Author: Nancy, PANews

After experiencing a dark moment, on-chain liquidity has recently shown signs of recovery. Several leading Solana Launchpads have successively launched new products and features, expanding growth space through new narratives, attracting market attention once again, and marking the beginning of a new round of competition.

Multi-Strategy Efforts, Pump.fun Regains the Throne

Pump.fun has regained market attention, with multiple metrics such as token price, revenue, and trading volume all soaring.

In terms of token price, CoinGecko data shows that the token PUMP has increased by 65.1% in the past 30 days, with a circulating market cap of approximately $2.1 billion and an FDV rising to $5.94 billion, surpassing the $4 billion valuation at the time of public sale. This trend indicates that market confidence in Pump.fun is gradually recovering.

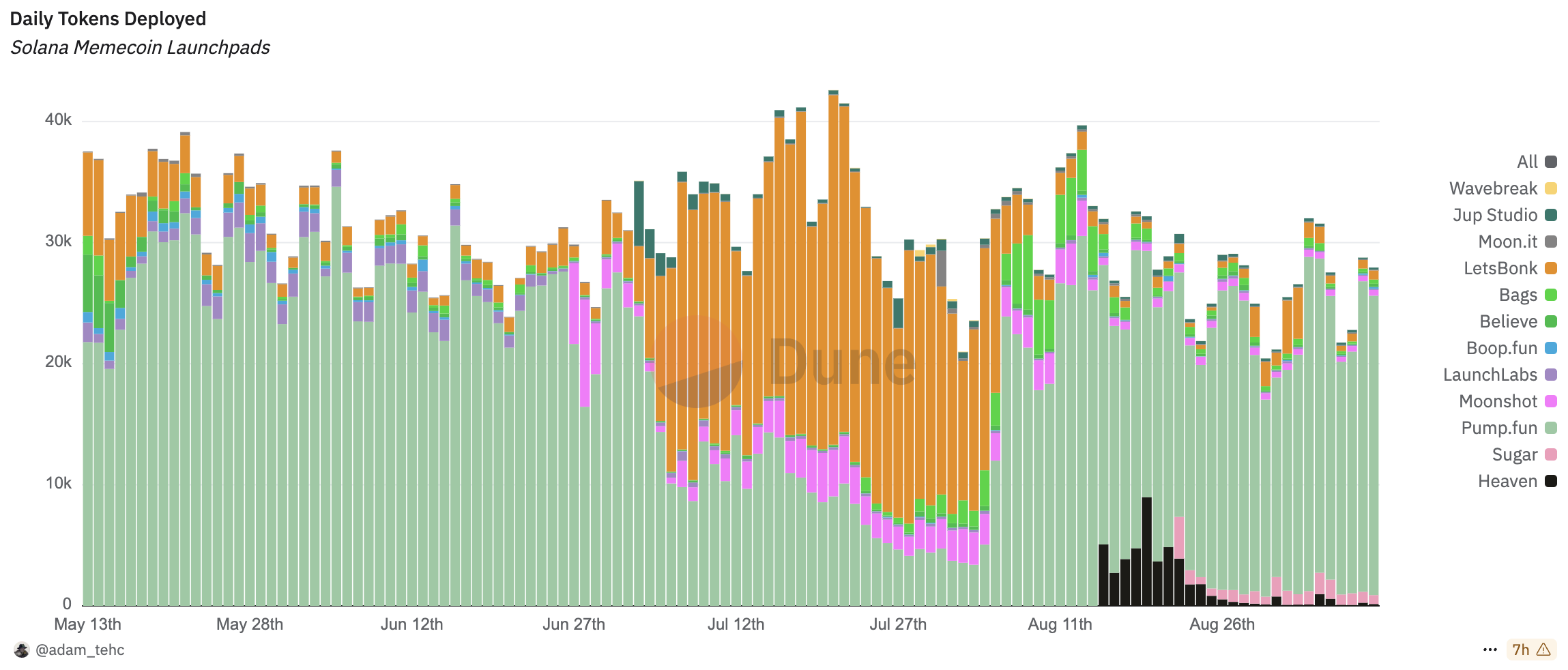

In the LaunchPad battle, Pump.fun's market share has also seen a rebound. According to Jupiter data, Pump.fun's market share reached 81.2% in the past 24 hours, significantly widening the gap with competitors like Letsbonk and Believe. Previously, Pump.fun had been surpassed and even crushed by rivals.

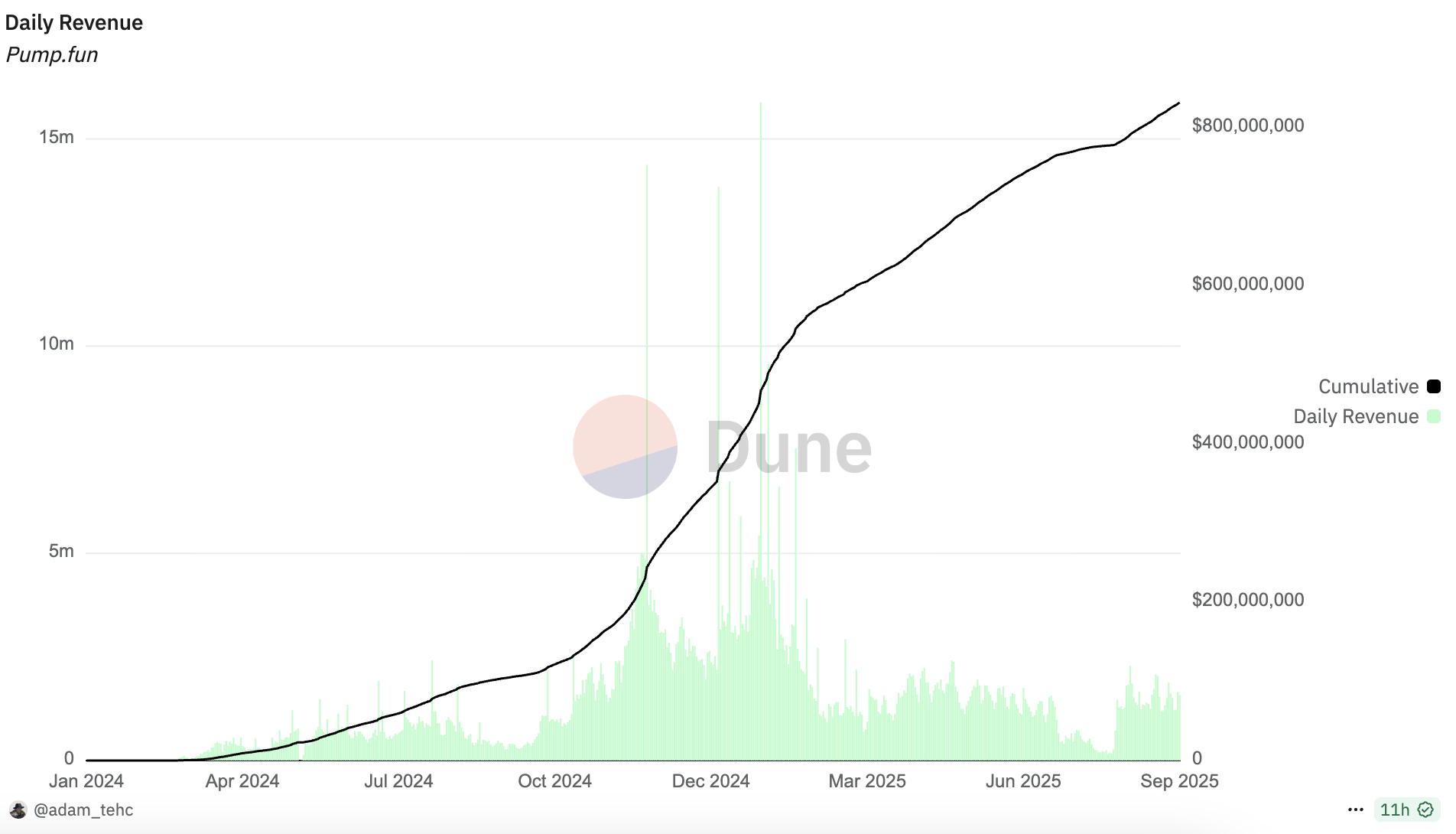

From trading data, Dune shows that Pump.fun's weekly trading volume has rebounded from less than $150 million at the end of July to $1.1 billion, with daily revenue surging from $161,000 in August to $1.575 million, and cumulative revenue exceeding $830 million. According to DeFillama data, in just the past 24 hours, Pump.fun achieved approximately $2.57 million in revenue, ranking fourth, only behind Tether, Circle, and Hyperliquid.

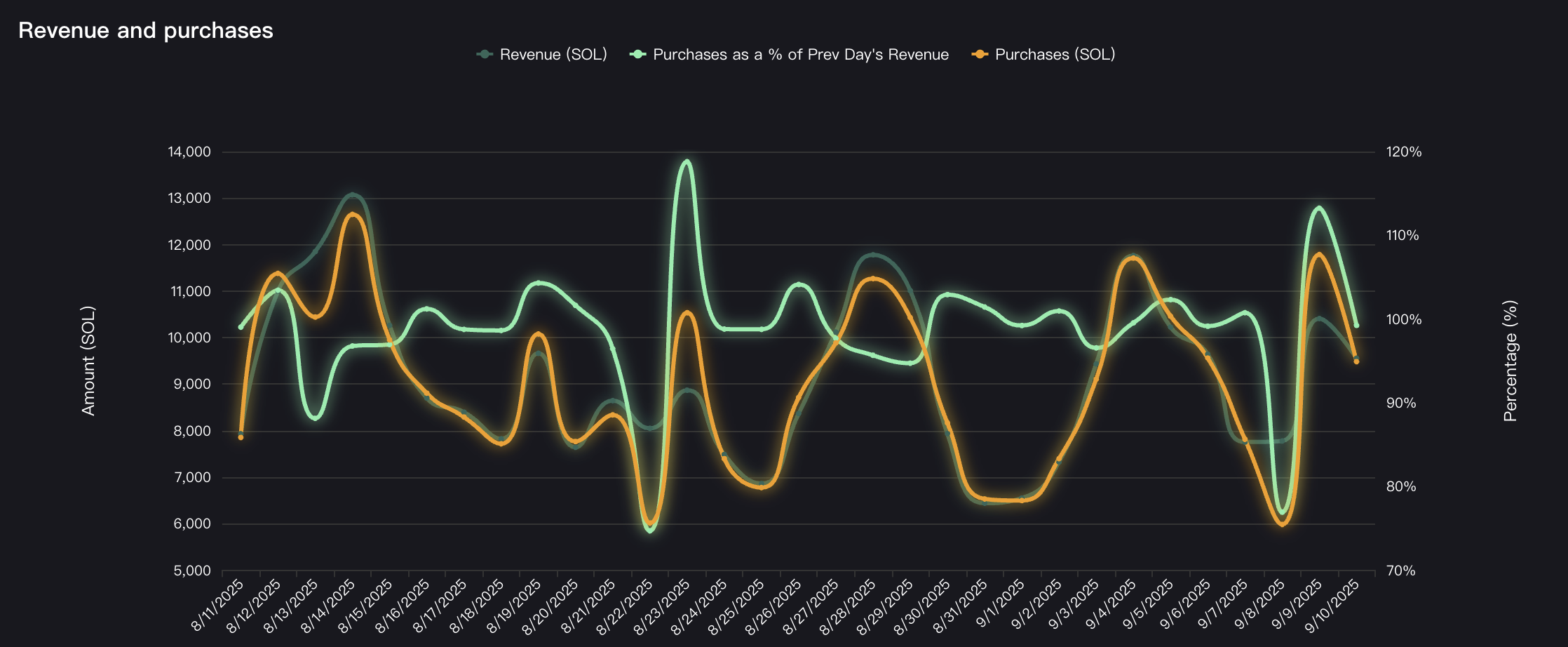

The recent market recovery for Pump.fun is attributed to the effective implementation of multi-layered strategies. In mid-July, Pump.fun announced the initiation of a buyback plan. Data from the official website shows that Pump.fun has used over 457,000 SOL to purchase PUMP tokens, valued at over $84.97 million, accounting for 6.158% of the total circulating supply. Over the past month, the ratio of Pump.fun's revenue to buyback expenditure has repeatedly exceeded 100%, effectively reducing circulating chips and providing some support for short-term token prices. According to Token Unlocks data, the next unlocking time for PUMP is July 2026, providing a time window for the project to continue tightening market circulation.

The following month, Pump.fun launched the Glass Full Foundation to inject liquidity into specific ecosystem tokens. Dune data shows that Pump.fun has invested over $1.694 million to purchase 10 MEME coins on Pump.fun (such as House, Tokabu, Salary, and USDUC). This move has activated investor confidence and boosted platform trading activity.

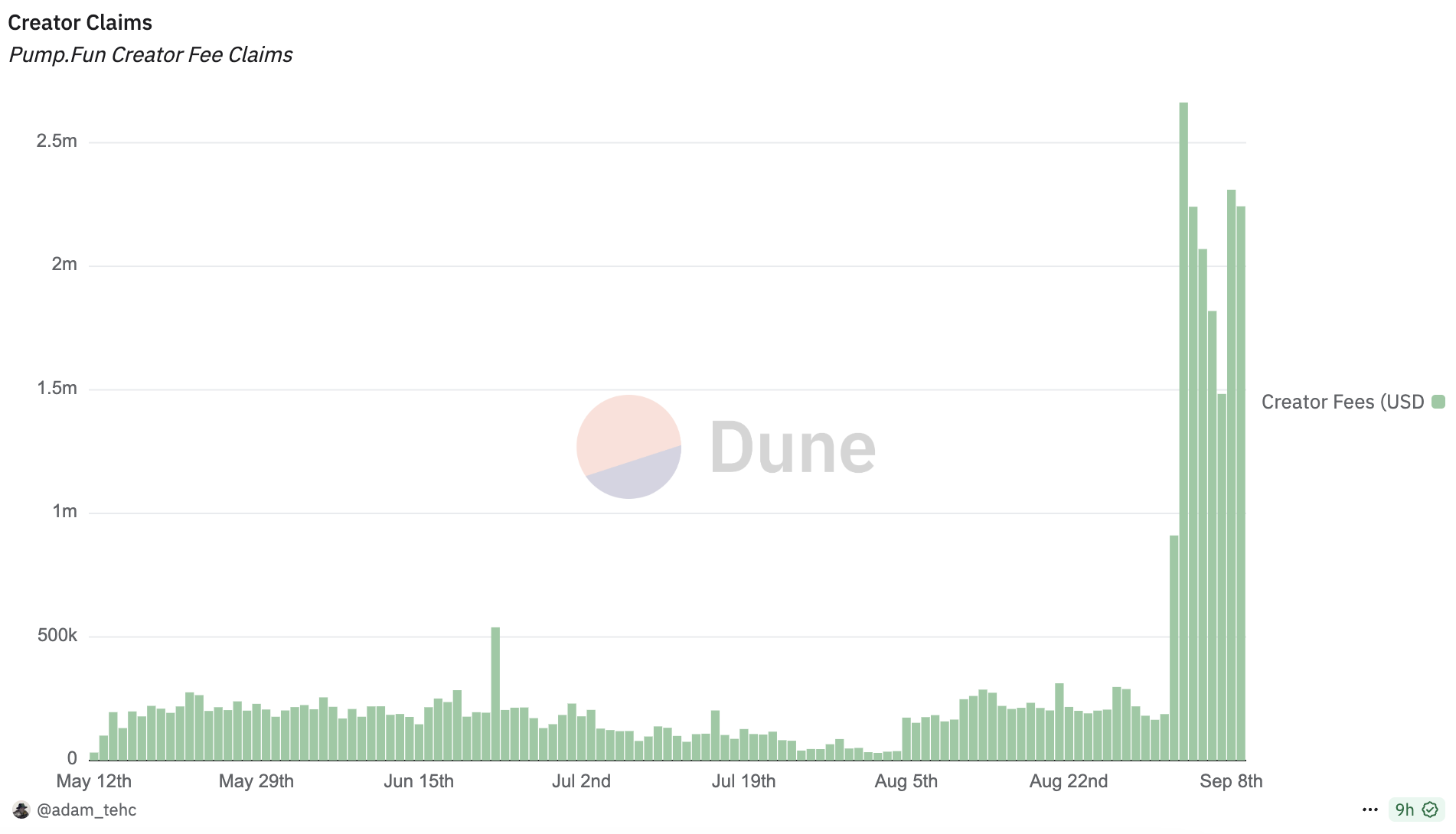

At the beginning of September, Pump.fun targeted the CCM (Creator Capital Market) track, launching the Project Ascend update plan, introducing dynamic fee V1 updates, where creator fees will be tiered based on market capitalization. This fee structure applies to all PumpSwap tokens (new and old), and the Pump.fun protocol fee rate and fees automatically compounded to liquidity providers (including burned LPs) remain the same as before. Dune data shows that in the past 7 days, Pump.fun's creator revenue exceeded $16.266 million, far surpassing protocol revenue; at the same time, the number of unique wallet addresses claiming rewards has rebounded from 1,898 in early August to 9,065.

It can be said that this round of Pump.fun has achieved a phase of recovery through strategies such as token buybacks, liquidity injection, and creator incentives, but it has not yet fully returned to historical peak levels. The co-founder of Pump.fun has boldly stated that the market is expected to return to the "trench" boom of Pump.fun in Q4 2024, and this time the increase will be even higher. Unlike before, this round has shifted the strategic narrative focus of Pump.fun to CCM, and whether it can maintain sustainable vitality and growth remains to be seen.

Market Share Plummets, BONK.fun Seeks New Growth Points

In contrast to the resurgence of Pump.fun, BONK.fun's market share has experienced a rapid decline.

Dune data shows that as of September 10, BONK.fun's core metrics have significantly retreated, with daily token deployment share dropping from a peak of 74.5% to 2.7%, daily token graduation share falling from 88.8% to 1.2%, and trading volume share declining from 86.4% to 3.2%. Clearly, BONK.fun has lost its market advantage at this stage.

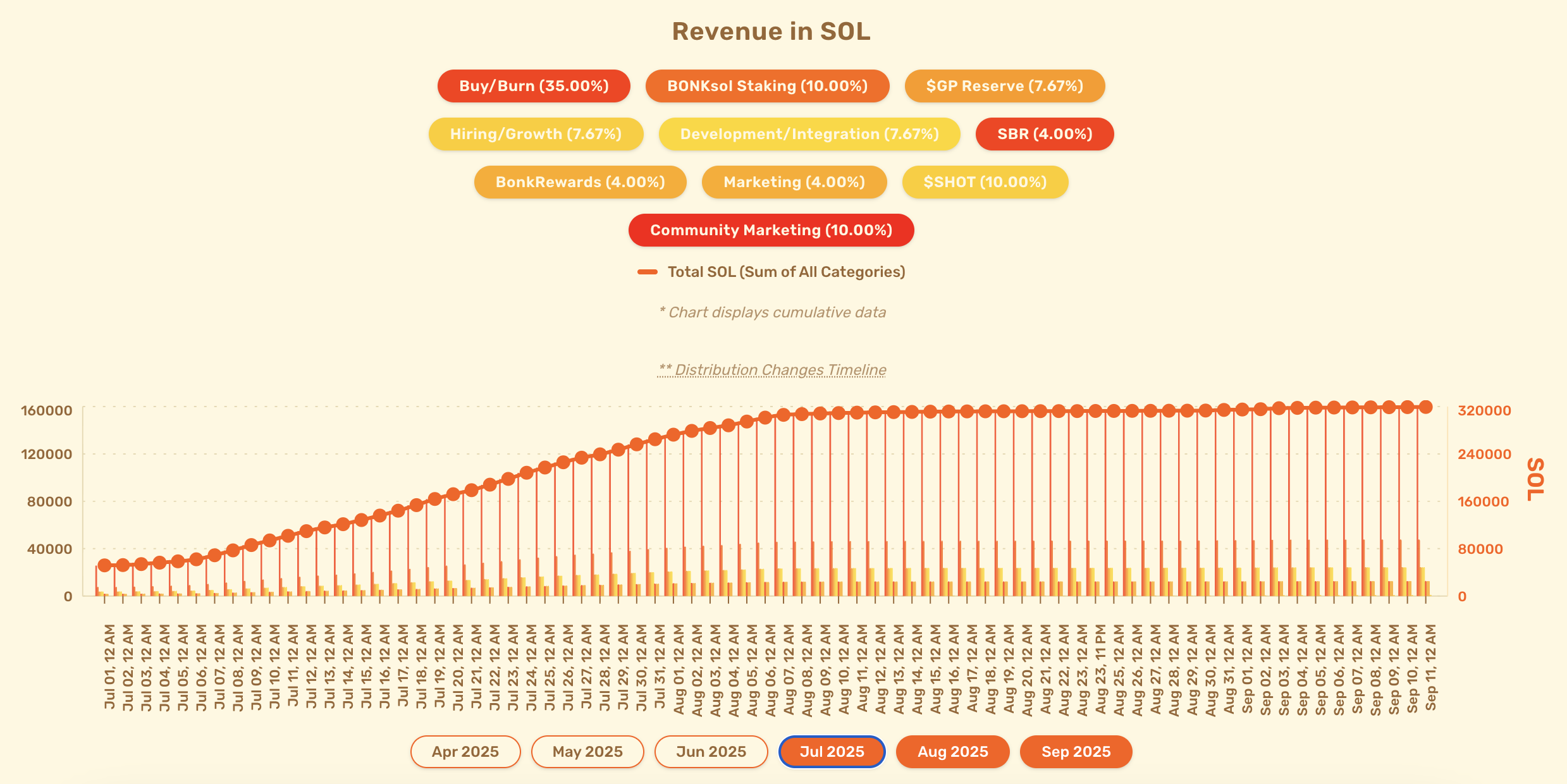

After experiencing a rapid shrinkage in market share, BONK.fun is attempting to save itself through various means. On one hand, BONK.fun continues to promote the token buyback and burn mechanism to stabilize the ecosystem. The official website shows that as of September 11, BONK.fun has generated over 319,000 SOL, of which 35% is used for the buyback and burn of BONK tokens, continuously reinforcing the deflationary logic. At the same time, treasury strategies have injected new narratives into BONK, with Nasdaq-listed company Safety Shot recently launching the BONK treasury strategy, completing $5 million in cash and $25 million in BONK token financing (paid by BONK founding members).

Simultaneously, on the narrative front, BONK.fun is rapidly adjusting its direction, focusing on the ICM (Internet Capital Market) track. Recently, BONK.fun announced a partnership with WLFI, which has become the official Launchpad platform for USD1 on Solana, where the ICM protocol Freya Protocol supported by USD1 will soon launch on BONK.fun.

Moreover, WLFI has also announced a collaboration with BONK.fun to launch the Project Wings plan, aimed at providing promotional rewards for eligible participants trading USD1 pairs on BONK.fun. Additionally, in response to Pump.fun's focus on live streaming features, BONK.fun has chosen to respond positively, recently announcing the integration of Kick, allowing creators to live stream on Kick.

From the price performance of BONK, these measures have also led to a short-term rebound in token price. CoinGecko data shows that BONK has fallen about 6.1% in the past 30 days, but rebounded by 17.4% in the past week. However, whether BONK.fun can reverse the trend of declining market share in the long term remains to be seen, particularly in terms of narrative innovation and community operation.

ICM Heat Drives Attention, Believe V2 Set to Launch

Believe is one of the earliest LaunchPad platforms to propose the ICM narrative, having once captured a significant market share. However, with the decline of the platform's token LAUNCHCOIN, its attention waned. Recently, as the ICM concept continues to gain popularity in the community, Believe has regained market attention. According to CoinGecko data, LAUNCHCOIN has risen 38% in the past month, and surged 70.4% in the past 7 days.

In terms of platform strategy, Believe founder Ben Pasternak recently revealed that the platform is building a flywheel mechanism centered on "investors → creators/platform → investors," with the plan currently about 80% complete. He stated that the flywheel mechanism will launch alongside a significantly upgraded product, aiming to make Believe a platform that helps creators turn ideas into long-term sustainable ecosystems. Meanwhile, according to a recent post by Imran Khan, founding partner of Alliance DAO, everything is ready, and Believe V2 will lead the next wave of fundraising for founders and projects driven by community insights.

It is worth noting that U.S. SEC Chairman Paul S. Atkins recently stated that it is essential to ensure that entrepreneurs can raise funds on-chain without facing endless legal uncertainties. This statement may encourage more on-chain entrepreneurs, further opening new market possibilities for launch platforms and testing who can seize the opportunity first.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。