Nomination for CFTC Chair May Hit Crypto Rules

The White House is said to be looking at new names after the nomination for CFTC chair of Brian Quintenz ran into trouble. The move comes as leaders worry the stalled confirmation could slow work on crypto regulation, digital assets, and market regulations.

Source : Bloomberg

Why the Nomination Stalled

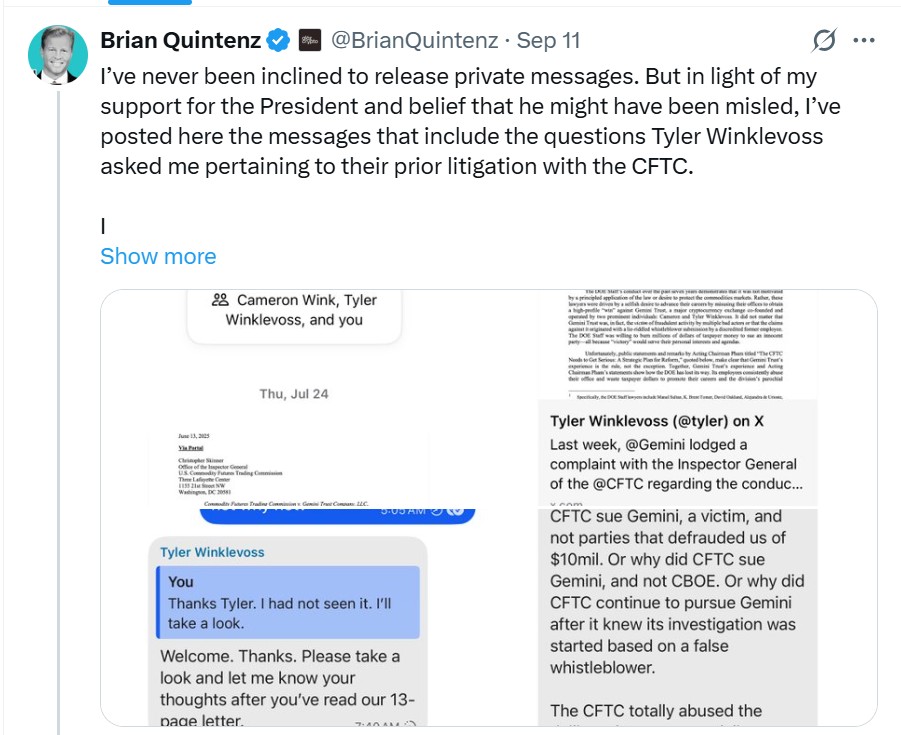

Brian Quintenz was President Trump’s pick to lead the Commodity Futures Trading Commission. He shared private text messages showing Tyler Winklevoss pressed White House officials to pause his confirmation. The Winklevoss twins were upset about a past CFTC settlement with their exchange, Gemini, and they asked for a delay. Quintenz says those messages and the twins’ lobbying helped stall his nomination.

Source : X

The Winklevoss lobbying plus the Kalshi-related legal worries created political heat. His confirmation has slowed after public pushback from digital assets figures and questions about past ties to Kalshi and prediction market issues. Lawmakers and industry voices raised doubts, and that has made the official pause and think about other candidates with clear cryptopolicy records.

Who Is Now on the Shortlist?

Reports say the White House widened the list to include officials known for work on cryptocurrency policy. Two names getting attention are Michael Selig, the SEC crypto task force’s chief counsel, and Tyler Williams, a digital asset adviser connected to Treasury officials and with private sector experience.

Williams joined the Treasury after working at Galaxy Digital. These choices show the White House may want a chair who understands SEC rules, crypto compliance, and spot Bitcoin ETF debates.

What This Means For Crypto Market

A delay at the CFTC matters. Firms waiting on clarity about blockchain trading, spot Bitcoin listings, or new products could face more uncertainty. This makes the choice of chair important for both investors and companies.

The agency helps set rules for futures, derivatives, and some cryptomarkets. With the agency short on leaders, big items like oversight of crypto exchanges, prediction markets, and cross-agency coordination may slow down.

Nomination for CFTC Chair Could Shift Toward Crypto Policy Focus

The White House has not withdrawn Quintenz’s name but is said to be vetting alternatives. If an alternative like Michael Selig or Tyler Williams is chosen, the CFTC chair job would likely focus on cryptopolicy expertise, coordination with the SEC, and handling spot cryptocurrency trading rules.

White House will still need to move on any new nominee, and the process could take weeks. For markets, the best outcome would be clearer rules and faster decisions on things like spot Bitcoin trading and derivatives oversight.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。