Author: Zhou, ChainCatcher

1. Capital Begins to Reinvest

Various capital sources are seriously allocating resources to the prediction market sector. According to statistics from the crypto data platform RootData, there are currently over 130 prediction market projects, half of which were established this year. Additionally, the total financing amount for this sector has exceeded $200 million this year, making it the highest year for financing to date, which stands in stark contrast to the overall decline in the financing market.

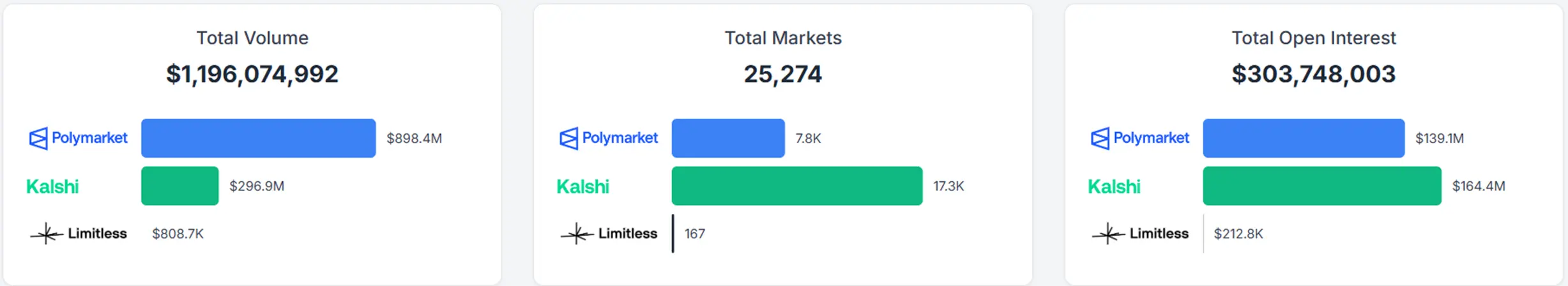

This year, one of the most noticeable changes in the prediction market is its scale. According to Polymarket Analytics, as of September 9, the leading prediction platforms have accumulated nearly $1.2 billion in total transactions, with approximately 25,000 active markets created, and the size of open contracts in the market is around $300 million. 1kx partner Michael Hua stated that this sustained interest has restored confidence among many venture capitalists in investing in this market.

Secondly, the maturity of product forms is evident. More and more platforms are no longer just one-off transactions but are becoming tradable positions: they have order books, allow for position adjustments, and permit early profit-taking and stop-losses, with information being converted into transactions more frequently. For platforms, revenue has expanded from a single transaction fee to multiple lines including settlement, market-making, and data/API services.

Furthermore, the supply of topics and channels has been streamlined. Beyond politics, events such as sports seasons, technology company milestones, crypto industry events, and macro data releases can all be standardized into short-term contracts, with tradable news available at any time.

At the same time, licensed platforms like Robinhood have directly integrated event contracts from partnered prediction market platforms into their app, bringing in new users along with compliance, making trading and revenue more visible.

Putting all this together, capital sees three actionable items: sustainable transactions, direct monetization of channels, and clear regulatory pathways—this is the reason why funding is willing to systematically increase this year.

2. Three Paths, Three Driving Forces

Currently, the landscape of prediction markets is divided into three paths: on-chain, compliant, and hybrid.

The representative of the on-chain path is Polymarket, which is centered around USDC pricing and order book matching, turning predictions into an on-chain exchange. Data shows that the total transaction volume of this project is nearly $900 million.

Additionally, Polymarket announced the acquisition of QCEX, a derivatives exchange and clearinghouse authorized by the U.S. Commodity Futures Trading Commission (CFTC), for $112 million, allowing Polymarket to operate legally and compliantly within the United States. Framework Ventures partner Brandon Potts described this as evidence that regulators are now willing to engage constructively.

The representative of the compliant path is Kalshi, which operates under DCM qualifications in the U.S. Its advantage lies in channel accessibility; after integrating with brokers like Robinhood, users can place orders within familiar apps, bringing considerable trading and revenue to the platform. Robinhood's management stated that integrating Kalshi's event contracts into the app resulted in approximately $1 billion in transactions and about $10 million in revenue for the company in Q2. Furthermore, after completing a $185 million financing round led by Paradigm in June of this year, Kalshi's valuation reached $2 billion.

The hybrid path is promoted by The Clearing Company (TCC), which aims to directly embed compliance into on-chain protocols, creating system-integrated interfaces for accounts, KYC, settlement, and dispute resolution, while retaining permissionless market creation and programmable extensibility. This allows both institutions and retail investors to trade on the same infrastructure, connecting to the corresponding modules as needed for compliance. This project was founded this year by former members of the Polymarket and Kalshi teams, and recently TCC secured a $15 million seed round led by USV.

3. A Surge of New Projects

Alongside the three main lines, many new projects have emerged in the market, which can be roughly categorized into four types—

① New prediction objects: expanding from betting on whether events will occur to betting on beliefs/valuations/attention (e.g., Belief, Ventuals, Noise);

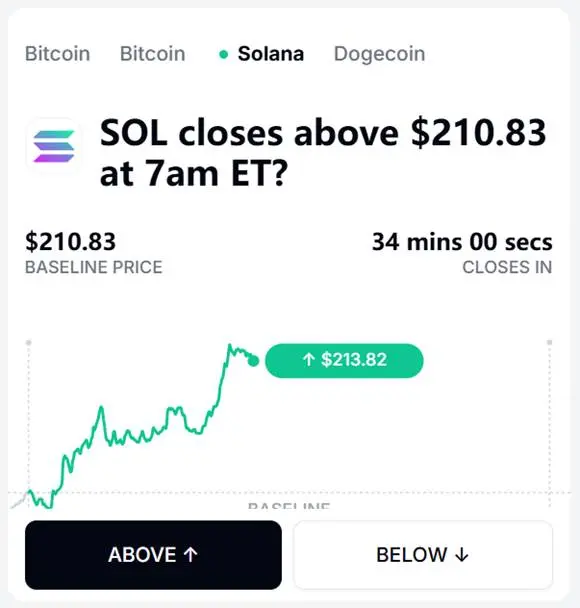

② New betting models: shortening cycles and creating continuous or interval forms (e.g., Limitless's hourly markets, O.LAB's continuous opinion markets);

③ New entry points: embedding trading directly into content/social links (e.g., fireplace's information flow, Myriad's in-content betting, Actions Protocol's "link is trade");

④ New ecosystems: transferring the prediction market model to emerging ecosystems like Monad, MegaETH, Hyperliquid.

The following cases fall into these categories.

Belief Market proposes a new model for prediction objects: betting on the outcome with the most funds, rather than the actual outcome. This project positions itself as a belief-based market, where the result with the highest betting amount becomes the winner, regardless of whether that outcome occurs. For example, in the U.S. presidential election event, if the total betting amount for the Trump option is the highest when the market closes, even if Trump does not actually become president afterward, the bettors can proportionally receive all funds from the prize pool. For fairness, users can only see the voting numbers after placing their bets, and the actual betting amounts are only visible until the market closes. The project lists investors such as Shima Capital and GSR among several well-known VCs on its official website.

fireplace focuses on the social experience of prediction markets, presenting the latest trading dynamics of user-followed accounts in the form of an information stream based on Polymarket's prediction events, allowing comments, replies, and copying on any trade.

Limitless focuses on short-cycle event contracts, typically settled on an hourly basis. Its page provides clear topics, such as "Will SOL exceed $210.83 before 7 PM?" After the time is up, the official will settle based on specified data sources, with winners receiving payouts equivalent to 1 USDC per share. This project has completed $7 million in financing, with investors including 1confirmation, paper ventures, and bing ventures.

Myriad embeds prediction events into media/creator content scenarios. For example, if a mainstream media outlet publishes a message stating "Solana Treasury Company SOL Strategies is about to go public on Nasdaq," the platform can embed an interactive card asking "What's next for Solana: Will it rise to $250 or drop to $130?" Users can click the link to place bets after seeing the content, and a wallet confirmation will pop up in the browser.

Opinion Labs is deployed on Monad, supporting permissionless market creation and allowing trading with any ERC-20 token, with results adjudicated by on-chain optimistic oracles. Users can make judgments about the future trends of events and express their views or place bets through the market. In March of this year, O.LAB completed a $5 million pre-seed round of financing, with investors including YZi Labs, Amber Group, and Manifold Trading.

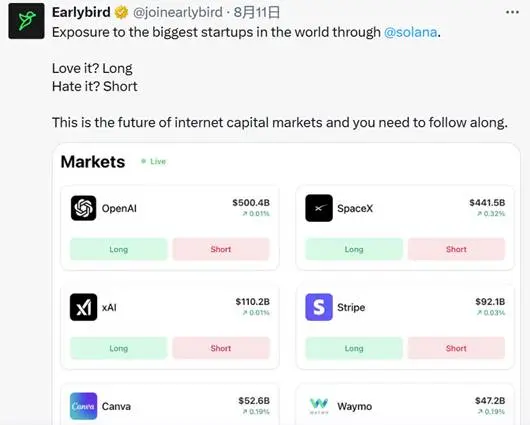

Ventuals is a platform focused on equity derivatives for unlisted companies, allowing long/short positions on primary market valuations of companies like OpenAI and SpaceX, with a maximum support of 10x leverage per transaction. The project uses Hyperliquid's margin and order book system as its underlying technology. A similar project is Earlybird, which also targets pre-IPO company valuations as prediction objects, but Earlybird is built on Solana and is currently open for a waiting list. According to RootData, Earlybird's investors include Robot Ventures, Ouroboros Capital, and 6th Man Ventures.

Noise also proposes a new direction for prediction objects, trading not on prices but on attention itself. Users can go long or short on the mindshare of well-known projects like Monad, Farcaster, or Abstract. Noise is built on MegaETH and uses Kaito as its first mindshare oracle to track the discussion volume of a project on crypto Twitter.

XO Market introduces a belief market where creators can pose clear questions about future events, define possible outcomes and resolution criteria, and inject funds into the market with initial stakes. Traders then place bets based on their thoughts, driving prices up or down. The platform emphasizes permissionless, user-driven creation, allowing any user to create a market on any topic within seconds while choosing any collateral token for trading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。