原文作者:Helios

摘要

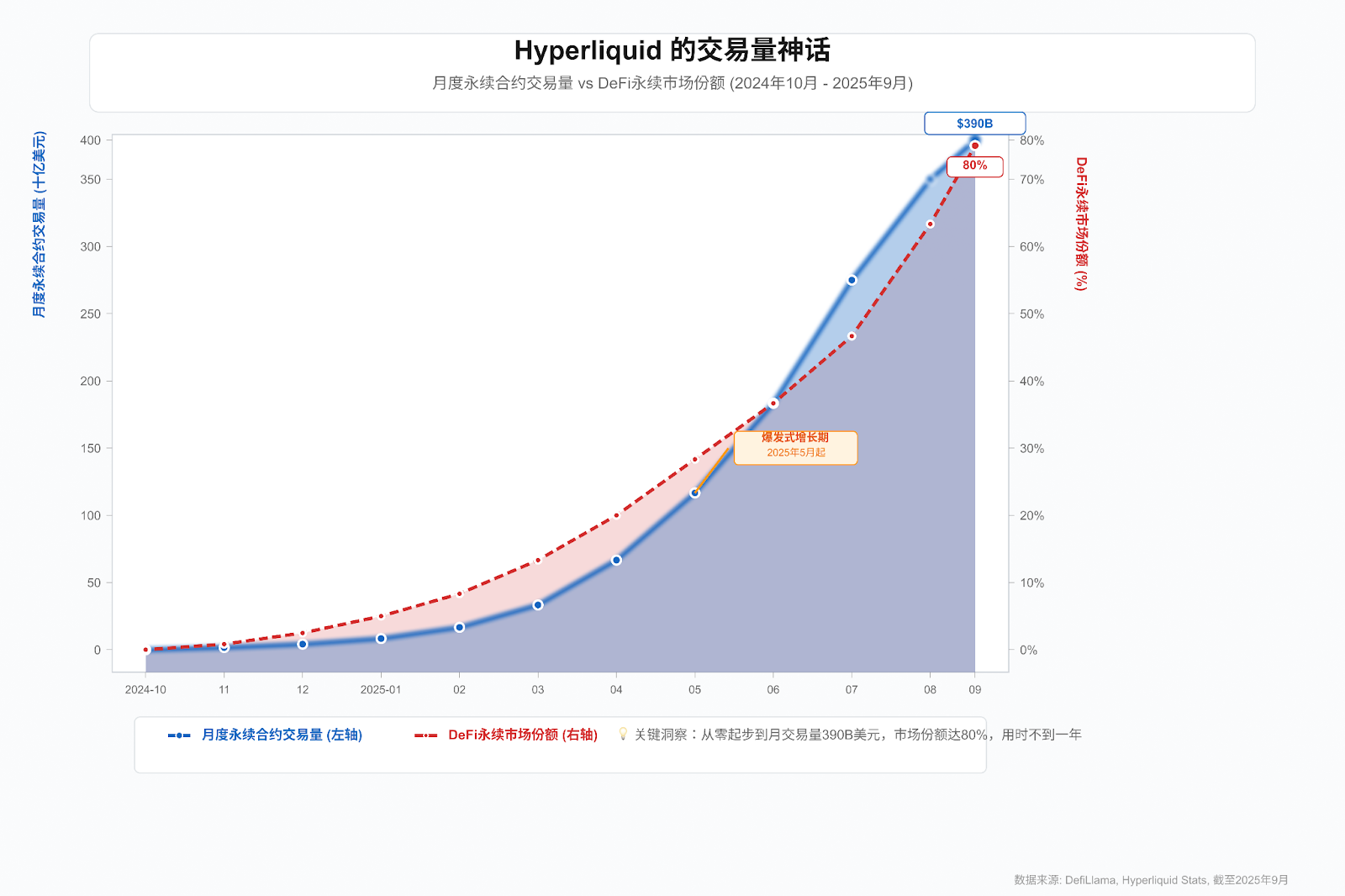

Hyperliquid 平台近期上演了一场争夺其 USDH 发行权的“稳定币大战”,吸引了 Paxos、Frax、Ethena 等行业巨头豪掷亿万,盛况空前。这背后是 Hyperliquid 高达 4000 亿美元的月交易量和巨大的生态引力。然而,在这场资本盛宴之下,一个更严峻的问题浮出水面:Hyperliquid 平台历史上已知的安全漏洞与高风险高收益的稳定币模型相结合,正在酝酿一场可能危及整个生态的系统性风险。

本报告深度剖析了这场大战。我们认为,这场竞争的本质并非简单的商业招标,而是一场在“合规稳健”(以 Paxos 为代表)与“高收益诱惑”(以 Ethena 为代表)两条路线之间的豪赌。核心矛盾在于,无论选择哪个光鲜的方案,USDH 都将被构建在一个历史上并非无懈可击的技术地基之上——其暴露出的验证者中心化、预言机操纵(XPL 事件)等问题,是所有讨论都无法绕开的“原罪”。

本报告论证,USDH 项目最大的挑战并非来自外部市场竞争,而是源于其内部平台风险与激进金融创新的致命组合。这场大战的结果不仅将决定 Hyperliquid 的未来,更将成为整个 DeFi 行业在高增长诱惑面前,如何进行风险定价的一个决定性案例。

第一章:引言

1.1 稳定币在加密经济中的核心作用

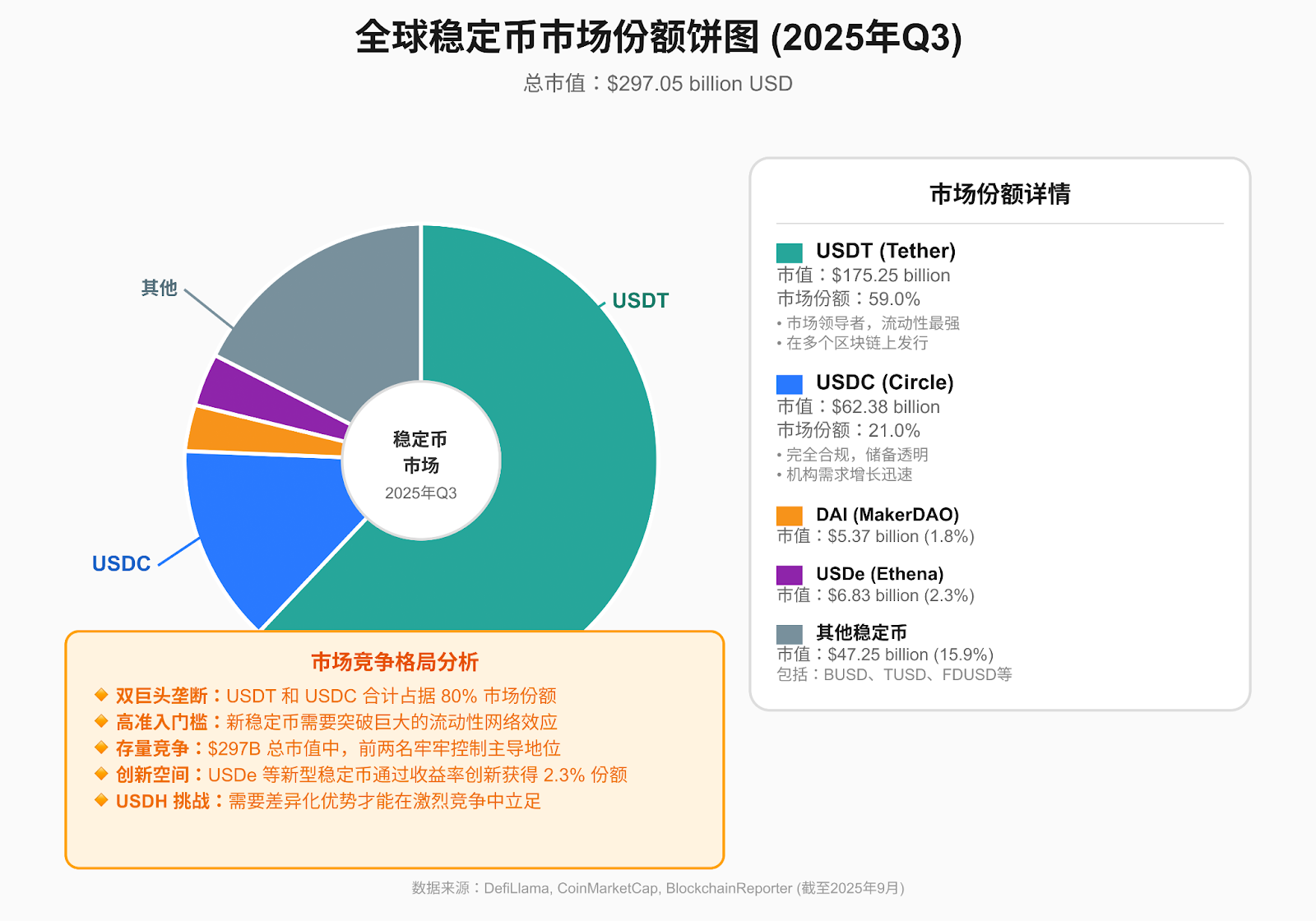

稳定币是价值锚定于某种稳定资产(通常为法币)的加密货币,在加密经济中扮演着链接法币与数字资产世界的关键角色。按照抵押品和机制不同,稳定币可分为三类:法币抵押型稳定币(如 USDT、USDC),由美元等法币储备 1:1 支持;加密货币抵押型稳定币(如 DAI),通过超额抵押加密资产发行;算法稳定币,依靠算法和套利机制维持锚定,风险较高。稳定币已成为加密市场的核心交易媒介和价值储藏手段,在交易结算、去中心化金融 (DeFi) 和跨境支付中发挥不可或缺的作用。截至 2025 年中,全球稳定币总市值已超过 2500 亿美元。

1.2 Hyperliquid 平台

Hyperliquid 是一个垂直整合的高性能 Layer-1 公链和去中心化交易所(DEX),专注于链上衍生品交易。其核心优势在于采用链上订单簿模式,结合自研的 HyperBFT 共识机制,实现了高达每秒 20 万笔订单的处理能力和亚秒级的交易确认延迟,提供了媲美中心化交易所的性能和体验。截至 2025 年 8 月,Hyperliquid 的永续合约月交易量已逼近 4000 亿美元,稳居 DeFi 衍生品市场首位。其发展愿景是打造一个高吞吐、低延迟且功能完备的链上金融体系。

1.3 Hyperliquid 稳定币大战的缘起

Hyperliquid 决定推出原生稳定币 USDH,旨在降低对外部稳定币(尤其是 USDC)的依赖,增强生态自主性,并分享稳定币储备资产产生的巨额收益。平台没有自行发行,而是选择通过公开竞标的方式,邀请全球顶尖机构提交方案。这一举动迅速引发行业地震,包括 Paxos、Frax Finance、Sky(MakerDAO 实体)、Agora、Native Markets 以及 Ethena Labs 在内的六家知名组织参与竞逐,提出了各具特色的设计和极具吸引力的条件。竞标的核心标准是为 Hyperliquid 生态带来最大价值,最终获胜者将于 2025 年 9 月 14 日由网络验证人投票决定。

这场竞争汇集了中心化与去中心化领域的顶尖玩家,被业界称为“ Hyperliquid 稳定币大战”。但它不仅关系到 Hyperliquid 生态未来的金融基石,更重要的是,它将 Hyperliquid 这个高速增长但根基尚浅的平台,直接推向了金融稳定性和安全性的极限压力测试。事件的真正看点,在于社区和验证者最终会将天平倾向于短期的高收益,还是长期的安全稳健——而这个选择,将与平台自身的技术风险直接碰撞。

第二章:Hyperliquid 稳定币(USDH)深度解析

2.1 USDH 提案:一场“华尔街”与“加密狂人”的路线之争

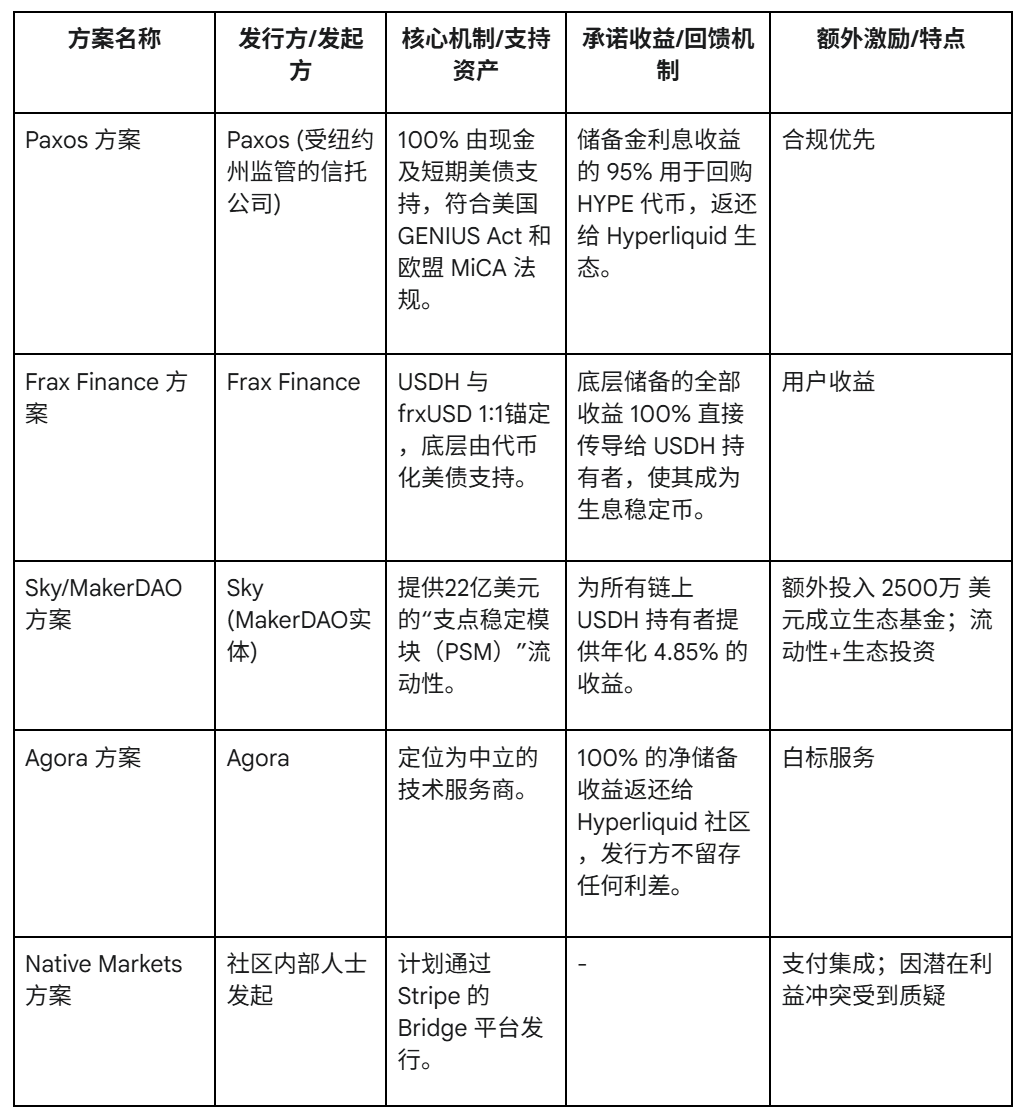

USDH 的六大提案表面看是商业计划的竞争,实则是两种截然不同发展哲学的对决。一方是以 Paxos 为代表的“华尔街路线”,强调合规、透明、监管友好,承诺提供一个安全但想象空间有限的稳定币。另一方则是以 Ethena 为代表的“加密原生路线”,通过激进的收益共享模型、巨额的生态激励,提供了一个极具诱惑力但潜在风险也更高的未来。这场对决的结果,将深刻定义 Hyperliquid 的生态气质。

所有提案的核心都在于如何管理 USDH 的储备金,并如何分配其产生的利息收益。各主要提案机制如下:

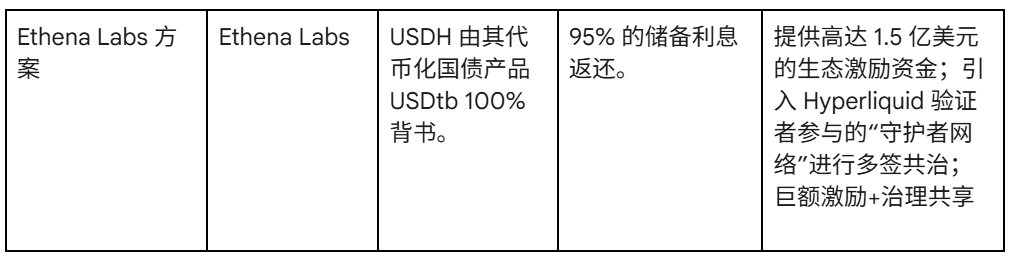

2.2 USDH 的技术架构:效率与风险的双刃剑

USDH 将原生发行于 Hyperliquid 链上,充分享受其技术优势:

- 统一状态架构 (Unified State):交易层(HyperCore)与智能合约层(HyperEVM)共享同一状态,USDH 的发行、交易和 DeFi 应用交互无需跨链或跨层,从根本上消除了桥接风险,实现了原子化操作。

- HyperBFT 高性能共识:提供亚秒级交易确认和极高的吞吐量,确保 USDH 的转账和交易体验如互联网支付般即时。

- 双区块架构 (Dual-block):通过并行运行 2 秒的“快块”和 60 秒的“慢块”,同时满足了 USDH 高频小额支付和复杂 DeFi 操作的需求。

- 与生态协议深度融合:USDH 将成为 HLP Vault(做市资金池)、Hyperlend(借贷协议)等原生应用的基础货币,构建“铸造-交易-借贷-支付”的内部价值闭环。

总而言之,Hyperliquid 的架构是一把精巧的双刃剑。统一状态和高性能共识为 USDH 提供了无与伦比的效率和原生优势。但这种高度的耦合也意味着“一荣俱荣,一损俱损”。任何底层的安全闪失或性能问题,都将毫无缓冲地、灾难性地传导至 USDH 的稳定性和价值之上。

2.3 USDH 的潜在风险:无法忽视的“历史原罪”

USDH 面临的所有风险中,最致命、最基础的风险,源于 Hyperliquid 平台自身。这些历史上已知的、未被彻底解决的脆弱性,是评估所有其他风险的前提。

- 验证者中心化:曾有报告指出,网络在早期阶段仅由极少数验证者节点维护,构成了潜在的单点故障和共谋风险。USDH 的发行和治理,很可能被少数关键角色掌控。

- 预言机操纵事件 (XPL 事件):攻击者曾通过操纵低流动性代币的价格,对 HLP 金库造成威胁。这证明平台的预言机机制在极端市场条件下存在被攻击的可能,这对任何依赖价格预言机的稳定币(尤其是其清算机制)都是一个致命威胁。

- 安全声誉事件 (Lazarus Group 疑云):平台曾因与朝鲜黑客组织 Lazarus Group 相关的钱包活动而引发社区恐慌和大规模资金外流。这表明市场对平台的信任基础依然脆弱,任何风吹草动都可能引发挤兑。

这些“历史原罪”如幽灵般盘旋在 USDH 项目上空,它们将其他所有风险都放大了数倍:

- 储备金管理风险 (平台风险加剧):即使储备金 100% 安全,但如果平台预言机可被操纵,清算机制就可能被攻击,从而间接威胁到整个稳定币系统。

- 竞争风险 (内部挑战的放大):在一个存在历史漏洞的平台上,任何关于 USDH 运营不善的传言,都会被竞争对手利用,迅速演变成信任危机。

- 监管风险 (被动触发):平台若因安全问题发生重大事故,必将招致监管机构的严厉审查,甚至可能直接取缔相关稳定币业务。

第三章:主流稳定币格局与 USDH 的竞争

3.1 主流稳定币(USDT、USDC、DAI)异同点回顾

- 相同点:均锚定美元,应用场景广泛,满足市场对稳定价值媒介的需求。

- 不同点:在抵押机制(中心化法币 vs. 去中心化加密资产)、中心化程度与监管(公司运营 vs. DAO 治理)、风险暴露(托管风险 vs. 智能合约和抵押品波动风险)上存在显著差异。

3.2 USDH 在现有稳定币格局中的定位

- 生态系统原生稳定币:拥有 Hyperliquid 这一强大的内生需求市场,具备冷启动优势。

- 合规与机构友好型潜力:通过选择 Paxos 等受监管实体作为发行方,有望吸引传统机构资金。

- 创新收益共享模型:将储备收益返还社区,对传统“发行方独享利润”的模式构成降维打击,可能引领新一轮稳定币创新。

3.3 USDH 面临的竞争格局

USDH 面临来自主流稳定币的市场竞争、Hyperliquid 内部竞标者的激烈角逐,以及其他生态系统原生稳定币的间接竞争。更重要的是,Aave 的 GHO 和 Curve 的 crvUSD 的经验是一个严峻的警示:即使在一个相对成熟和安全的生态中推出原生稳定币,尚且困难重重。而 USDH 不仅要面对这一切挑战,还要额外背负 Hyperliquid 平台独特的历史风险包袱,这使其突围之路变得异常艰险。

第四章:稳定币赛道最新发展趋势与监管政策

4.1 稳定币赛道最新发展趋势

- 市场规模持续增长与多元化:总市值突破 2500 亿美元,新发行方(如支付巨头 PayPal)和新类型不断涌现。

- 合规性与透明度成为核心竞争力:储备金公开化和定期审计已成行业标配。

- 应用场景拓展深化:从交易媒介拓展至跨境支付、零售结算和链上资产代币化。

- 收益型稳定币兴起:以 Ethena 的 USDe 为代表,分享储备收益成为吸引用户的关键。

- 与 CBDC 的潜在互动:长期来看,私人稳定币与央行数字货币可能形成互补共存的关系。

4.2 稳定币监管政策

- 美国 (GENIUS Act):确立了“联邦牌照+全额高质量储备+禁止付息”的监管框架,将稳定币纳入银行监管体系。

- 欧盟 (MiCA 法规):已于 2024 年 6 月对稳定币生效,对发行方资质、储备金管理、消费者权益等做出详细规定。

- 全球趋势:强调储备金质量、消费者保护和反洗钱(AML/CFT),监管趋同化明显。

第五章:结论与展望

5.1 Hyperliquid 稳定币大战的深远意义

这场大战的真正意义,并非展示 DeFi 的繁荣,而是揭示了在牛市的高增长狂热中,风险是如何被系统性低估的。它是一个完美的案例,展现了当创新金融模型(高收益稳定币)与一个尚未经历足够时间考验的技术平台相遇时,可能产生的巨大潜在冲突。Hyperliquid 的选择,将成为行业未来在“增长速度”与“安全底线”之间如何取舍的试金石。

5.2 USDH 的未来展望与最终赢家预测

最终赢家预测与关键变量

基于加密社区对高收益的天然偏好和 Ethena 方案提供的巨大激励,我们做出如下预测:Ethena Labs 的方案最终胜出的可能性最大。然而,这同时也是风险最高的选择。Ethena 激进的模式与 Hyperliquid 平台的历史脆弱性相结合,将创造一个极不稳定的“高压锅”。最终的胜负手将取决于两个关键变量:

- Hyperliquid 能否在 USDH 上线前,拿出有力的、可验证的方案来解决其历史安全问题?

- 中标方(尤其是 Ethena)是否愿意将其部分治理权和风控权限,以一种不可篡改的方式让渡给一个更去中心化、更独立的社区监督机构?

如果这两个问题的答案是否定的,那么 USDH 的未来将充满不确定性。

5.3 稳定币赛道的未来发展方向

未来稳定币赛道将朝着多元化、合规化、创新化、与传统金融深度融合四大方向演进。稳定币将变得更智能、更普及,并逐渐模糊与传统金融的界限。

5.4 建议

- 对 Hyperliquid 社区:必须将平台的历史安全漏洞作为最高优先级的议题进行质询。在投票时,切勿仅被短期收益蒙蔽,而应要求所有候选方提交针对平台特定风险的详细缓解计划。

- 对 USDH 发行方:必须正视 Hyperliquid 的底层风险,并主动建立超出提案承诺的额外风险准备金和应急预案。透明度不应仅限于储备金,更应包括对平台安全状态的实时监控报告。

- 对监管机构:必须认识到,对此类项目的监管不应仅停留在发行方层面,还应延伸至其运行的底层平台。平台级的风险,是当前监管框架的盲区。

- 对市场参与者:必须明白,潜在的高收益永远伴随着对等的高风险。在参与 USDH 时,应将其视为一种高风险的金融实验,而非无风险的稳定资产。

附录

术语表

- Hyperliquid:新一代高性能 Layer-1 公链去中心化交易平台。

- USDH:Hyperliquid 计划发行的原生稳定币。

- HYPE:Hyperliquid 平台原生代币。

- HyperBFT:Hyperliquid 采用的定制化拜占庭容错共识协议。

- 统一状态架构 (Unified State):Hyperliquid 的核心技术特性,消除了跨层通信延迟。

- GENIUS Act:美国 2025 年通过的联邦稳定币法案。

- MiCA:欧盟《加密资产市场监管法规》。

- GHO / crvUSD:分别由 Aave 和 Curve 协议发行的原生稳定币,可作为 USDH 的参照案例。

参考来源

Hyperliquid 官方及技术文档

Hyperliquid Docs:https://hyperliquid.gitbook.io/hyperliquid-docs

IQ.wiki:https://iq.wiki/wiki/hyperliquid

Halborn:https://www.halborn.com/blog/post/hyperliquid-smart-contract-security-audit

Hyperliquid 稳定币大战新闻报道

稳定币发行方竞标 USDH 的背景报道:https://unchainedcrypto.com/stablecoin-issuers-enter-bidding-war-to-launch-hyperliquids-usdh/

Paxos, Frax, Agora 等多方提案对比:https://www.dlnews.com/articles/defi/paxos-frax-agora-and-native-markets-compete-to-build-usdh-stablecoin/

Ethena Labs 提案详情,包括与贝莱德基金的合作:https://www.mitrade.com/au/insights/news/live-news/article-3-1109397-20250910

平台历史风险事件报道

关于 Lazarus Group 黑客组织与 Hyperliquid 关联的报道:https://bravenewcoin.com/insights/lazarus-group-linked-to-hyperliquid-exploit

Lazarus Group 在 Hyperliquid 上的资金动向及平台漏洞分析:https://www.ccn.com/news/hyperliquid-exploited-lazarus-group-moves-funds-to-bybit/

稳定币基础、风险与趋势

稳定币:https://en.wikipedia.org/wiki/Stablecoin

稳定币的定义、分类和基本原理:https://www.investopedia.com/terms/s/stablecoin.asp

稳定币通用风险与回报分析:https://www.chainalysis.com/blog/stablecoin-risks-rewards/

代币化国库券的机制与风险研究:https://www.jpmorgan.com/insights/en/research/institutional-investing/investment-insights/tokenized-treasuries

稳定币的未来发展趋势与应用场景分析:https://www.mckinsey.com/capabilities/mckinsey-digital/our-insights/what-is-the-future-of-stablecoins

Visa 在稳定币结算领域的解决方案和观点:https://usa.visa.com/solutions/crypto/stablecoins.html

主流及原生稳定币对比

USDT, USDC, DAI 三大主流稳定币对比:https://www.coinsdo.com/blog/usdt-vs-usdc-vs-dai-which-stablecoin-is-the-best

USDT vs. USDC 对比分析:https://moonpay.com/learn/crypto/usdt-vs-usdc

Aave GHO 原生稳定币案例研究:https://21 shares.com/research/aave-and-gho-stablecoin

Curve crvUSD 原生稳定币深度解析:https://coinmarketcap.com/academy/article/a-deep-dive-into-curve-s-crvusd-stablecoin

全球监管政策

美国 GENIUS Act 法案官方文本:https://www.congress.gov/bill/118 th-congress/house-bill/4766

对美国 GENIUS Act 法案的法律解读:https://www.lathamwatkins.com/en/alerts/2024/09/us-house-passes-bipartisan-stablecoin-bill

欧盟 MiCA 法规实施时间线及指南:https://micapapers.com/guide/timeline/

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。