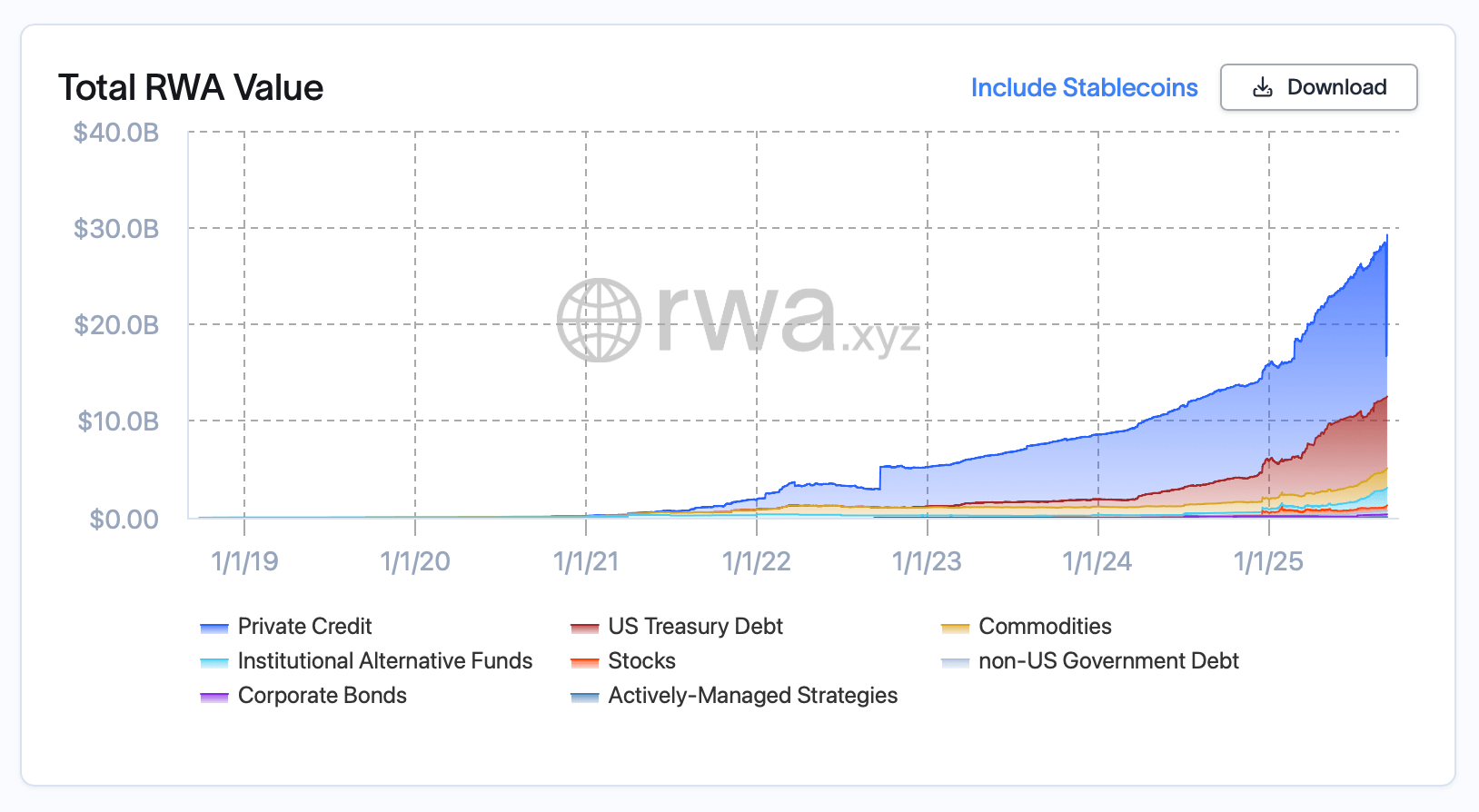

This week, according to rwa.xyz stats, total RWA value onchain sits at $29.18 billion, up 8.25% over 30 days, with 387,104 asset holders and 210 issuers contributing to the party. Stablecoins remain the heavyweight liquidity layer. While stablecoins are not the story today, they’re the fiat-pegged rails that make everything else hum.

Drilling into composition, private credit is the biggest slice of the tokenized pie at $16.7 billion, with U.S. Treasury debt next at $7.42 billion. Commodities clock in near $2 billion, and institutional alternative funds add $1.8 billion. The growth curve in the total-value data is no wallflower; as metrics show a steady climb through 2024 and a clear lift through 2025 as products matured and distribution widened.

On the issuance front, the cadence from April through September shows consistent new mints across categories, with no single month stealing the show. In the $0–$100,000 transfer band for the past seven days, the leaderboard is a who’s who of practical tokens: USTB, PAXG and USDY trade hands around the $100,000 mark across blockchains like Ethereum and Solana.

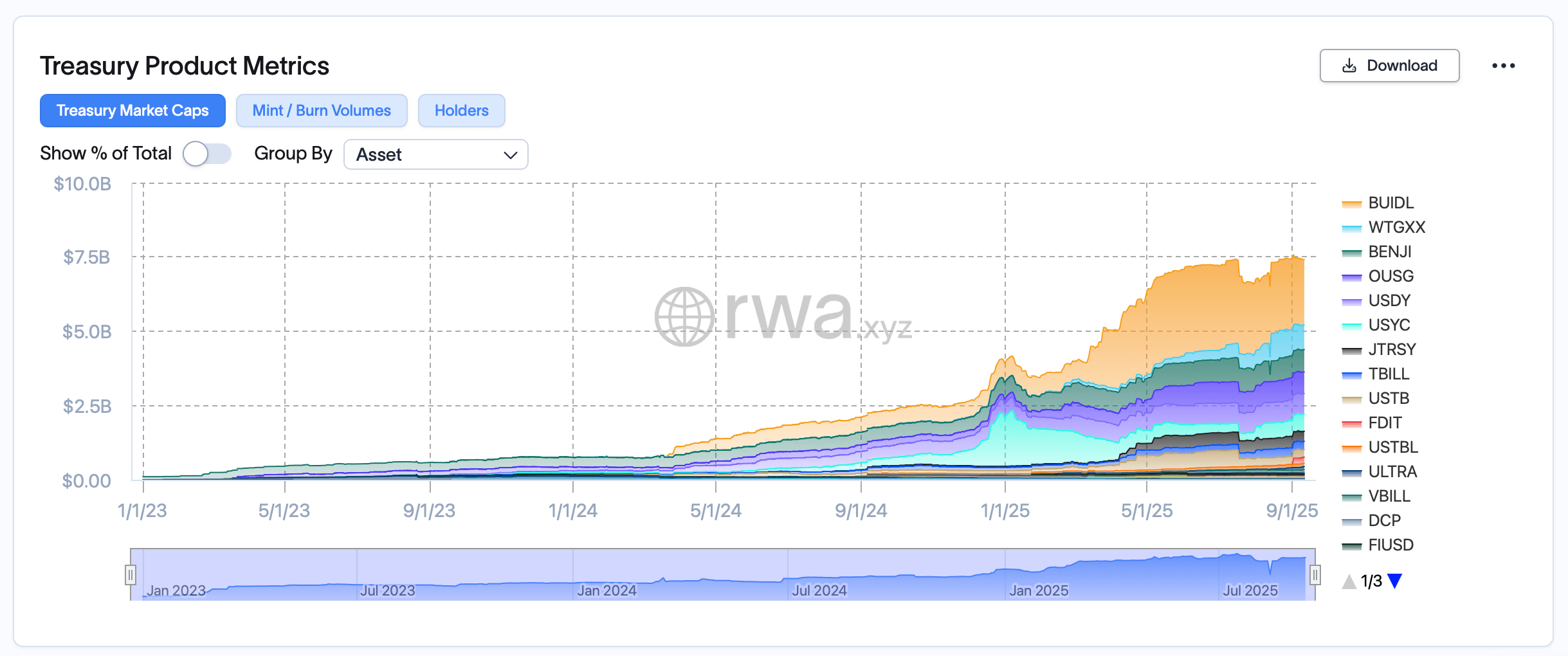

Tokenized treasuries remain the RWA market’s showpiece. The category totals $7.42 billion in value (down 0.46% week over week) with an average yield to maturity at 4.11%, 49 distinct assets, and 52,981 holders (up 0.15% on the week). Product by product, the roster reads like a money-market tour.

These include Blackrock’s BUIDL at $2.2 billion (softening), Wisdomtree’s WTGXX at $832.28 million (rising), Franklin’s BENJI at $752.31 million (rising), Ondo’s OUSG at $729.64 million (easing), Ondo’s USDY at $690.43 million (rising), Circle’s USYC at $579.08 million (easing), Centrifuge’s JTRSY at $337.48 million (rising), Openeden’s TBILL at $278.36 million (rising), Superstate’s USTB at $252.80 million (easing), and Fidelity’s FDIT at $203.69 million (in growth mode).

Follow the money and you’ll spot the 30-day net-flow winners: Wisdomtree’s WTGXX (+$237 million) and Fidelity’s FDIT (+$203 million) sit at the top, with Superstate’s USTB (+$95 million), Libeera’s ULTRA (+$61 million), Circle’s USYC (+$51 million), and Ondo’s OUSG (+$26 million) in the green. The standouts on the other side are Securitize’s BUIDL (-$135 million) and Centrifuge’s JTRSY (-$48 million).

As far as chains are concerned, Ethereum dominates tokenized treasuries with $5.2 billion of market cap. Stellar follows at $507.2 million, then BNB Chain at $426 million, Solana at $304.7 million, Arbitrum at $180.2 million, XRP Ledger at $159.3 million, and Avalanche at $149.5 million. It’s a reminder that while multi-chain access matters, network gravity still pulls hardest toward Ethereum, where tooling, custody, and liquidity are thickest.

Tokenized commodities have seen significant growth in 2025.

Commodities are shining, quite literally. The tokenized commodities bucket totals $2.51 billion, up 7.34% in 30 days, with $1.31 billion in monthly transfer volume (+4.31%). Monthly active addresses rise to 8,808 (+4.24%), and holders reach 85,280 (+4.49%). Gold dominates: Paxos Gold (PAXG) sits at about $1.05 billion, Tether Gold (XAUT) at $901.27 million, and Matrixdock’s XAUm at $47.50 million.

Agriculture makes a cameo with Justoken’s JSOY_OIL at $307.20 million and JSOY at $161.39 million, while cotton (JCOT, $19.76 million) and corn (JCORN, $4.48 million) give the farm a token. Alongside this, smaller entries like CGO, TXAU and WTGOLD round out the shelf.

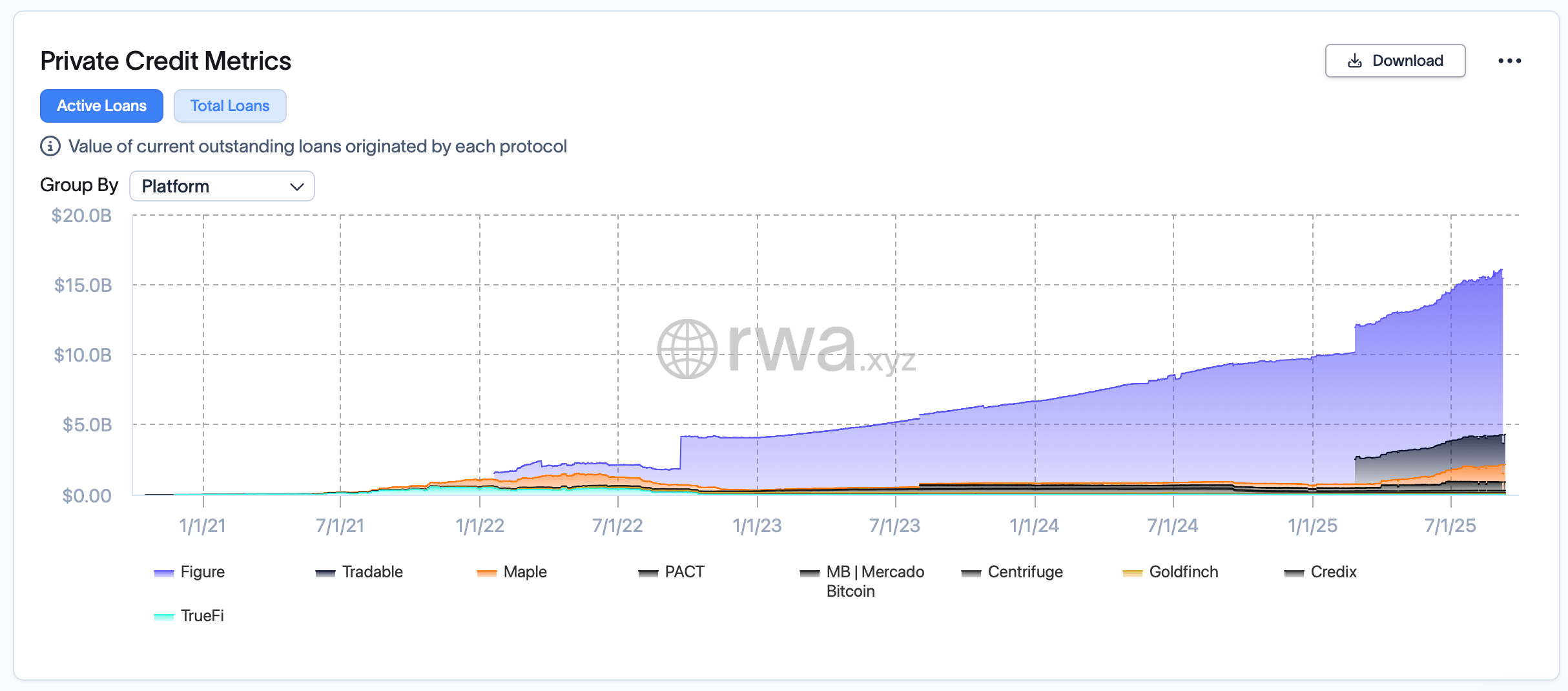

Private credit, the quiet heavyweight, shows $16.72 billion in active loans against $30.58 billion in total originations, with a 9.74% average APR across 2,598 loans. The recorded history on rwa.xyz makes one thing clear: this segment grew up while everyone argued about ETFs. Platforms like Figure carry a large share, with Credix and others expanding niches.

Tokenized stocks have their own subplot. Total value stands at $490.64 million, up 62.24% on the month, while monthly transfer volume slips to $227.71 million (down 23.68%). Monthly active addresses cool to 23,627 (down 38.64%), but holders climb to 66,910 (up 8.94%). In other words, capitalization is building even as short-term trading thins—a pattern consistent with new wrappers finding longer-term users.

Global bond tokens show the category totals $622.86 million (up 1.75% week over week) across 29 assets with 15,931 holders (up 2.27%). The leaderboard features Spiko’s EU T-Bills Money Market Fund (EUTBL) at $324.31 million, Cashlink-hosted KFW and NRW1 at $117.03 million each, and a cohort of Backed Finance products such as bERNX ($12.76 million) and bC3M ($9.99 million). Opentrade’s XEVT ($8.12 million) and XRV ($3.99 million) add E.U. flavors, while China AMC’s CAMMF ($6.98 million) and Etherfuse’s CETES ($4.63 million) broaden the map.

So, where does this leave tokenized RWAs in 2025? Bigger, busier, and a little cheekier. Stablecoins and tokenized treasuries remain the anchor, commodities supply the shine, private credit brings the yield, stocks add an equity garnish, and global bonds expand the map. Holders are growing, issuers are multiplying, and flows are shuffling toward the best mix of fees, partners, and rails. If this market were a playlist, it wouldn’t be one song on repeat—it would be a tidy set with more instruments every month.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。