How No Fed Rate Cut in September 2025 Could Crash Crypto Markets

The Fed meeting date on September 17, 2025, has the entire financial world on edge. Investors and the crypto community are anxiously asking: Will the crypto market crash if the Fed decides not to cut rates? Historically, the Fed has reduced rates twice a year, but in 2025, no cut has happened so far. All eyes are now on this week’s Fed meeting date, with high expectations of a 25bps or 50bps rate reduction.

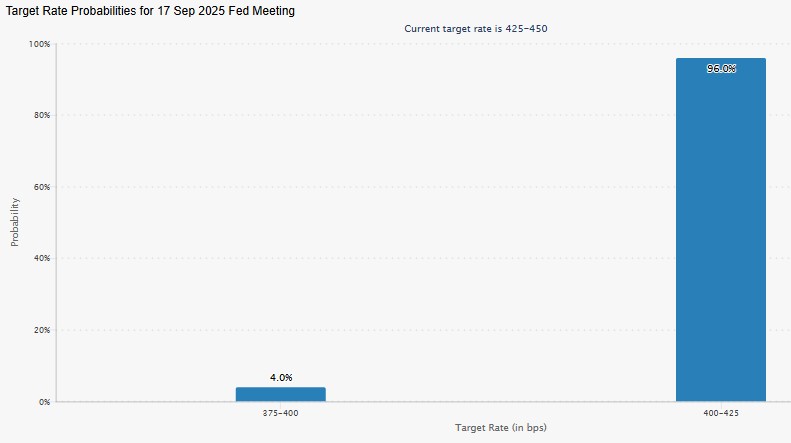

With the use of the FedWatch tool, the rate stands at 425-450bps. There are 96% probability of a 25bps cut and merely 4% of a 50bps one.

Source: FedWatch Tool

Source: FedWatch Tool

What if the probability reduces to 0%, i.e., there will be no rate cut? The market will be left in a daze, according to experts.

Lisa Cook News and Market Speculations

To further confuse is the recent Lisa Cook news. The DC Circuit just rejected President Trump's action to oust Fed Governor Cook , and she gets to be a part of this week's ruling. Everyone now wonders if Lisa Cook will comply with President Trump's rate expectation or hold firm as an act of revenge. Her move will have a phenomenal impact on the stock and digital asset sector.

The stakes are high. If the Fed keeps it steady, it will actually be causing a state of panic among investors who are already speculating on Fed rate cut news . This will lead to the largest crash in history because the investors will lose faith in riskier assets such as Bitcoin and Ethereum.

Crypto Market Crash: Technical Signals and Predictions

The overall crypto sector is already in a fragile position. The overall crypto market cap at the time of writing went down to $4.01T, losing 0.93%. Bitcoin currently stands at $115,888.89, losing 0.26% in 24 hours, and Ethereum stands at $4,512.27, losing 2.65%. Traders are wondering: why did crypto fall today?

Source: TradingView

Source: TradingView

The intraday chart of Bitcoin indicates a possible double top at $120,000 (July-August highs). The breakdown of this level with limited volumes is indicative of declining bullish pressure. If Jerome Powell does not cut rates, BTC can decline to the $95,000–$100,000 zone, a 10–15% decline. This is consistent with previous areas of consolidation in April-May and dictates a cautious Bitcoin price forecast.

Expert Opinions and Market Impact

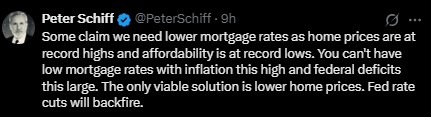

Large investors like Peter Schiff are opposed to rate cuts . He opines that reducing interest rates at times of peak inflation and historic federal deficits could backfire and damage home affordability as much as the overall economy. Schiff has positioned himself to profit from the mess but believes that Powell should care more about long-term economic stability than short-run gains.

Source: X

Source: X

The probable effect is straightforward: diminished investor optimism, lower risk appetite, and a huge shock in both stock and cryptocurrency.

Conclusion

Investors are watching the meeting date closely. A no rate cut can lead to a historic cryptocurrency crash, with Bitcoin, Ethereum, and other coins suffering heavily. Remaining vigilant and being ready for market volatility will be essential for traders in the days ahead.

Disclaimer: For educational purposes only. Always do your own research before any investment in crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。