I have been pondering a question:

If we are at the starting point of a new round of upward movement, what is driving the bull market?

The cryptocurrency market is small, and there are too many short-term influencing factors.

Macroeconomic interest rate decisions? They could affect the U.S. stock market and global financial markets, and the cryptocurrency market would certainly be among the first to feel the impact. However, macroeconomic predictions are difficult; apart from the Federal Reserve, almost no one can accurately guess interest rate policies.

Sentiment? The rise and fall of cryptocurrencies often reflect sentiment, which can indicate market reversals. However, the current sentiment has not reached extreme FOMO or extreme panic; the temperature is somewhat warm, suggesting a high probability of continued upward movement. More importantly, sentiment is often a lagging indicator of market conditions, making short-term predictions challenging.

There are also experienced analysts looking at candlestick charts, an area I am not proficient in. In my understanding, technical analysis can only serve as a reference; relying solely on technical analysis or a single technical indicator can easily lead to misjudgments.

So what is the main driving force? A statement from Teacher Xiao Ming (@RiceMaximalist) awakened me: the driving force behind this bull market is capital inflow, including off-exchange capital inflow (ETFs and DATs) and on-exchange capital inflow (profit buybacks).

- Let’s review the biggest player in this round, Solana, based on this idea:

The main buying force for Solana this time is off-exchange DATs. Taking the largest Galaxy DAT as an example, as of September 12, it announced a total fundraising amount of $1.65 billion, and has completed the purchase of approximately 1.75 million SOL, worth $430 million, with about $1.21 billion remaining. (https://intel.arkm.com/explorer/entity/forward-industries)

There are also reports that Galaxy purchased around $1 billion worth of Solana over the weekend, but there is no clear evidence that these purchases belong to the DAT company. If they do belong to the DAT company, then the DAT has essentially completed all its purchases.

Let’s first calculate based on the assumption that purchases have not yet been made:

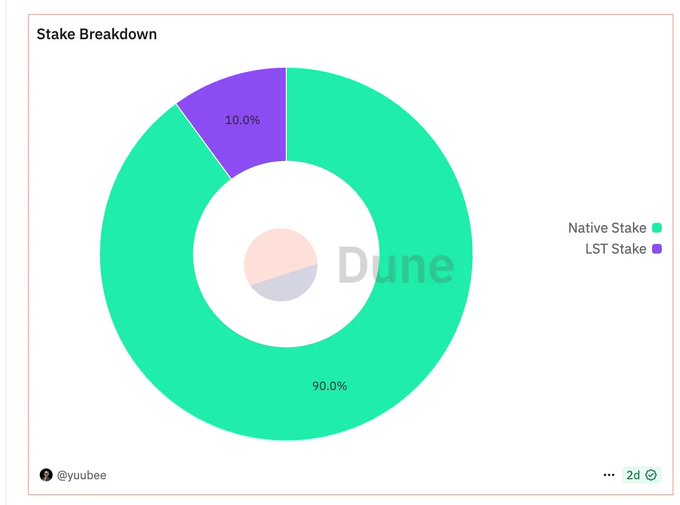

Currently, the circulating supply of Solana is total supply - Native Staking amount (staked amount - liquid staking) = 542 million - 378 million = 164 million.

The remaining unspent DAT funds can purchase approximately 5 million SOL, which is about 3% of the total circulating supply.

Considering that Pantera's new DAT has just been announced, with $1.25 billion in funds yet to purchase Solana, we estimate that this portion can also account for 3%.

This means that approximately 6% of the total circulating supply will be purchased in the near future, which provides strong support for Solana's price.

So how much can purchasing 6% of the total circulating supply increase Solana's price?

We can compare it to ETH for calculation. The total net inflow of ETFs for ETH from July to August was $9.3 billion, and the total market cap of DAT was $13 billion. We can roughly consider the market cap as the value of ETH that has already been purchased, which means that ETH purchased $22.3 billion over these two months.

The total circulating supply of Ethereum is 123 million, currently valued at $492 billion (estimated at ETH $4000), with a purchased circulating ratio of 4.5%.

For Ethereum's $560 billion market cap, an external purchase of 4.5% of the circulating supply led to an approximate 76% increase from July to August (calculated from $2500 to $4400).

Now, comparing to Solana, assuming the future purchased circulating supply is 6%, we conservatively estimate that the on-exchange speculative funds for Solana are less than those for ETH (considering that on-exchange funds have already entered the market from July to August), the possible increase is at least capped at 76%. If Galaxy's buying power is exhausted, we conservatively estimate the increase to be halved, suggesting at least a future potential of 35%+, corresponding to a Solana price of $324.

At the $240 position, despite external variables including macro policies, sentiment games, and on-exchange capital leverage, the potential buying volume is known and certain, still leaning towards a bullish outlook.

- Now, using the same logic, let’s look at the popular Pump:

According to data from https://fees.pump.fun/, if pumpfun's total buyback amount from July 14 to September 14 is 497,660 SOL, then the average daily buyback is 7,902 SOL, averaging about 1.5 million daily, completing a buyback of 6.574%.

It is known that before the unlocking in July 2026, the circulating supply of Pump was 43%, so at this rate, it could complete 17.84% of the circulating supply this year.

This conclusion has a premise that Pump's profitability can be maintained, which is the biggest difference from Sol's buyback logic. So far, it has been on-exchange funds buying Pump.

Will on-exchange funds continue to buy Pump? Or, to put it another way, can Pump continue to be profitable?

(Finally, we return to the business model analysis segment that VCs love.)

First, the conclusion: I believe it is sustainable in the short term.

Reason 1: The founder has grasped the core of the business; he knows what business model to pursue, and his judgment on the business model has undoubtedly been validated.

Pumpfun's profits for streamers, especially for mid to long-tail streamers, are over 100 times those of traditional platforms like Twitch, TikTok, Instagram, etc. Countless live streaming guilds in Los Angeles, Kuala Lumpur, and HZ know how profitable this is, and it’s just a matter of time before they enter pumpfun to group up for profits.

Pumpfun is not targeting the top streamers of traditional platforms but rather those mid to long-tail streamers who cannot earn high profits on traditional platforms and newcomers who have not yet started streaming but have potential for development. The team even "recently spent about $500,000 to procure a batch of 'streamer starter kits,' which include cameras, monitors, keyboards, and mice to help newcomers start streaming."

You can listen to the podcast interview with Delphi Digital; it is very informative. By the way, I believe listening to podcasts is a great way to understand project teams and founder styles (https://x.com/Delphi_Digital/status/1965123340802425163).

Reason 2: There is room for valuation improvement.

Pump currently has a circulating market cap of $2.7 billion, a total market cap of $7.7 billion, and 30-day revenue of $56 million; compared to Hyperliquid, which has a circulating market cap of $14 billion, a total market cap of $53 billion, and 30-day revenue of $94 million.

Pump's circulating market cap/annual revenue = 4; Hyperliquid's circulating market cap/annual revenue = 12.

Of course, Pump's revenue stability is far less than that of Hyperliquid. If Pump's token price falls or the market cools, its revenue will definitely decline faster than Hyperliquid. However, even so, if current revenue remains unchanged, it is reasonable to expect Pump's circulating market cap to double.

Moreover, a larger imaginative space can be compared to the live streaming giant Twitch, which is currently valued at about $50 billion. They have about 70,000 to 90,000 concurrent viewers at any given time, while Pump's live streaming peak can reach 3% to 5% of Twitch's user base. If we calculate based on 5%, Pump's market cap should be $2.5 billion, which is on par with the current market cap. However, Pumpfun's mobile daily active users have already reached 35,000, and if they can all convert to live streaming users, it could rival half of Twitch.

Of course, in addition to this, Pump may also have DAT buying power in the future, which we will temporarily ignore due to uncertainty about its scale.

Regarding buybacks, Mr. Mai has previously written related articles:

https://x.com/Michael_Liu93/status/1956623640289808425

- Finally, let’s talk about Cards:

Cards (collectorcrypt) operates in a very mature offline card collection industry (collecting and exchanging game cards), also known as game cards/TCG (Trading Card Game). The most famous in the TCG industry is The Pokémon Company, which disclosed that as of March 2025, over 75 billion Pokémon TCG cards have been printed, with about 10.2 billion printed in the 2024 fiscal year (April 2024 - March 2025), reaching industry ceiling levels. The entire TCG industry's revenue is also in the tens of billions of dollars.

Cards' business is to RWA (Real World Asset) Pokémon's physical cards and utilize the blockchain market for the entire process of issuance, circulation, and trading. Users can choose to buy card packs to draw cards, and if they draw rare cards, they can sell them at high multiples (similar to the logic of blind boxes).

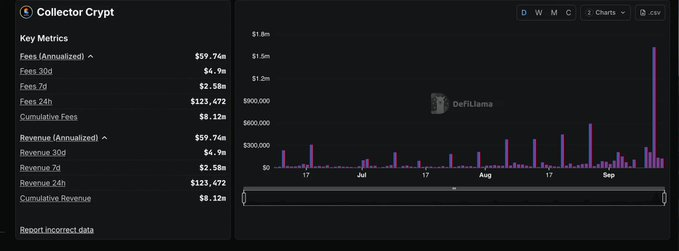

Cards currently has a 30-day revenue of $4.9 million, with $2.58 million in the last 7 days, and transaction fees reaching as high as $8.12 million.

Cards' revenue will flow into the treasury for future buybacks and dividends to Cards token holders.

Currently, the circulating market cap is $67 million, and the total market cap is $565 million, with a circulating market cap/annual revenue ratio of 1.13, significantly lower than the valuation ratios of Pumpfun and Hyperliquid.

Of course, Cards' low valuation premium is also because its business moat has not yet formed, and the revenue explosion of the business has only just begun this week. Its sustainability still needs to be observed, and it has not yet formed its advantages against similar competitors like Courtyard and Phygitals.

I am currently taking a small position to speculate.

In terms of certainty, I would rank them as SOL > Pumpfun > Cards. In terms of growth potential, I believe Pumpfun is slightly higher than or equal to Cards, and higher than Solana.

Regardless of the outcome of this week's Federal Reserve meeting, funds are beginning to reposition, prioritizing projects with cash flow (Hyperliquid, Pumpfun, Cards).

When the elusive narratives fail to trigger FOMO, people will choose to believe in projects that actually generate profits, which can be seen as a sign of progress for the industry.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。