Grayscale ETF Debut and Eyes Dogecoin ETF Conversion: GDOG Coming Soon

Grayscale CoinDesk Crypto 5 ETF Debut : A Strong Start for Multi-Asset Crypto ETFs

Grayscale launched its Digital Large Cap Fund (Ticker: $GDLC) on Sept. 19 and the product opened with nearly $22 million in trading volume as 381,298 shares changed hands on NYSE Arca. This is a big first day for a new crypto exchange-traded product, especially compared with many ETF debuts that often trade under $1 million on day one.

Source : X

What’s Inside GDLC

GDLC is a basket-style, multi-token ETF. It gives investors one place to buy regulated exposure to five top coins instead of buying each token separately. The debut volume looked strong versus other recent launches, including the Rex-Osprey Dogecoin product, which saw heavy early trading during its Sept. 18 opening.

The fund holds a mix of large-cap crypto that is:

-

72% Bitcoin,

-

17% Ethereum,

-

6% XRP,

-

4% Solana, and

-

1% Cardano.

That weighting gives the vehicle broad market exposure inside one regulated product. GDLC also tracks the CoinDesk 5 index and now operates with in-kind creation and redemption like many ETFs.

Source : Eric Balchunas

Bloomberg ETF analyst Eric Balchunas called the GDLC debut “shockingly solid,” noting that most ETFs trade below $1 million on day one which makes GDLC’s $22M debut stand out. Other analysts see a future where basket-style ETFs become a major category after single-asset Bitcoin funds.

G rayscale’s other moves: Grayscale Seeks to Convert Dogecoin Trust to GDOG ETF

At the same time, Grayscale filed a revised S-1 to convert its Dogecoin trust into a proper exchange-traded fund. NYSE Arca has also signaled adjustments to listing rules around some of Grayscale’s Ethereum trusts. These steps show Grayscale is actively expanding its ETF lineup beyond Bitcoin and Ether exposure.

The SEC’s recent approval of generic listing standards on Sept. 18 reduced filing friction for spot cryptocurrency ETFs and allowed exchanges like NYSE Arca to list multi-token products more quickly under Form S-1 review windows. The SEC move is a major policy shift meant to speed up approvals while keeping market-quality rules for liquidity and market cap.

How Crypto Market Reacted and Price updates

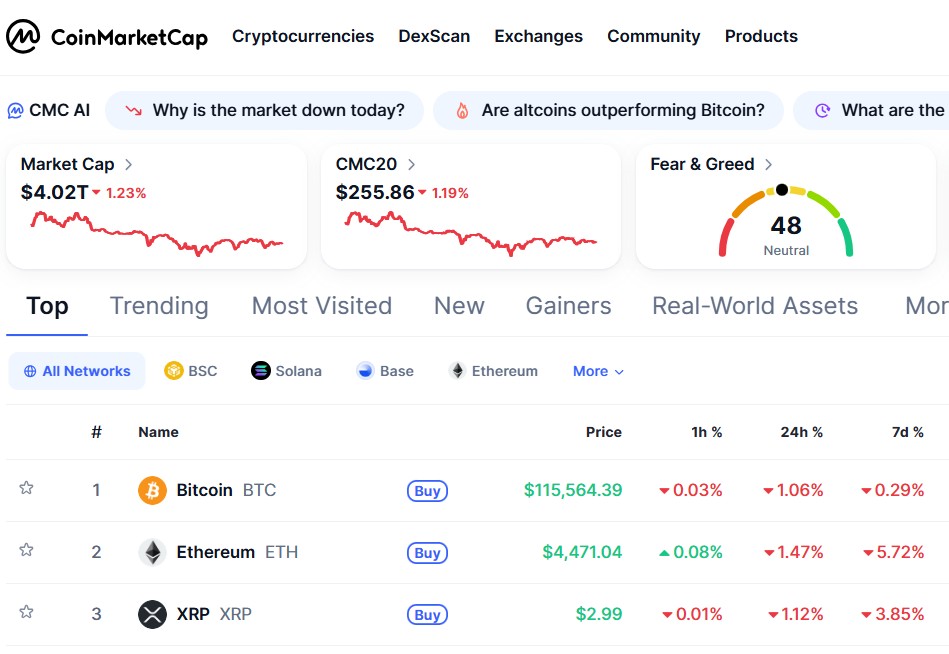

According to coinmarketcap data the global cryptocurrency market capitalization stands at approximately $4.02 trillion, experiencing a slight decrease of about 1.23% over the past 24 hours. At the time of writing the prices of coins which the fund holds are below:

-

Bitcoin (BTC): $115,564.

-

Ethereum (ETH): $4,471.34.

-

XRP : $2.99.

-

Dogecoin (DOGE): $0.2652.

![]()

Source : Coinmarketcap

Even though prices have dipped recently, many market watchers still feel good about the long-term outlook for major cryptocurrencies.The launch of GDLC should help that confidence. By giving investors a regulated, diversified way to own top coins in a single product, the fund makes crypto exposure simpler and more familiar to big institutions and everyday investors alike.

Final Thoughts

Grayscale’s launch shows investor appetite for regulated, easy-to-access crypto exposure through normal brokerage accounts. The new SEC rules and in-kind ETF structure reduce premium/discount issues and make price discovery cleaner. With firms like Bitwise, Hashdex, and Franklin Templeton filing similar multi-asset products, we may see many more diversified cryptocurrency ETFs soon.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。