Author: Chao Source: X, @chaowxyz

It was supposed to be a decentralized utopia, but the data reveals a digital oligarchy controlled by 1%. We reviewed all on-chain votes from Uniswap over the past four years, uncovering the astonishing truth behind the governance utopia of Uniswap.

In November 2021, Uniswap, a giant in decentralized finance, launched a highly anticipated governance mechanism: a digital democracy system where UNI token holders collectively decide the platform's future. It painted an enticing vision: a pure democratic utopia without a CEO, no board of directors, where power transparently belongs entirely to token holders.

However, a deep investigation into the Uniswap decentralized autonomous organization (DAO) over four years—a detailed quantitative analysis based on 21,791 voters, 68 governance proposals, and 57,884 delegation events—revealed a surprising reality: digital democracy has evolved into a highly centralized digital oligarchy in practice, and the delegation mechanism intended to improve governance may instead exacerbate inequality and suppress participation.

This study not only exposes the complex nature of digital governance but also challenges many of our fundamental assumptions about decentralized autonomy, providing profound insights for the future development of the cryptocurrency space and even traditional democratic systems. It is not a romantic story about pure democracy, but an epic about how humans organize themselves under new tools, balancing efficiency and fairness.

I. The Ruthless Judgment of Digital Oligarchy

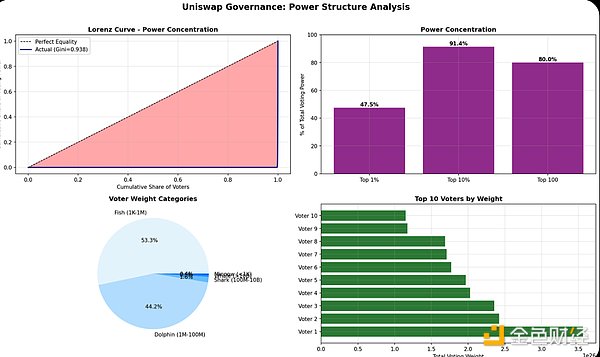

The judgment of data is merciless. The average Gini coefficient of Uniswap governance is as high as 0.938, which is more unequal than the wealth distribution in almost any country on Earth. The facts are staggering:

• The top 1% of voters control an average of 47.5% of the voting power, reaching as high as 99.97% in some extreme proposals.

• The top 10% of voters consistently control 91.4% of the decision-making power, rendering the vast majority of token holders virtually powerless in the decision-making process.

Power structure of Uniswap's on-chain governance

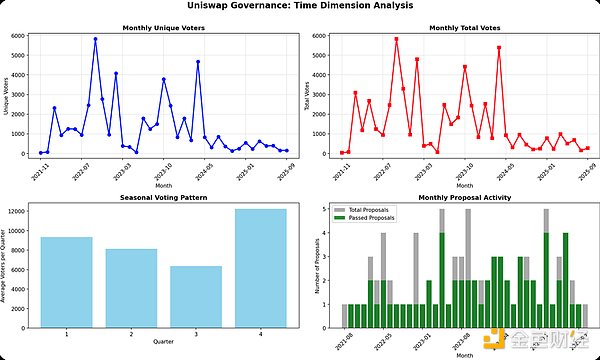

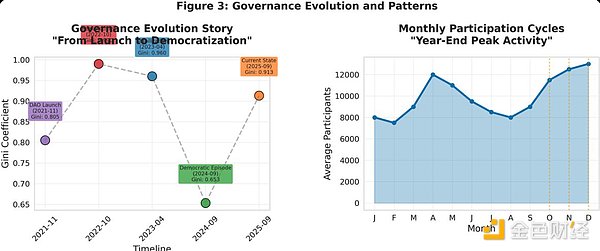

This concentration of power is not accidental but a natural manifestation of the token-weighted governance system in reality. Accompanying this is a concerningly low participation rate: over four years, the median voter has only voted once, while the top 10 most active voters have voted an average of 54 times each. Monthly participation rates plummeted by 61% from their peak in 2022-2023, indicating that the legitimacy of governance is facing a survival threat. We are approaching a critical point where possibly fewer than 200 people regularly determine the fate of a protocol worth hundreds of billions of dollars.

II. "Consensus Theater": Indifference is More Dangerous than Opposition

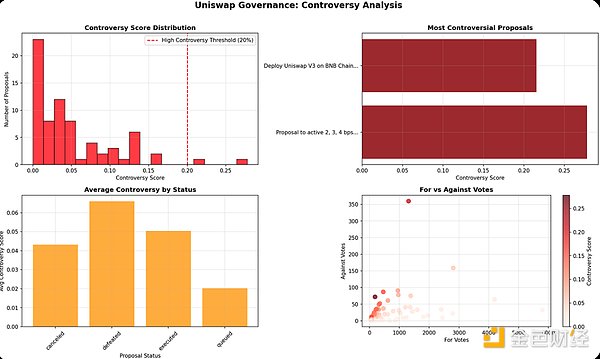

Despite the highly concentrated power, the success rate of Uniswap's proposals is as high as 92.6%.

It must be acknowledged that most proposals undergo discussions in community forums and "consensus checks" through off-chain voting on Snapshot before on-chain voting, which is one reason for their efficiency and high consensus. However, on-chain data still reveals a deeper issue:

- 94.2% of voters are loyal "supporters," with an average support rate of 96.8%.

- The failure of proposals is 100% due to failing to meet the minimum voting weight threshold, rather than a majority opposition.

Proposal controversy analysis

Meaningful opposition is exceptionally rare, with only 2 proposals facing more than 20% opposition votes. The failure of proposals is not due to opposition but rather indifference— all 5 failed proposals stemmed from failing to meet the quorum, not from a majority opposition. This reveals a profound truth: whether in digital or traditional democracy, the true enemy is not disagreement but the apathy of participants. Convincing people you are right is less effective than convincing them to care enough to participate.

III. The Hidden Architecture of Power and Voter Ecology

Uniswap's governance is not a single, flat structure but a nested, complex ecosystem.

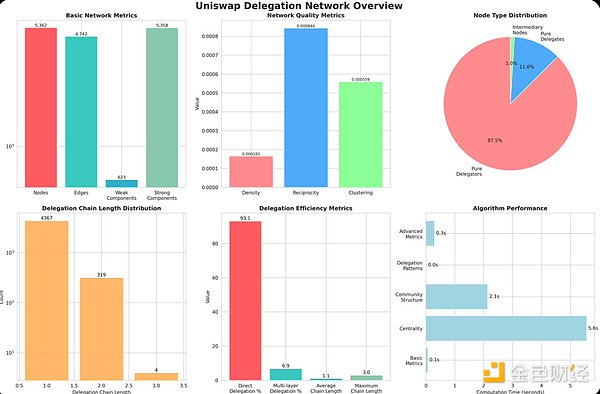

Through network analysis, we revealed a "shadow governance structure" operating through delegation. 5,833 delegation events constructed a complex network, but it is highly fragmented, with 623 weakly connected components, forming **"island governance"—isolated islands of influence rather than a unified democratic system.

At the same time, the network evolution presents a "rich get richer" pattern: 85% of new delegations flow to existing large proxies, and the status of top proxies remains stable over 3.8 years. Its "star structure" (87.5% are pure delegators, 11.6% are pure trustees) clearly outlines the distribution of power around a few central nodes.

Voting delegation network analysis

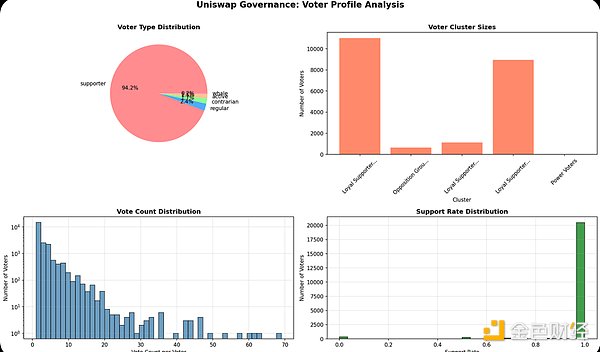

Deeper analysis also identifies different typical voter types, constituting Uniswap's "five-layer voter ecosystem":

• Whale Voters (0.8%): Extremely high weight, low-frequency participation, yet capable of deciding outcomes instantly.

• Active Governors (3.2%): High weight, high-frequency participation, the backbone of governance.

• Institutional Participants (1.5%): Medium to high weight, selective participation.

• Technical Experts (4.1%): Medium weight, focused on technical proposals.

• Followers (15.8%): Low weight, following the mainstream.

• Silent Participants (74.6%): Extremely low weight, very little participation, representing untapped governance potential.

Voter profiles

These different levels of voters operate with their own incentives, information levels, and participation patterns. Interestingly, voter lifecycle analysis shows that as experience grows, voters become more independent but simultaneously more inclined to delegate—this explains why experienced participants have reduced direct voting. Additionally, different types of proposals exhibit different power structures: technical deployment proposals have the highest concentration of power (Gini coefficient around 0.997), while governance reform proposals have the lowest concentration (Gini coefficient between 0.78-0.92). This indicates that Uniswap actually operates under "four different governance systems" based on decision types.

IV. The Delegation Paradox: Unintended Consequences of Good Design

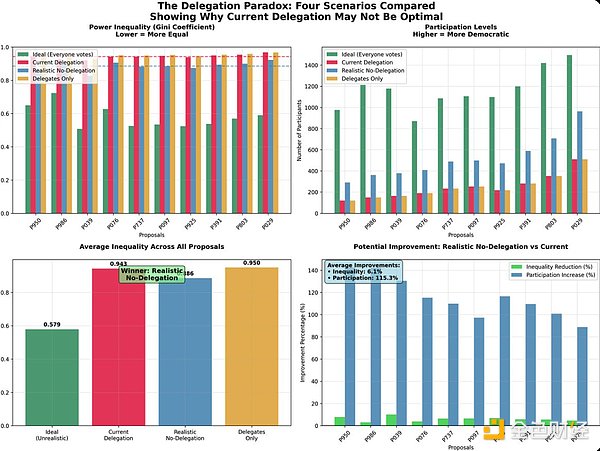

However, on top of all these findings, there is an even more shocking "plot twist": the delegation system intended to democratize governance may be making things worse.

The delegation mechanism is widely regarded as a remedy for the "laziness" of token holders. Theoretically, it should increase participation, improve decision quality, and reduce inequality by allowing token holders to delegate their voting rights to experts or community leaders. It sounds great, but the data tells a different story.

To understand the true impact of delegation, we can interpret these four scenarios as four "simulated reenactments" of the same vote, each time changing one key variable:

Scenario 1: Ideal Democracy (Theoretical Benchmark) assumes all token holders vote in person. This represents the theoretically most democratic and equal upper limit.

Scenario 2: Current Status (Reality Benchmark) is what actually happens: some people vote directly, while others delegate their votes to "representatives."

Scenario 3: Reality without Delegation (Key Comparison) is a critical thought experiment: if the delegation function is disabled, the original group of "representatives" can only vote with their own votes, while we assume 10% of ordinary people who would have chosen to delegate are activated to vote in person. This represents the most realistic alternative.

Scenario 4: Only Representatives Vote (Minimized Benchmark) assumes only the currently active "representatives" vote, and they can only use their own tokens, with no delegated votes at all. This represents the lower limit of participation.

• Compared to the reality without a delegation system, the current delegation system increases inequality by 6.6% (average Gini coefficient rises from 0.881 to 0.943).

• Compared to the reality without a delegation system, the delegation system reduces the number of participants by 88% (an average of 267 participants per proposal compared to 503).

• All 10 test proposals exhibited the same pattern, confirming 100% consistency of this finding.

Thus, the delegation paradox is born: the delegation system simultaneously reduces the equality and participation of governance.

Why does this happen? The root cause of the paradox lies in a misunderstanding of human behavior. The traditional view holds that delegation can increase participation through representation, but the reality is:

Delegation concentrates power: it consolidates the voting rights of multiple token holders into the hands of a few delegates.

Reduces effective participants: thousands of delegators may ultimately be represented by only a few hundred active delegates.

Creates artificial scarcity: there are only a limited number of "trustworthy" delegates.

Suppresses direct participation: the delegation mechanism creates a psychological effect where people think "others will handle it," thus suppressing the willingness to participate directly.

In a realistic system without delegation, delegates would still vote with their own tokens, while some token holders who would have delegated would choose to vote directly. The end result would be more participants and more dispersed power. This system, designed to democratize governance, may actually be heading in the opposite direction.

V. The Dynamic Evolution of Democracy: The Self-Regulation of Oligarchy and a Ray of Hope

Despite the extreme inequality and the delegation paradox, this study also found an encouraging trend: Uniswap is gradually moving towards democratization. Over 3.8 years, the average Gini coefficient decreased from a peak of 0.990 in 2022 to 0.913 in 2025, achieving an 8.1% democratization, while the proposal success rate remained above 77%.

Among them, the coefficient change in September 2024 was due to a specific proposal and does not represent the overall situation for the entire year of 2024.

This indicates that the token-weighted system has an inherent potential to evolve towards greater equality without formal rule changes. Perfect blockchain democracy may be an unattainable utopia, but digital oligarchy is not immutable; it may represent a transitional phase towards more democratic governance. (Important note: The comparative data is based on actual votes from existing proposals, supplemented by simulated data formed under reasonable assumptions. It aims to provide a trend insight but is not entirely equivalent to the real situation, and its model premises should be considered in interpretation.)

VI. Profound Implications for Future Governance and the Path Forward

In summary of all findings, Uniswap's governance model can be described as an efficient, stable, yet highly elitist "Plutocratic Republic." It excels in driving protocol technological iterations and fund management but shows a significant gap from the democratic ideals of a decentralized community.

The structure of Uniswap governance, which blends oligarchic efficiency, broad legitimacy, economic consistency, and evolutionary capability, bears a striking resemblance to the historical Venetian Republic. The Venetian Republic sustained itself for a millennium by balancing these forces; perhaps Uniswap has inadvertently replicated a time-tested governance model—not pure democracy, but a functional democracy that works in practice.

However, they compel the industry to rethink:

- Is the default status of the delegation mechanism reasonable? It may not be a universal solution but rather a "prescription" that needs to be used cautiously. One should not blindly assume that delegation will improve governance outcomes; empirical analysis should be conducted to verify its benefits.

- Should the optimization direction of DAO governance shift from "optimizing delegation" to "incentivizing direct participation"?

- Should we design new governance modules, such as liquidity democracy or quadratic voting, to balance the systemic flaws of the existing delegation system?

The story of Uniswap is not a case of failure but a valuable sample filled with real-world data and lessons learned. However, what is hopeful is that these systems can evolve, improve, and gradually democratize. We are not stuck at the first version of digital governance; we can learn, adapt, and build better systems.

Despite the inequalities, Uniswap's governance has achieved extraordinary accomplishments: a 91% proposal success rate, ongoing democratization, broad legitimacy, and consistency of economic interests. This may not be the perfect democracy we envision, but it could be a more valuable functional democracy.

Uniswap's governance experiment provides an unparalleled real-world laboratory, allowing us to study how human societies organize under new tools for collective decision-making in a completely transparent manner. Digital oligarchy is not a design flaw but a characteristic of how humans naturally organize when faced with new tools. Understanding and adapting to this reality, rather than opposing it, may be key to building a new generation of organizational and governance systems. Future governance, whether digital or traditional, will be built on the valuable lessons we learn today from these early experiments in decentralized democracy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。