How US CPI Data Release Date Could Shape Crypto Market and Fed Rate

The US CPI Data release date is here, and markets are waiting for clues about the economy’s next move. The release today time is set for 8:30 AM ET on September 11, with expectations pointing to 2.9% year-over-year growth.

Source: X

Source: X

In July 2025, the annual Consumer Price Index stood at 2.7%, while monthly inflation slowed from 0.3% to 0.2%. Core inflation, which leaves out food and energy, rose 3.1% from a year ago, slightly up from 3% in June. Monthly core inflation also ticked up from 0.2% to 0.3%.

Economists now expect August CPI to rise 0.3% month-over-month and 2.9% annually. Some forecasts are slightly higher—Goldman Sachs sees core Consumer Price Index climbing 0.36% monthly, which could lift the annual rate to 3.13%.

This release comes as recent U.S. jobs details hinted at labor market weakness, fueling fed rate cut expectations at the upcoming FOMC meeting.

US PPI Data Insights: Market Reaction and Takeaways

Just a day earlier, the Producer Price Index (PPI) showed signs of easing. Headline PPI inflation rose 2.6% year-over-year in August, down from July’s revised 3.1% and below forecasts of 3.3%. Month-over-month PPI fell by 0.1%, after a sharp 0.7% rise in July.

Core PPI also slowed—falling 0.1% monthly and easing to 2.8% annually from 3.4%. This softer reading briefly pushed down U.S. Treasury yields and the United States dollar, while U.S. stock indexes touched new highs. Gold prices also saw a short-lived rise.

This optimistic mood spilled over into digital assets. In the last 24 hours, the global crypto market cap rose 1.67% to $3.96 trillion. Bitcoin gained 1.36% to reach $113,908.70, while Ethereum climbed 1.92% to $4,409. Other major altcoins like Solana, XRP, and Cardano also saw price jumps. This explains why is crypto going up today despite wider market uncertainty.

How Will Crypto Market React to US CPI Data Today?

Traders are now asking: Will crypto market crash again or continue its rally? Analysts outline three clear scenarios:

-

If CPI comes below 2.9%, Bitcoin and altcoins could see sharp gains. Market strategist Tom Lee even predicts Bitcoin might reach $200,000 by the end of 2025.

-

If it matches 2.9%, markets might pull back slightly because last month’s number was 2.7%.

-

If it is above 2.9%, it could trigger a broad sell-off across risk assets.

Is a Fed Rate Cut Next After US CPI Data Release?

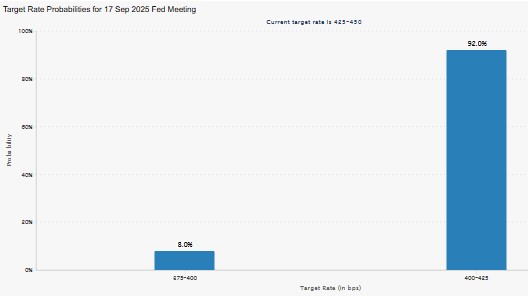

A softer and core CPI could increase chances of a big policy move at next week’s FOMC meeting. Arthur Hayes, co-founder of BitMEX , has forecast a bold fed rate cut of 50 basis points. He pointed to weak jobs data and falling two-year Treasury yields as signs that Jerome Powell may deliver stronger easing. According to the CME FedWatch Tool, markets currently see a 92% chance of a 25bps cut and an 8% chance of a 50bps cut.

Source: FedWatch Tool

Source: FedWatch Tool

Conclusion

The Consumer Price Index data release date could shape global markets this week. A lower reading might fuel rallies in stocks and crypto, while a hotter print could spark selling pressure. All eyes are now on the US CPI Data release to see if it confirms growing fed rate cut expectations.

Disclaimer: This is for educational purposes only. Always do your own research before any crypto investment.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。