Written by: Xiao Za Legal Team

On September 10, according to publicly available information from the Hong Kong SAR Government press release, the Secretary for Financial Services and the Treasury, Mr. Christopher Hui, responded to inquiries regarding a series of implementation issues related to the "Stablecoin Ordinance" during a Legislative Council meeting and provided written answers to a range of market concerns.

Among the most notable points was his clear response to a question from a Legislative Council member: Can virtual asset over-the-counter (OTC) institutions (including exchange shops) provide stablecoin exchange services to the public?

The Secretary's clear answer: No. His stance: Educate first, act later.

Today, the Xiao Za team will analyze the risks of exchanging stablecoins in Hong Kong without a license, as well as the reliable ways for residents of mainland China to obtain stablecoins.

01 Ending OTC Stablecoin Exchange Services Has Become a Regulatory Consensus

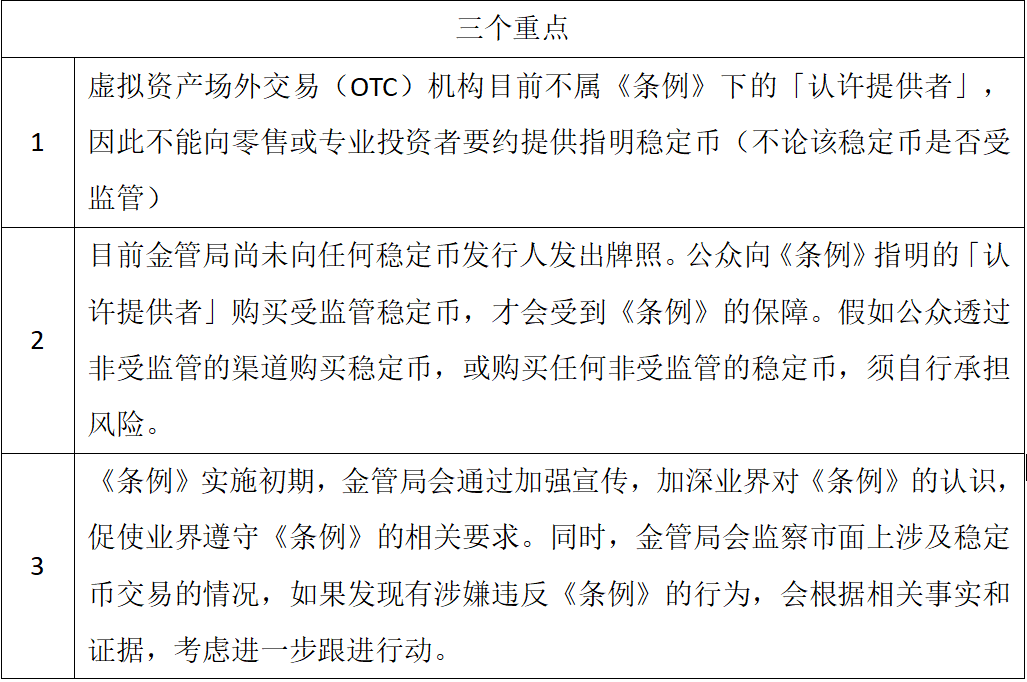

A few days ago, a member of the Hong Kong Legislative Council inquired about the current implementation of the "Stablecoin Ordinance" and whether OTC (including exchange shops and other institutions) would be banned. The Secretary provided a serious written response, which the Xiao Za team summarized into three key points:

It is evident that the recent speculation about whether exchange shops in Hong Kong can still provide services for exchanging stablecoins like USDT has been directly "killed" by the Secretary, with regulators giving a clear conclusion: No.

02 What Are the Legal Risks of Providing OTC Stablecoin Services Without a License in Hong Kong?

We need to clarify the regulatory scope of the "Stablecoin Ordinance" in Hong Kong. In simple terms, only five types of "authorized providers" can: (1) offer stablecoins issued by licensed issuers regulated by the Monetary Authority to retail investors (individuals) and professional investors; (2) offer unregulated stablecoins to professional investors.

Note: The five types of "authorized providers" have been introduced in a previous article by the Xiao Za team, and will not be repeated here. Friends can click the link to review it.

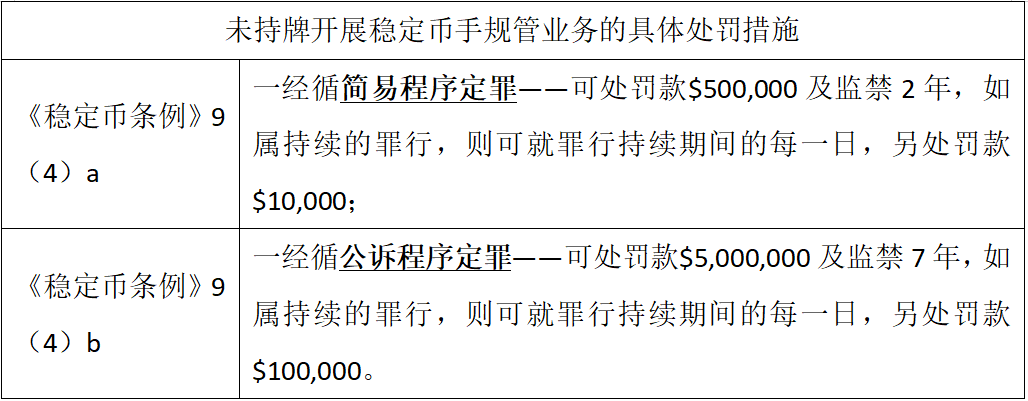

So, if OTC institutions that do not belong to the above five types of "authorized providers," such as numerous "exchange shops," cryptocurrency dealers, or underground money changers, continue to provide stablecoin exchange services to the public in Hong Kong without a license, or "display themselves engaging in regulated stablecoin activities," they may be suspected of committing a crime under Article 9 of the "Stablecoin Ordinance," with penalties as follows:

It is worth mentioning that in response to a question from a Legislative Council member, it was specifically noted that many exchange shops in Hong Kong are continuing to operate and evade regulation through "passive trading or customer-initiated quoting." The Xiao Za team warns that this approach is not viable; whether in mainland China or Hong Kong, regulatory agencies adhere to the principle of "substantive regulation" in the financial industry, meaning they look beyond appearances to the essence, and small tricks are generally ineffective.

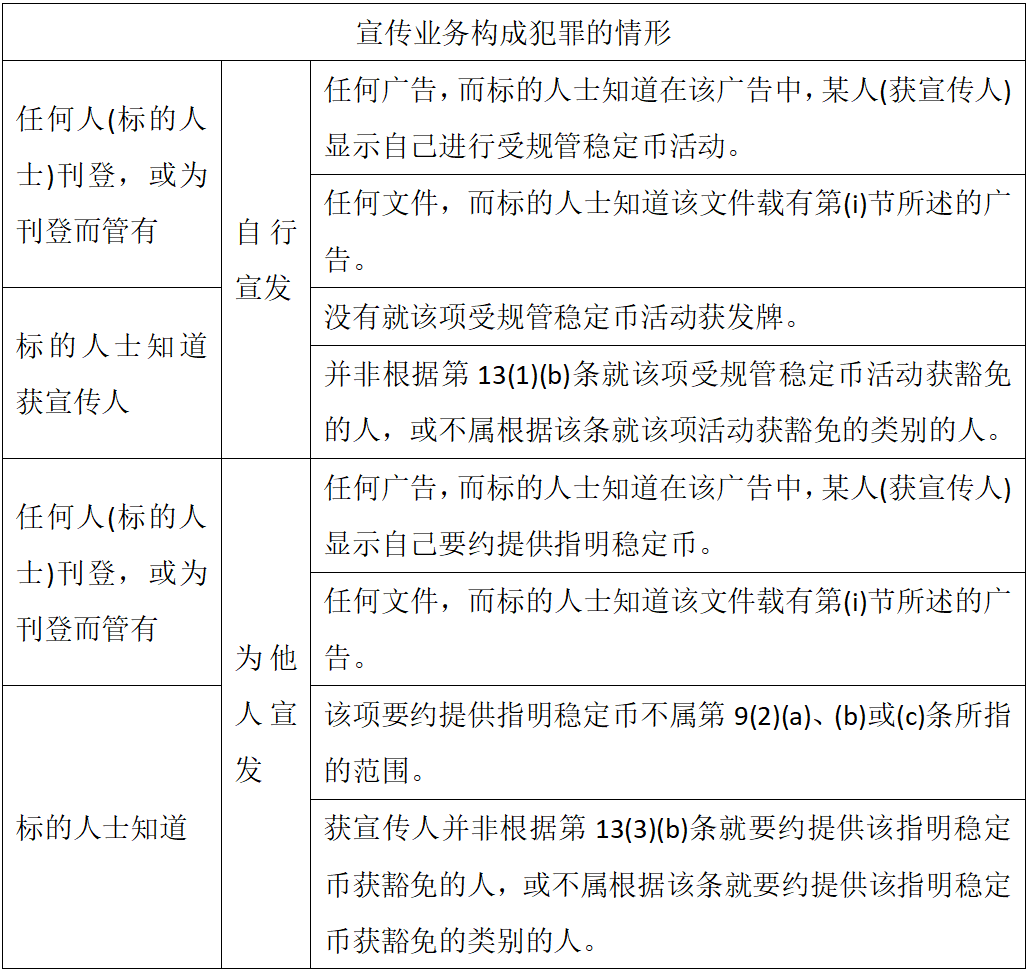

Additionally, it is important to be cautious about the actions of promotional entities such as KOLs. Article 10 of the "Stablecoin Ordinance" clearly states that the following behaviors related to advertising regulated stablecoin activities and offers may be considered criminal:

03 Are There Reliable Channels for Mainland Residents to Obtain Stablecoins at This Stage?

According to the Xiao Za team's practice and recent communications with legal, financial, and cryptocurrency regulatory professionals in Hong Kong, in the current context where OTC has been clearly regulated, if mainland residents want to obtain cryptocurrency, a relatively reliable way is to do so through one of the five types of "authorized providers" (especially cryptocurrency exchanges holding VATP licenses or banks that have upgraded their licenses). Whether these five types of "authorized providers" can open accounts and agree to trade for mainland residents is generally conditional.

For individuals, the most important condition is to hold a permanent permit or long-term (more than one year) visa from a foreign country or jurisdiction (preferably a cryptocurrency-friendly country). If this condition is met, as long as KYC is completed, "authorized providers" can generally provide cryptocurrency trading services to mainland residents.

Additionally, after multiple investigations by the Xiao Za team, there are currently not many institutions that can provide cryptocurrency trading and exchange services to mainland residents (individuals), but if it is a legal entity, the KYC and account opening requirements are slightly lower than for individuals.

In Conclusion

Of course, if friends do not want to go through the hassle, they can directly find someone nearby who trades cryptocurrencies to buy or exchange stablecoins. However, overall, if one seeks clean assets and legal recourse, the Xiao Za team still recommends obtaining stablecoins through compliant channels via the five types of "authorized providers."

After all, the Monetary Authority has made it clear: "If the public purchases stablecoins through unregulated channels, or purchases any unregulated stablecoins, they must bear the risks themselves." In other words, if the public obtains cryptocurrency through "authorized providers," in the event of a dispute, they can seek legal remedies to protect their rights.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。