Original Author: Wen Paopao, EeeVee

Original Editor: Sleepy.txt

Original Source: Dongcha Beating

In 1999, a 10-year-old boy traded his lunch sandwich for a shiny Charizard Pokémon card. At the time, it seemed like just a typical exchange among kids, as ordinary as trading marbles for gum.

Twenty years later, that card sold at auction for over $400,000.

This story sounds like an urban legend, but it really happened. The first edition Charizard card, released in 1998, became the holy grail of collectors after being certified as a perfect 10 by the PSA grading agency.

From a child's lunch trade to a sky-high auction sale, this small piece of cardboard witnessed the rise of a phenomenal market.

Now, Web 3 seems to be rewriting the rules of this market.

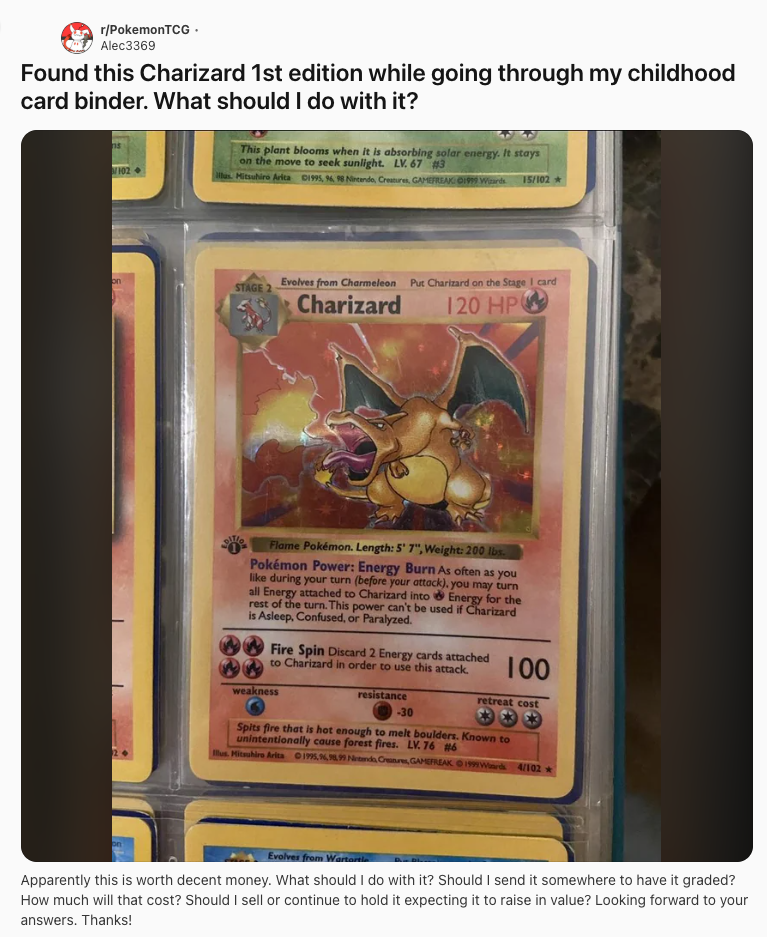

A Reddit user shared that he unexpectedly found his first-generation Charizard card in his childhood card binder.

1. An Underrated Massive Market

To understand why Pokémon cards have become so crazy, one must first grasp the true scale of this market. Many people think of it as just a toy for kids, but it has long since matured into a serious investment market.

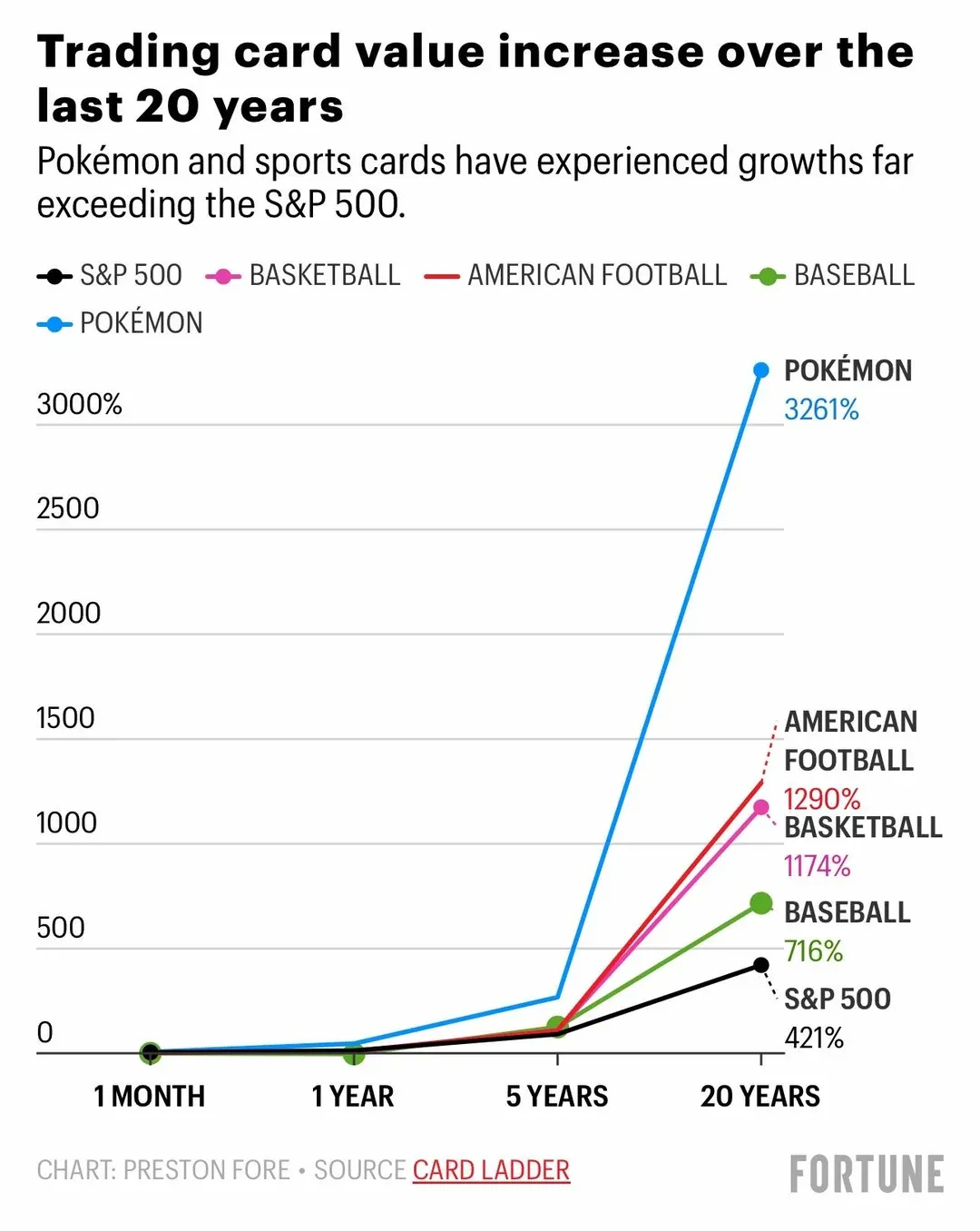

According to data from the analysis company Card Ladder, the monthly cumulative return of Pokémon cards since 2004 has reached an astonishing 3,821%. This figure has shocked Wall Street fund managers.

In comparison, the S&P 500 index rose by 483% during the same period, and even tech stock star Meta has only increased by 1,844% since its IPO in 2012.

Several key factors contribute to this growth, with time being the first. The Pokémon game was released in Japan in 1996, and the trading card game followed two years later. The earliest cards now have a history of 26 years, corresponding to a generation's growth trajectory; the children who bought these cards back then have now become financially capable adults.

Harris, a trader working at an investment bank in New York, co-founded a Pokémon card trading community called NY Crazy's Lab with friends. In an interview, he shared that after establishing this platform, he encountered diverse groups from various industries that he had not met in the investment banking world.

From police officers to plumbers, from high school students making millions trading Pokémon cards to elderly individuals nearing the end of their lives. The widespread popularity of the Pokémon IP has allowed his community to promote it with almost no customer restrictions.

Harris showcases his "Screaming Pikachu" at a card exhibition, with the card priced between $17,000 and $18,000.

The primary consumer group for Pokémon cards today consists of millennials and Gen Z individuals aged 20 to 40.

According to a BBC report, the global Gen Z population now has a spending power of $450 billion, while millennials have a disposable income of $8 to $10 trillion annually. Together, their spending power accounts for over 50% of global consumer spending (35% from millennials and 17% from Gen Z), with emotional value consumption making up a significant portion.

Scarcity further amplifies this value. The early Pokémon cards had relatively low print runs, and most were used by children for play. After more than twenty years, very few cards remain in pristine condition. There may only be a few hundred PSA 10 first edition Charizard cards in the world.

In addition to the rarity levels of the cards themselves (Common, Uncommon, Rare), there are many sub-levels within each category. Different Pokémon appear in each quarter's card packs, and with special limited edition cards and unique cards from different language regions, the Pokémon Company has effectively elevated the concept of rarity to a multi-dimensional level.

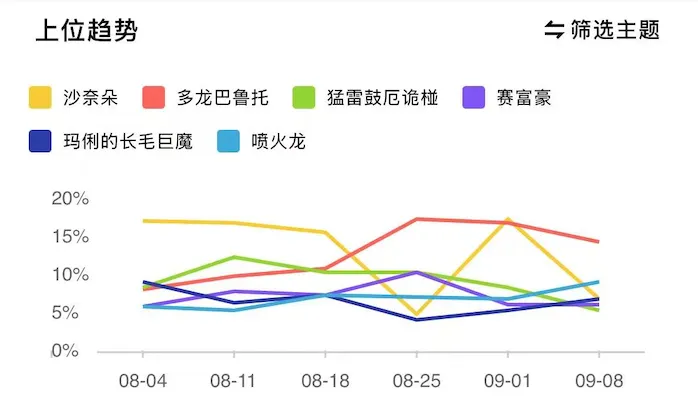

Certain specific Pokémon cards are favored in the market, with prices higher than other Pokémon at the same rarity level; source: Trading Card Society.

The celebrity effect has acted as a catalyst. During the pandemic in 2020, well-known YouTuber Logan Paul spent $6 million on a box of 1998 Pokémon card packs and opened it live on stream.

This event garnered global attention, transforming Pokémon cards from niche collectibles into mainstream investment targets. Traditional auction houses like Sotheby's and Christie's gradually began to recognize the value of the TCG industry, opening dedicated Pokémon auction events.

In July 2021, Logan Paul purchased a "Pikachu Illustrator" card from collector Marwan Dubsy for $5.3 million, setting a Guinness World Record and igniting the Pokémon card trading market.

The investment logic behind Pokémon cards has matured alongside the increase in trading volume. Professional grading agencies like PSA and BGS have established standardized grading systems, where every 0.5-point difference can lead to significant price variations.

Platforms like eBay and PWCC provide transparent price discovery mechanisms, allowing investors to analyze card price trends as they would with stocks.

This has even created a substantial profit margin for the card grading industry. Research indicates that the market size in this field will be around $360 million to $400 million in 2024-2025, growing at a CAGR of 7-8%, potentially reaching over $560 million by 2030.

Data shows that sales in the U.S. toy sector grew by 6% in the first four months of 2025, largely due to new Pokémon releases and the increasing popularity of collectible cards.

Walmart's market report indicates that from February 2024 to June 2025, trading card sales grew by 200%, with Pokémon card sales increasing more than tenfold year-on-year.

2. Pokémon in Crisis

Despite the Pokémon card market becoming increasingly mature, it still faces some fundamental issues. These problems not only affect market efficiency but also limit participation from ordinary investors.

The traditional Pokémon card trading process is quite cumbersome; you need to send the cards to a grading agency and wait weeks or even months for the grading results. If you do not participate in grading, the card's price will be significantly discounted.

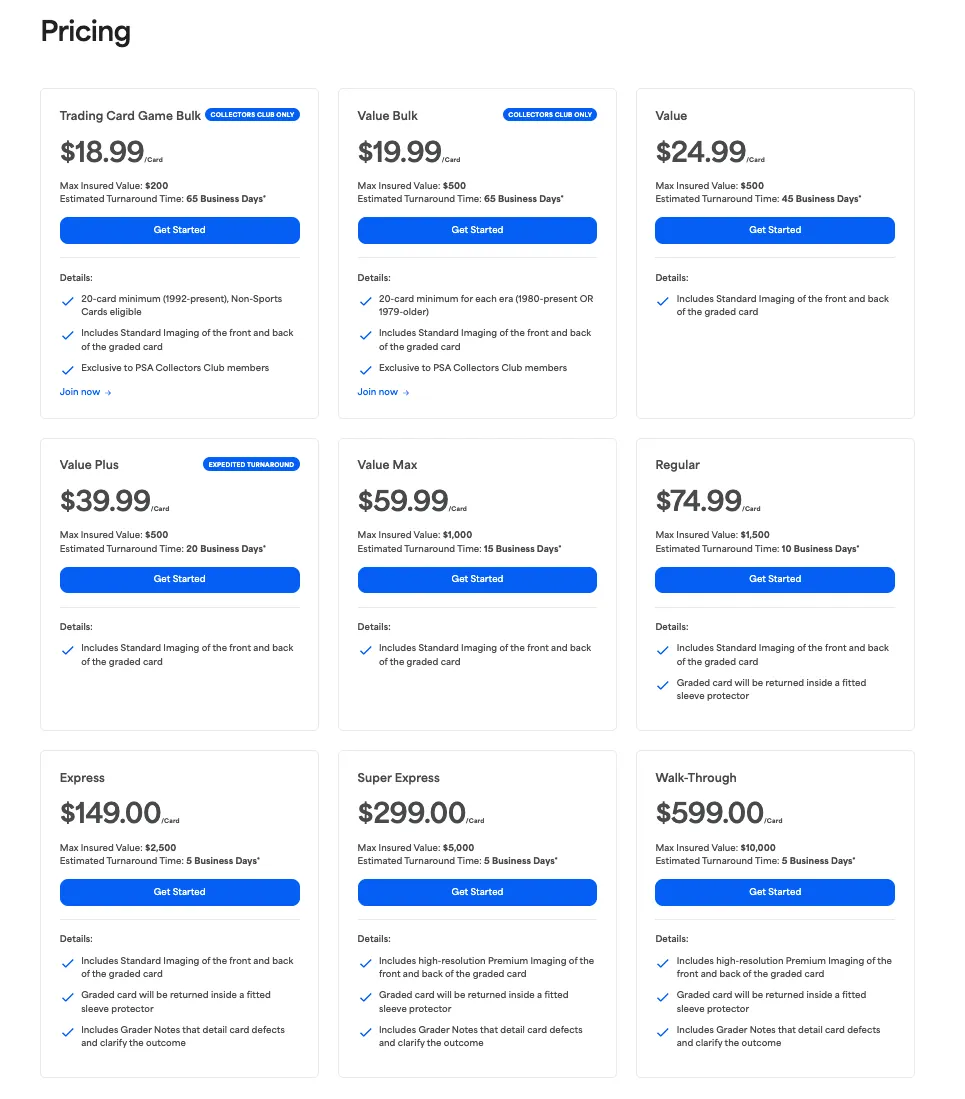

Most institutions charge a minimum of around $20 per card for grading, while the cost can go as high as $600 depending on the review time and the base value of the cards being graded (including services like insurance).

PSA's official pricing based on different services.

This may be relatively convenient for players in North America, close to the institutions, but for participants in other regions, the costs can become quite high.

For example, in East Asia, even through collective orders or professional submission intermediaries, the cost usually starts at around 200-300 RMB per card, which is about 1.5 times the grading fees for players in North America.

After overcoming numerous challenges, auctioning on traditional trading platforms (mostly eBay's TCGplayer and Cardmarket abroad, while domestically it's more scattered with Trading Card Society, Card House, or Xianyu) incurs high fees (usually 5%-10%, with some offline card shops charging even 10%-15%), not to mention the risks of damage during shipping and the information silos created by price discrepancies across different platforms.

More importantly, there is a trust issue; without third-party guarantees, it is difficult for buyers and sellers to establish trust. Issues like counterfeit cards, swapping, and refusal to ship occur frequently.

After navigating such a complex process, the money received from trading a Pokémon card may be far less than its actual price, and the high volatility in the secondary market adds significant risk to Pokémon card trading.

Harris encountered an interesting phenomenon in his Pokémon trading community: whenever the trading enthusiasm for NFTs or Bitcoin surged, so did the enthusiasm for trading Pokémon cards. During active crypto market periods, some players even directly used Bitcoin to purchase Pokémon cards.

However, various restrictions prevent Pokémon card players from promptly leveraging this market trend, and sometimes even these core traders are unaware of the bubble's rupture.

So far, the Pokémon card bubble has burst multiple times. For instance, during the second half of 2020, leading up to Logan Paul's $5.3 million purchase of the "Pikachu," FOMO sentiment in the market caused many Pokémon card prices to surge by as much as 10 times, with some special cards even increasing by 30-50 times.

Afterward, prices plummeted, with the overall market correcting by over 60%, leaving many new entrants stuck at the peak.

In 2023, some Japanese market makers collectively inflated the prices of certain female "character cards," with some cards' prices rising by thousands of dollars within a week, only to crash to just $200-300 in the following three months.

The lengthy card grading process, combined with the complexities of trading and spatial limitations, often prevents Pokémon card participants from acting quickly in a declining market, leaving them unable to escape the fate of "being zeroed out."

Tuam, the founder of the blockchain TCG trading platform Collector's Crypt, has firsthand experience with these issues.

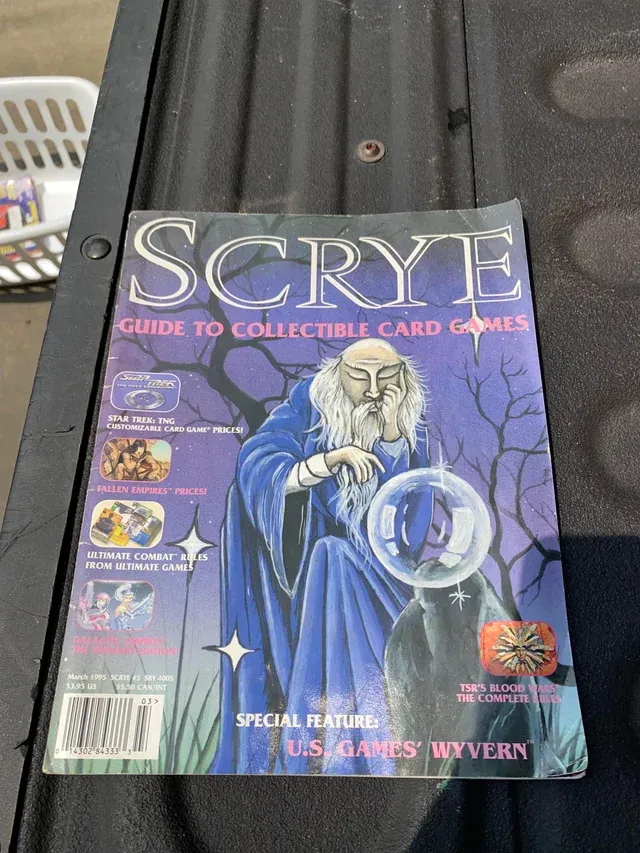

As a seasoned collector who started playing Magic: The Gathering in 1993, he was once a semi-professional player and even wrote for the longest-running TCG magazine, Scrye.

Before college, he sold most of his card collection to pay for his undergraduate tuition. Later, the remaining Magic: The Gathering collection was worth even more than his property.

Collector's Scrye magazine.

However, over the past few decades, Tuam has conducted numerous card transactions through eBay and has personally experienced the troubles caused by trust, safety, customs, damage, and fraud.

He once sold a $10,000 Magic: The Gathering card to a buyer in Croatia, only for the card to be held up in customs for two months before being returned. He lost the shipping and insurance costs, and eBay refused to refund the seller's fees, which cost him 40 hours to resolve these unnecessary troubles.

He discovered that a more serious issue was the abuse of transaction settlements. During the Super Bowl, speculators would simultaneously bid on rookie player cards from two teams; if their supported team lost, they would cancel the order or refuse to pay, while the winning team's cards would be purchased at pre-game prices, effectively obtaining a "free futures contract."

The storage of collectibles is also a headache for many collectors. In 2018, Tuam's parents' home was destroyed in the Thomas Fire in California, losing everything, including a 1969 Camaro.

In 2021, he himself was evacuated from his home in San Francisco due to wildfire threats, having to place a large number of Magic: The Gathering collectibles in the passenger seat of his pickup truck for 8 hours in 105°F heat, which made him realize the significant risks of traditional storage methods.

The Pokémon Company also attempted to use digitalization to solve its complex structural issues, but the results were unsatisfactory.

In 2021, the Pokémon Company launched Pokémon TCG Live, allowing players to obtain redemption codes after purchasing physical card packs to exchange for corresponding digital cards in the game. However, this system only allowed for a one-way flow from "physical to digital," with digital cards unable to be exchanged back for physical ones or traded between players.

Daniel Paez, the executive producer of Gods Unchained, who previously worked at Blizzard and participated in the development of famous card games like Hearthstone, pointed out a fundamental issue with traditional digital card games:

Players cannot truly own their assets in the game.

3. When RWA Meets Pikachu

Based on these pain points, Tuam decided to establish the Collector's Crypt project. Although discussions about using NFTs to represent real-world assets began as early as 2017, there was a lack of stable infrastructure at that time, such as stablecoins and NFT trading platforms.

It wasn't until the DeFi summer and the NFT boom that the infrastructure surrounding NFTs gradually emerged, providing a viable foundation for projects like Collector's Crypt.

The operational model of Collector's Crypt is relatively simple yet extremely innovative.

First, they collaborate with professional vaults to provide secure storage for physical Pokémon cards that have been graded by PSA or BGS. These vaults have temperature and humidity control, as well as advanced fire prevention measures like the "Halon system," which fills the vault with foam to extinguish fires by removing all oxygen when sparks are detected.

Then, a unique NFT is generated for each stored card. This NFT contains all the important information about the card, including its name, rarity, grade score, serial number, and more. More importantly, an immutable correspondence is established between the NFT and the physical card.

Players can obtain these NFT cards in various ways. They can directly purchase already minted NFTs or participate in "pack opening" events. However, unlike traditional pack openings, the Collector's Crypt pack opening experience is designed as a gamified shopping experience with positive expected value.

Collector's Crypt's "pack opening" machine.

Traditional physical card packs typically have an expected value that is negative by 60% to 70%. However, in Collector's Crypt's $50 vending machine, an average investment of $50 yields cards worth $55, providing a positive expected value (10% positive EV) right from the initial draw.

After obtaining NFT cards, players have various options. They can trade these NFTs on the secondary market or choose to redeem the NFTs for the corresponding physical cards. Collector's Crypt promises to securely deliver the physical cards within a certain timeframe after receiving the redemption request.

This model addresses several core pain points of the traditional market. Through NFT technology, players' ownership of cards is recorded on the blockchain, making this record immutable and inalienable. In the world of Web 3, players can trade directly peer-to-peer without the need for centralized platforms.

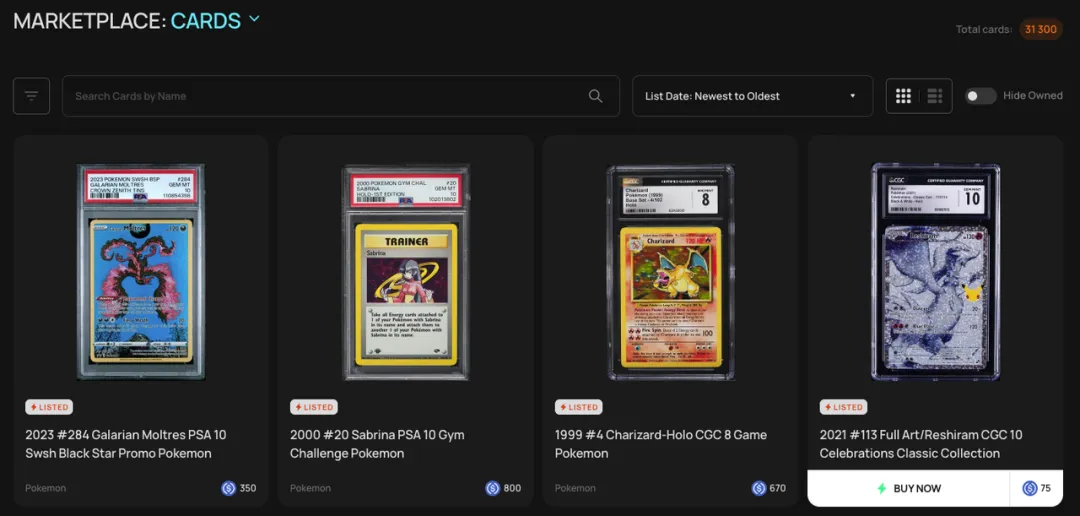

The secondary market trading platform for CARDS.

Blockchain technology breaks down geographical barriers, allowing collectors worldwide to trade in a frictionless market. A player in Tokyo can instantly sell a card to a buyer in New York without worrying about exchange rates, payments, or logistics.

The one-to-one mapping technology of RWA enables a two-way free flow between physical cards and NFTs. After players convert physical cards into NFTs, they can redeem them back into physical cards as needed. In contrast, on the traditional Pokémon TCG Live platform, users can only achieve a one-way conversion from physical cards to digital cards.

Collector's Crypt has also innovatively introduced a buyback mechanism, promising to repurchase NFT cards from players at 85-90% of market value. This provides a price floor for the cards, alleviating concerns about "not being able to sell." Additionally, transactions on the blockchain are nearly instantaneous, with fees significantly lower than those on traditional platforms.

The significance of the Collector's Crypt project extends far beyond card collecting itself. It represents the beginning of a larger trend: the digitization of real-world assets.

In the real world, investing in high-value collectibles has always been the privilege of the wealthy. A Picasso painting, a bottle of 1947 Lafite wine, or a 1952 Mickey Mantle baseball card can be worth millions of dollars, making it impossible for ordinary investors to participate. Even with sufficient funds, the complexities and risks involved in purchasing, storing, insuring, and certifying these assets are daunting.

Pokémon cards, as RWA, have several unique advantages:

First, they are standardized collectibles, with each card having a clear version, rarity, and grade rating, making tokenization relatively straightforward.

Second, Pokémon cards have an active secondary market and a transparent price discovery mechanism, providing reliable references for NFT pricing.

Additionally, Pokémon cards are small in size and high in value, making them ideal for physical storage and digital management. A card worth tens of thousands of dollars is only the size of a credit card, easily stored in a professional vault, while the corresponding NFT can circulate freely worldwide.

Tuam, the founder of Collector's Crypt, envisions that in the future, their tokens could be seen as a "Pokémon card ETF."

Pokémon cards are one of the best-performing asset classes of this century, with a compound annual growth rate of about 20% to 25% since the early 2000s, far exceeding the S&P 500 index and being uncorrelated with traditional assets. The only assets that can surpass them are a few cryptocurrencies like Bitcoin, Ethereum, and Solana.

20-Year Investment Returns in the Card Market | Source: FORTUNE

However, high-net-worth individuals (such as family offices managing billions) have found it difficult to invest in trading cards. The entire process involves many troublesome steps, such as how to procure cards, prevent buying counterfeits, and the need to spend significant time and effort on storing and transporting these cards.

Collector's Crypt's tokens are backed by a vault of real-world assets, and their token market value reflects, to some extent, the value of Pokémon cards in the vault.

This means that investors can purchase their tokens, $Cards, through decentralized exchanges, easily gaining exposure to Pokémon card assets without dealing with the complexities of physical transactions.

Users can also use $Cards tokens to purchase NFTs on the platform and participate in governance voting, influencing the future development of the platform. To incentivize token holders, Collector's Crypt provides returns through the buyback mechanism, allowing them to benefit from the project's revenue growth.

The success of this model offers valuable insights for other RWA projects. High-value collectibles like art, luxury goods, and rare metals can also be tokenized in similar ways. The key lies in establishing a trustworthy custodial mechanism, a transparent price discovery mechanism, and a convenient redemption process.

4. The Beginning of a New Era or Old Wine in New Bottles?

The success of the Collector's Crypt project is not just a business case; it is a milestone in the digital transformation of the entire collectibles industry. It demonstrates the potential application of Web 3 technology in traditional industries and provides a reference model for the digitization of other collectible categories.

Tuam is optimistic about the future of the crypto industry. He believes that in the last cycle, many Web 2 major brands entered the crypto space primarily driven by marketing teams, attracted by the hype surrounding NFTs. When the marketing hype faded, these projects disappeared as well.

He observes that the current trend has shifted, driven more by practicality.

For example, internet payment giant Stripe acquired a payment processing company to improve the deposit and withdrawal experience for blockchain users and smart wallets, allowing users to use them safely without three years of crypto experience.

However, Tuam believes that true mass adoption of cryptocurrency will not come from people downloading wallets and speculating. Instead, it will be a "seamless," hidden technological revolution in the background.

For instance, Walmart might use smart wallets and NFT technology to reserve Pokémon boxes for specific users, without them even knowing that blockchain technology underlies it. He believes this "revolution" will fundamentally change the game in the next five years.

That $400,000 Charizard card witnessed the transformation of Pokémon cards from children's toys to investment assets. From a sandwich trade in 1999 to the Web 3 revolution in 2024, this story spans 25 years and reflects profound changes in technology, culture, and economics.

The emergence of Web 3 technology has injected new vitality into this ancient collectibles market. It addresses many pain points of traditional markets and brings new possibilities to the collectibles market.

From a Charizard obtained in exchange for a sandwich to a $400,000 auction item, and now to freely tradable digital assets, this story continues. And we stand at the starting point of a new era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。