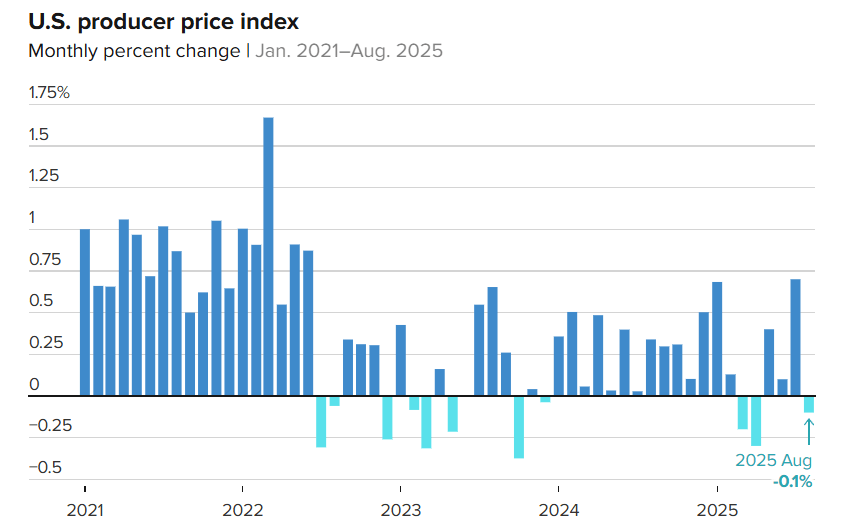

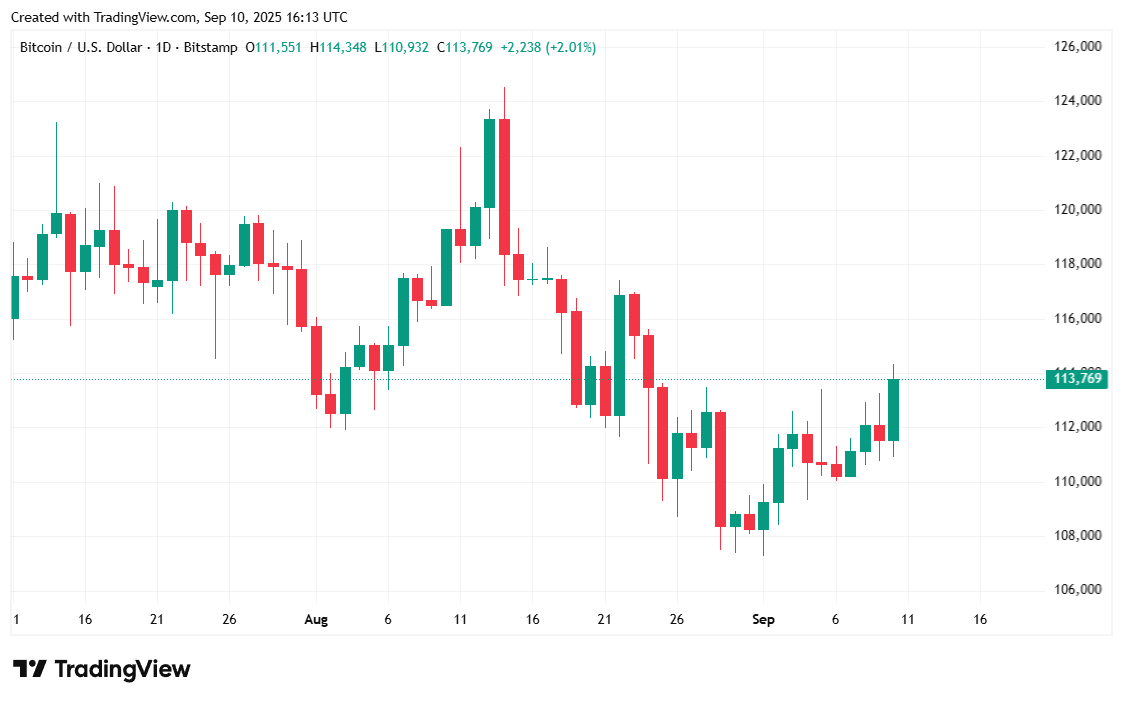

Economists were caught off guard on Wednesday morning when the Bureau of Labor Statistics (BLS) announced a 0.1% drop in the August Producer Price Index (PPI), which measures U.S. wholesale inflation. Experts had predicted a 0.3% increase after July saw the PPI climb by 0.7% despite a downward revision. Bitcoin soared to $114K on the news after days of treading water in the $110K range.

(August’s PPI came in at 2.6% which was 0.1% lower than expected / U.S. Bureau of Labor Statistics via CNBC)

The primary driver for August’s lower inflation came from cheaper machinery and lower vehicle wholesale prices. “Three quarters of the August decrease in prices for final demand services can be attributed to a 3.9% decline in margins for machinery and vehicle wholesaling,” according to Wednesday’s announcement.

The PPI is widely considered a leading indicator to its counterpart, the Consumer Price Index (CPI), which calculates inflation for retail customers. The BLS will publish its CPI report on Thursday, but for now, both stocks and bitcoin are enjoying upward momentum from the mostly positive PPI data. The overall index now stands at an annualized rate of 2.6%, and when the volatile categories of food, energy, and trade services are removed, the adjusted PPI for August is 2.8%.

“Just out: No Inflation!!!” President Donald Trump wrote on Truth Social. “‘Too Late’ must lower the RATE, BIG, right now. Powell is a total disaster, who doesn’t have a clue!!! President DJT.”

Bitcoin was trading at $113,877.77 at the time of writing, up 2.7% for the day according to Coinmarketcap. The cryptocurrency has traded between $110,776.70 and $114,275.25 in the last 24 hours.

( Bitcoin price / Trading View)

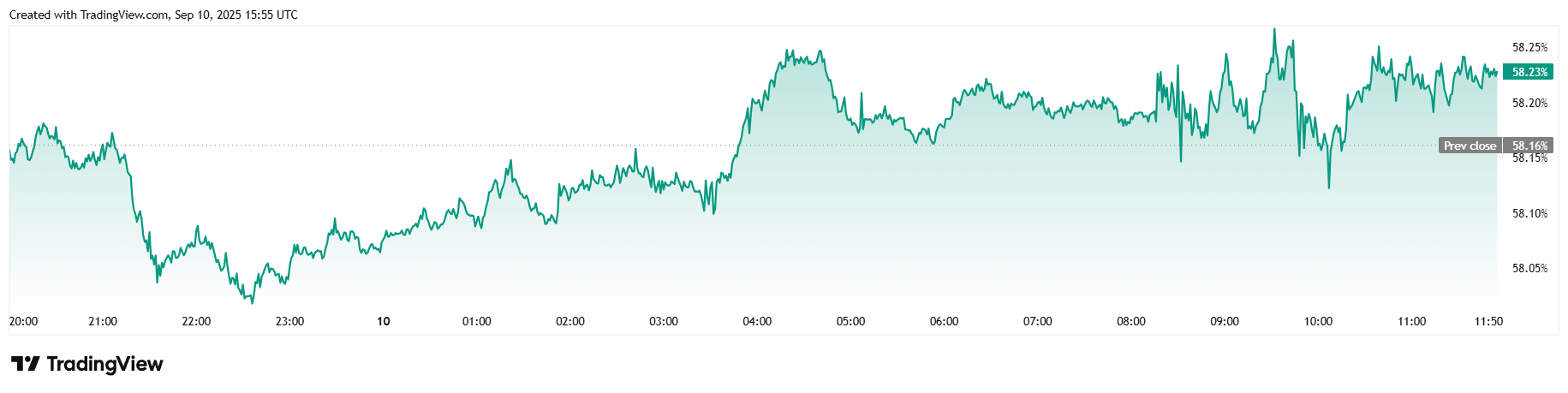

Trading volume was up 15.65% since Tuesday and stood at $53.04 billion at the time of writing. Market capitalization climbed to $2.26 trillion, a 2.67% jump, in line with today’s price increase. Bitcoin dominance edged up slightly by 0.10% since yesterday, reaching 58.23%.

( Bitcoin dominance / Trading View)

Total open interest for bitcoin futures jumped to $84.86 billion, a 3.87% increase over 24 hours, according to Coinglass. Bitcoin liquidations dropped to $37.96 million for the day, with short sellers dominating most of those losses at $34.96 million. The remaining $3 million consisted of long liquidations.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。