Arthur Hayes says Bitcoin is not like gold or stocks

Arthur Hayes: “Stop chasing a quick Lambo” — Bitcoin needs patience

BitMEX co-founder Arthur Hayes said in an interview that Bitcoin buyers should be patient. He warned people who buy BTC hoping to make fast money and buy a Lamborghini the next day. He said that this kind of thinking can lead to big losses and being liquidated. Hayes wants buyers to think long term, not chase quick pumps.

Source : X

Hayes says Stop Comparing Bitcoin with Gold or Stocks as short-term thinking is dangerous

Gold and the S&P 500 also hit record highs recently, which some people say shows money is moving into other stores of value. Hayes argues that asking “why isn’t Bitcoin higher when stocks and gold are at records?” misses the point.

He says BTC is a long-run store of value and that short-term traders who expect instant riches usually lose money. He reminded listeners that people who bought BTC years ago did not plan to sell after a few weeks. His view is that investors should plan and not panic at every market move.

Will the Bitcoin market push back again?

Bitcoin’s history is clear: big rallies, sharp drops, and new all-time highs later. The cycle repeats, strong gains, then profit taking, then recovery and a new record. The August high above $124k record is the latest example of this pattern. That is why Hayes tells people to keep perspective and not treat each pullback as the end.

If macro signs stay friendly — for example, hopes for lower interest rates or continued institutional demand — the token could try to climb to new highs again. But the path is bumpy and may have big swings.

Bitcoin dominance and market mood

BTC still holds a large share of the crypto market . When token dominance rises, capital often flows into BTC and away from smaller coins. When it falls, altcoins can outperform. Right now sentiment is mixed: some traders look for quick trades, while longer-term holders follow the Hayes view and stay steady.

BTC Price, Volatility, and Analyst Views

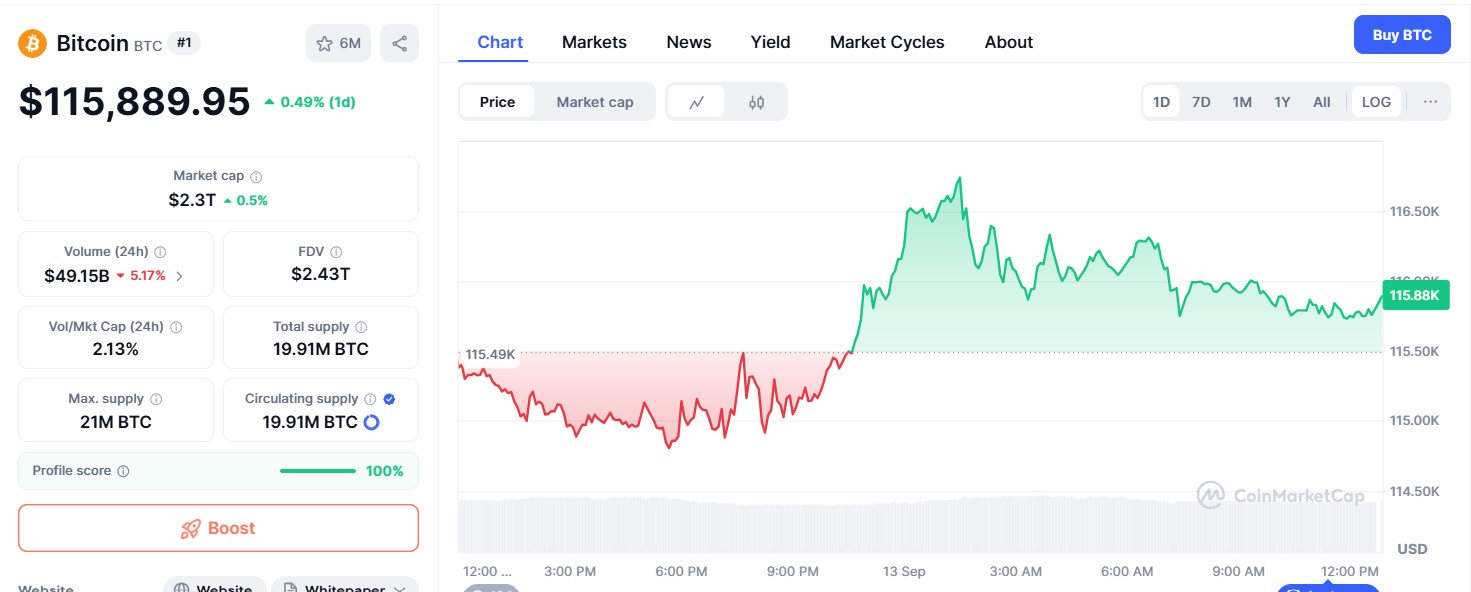

Right now the coin trades near $115k, according to CoinMarketCap live data. Market cap is at 2.3T and 24 hr volume goes down with 5% stands at $49B. The token is sliding between slight high and low from past 24hrs showing token volatility.

Source : Coinmarketcap

Many analysts say Fed may lower interest rates and continued institutional interest could help coin try for new highs again later this year. But markets are not certain, macro news, policy, and investor flows matter a lot.

Gold and the S&P 500 also hit record highs recently, which some people say shows money is moving into other stores of value.

What analysts are predicting

-

Some price models and trading services show forecasts from $120k–$180k for the next months, with a range of views into 2026 and beyond.

-

Analysts and other mainstream outlets note that if macro tailwinds like Fed cuts continue, Bitcoin’s rally could resume and test higher levels. But experts also warn of normal pullbacks and volatility.

Implications what this means for regular investors

-

If you are long-term, Hayes’ point is to avoid gambling on instant gains and focus on a plan.

-

If you are short-term, expect high volatility and use risk controls (position size, stop losses).

-

Watch macro news: Fed moves, CPI, and big institutional flows often move crypto fast.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。