Lawmakers, Saylor, Crypto Leaders Back Strategic Bitcoin Reserve Bill

The debate over whether the United States should create a Strategic Bitcoin Reserve is reaching a new level.

On Tuesday, lawmakers and top crypto executives will gather on Capitol Hill for a roundtable hosted by Senator Cynthia Lummis and Representative Nick Begich.

The focus will be the BITCOIN Act, a bill that proposes the U.S. government acquire 1 million BTC over five years using what sponsors describe as “budget-neutral strategies.”

The plan is being pitched as a modern version of the nation’s gold stockpile. If passed, it would mark the first time the U.S. government formally commits to Bitcoin as a long-term reserve asset .

Michael Saylor and Crypto Leaders Join the Push

Strategy co-founder Michael Saylor, known for leading one of the biggest corporate BTC purchases in history, will attend the roundtable.

He will be joined by Marathon Digital CEO Fred Thiel, Cardano founder Charles Hoskinson, and other industry executives.

Together, they will make the case that a Strategic Reserve could strengthen America’s financial stability while also boosting its position in the global economy.

Michael Saylor’s own firm, Strategy, continues to add Bitcoin aggressively . The company now holds nearly 639,000 BTC worth about $73 billion, or more than 3% of the total supply.

A Policy Shift With Global Impact

The idea behind the this Act is that accumulating one million BTC by 2029 would not only provide a hedge against inflation but also help offset national debt.

According to research shared by VanEck, if BTC compounds at 25% annually, the U.S. could reduce its projected 2049 debt by about $21 trillion roughly 18% of the total.

That projection assumes U.S. debt grows at 5% per year and crypto’s price climbs to around $21 million per coin by 2049. While optimistic, it highlights how a Strategic Bitcoin Reserve could reshape sovereign finance.

Global reaction would also be significant. If the U.S. builds a reserve, other nations may be forced to decide whether to buy, regulate, or restrict this digital asset.

Divided Opinions on State BTC Holdings

Not everyone is on board, though. BTC maximalists like Bo Hines consider the proposal a significant victory, contending that it legitimates the asset's status as digital gold.

But critics worry that government control would distort the market, restrict supply to private investors, and introduce new risks.

Social sentiment shows the community split between excitement and caution.

Some think a term called Strategic Bitcoin Reserve would cement BTC's position as a major macro asset, and some others suggest that it could detract from its decentralized model.

Effect on Bitcoin Price

If the U.S. goes ahead with a Strategic Reserve, demand would increase as the government purchases up to 1 million BTC. With total supply capped at 21 million and only 19.9 million mined to date, this buying pressure is able to drive the price over $150,000 in the short term.

Such action can create a squeeze on liquidity, driving altcoins higher as well and causing a widespread crypto rally.

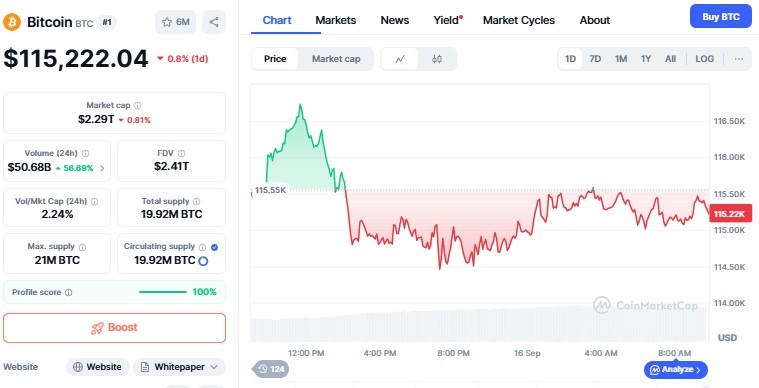

Source: CoinMarketCap

The coin is currenlty trading at $115,222 with a decrease of 0.8%, while trading volume has increased by 58% as per the CoinMarketcap. It has surged post strategy's buying news, from $112,000 to $116,000.

What Comes Next

The BITCOIN Act still faces hurdle . It presently has support primarily from Republican lawmakers. To get further, it must clear hearings in both the House Financial Services Committee and the Senate Banking Committee.

Still, there is a gathering momentum. Having just passed a bill regarding stablecoins earlier in the year, legislators are now setting their sights on broader crypto legislation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。