kalshi's market creation system is roughly similar, except that the collateral does not use USDC and is not conducted on the blockchain.

To create a market on Kalshi, it must be initiated directly by the team, by a creator approved by the exchange, or suggested by users and ultimately reviewed. Polymarket events can produce mutually exclusive outcomes, which are bundled together and collateralized, with $1 covering the entire set.

On Kalshi, each outcome is an independent binary (yes or no) contract, and the market is created by bundling all these binary contracts together and presenting them as a single market in the user interface. This does not affect the end user, as the way the 2028 U.S. presidential election market is displayed on Polymarket and Kalshi is the same, but there are significant differences in essence, with several key distinctions. The multi-outcome markets on Kalshi function similarly to those on Polymarket, just constituted in different environments.

Since each market on Polymarket is fully collateralized by USDC, the sum of probabilities must always equal 100%. Kalshi differs in this regard, as when these binary contracts are combined, the probabilities may not add up to 100%, leading to arbitrage opportunities. This does not mean that Kalshi's markets are not fully collateralized—they are indeed collateralized—but their composition differs from Polymarket, and these structural differences lead to Polymarket and Kalshi employing different strategies.

While these examples simplify matters, the market making and liquidity provision on these platforms are much more complex.

Partial Metrics

Before analyzing market maker dynamics, let’s observe some more general metrics, such as trading volume, open contracts, number of trades (if applicable), and daily active users, to get a rough idea of where these platforms stand in their quest for more users.

Of its $34 billion initial trading volume, approximately 79% came from Polymarket, while about 21% came from Kalshi. There is no significant competition between the two platforms in attracting market makers or maintaining liquidity; however, some recent strategies from Kalshi have put pressure on Polymarket. Recently, Kalshi's market share, calculated by nominal trading volume per week via the Dune platform, rose from 8% in January 2025 to over 62% in September 2025.

Since Polymarket is a blockchain-based application, its user numbers are evident; while Kalshi is a centralized application, the number of trades is a better indicator of its actual usage. According to Dune data, Polymarket has a cumulative trading volume of 61 million trades since its inception, while Kalshi has 30 million trades. Polymarket's trading volume is twice that of Kalshi, as Polymarket has been around longer, while Kalshi has only recently begun to gain more attention.

This is not to undermine Kalshi; although Kalshi's cumulative trading volume lags, its recent growth rate far exceeds that of Polymarket. Three months ago (as of June 1, 2025), Polymarket's average daily trading volume was about 147,000 trades, while Kalshi's average daily trading volume was 142,000 trades, an increase from 24,000 trades in 2024.

Kalshi's "Basketball Dream"

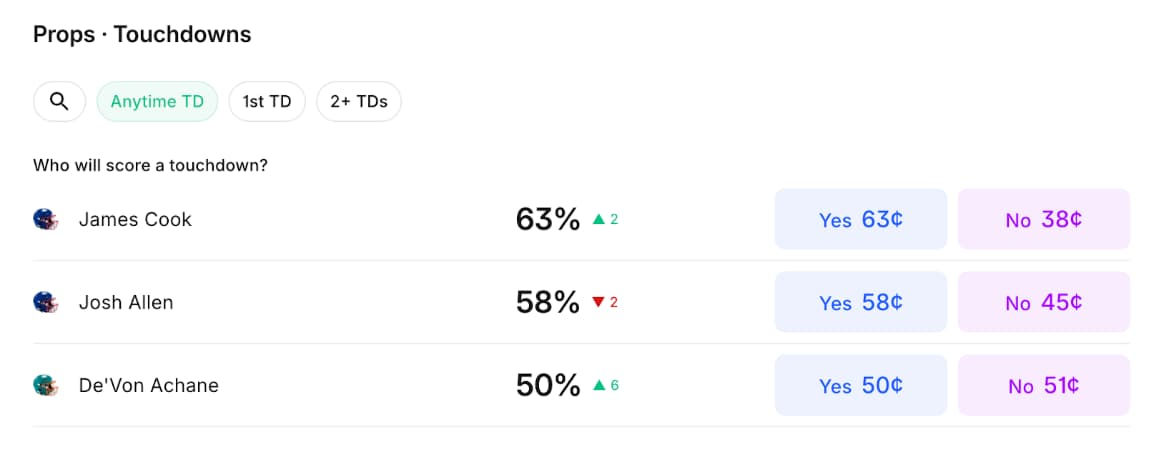

Kalshi is very aware that Parlay (note: a type of sports betting that allows players to link two or more individual bets on different games or teams and combine them into one bet) and prop betting are increasingly dominating sports betting, so it is not surprising that such applications are submitted. Moreover, about 80% or more of Kalshi's trading volume comes from sports events, and they are performing quite well. Below is a screenshot of the Miami Dolphins vs. Buffalo Bills game on September 18, showing real-time player props:

One underrated advantage of using Kalshi compared to other sports betting platforms is that it has no withdrawal penalties or fees. Closing a position on DraftKings could result in a loss of 25-30% of the bet amount, especially if the game has already started. On Kalshi, withdrawals depend on other factors such as liquidity, current price, and potential short-term volatility, but are smoother than on any other platform.

It is well known that if someone is too savvy in sports betting, they are likely to be kicked off the platform. Over the years, this has led to the emergence of many different workarounds—this is quite an interesting "rabbit hole"—but Kalshi and Polymarket have no incentive to ban their top traders, as they are not "bookmakers."

Considering the recent comments from Kalshi's head of business development regarding its internal market making team (referred to as Kalshi Trading), this itself is a "rabbit hole," particularly the statement that "market makers, including KT, compete for flow in an open, transparent, and fair market, setting their own prices for the contracts they are willing to pay, but cannot influence the broader market."

Due to the inability to obtain such data, this article has no authority to confirm or deny whether KT or any other market makers enjoy preferential treatment, but this conflict of interest has raised widespread concern, and its impact can be summarized as follows:

"Kalshi claims that market makers, despite receiving fee rebates, cannot influence the market, which is one thing; but it is even worse that while making such statements, they leverage their economic power to reduce competitive pricing in the same market."

On September 8, Dustin Gouker from The Closing Line published weekend data, highlighting Kalshi's $300 million trading volume, of which as much as 96% came from sports events, with NFL games alone accounting for 84%.

This does not mean that Kalshi will immediately compete with companies like DraftKings or FanDuel, nor does it mean that customers of these established companies will all turn to Kalshi, but Kalshi's regulatory position with the CFTC in the U.S. is more favorable, allowing their products to be sold in all 50 states.

Gradually Incentivizing More Liquidity

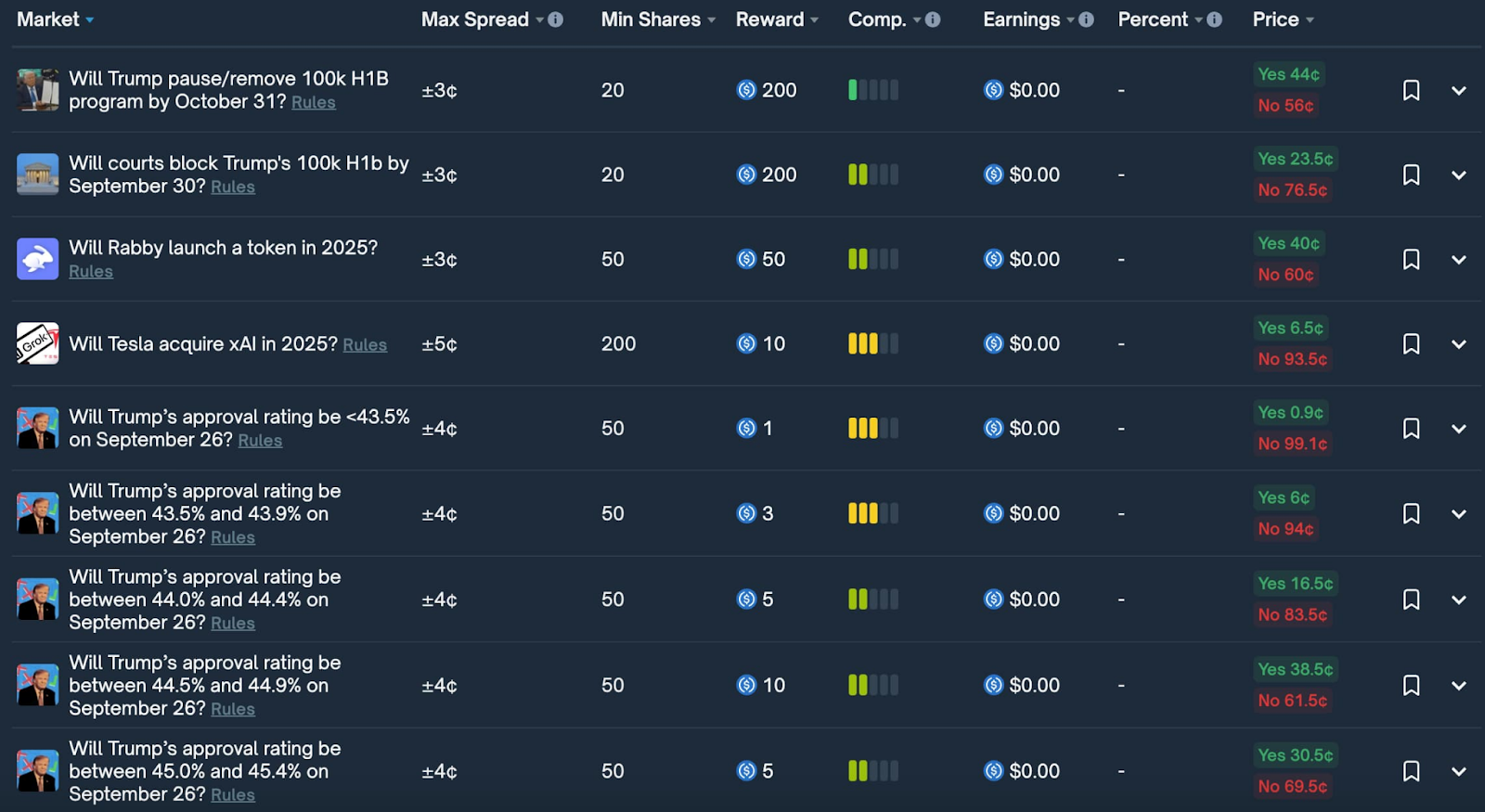

Polymarket recently created this liquidity incentive dashboard to attract more amateur market makers by specifically describing their requirements and the exchanges in return.

The dashboard lists the maximum allowable spread, USDC rewards, competitiveness for each market, and existing prices. This is a good start, and it is clear that incentivized markets will be very active at some point, but currently, it is difficult to get started, and liquidity for all trades is low. From a macro perspective, the basic description of how Polymarket determines liquidity rewards is as follows:

- The closer the price is to the average level = the higher the earnings

- The reward amount depends on how your order "helps" other orders, including order size and pricing

- The more competitive your limit order, the more you can earn

- Daily payments based on your order's contribution to the market

Both platforms can provide liquidity returns, but it is hard to say when this will happen and in which markets. Despite the information gap, one can observe the open interest metrics on these platforms and conclude that neither has truly enhanced returns enough to crowd out competitors.

Solutions to Liquidity Issues and Their Necessity

Yoshi wrote a short article proposing five unique methods to address liquidity issues in prediction markets, each targeting different aspects of the prediction market space. One proposal suggests introducing more futures and options (F&O) market makers, another suggests introducing a curve similar to pump.fun to inject memecoin liquidity into long-tail prediction markets, along with other seemingly very realistic and achievable basic proposals, even in the short term.

If the mechanisms for injecting liquidity or improving liquidity distribution are so obvious, why isn't anyone doing it?

This question is well-posed, but it does not recognize the situation that Polymarket and Kalshi are in. In September 2025, over 90% of Kalshi's trading volume came from sports events. If your platform sees a significant increase in trading volume in a specific category, you might be more inclined to incentivize that growth in the future.

Providing more incentives than competitors is one way to maintain liquidity, but given the risks involved, maintaining liquidity is even more important.

In stark contrast, sports betting is a "spring dream" for market makers due to the allure of uninformed retail trading flow, combined with the more predatory incentive structures in sports betting. It is foolish to think that market makers would not accept a small inventory risk on platforms like Polymarket or Kalshi in exchange for a large amount of uninformed retail trading flow (along with favorable fee structures or rebates).

Yoshi suggests introducing more futures and options market makers, which may be the clearest short-term solution to the liquidity stickiness problem, as both have similar payment structures. However, this suggestion is also essential considering the risks that non-professional LPs may face in any specific prediction market. Since these market makers have experience managing inventory risk and possess the skills to accurately simulate volatility in new markets, their presence may narrow spreads, but the complexity has not yet been popularized on these platforms.

Theoretically, this makes sense, but it is worth noting that even if these market makers enter prediction market trading with knowledge from other industries, it is not straightforward to correspond to hedging binary prediction market outcomes. Futures and options market makers can utilize countless strategies, tools, and financial engineering techniques to hedge any risk, but doing so in the existing prediction market space is quite challenging, if not nearly impossible.

Regarding wash trading or minimizing fraudulent behavior by market makers, Kalshi recently launched a new incentive mechanism aimed at encouraging deeper and more consistent liquidity across all its markets.

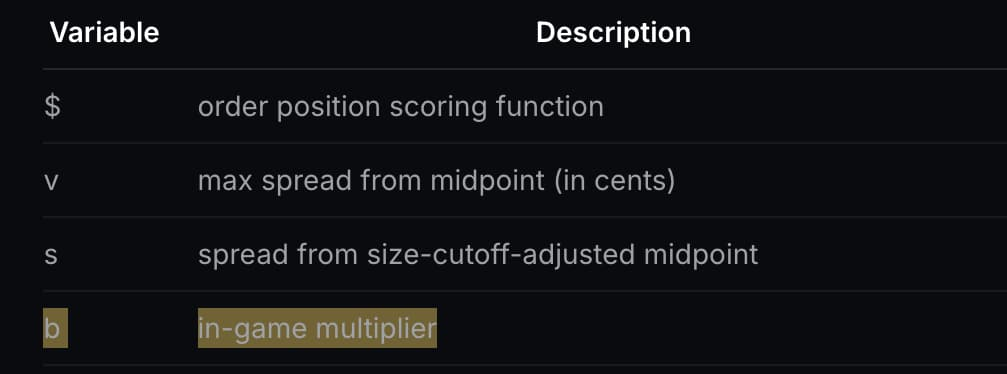

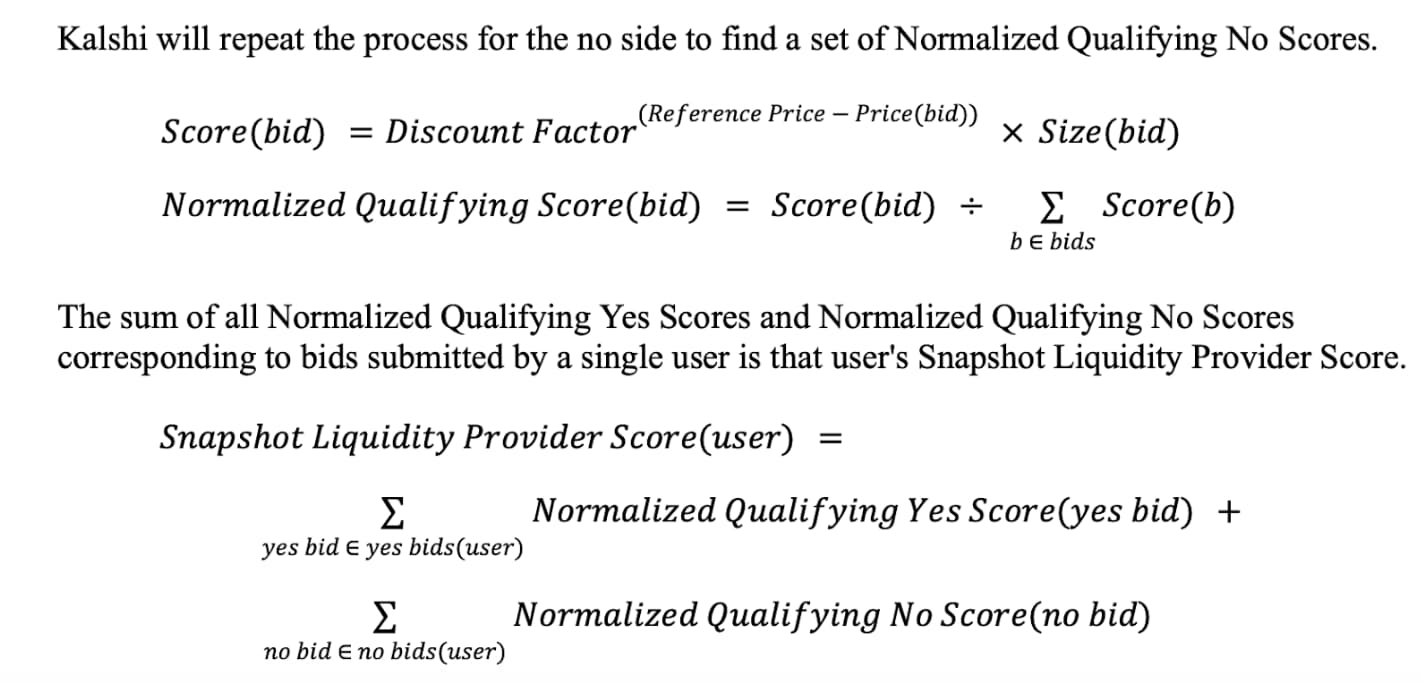

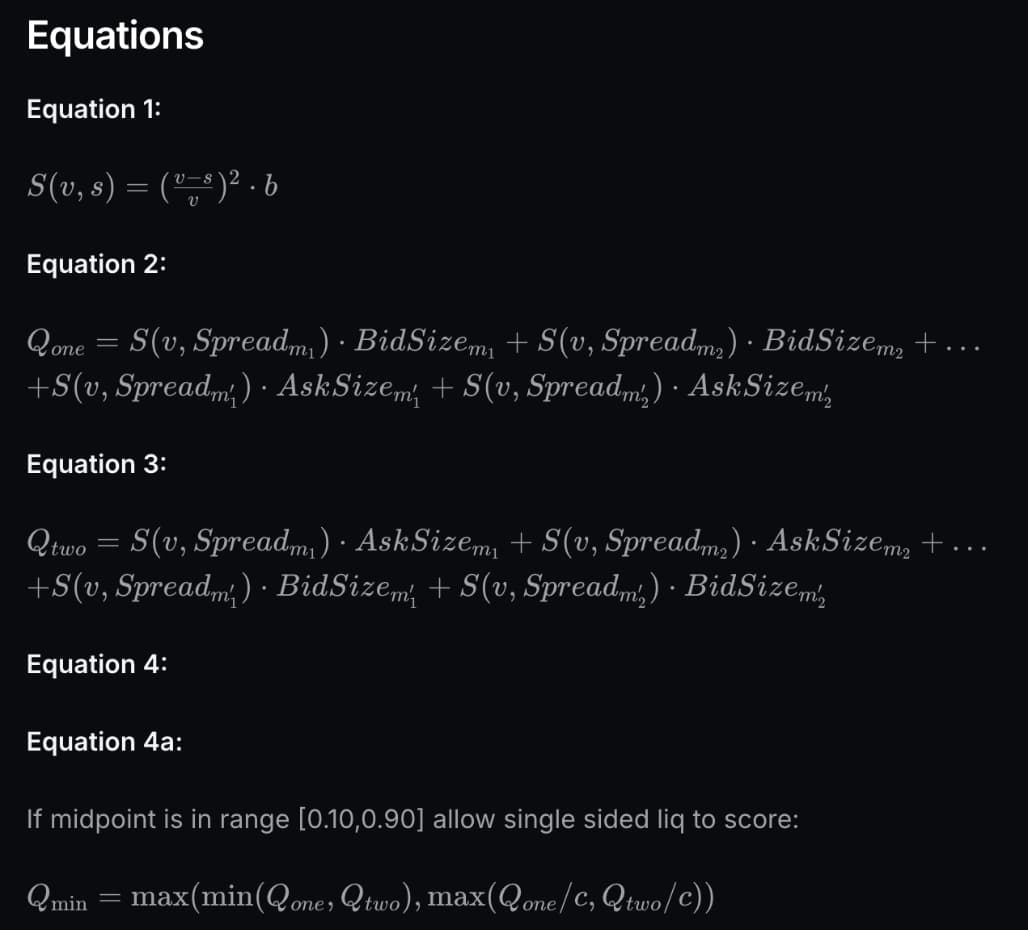

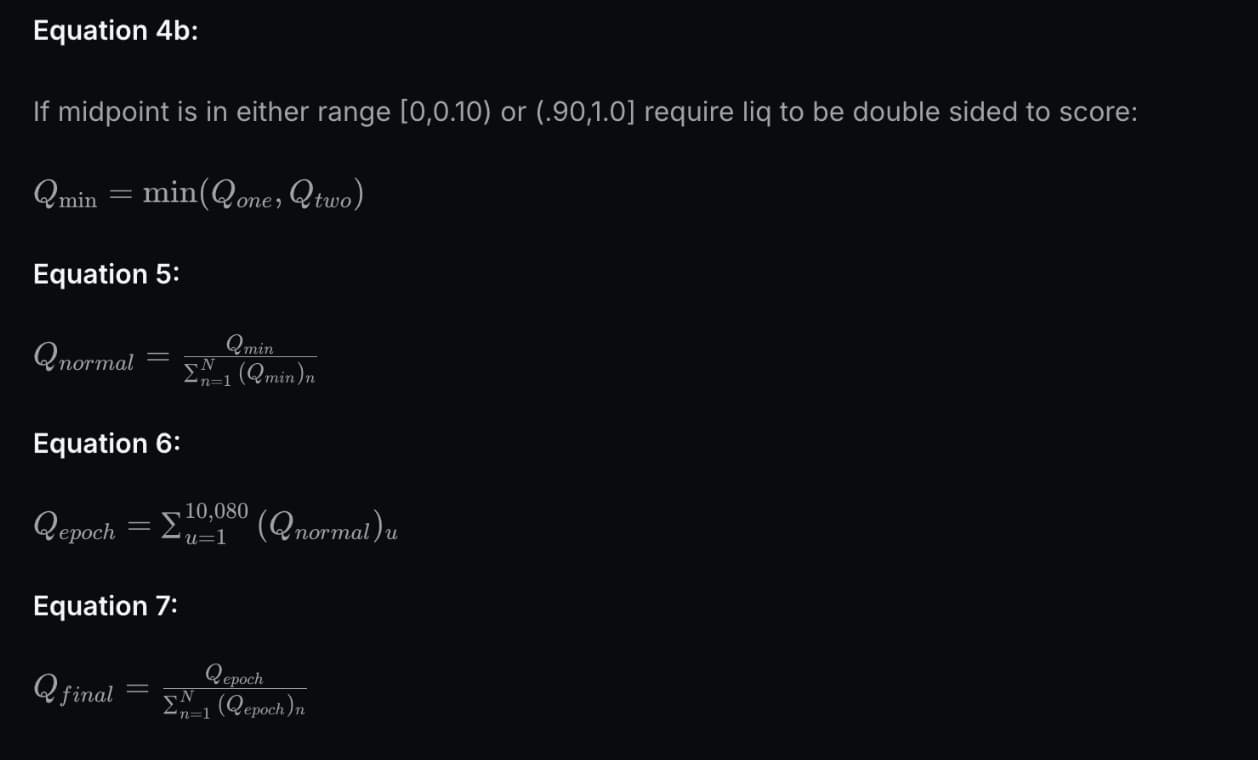

Kalshi's new liquidity program defines three parameters and sets them for each market designated as qualified. These three parameters are target size, discount factor, and time period rewards.

For example, Adhi, an aspiring market maker, might place an order for 1,000 contracts in a market with a discount factor of 0.9 and a reward pool of $100.

These 1,000 contracts might be split into three different price points (best buy price, 1 cent off, 2 cents off), representing three unique payment structures for that order. Theoretically, the calculation is very simple: just multiply the size by the discount factor, then multiply by the distance from the best buy price to get the score.

This simple calculation measures the return rate for Kalshi market makers, clearly prioritizing stricter liquidity and reducing the profit-driven behavior of market makers through second-by-second snapshots.

Kalshi hopes to reward more sticky liquidity, which is understandable, but importantly, this revision makes it difficult to determine what systems Kalshi has adopted, and the centralized nature of these systems makes it nearly impossible to peek behind the scenes.

Recently, rumors have intensified regarding some market makers enjoying zero fees or rebates, but specific details remain uncertain. SIG (Susquehanna International Group) was the first institutional market maker to join Kalshi (in April 2024), and this is not to discuss the business acumen of these teams, but it would be absurd to think that SIG would not agree to join Kalshi and would not provide some form of preferential treatment.

Although front-running is a significant issue in these markets, both Polymarket and Kalshi strongly encourage market makers to provide two-sided liquidity and impose strict penalties on those who do not comply with this rule.

Kalshi incentivizes market makers to provide two-way liquidity by softly penalizing those who do not provide one-sided quotes. If a market maker decides to only provide one-sided quotes, the other side of the equation will essentially be zeroed out. According to Kalshi's documentation, market makers can only earn between $0.03 and $0.97 in liquidity. This makes sense as it curbs the incentive to manipulate the market to extreme prices.

Polymarket's penalties for one-sided liquidity are even harsher. If you look at the equation below, you will find that providing one-sided liquidity means you will essentially get your accumulated points divided by 0.3333. Additionally, you can only provide one-sided liquidity when the contract trading price is between [0.1, 0.9]; if you want to earn points outside that range, you must provide two-sided liquidity.

In summary, Polymarket's penalties for one-sided liquidity are much stricter, and due to the lack of KYC, insider trading is more likely to occur on their platform. That said, they should be more lenient towards one-sided liquidity providers because on Polymarket,

Liquidity Incentives and Multipliers

Polymarket has invested about $5 million in its liquidity incentive program. Approximately 90.5% of incentivized markets have daily incentive amounts of $5 or less. In the sports betting sector, the liquidity incentives for most markets are nearly zero (with a median of 1).

However, some markets related to teams that are very likely to reach the Super Bowl have daily liquidity incentives of around $400. This indicates that Polymarket does not genuinely want to "vampire" Kalshi or compete with Kalshi for all sports betting markets, but rather wants to compete with it in the markets with the strongest liquidity (such as the Super Bowl). Possibly due to regulatory restrictions, Kalshi cannot truly offer predictions like "Will X surpass earnings per share this quarter?" as this is too similar to financial products. However, for Polymarket, this is an interesting market where they have invested heavily in liquidity.

These markets open as they approach their expiration date, sometimes attracting significant trading volume. Among markets where daily liquidity incentive amounts reach or exceed $100, 69.5% are politically related, and Polymarket seems more interested in cultural/political-related fields rather than sports, which is Kalshi's forte.

According to Kalshi's API, there are currently 35 markets offering liquidity incentives, of which all but two are sports markets. Since its inception, Kalshi has invested $8.75 million in incentives, averaging about $35,000 daily, nearly double Polymarket's daily average investment. Additionally, the site lists 37 active incentivized markets, although there is significant overlap between these markets, leading to a cautious stance towards both.

Kalshi's market-making documents explicitly mention benefits such as "including but not limited to financial gains, reduced fees, different position limits, and enhanced access," which are well-known. However, whether certain market makers enjoy more favorable conditions than others is another matter.

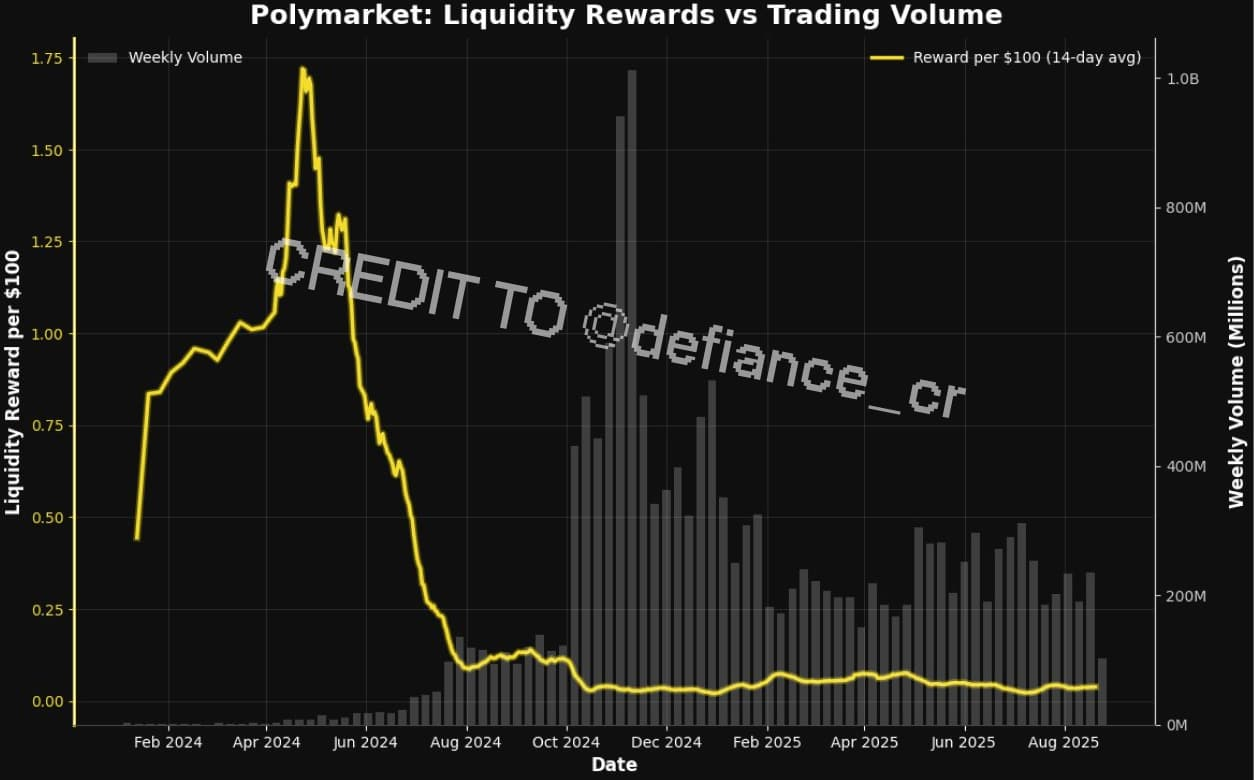

At the beginning of 2024, Polymarket briefly paid its market makers a commission of $1.70 for every $100 in trading volume, before reverting to a more reasonable commission level of $0.025 per $100. It is reasonable to assume that this significantly boosted the platform's trading volume, as everyone likes to earn a little extra money, but in reality, it did not have much impact on the growth of trading volume, as shown in the chart below:

This chart shows that after adjusting the reward amount to $0.025 per $100, Polymarket's trading volume actually increased significantly, indicating that LPs were relatively indifferent to this substantial increase in earnings, or may not have even been aware of it.

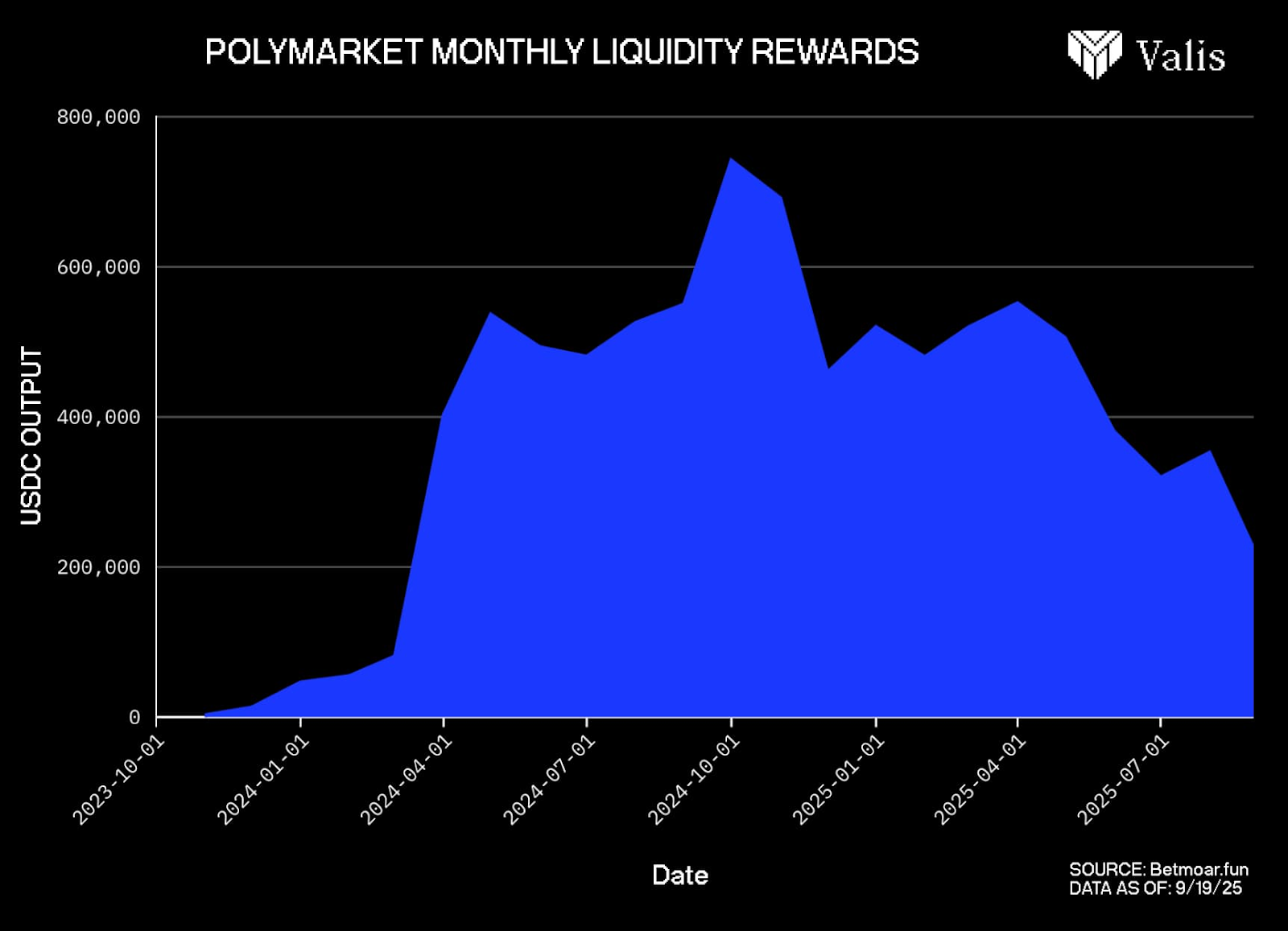

According to data from betmoar.fun, Polymarket has paid nearly $10 million in liquidity rewards since its inception, while Kalshi's data remains opaque. It is important to note that the $10 million mentioned here was paid entirely in USDC (or other dollar-backed stablecoins), rather than token rewards, as neither platform has issued tokens. If Polymarket were to issue tokens, it would significantly change the competitive landscape with Kalshi.

Regarding Kalshi, it is impossible to make a conclusive assertion or to state what is happening. It is possible that the underlying reward distribution remains unchanged or has only slightly increased, but more importantly, it may provide market makers, especially third-party or external trading partners like SIG, with more favorable conditions.

However, liquidity issues go beyond this; they relate to the rapid onboarding of more institutional market makers.

Parlays and Leverage

Parlays are very popular and have quickly become a major source of revenue for traditional sports betting companies. A blog published by the PGA Tour in 2023 claimed that Parlays accounted for nearly 70% of all NFL and NBA bets on FanDuel.

Sports betting companies make it very easy to build Parlays within their apps, providing dedicated tools to combine different bets into an N-leg Parlay without manual calculations of odds. All Parlays are different, and platforms like Reddit are filled with various absurd posts about 10+ leg Parlays, where the implied odds have essentially disappeared.

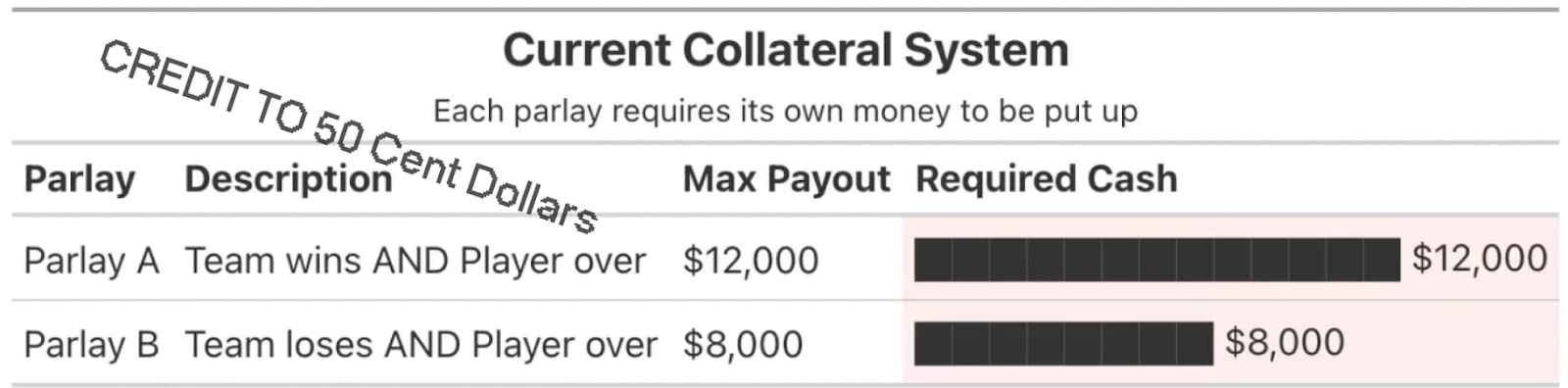

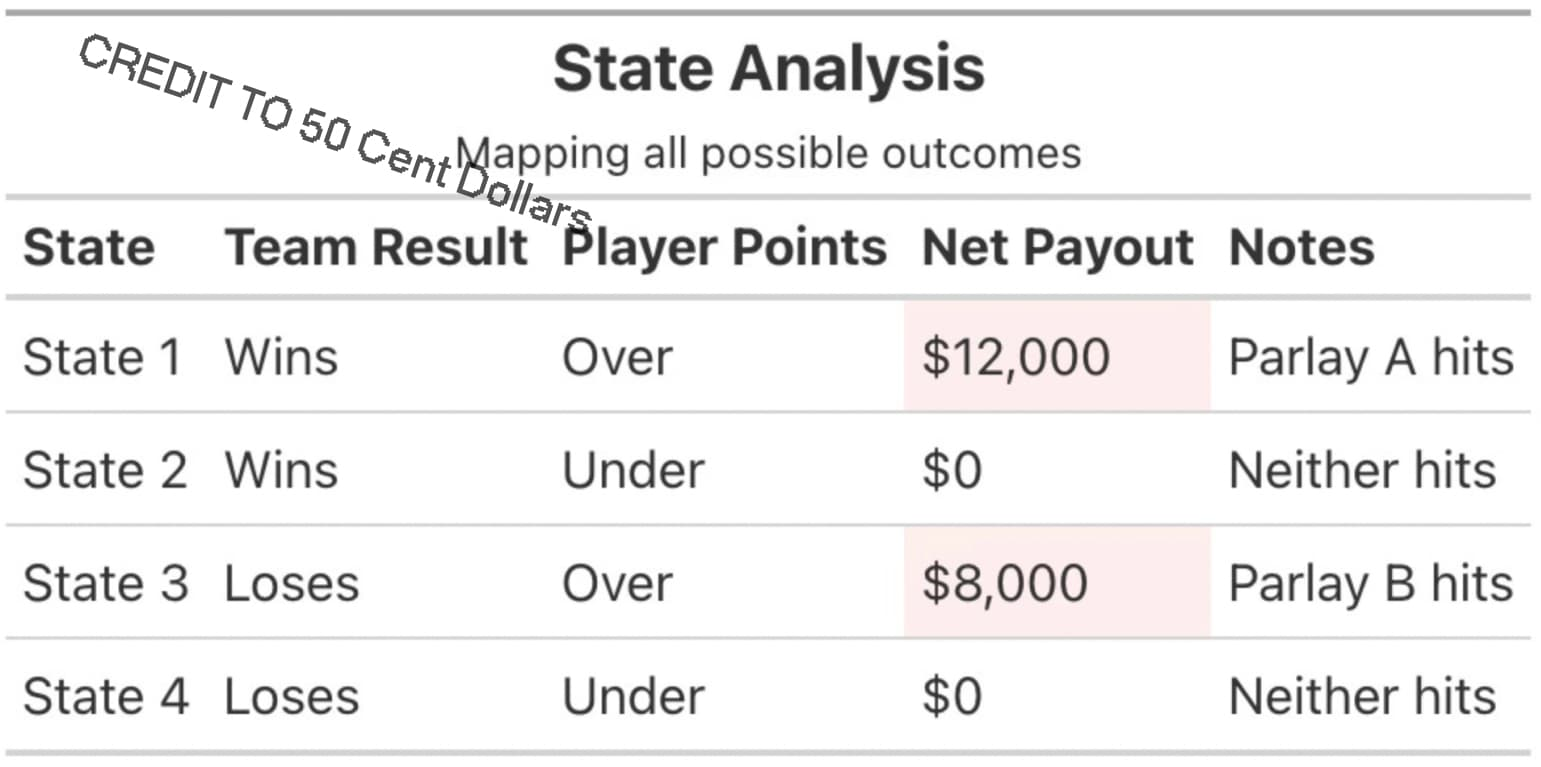

Polymarket and Kalshi must provide full collateral for all positions on their sites. If the open contract amounts on these two platforms are $150 million each, then all of this capital comes from the active positions held by traders on the platform. Sports betting companies, on the other hand, operate differently, as their users are betting against the bookmaker or other market makers, who will pay out based on the results. This key difference affects the available liquidity on the order books of any specific event market, as funds must be paid by the market makers or users, who must deposit dollars or USDC to place bets.

A sports betting company may have daily trading volumes of billions of dollars, but not all of this capital is real, especially in Parlays. If a user bets $10 on a 12-leg Parlay with odds of +192876, guaranteeing a payout of $19,287, the market maker or counterparty on the other side does not need to pay out that amount immediately. In prediction markets, funds must be used for settlement, and considering these long-tail outcomes, the difficulty of Parlays is quite significant.

Existing market makers find it nearly impossible to meet even a small demand for Parlays. Even taking on just 5-10% of traditional Parlay demand would cause a surge in capital requirements for market makers, considering the previously discussed issues of adverse selection, volatility, and inventory risk related to prediction markets, which would undoubtedly be an unnecessary burden.

If a cash-backed prediction market platform wants to offer Parlays, Adhi outlined three possible steps, each still representing a simplified version of sports betting Parlays:

- Significantly limit tail betting amounts

- Guide users to a pre-set Parlay submenu

- Obtain permission for a margin portfolio instead of pre-paying all worst-case payouts

Regardless of the approach taken, the end result is that the Parlay experience is far less thrilling compared to the "self-select" model of sports betting, and it lacks the lottery-like Parlay outcomes that users crave.

Kalshi cannot achieve this; if a third party attempts the above examples, it would resemble an over-the-counter trading business rather than other DeFi protocols, making it less likely to gain attention and fraught with other regulatory risks.

This discussion reveals the collapsing collateral system in prediction markets, where market makers must put up capital equivalent to the worst-case scenario, while ignoring the obvious fact that the two different solutions are mutually exclusive, and there is no need to over-insure against statistically (and logically) impossible situations.

If market makers are forced to allocate all their funds to extremely unlikely events instead of using them for other prediction markets that differ from Parlays (which could greatly enhance their capital efficiency), then their incentive mechanisms become completely inconsistent.

While Parlays may be the primary method for increasing payout rates in the sports betting sector, leverage is the simplest way to achieve this in the crypto space.

Implementing leverage in prediction markets will be very tricky, potentially even more complex than the previously discussed principal-and-interest structure. This relies on prior knowledge of market makers' risk preferences and the challenging role of managing inventory risk, considering that one side of the market will inevitably trade at $0 after settlement. The market making for leveraged prediction markets will exacerbate these difficulties, which may be great for speculative users, but is a completely unknown territory for any existing counterparties.

Polymarket and Kalshi have yet to explore leverage, likely because these platforms are still figuring out the nuances of spot market making, but it may also be due to the annualized volatility of up to 1,500% in prediction markets.

Volatility is just one factor to consider, as the natural structure of binary prediction markets means that liquidity does not gradually dissipate from one side of the order book as the outcome approaches settlement (100% or 0% probability). John Wang's post on Hyperliquid discussing prediction market risks lists some potential solutions, such as liquidation ranges, pre-expiration leverage decay, throttled oracles, and pre-settlement auctions.

Some of these solutions are better than others, and this article also argues that liquidation ranges and leverage decay should become the norm for a considerable period in the early stages. This article is well-written but points out a flaw, especially regarding scalar markets: "Scalar markets settle to a range, such as CPI percentage or BTC share, rather than 0 or 100. This greatly reduces jump risk and supports higher leverage."

Scalar markets are still subject to binary options, even if these are ranges rather than binary "yes" or "no" options. The issue lies not in how prediction markets are presented, but in how they reach conclusions, all of which are resolved in the same zero-sum game manner. Even if scalar markets perform differently due to their continuity, prices will converge to one side, and there is indeed jump risk, especially in markets relying on third-party signals (such as consumer price index data).

Safe leverage ratios can be gradually implemented over time, but the leverage ratios in the crypto perpetual futures market are simply unattainable, let alone outside the top 25-30 markets on these platforms. While the crypto industry is fascinated by perpetual futures, the leverage issues surrounding Solana memecoins remain unresolved—this is simply a tricky financial engineering problem that any leveraged product should handle with extreme caution.

Forms of Manipulation and Historical Accuracy Analysis

As we are about to discuss market settlements and their accuracy before settlement, it is best to briefly explain how these platforms handle dispute resolution and settlement in their unique ways.

Oracles

In the case of Polymarket, the UMA oracle manages settlements and dispute resolution in a way that requires almost no human oversight. The UMA protocol brings a large amount of data on-chain and is overseen by a committee composed of UMA token holders. UMA is a native crypto protocol but has gained widespread recognition primarily through its partnership with Polymarket.

"The oracle problem is not really an oracle problem, as the design of crypto oracles is not intended to address events like world events," or more simply put, UMA is not well-suited to manage the governance processes that Polymarket currently handles, which amount to hundreds of millions of dollars each month.

Kalshi does not face this issue, as it has an internal team responsible for market review and dispute resolution, which, although slower than a more automated oracle approach, likely saves them a lot of trouble and negative press. Kalshi has a dedicated market team responsible for internal review and dispute resolution. Notably, they may use data sources similar to those of Polymarket, but despite the slower processing speed, they may be more defensive in dispute resolution.

Manipulation, Crime, and Some Considerations

Having just discussed the historical accuracy of prediction markets, it is essential to revisit this concept from a more updated, non-academic perspective. Whether you agree that prediction markets are more accurate than mainstream media, polling data, or other sources of truth is irrelevant: manipulation is not only measurable but can be said to be a problem.

Two different types of manipulation are presented here—social coercion and insider arbitrage—and the potential involvement of whales and large traders is explained.

Assume that an executive at Universal Music Group wants to understand public sentiment regarding Drake's new album. Perhaps internal polling and data suggest that the album will sell well, but they are not certain. They ask an employee in the hypothetical marketing or data science department to create a simple, multi-outcome market on Polymarket titled something like "What will Drake's first-week album sales be?" and provide a small amount of liquidity.

The outcome ranges might include: 1.5 million, 1.5 million-2 million, 2 million-2.5 million, >2.5 million. This way, you can reasonably gauge consumer expectations for Drake not only from the artist's perspective but also from an investment standpoint. The multi-outcome market is not just a boring bet by traders on the album's success or failure, but rather a composite belief from numerous market makers and potential informed fans who demonstrate their value through action.

Returning to the accuracy of prediction markets, it is easy to conclude that even a less liquid market (or hypothetical market) would be more valuable than randomly polling a group of individuals without a way to gauge their internal views or assess whether they are telling the truth.

Assuming that hypothetical markets for artists like Taylor Swift, Olivia Rodrigo, or Ed Sheeran have already made headlines and garnered millions of views on platform X, thus sparking a small marketing wave in the process.

Assuming that the record label executives then decide to leverage overwhelming orders to boost first-week sales and create a buzz around Drake's new album, prioritizing the highest first-week sales records to the extent that anyone who sees the album will be compelled to pay attention to Drake's upcoming release.

This would obviously incur costs for the record label, but in this case, it is a good way to generate buzz and make headlines, something that has not been attempted before, and it may be cheaper than typical corporate marketing campaigns aimed at artists of Drake's caliber.

If you are a more astute reader, you might notice a problem with this assumption: if an entity were to purchase over 2.5 million contracts on its own, wouldn't the natural forces of the market restore it to some equilibrium and fair value?

This is not only correct but has been tested and validated, even though the scale of this hypothetical market is vastly different from real-world market scales.

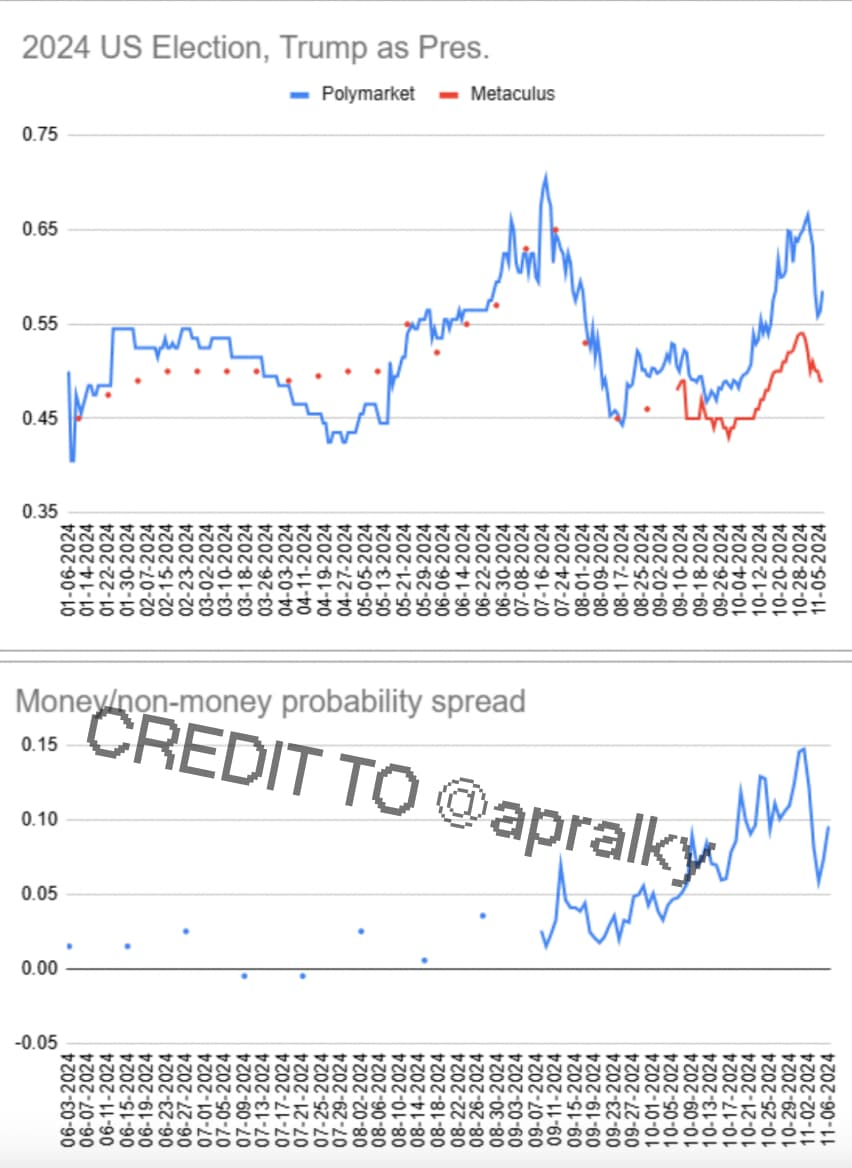

Yung Macro published an analytical article on X in June of this year, pointing out the flaws in Scott Alexander's argument, particularly his claim that "whale skew" is the reason Polymarket exaggerated the odds of Trump winning the 2024 U.S. presidential election.

Scott wrote that money-based prediction markets priced Trump's odds of winning significantly higher than non-money-based prediction market platforms (like Metaculus), seemingly due to whale bets distorting the odds beyond "fair value." Scott presented a counter-argument and a rebuttal to that counter-argument, but here we focus only on the objective facts.

Whether it is whales distorting the odds from fair value (Trump's winning probability at 54%) to around 8-10% (Trump's winning probability at 62-64%), the reality is that this market did not correct the overly enthusiastic whales nor restore it to the hypothetical fair value. In fact, Yung Macro's data shows that the price difference between money and non-money platforms did not revert to fair value but rather widened over time.

If traders believe that whales are distorting the market, causing it to deviate from reality, then sellers would take advantage of this, gradually pushing prices down over time, ultimately returning to the price before the whales appeared. But this did not happen, and it is illogical to maintain this assertion when the data indicates otherwise. In short, even if experts hold opposing views, the market still fulfilled its role by expressing the beliefs of traders.

This phenomenon is most clearly reflected in the distinction between Polymarket and mainstream media coverage of the election. CNN reported that platforms like Polymarket saw things they did not. But more likely, Polymarket itself saw nothing, and the "collective mind" trading on it expressed their original beliefs and backed them with money.

This article does not oversimplify, but such phenomena can occasionally be seen in traditional finance: a company's earnings may far exceed expectations, and its after-hours stock price may rise by 20% or 30%, only to self-correct the next day.

Returning to the second form of manipulation, insider arbitrage (or insider trading), there is actually a good example that has been widely debated since Camilo posted on X here.

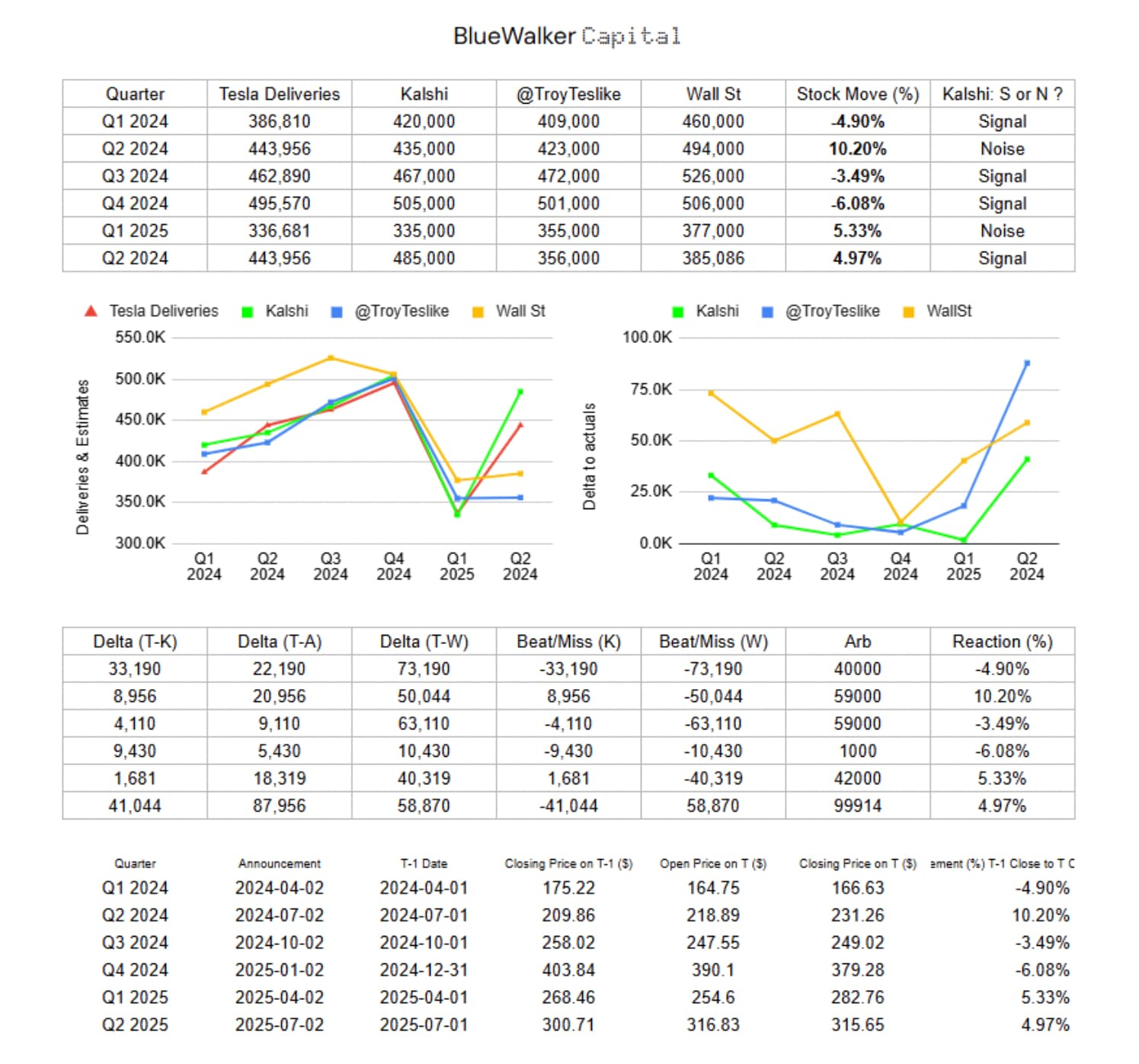

At first glance, Kalshi seems to have predicted Tesla's quarterly delivery numbers more accurately than @TroyTeslike (a person specializing in quantitative analysis of Tesla and TSLA).

Does this indicate that some individuals with insider information are profiting from the lax regulatory nature of prediction markets without facing legal penalties?

Due to Polymarket's current legal status, CFTC regulation is impossible, and tracking potential insiders is essentially unfeasible, as they can exploit MNPI (material non-public information) at will. Kalshi might be doing this, although no information about this strategy has been released yet, as it is likely managed by the company's internal legal team.

This is not to imply that this is a typical case of insider trading, but merely the possibility of such occurrences is enough to raise concerns and potentially impact these platforms in the short term. It might be explained from the "devil's advocate" perspective that this is likely just a case of some extremely astute data science experts/detectives utilizing a more simplified interface.

Future Directions and How to Leverage This Trend

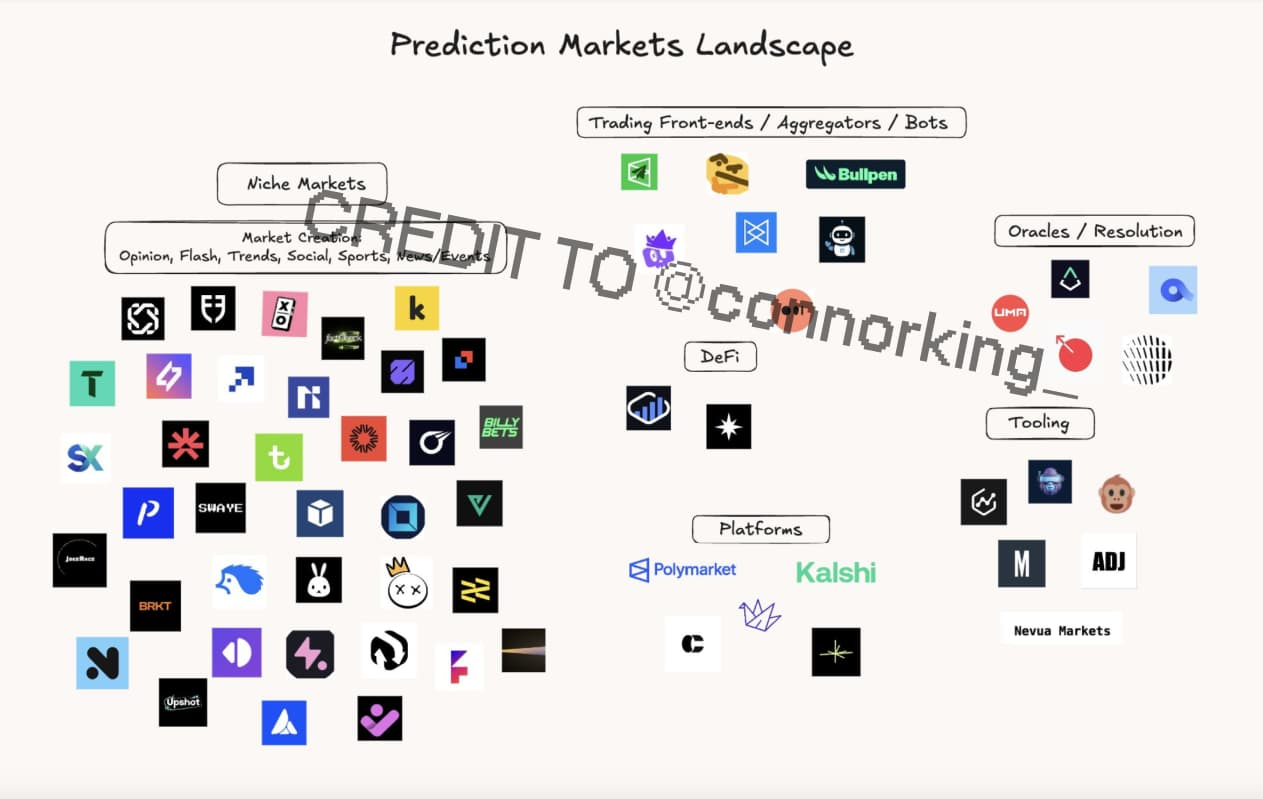

One thing that has not yet been discussed is the potential design space for entirely new prediction market platforms, improved infrastructure/tracks, and some social-first applications operating in this field. Connor King created a market map covering all the cases of crypto-native prediction market startups being built, defining categories such as tools, platforms, DeFi space, trading frontends, oracles/solutions, and niche markets.

This article provides a simple framework to evaluate these startups, whether you choose to invest in them through private agreements or liquidity markets (token purchases).

Platforms like Limitless, Clearing Company, and Manifold directly compete with the two major platforms, Polymarket and Kalshi, which is understandable. However, figuring out the positioning of these other applications is not easy.

Some applications are building experiences that are easier to identify than others.

Many of these newcomers are optimizing for social engagement, discoverability, or a more user-friendly interface while structurally offering the same types of products that users are already trading on major platforms, meaning that competition is, to some extent, a zero-sum game.

What Existing Platforms Might Be Planning

An obvious goal is to compete to become the TikTok of prediction markets, or something similar, to attract users more aligned with the Zoom user base, but even so, it still feels distant and difficult to achieve. Polymarket and Kalshi have more influence than many realize; they have established channels to reach retail investors and frequently appear on live television networks like CNN or CNBC.

In terms of reach, the partnership between Robinhood and Kalshi is one of the most significant developments in fintech history in recent years. This partnership officially allows Robinhood users to trade based on the outcomes of NFL and college football games, effective August 19.

Previously, Robinhood and Kalshi collaborated to allow Robinhood users to trade contracts for the 2024 U.S. presidential election on Kalshi. According to a blog post released by Robinhood, over 2 billion contracts changed hands during that election period. It was previously discussed how Robinhood successfully transformed ordinary people into options traders, and now it seems they are extending this strategy to prediction markets through ongoing collaboration with Kalshi.

Given Robinhood's 274,000 funded accounts as of Q2 2025 and Kalshi's pursuit of trading volume, this is not surprising. However, Kalshi's significant growth raises an interesting question: how many of these may come directly from Robinhood users? Can this be measured before the quarterly earnings report?

It is currently impossible to determine, but considering the previously discussed situation where bettors leave sports betting platforms after being eliminated, the clearer odds in prediction markets, and the convenience of betting directly in Robinhood's extremely simplified interface, it is not impossible. Whether Robinhood will continue to collaborate with Kalshi in markets beyond sports and politics remains to be seen, but the initial success provides no reason to suggest that the two parties will not cooperate.

It is currently difficult to assert which platform, Polymarket or Kalshi, is performing better, but based on all discussions, the view that these two platforms can coexist peacefully for at least a few more years is not entirely contradictory. They have been doing so, and it is clear that each harbors different short-term goals, with each platform at different stages between centralization and decentralization.

Perhaps Kalshi will continue to prioritize the development of sports-related markets and compete with all traditional sports betting companies. Polymarket may continue to push for deep liquidity in long-tail markets over the next six months and improve relationships with regulatory-friendly U.S. trading platforms. These outcomes are not mutually exclusive, providing ample reason for users of both platforms to continue their trading activities, regardless of news headlines or external pressures.

While Kalshi is ambitious and Polymarket is focused on trading profitability, the developmental paths of these two platforms remain very similar:

Elon’s companies X and xAI have signed some form of cooperation agreement with Polymarket and Kalshi, respectively.

Although the situations are different, both platforms continue to advance their regulatory efforts.

Despite both platforms announcing $200 million and $185 million in funding three months ago, the allure of more venture capital remains, and it seems to be heating up.

Discussion on Tokens

What follows is highly speculative or may be completely inaccurate, but for those who cannot participate in the private rounds of Polymarket or Kalshi, the best course of action is undoubtedly to use these platforms directly.

In the case of Kalshi, considering they are not yet blockchain-based applications, their considerations are different, although their team has recently expressed intentions to further delve into the cryptocurrency space.

Given that Polymarket leans more towards the crypto-native realm and has the potential for airdrops, the above advice is particularly applicable to Polymarket.

There are many reasons why Polymarket is considering issuing tokens. Lucas first proposed that a certain percentage of the token supply could be specifically allocated to enhance liquidity rewards, thereby reducing Polymarket's reliance on paying USDC reserves (approximately $6 million annually). If the rumors of a $10 billion investment deal for Polymarket are true, then Lucas estimates that 0.76% of the supply would be used for incentives, assuming a token valuation of $10 billion, which would mean over $76 million in liquidity incentives. If Polymarket is more conservative and only provides $25 million in annual incentives, then only 0.25% of the token supply would be needed each year.

Another benefit is that it aligns more closely with the user retention strategies of traditional sports betting companies. Before the Hyperliquid airdrop, a common points acquisition strategy was to purposefully liquidate leveraged positions to earn higher weekly point distributions. The result was that even net losing accounts could achieve a positive return on investment after accounting for the profits from selling HYPE rewards.

This model is most similar to how sports betting companies like DraftKings or FanDuel offer free bets or promotions to users (especially those with a history of losses) to keep them on the platform. Even distributing 0.3% to 0.5% of the USDC supply annually could lead to poor price performance, although this is just a small expenditure, and assuming Polymarket does not charge any fees, consuming USDC reserves without any leverage to bring funds back into the system is unsustainable.

Data from Dune platform @filarm shows that only 15% of account balances on Polymarket are positive, while the remaining 85% are negative (possibly due to accounts being zeroed out). Research indicates that only 3% of sports betting users can profit in the long term; although this is far from Polymarket's 15% profitability rate, a strategy of airdropping more token rewards to net negative accounts would have a significant impact on user retention.

Related reading: A Brief History of Prediction Markets: From Papal Elections to Polymarket

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。