Waiting for nine years, MetaMask has given us a stablecoin?

Written by: angelilu, Foresight News

When you ask friends who have entered the crypto space what their first on-chain application was, without a doubt, it is the little fox wallet. A plugin wallet with a cute little fox head image, backed by the powerful Ethereum ecosystem company Consensys.

In 2016, under the leadership of MetaMask founder Aaron Davis, this little fox that has taken the blockchain world by storm was born. Now, nine years later, although the community has long been eagerly anticipating the issuance of a native token by MetaMask, it unexpectedly chose to bet on the stablecoin track first.

Against the backdrop of the unprecedented clarity brought by the U.S. "GENIUS Act" for stablecoin regulation, MetaMask seized the opportunity and yesterday (September 15) announced the official launch of its native stablecoin MetaMask USD (abbreviated as mUSD).

Technical Architecture and Partners of mUSD

MetaMask first revealed its plan to launch a stablecoin in a governance proposal in early August, and less than a month and a half later, on September 15, the MetaMask stablecoin mUSD was officially launched. This rapid release is inseparable from the partners of mUSD.

mUSD adopts a tripartite cooperation model for issuance: Bridge, a company under Stripe, as the issuer, with on-chain support provided by M0, while MetaMask is responsible for deeply integrating the stablecoin into its wallet ecosystem.

In its issuance structure, M0 plays a crucial role, as the platform allows for the separation of stablecoin reserve management and programmability, enabling regulated entities to connect to the platform to hold and manage reserves, while developers use the platform to control how their stablecoin operates: defining who can mint, hold, and transfer, while customizing new revenue sources and loyalty opportunities.

M0 announced the completion of a $40 million financing round at the end of August this year, bringing its total financing to $100 million. In addition to issuing the MetaMask stablecoin mUSD, it also participated in the issuance of the stablecoin USDN for the RWA blockchain Noble and the stablecoin protocol Usual's USD0. Furthermore, new banking-style platform KAST and gaming platform operating system Playtron are also using M0 to build their own stablecoins.

So, who is the regulated entity responsible for the actual issuance of mUSD? Undoubtedly, it is Bridge, which provides compliance licensing, monitoring, and strict reserve management for mUSD. Bridge was acquired by payment giant Stripe for $1.1 billion last October and can provide comprehensive support and solutions for businesses to issue customized stablecoins.

In the issuance of mUSD, Bridge co-founder and CEO Zach Abrams stated, "Issuing a customized stablecoin used to take more than a year and involved complex integrations. With our issuance technology, we have reduced this time to a few weeks."

Positioning and On-Chain Ecosystem Layout of mUSD

mUSD is positioned as a "wallet-native, self-custodial, highly usable" stablecoin, with its biggest difference from traditional stablecoins being its seamless integration experience with wallets. mUSD will play a role in two core scenarios:

On-chain applications: providing seamless deposits, exchanges, transfers, and cross-chain transactions;

Real-world: expected to support usage at millions of merchants worldwide accepting Mastercard through the MetaMask card by the end of 2025.

MetaMask product lead Gal Eldar stated, "mUSD is a key step in bringing the world on-chain. It will help us break through some of the most stubborn barriers in web3, reducing entry friction and costs for users. We are not only bringing people on-chain but also building reasons for them to never want to leave."

mUSD will initially be deployed on Ethereum and Linea, with Linea being an EVM-compatible layer two network developed by Consensys. On Linea, mUSD will play an infrastructure role, integrating into various core DeFi protocols, including lending markets, decentralized exchanges, and custodial platforms, providing users with deep liquidity. The official statement also indicated that the introduction of mUSD will help drive the continuous growth of Linea's TVL and protocol activity.

Stablecoins have always been a pillar of DeFi, but they have remained outside of wallets. This stablecoin layout demonstrates Consensys's ambition—not only to build a wallet but also to create a complete on-chain financial ecosystem.

Moreover, although mUSD currently does not disclose any yield features, MetaMask has previously launched savings and yield features for the stablecoin Earn, suggesting that the yield of mUSD is worth imagining.

Cross-Chain Ecosystem is also an Important Development Direction for mUSD

For stablecoins, the composition of reserves is crucial. Although MetaMask has not explicitly stated the reserves of mUSD, M0, as the technical support party, implements an on-chain reserve proof mechanism, allowing users to verify in real-time the relationship between the issuance of mUSD and the reserve assets.

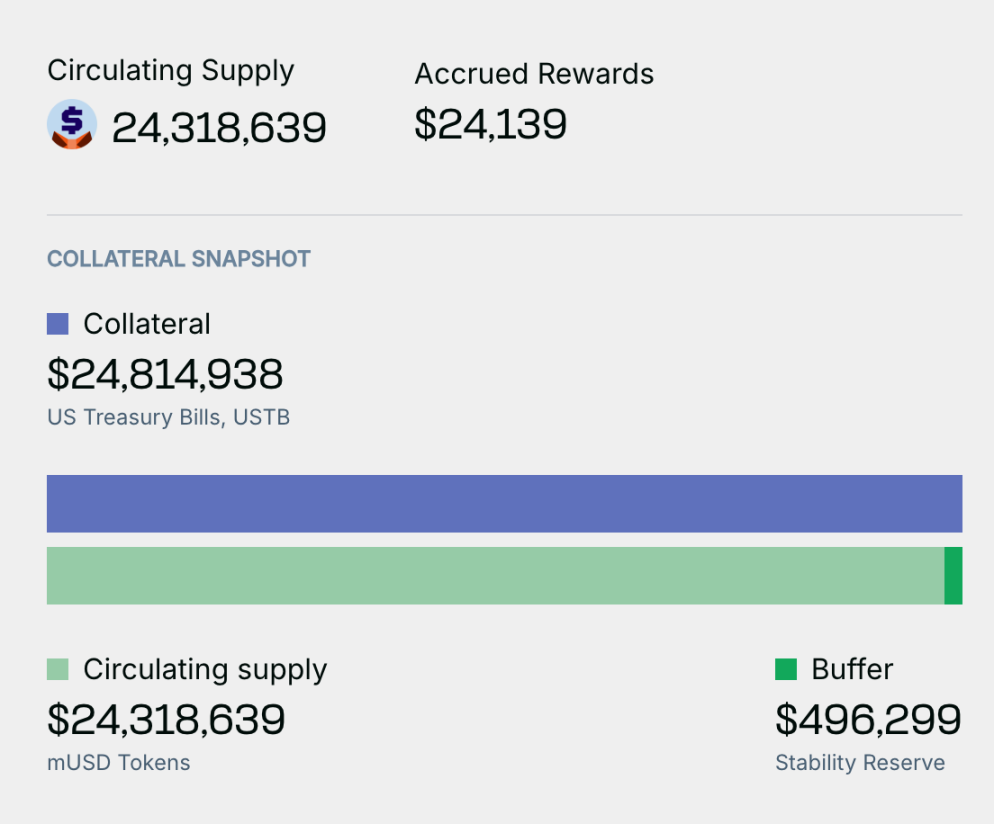

On the M0 disclosed page, it shows that mUSD adopts an over-collateralization model, with the collateral value ($24,814,938) exceeding the circulating supply ($24,318,639), resulting in an over-collateralization rate of about 102%. The system has set up nearly $500,000 in stability reserves as an additional buffer to withstand market fluctuations. The collateral for mUSD is entirely composed of highly liquid, low-risk assets such as U.S. Treasury bonds.

Currently, the MetaMask official website has provided a purchase and exchange interface for mUSD. Less than 24 hours after the launch of mUSD, according to Etherscan data, as of the time of writing, the current circulating supply of mUSD is 24.36 million, with 179 holders and 1,539 transactions.

Consensys has not publicly disclosed the specific business model and revenue sources of mUSD. According to industry practices, stablecoin issuers typically profit through interest income generated from reserve assets, transaction fee sharing, or ecosystem value capture.

Towards DeFi Super Applications

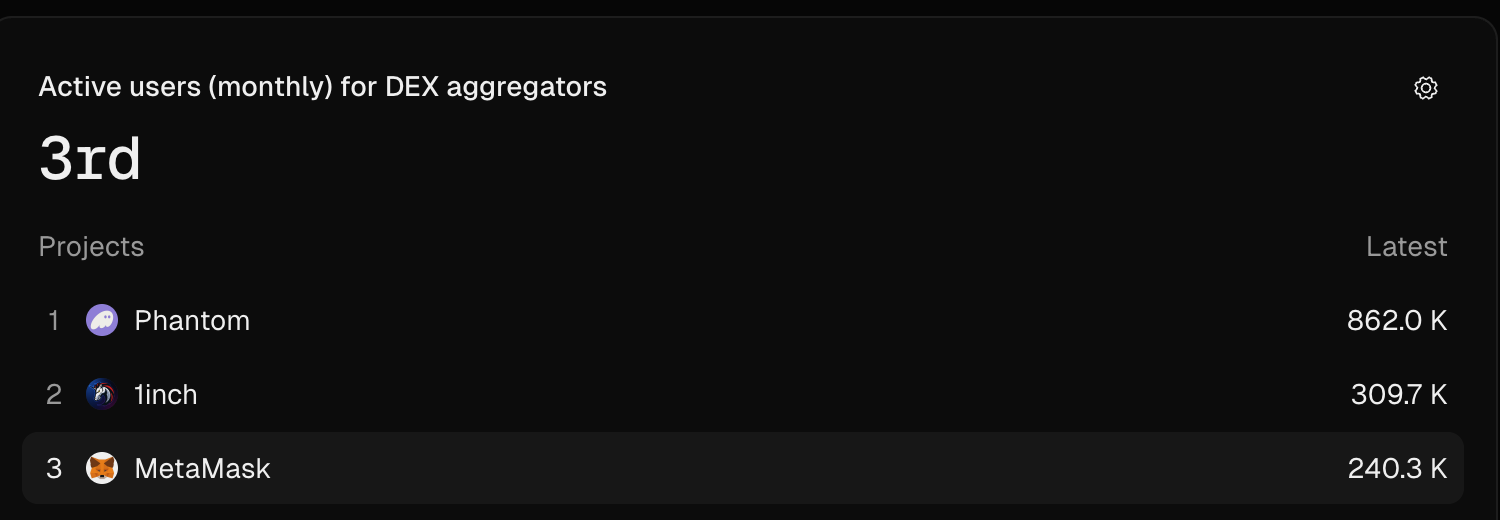

MetaMask has been the undisputed leader in the wallet space, achieving a remarkable record of 30 million monthly active users during the bull market in 2021 and the peak in January 2024. However, according to Token Terminal data, its monthly active users have been around 250,000 in recent months, with its market share dropping to 14.8%, falling to third place among similar products.

At the same time, looking at DeFi applications during the same period, platforms like Uniswap and Aave are evolving from single-function tools to comprehensive platforms: Uniswap is developing into a trading super application with its own wallet, cross-chain standards, and routing logic; Aave is issuing its own stablecoin and integrating lending, governance, and credit functions. The market clearly indicates that single-function products are giving way to ecosystem super applications.

In this context, as one of the most iconic wallets in the Ethereum ecosystem, the strategic significance of MetaMask launching mUSD goes far beyond a product update. It is not only a systematic exploration in the field of token economics but also a key part of Consensys's construction of a comprehensive DeFi service matrix.

The "little fox" is also transforming from a simple wallet tool to a comprehensive financial service platform. In today's increasingly mature Web3 experience, MetaMask is no longer satisfied with being a simple entry point but aims to accompany Web3 users throughout their entire on-chain journey as a "super application."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。