Traders Eye DOGE as 21Shares Dogecoin ETF Advances

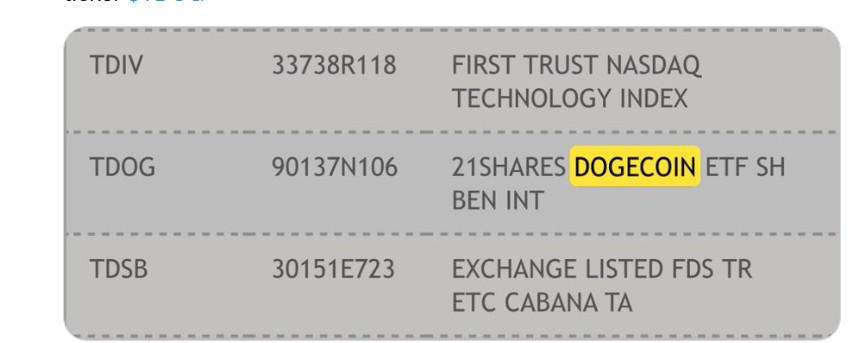

21Shares’ Spot Dogecoin ETF has been listed on the Depository Trust & Clearing Corporation under the ticker $TDOG. This listing is a routine but important step that prepares the fund for trading infrastructure and settlement.

TDOG Appears in DTCC Database — A Move Through the Technical Rails

21shares dogecoin ETF appears now in DTCC’s ticker database, signalling that the product is moving through the technical rails needed for a U.S. launch.

Source : Website

21Shares first filed an S-1 registration with the SEC in April 2025 to offer a Dogecoin Exchange Traded Funds in the U.S. Later, Nasdaq submitted a proposed rule change to list the fund under its commodity-based trust rules. Those filings are public and show the formal path 21Shares is taking to win regulatory approval and list shares on an exchange. This is the latest step in that multi-stage process.

Clearing, Settlement and What This Listing Means

DTCC is the back-office system that helps brokers clear and settle trades. When an ETF’s ticker is registered there, it means brokerages can map and settle once the fund starts trading.

It does not mean the U.S. Securities and Exchange Commission (SEC) has approved the ETFs that are a separate, regulatory step. The listing under TDOG is best read as preparation, not final permission.

Why markets and influencers are talking about it

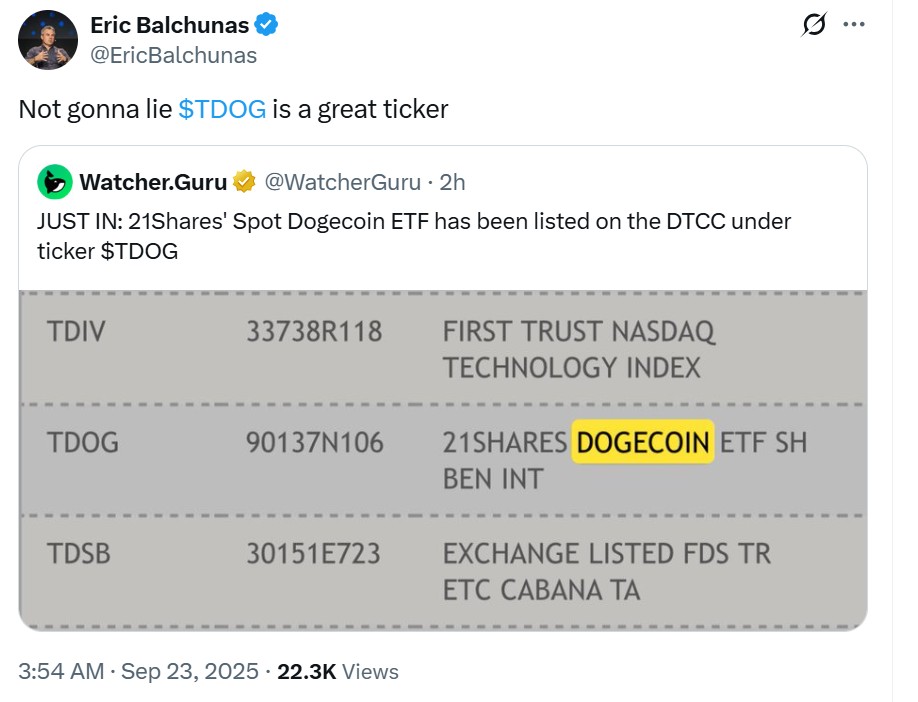

Crypto market watchers and analysts reacted quickly. Bloomberg analyst Eric Balchunas and other influencers have posted about possible Dogecoin Exchange Traded Fund launches and the wave of new crypto ETF filings. Balchunas has suggested that $TDOG may be a great ticker, which helped spark discussion among traders and on social platforms.

Source : Eric Balchunas

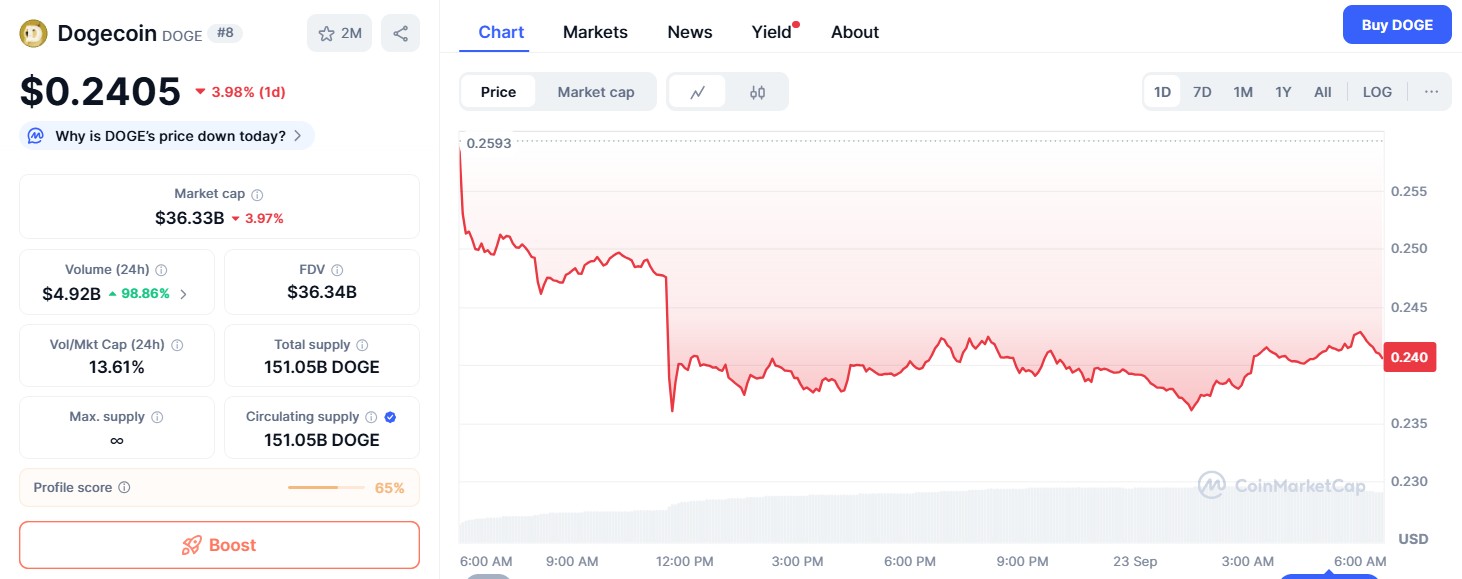

Dogecoin Price Movement

The coin has seen a decline after the DTCC listing news. Memecoins have seen a surge following news like this, but they are very volatile and react quickly. Traders must watch carefully. The coin is trading at $0.2405 with a dip of ~4%. Whereas the 24hr volume jumped to 98% at $4.9B.

Source : Coinmarketcap

Analysts say this is a good technical step, but the SEC must still allow trading. If this clears regulators and starts receiving money, the memecoin could see further demand. Market movement was mixed; some traders bought in on the news while others took profits or waited for SEC clarity.

What investors should watch next

The DTCC listing for the 21Shares Dogecoin ETF is an important operational step. It shows readiness on company's side but does not equal final approval. Watch for the SEC’s response to Nasdaq’s listing proposal and any effective date set in the registration. Also monitor official announcements from 21Shares and the exchange (Nasdaq or Cboe) for a launch date. Until then, the DTCC entry simply tells us the fund is being prepared for potential launch.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。