Nakamoto Invests $30M in Metaplanet to Boost Bitcoin Strategy

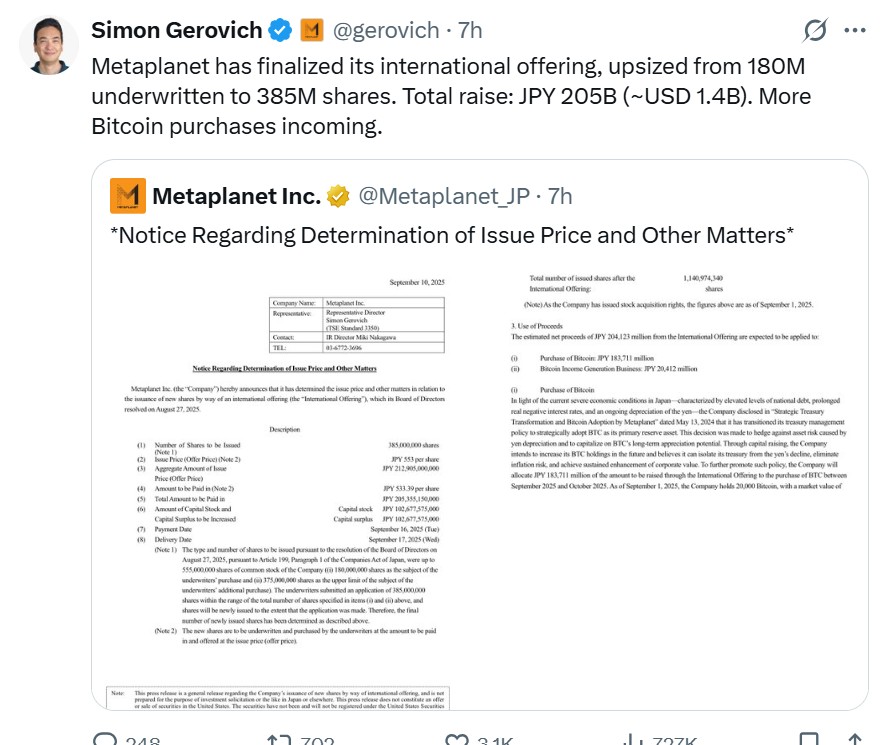

Metaplanet to sell 385 million shares to buy more bitcoin and fund BTC options

Japan-listed firm said it will issue 385 million new shares at ¥553 per share in an overseas offering. The deal will raise about ¥212.9 billion ($1.4 billion), and most of the money will go to buy digital gold and to expand crypto-related income strategies, such as trading BTC options. The company said the share issue will lift its total outstanding shares to about 1.14 billion.

Source : Simon Gerovich

Clear Plans: Buying Bitcoin & Funding Income Business

According to a company filing, Metaplanet expects to apply about ¥183.7 billion of net proceeds to purchase coins between September and October 2025, and ¥20.4 billion will support its digital assets income-generating business through BTC options trading. As of September 1, 2025, the firm already held around 20,000 tokens, valued at roughly ¥322B.

How the Market Reacted

Shares and crypto markets moved fast after the announcement. Several crypto media reports noted the offering was upsized and framed it as an aggressive push to expand Metaplanet’s BTC holdings. Some investors cheered the plan because more buying by a public company can lift demand for digital gold. Others worry about dilution of the stock and the risk of using equity to buy a volatile asset.

Recent Bitcoin Buys: Steady Weekly Accumulation

In the past week, the firm made a modest purchase of 136 coins (about $15.2 million), boosting total holdings to 20,136 coins. This brings them closer to their ambitious targets of 100,000 tokens by the end of 2026 and possibly 210,000 coins by 2027.

Additionally, over the past ten weeks, the company executed ten separate Bitcoin acquisitions, totaling 7,791 BTC. This shows steady, disciplined accumulation week after week.

Metaplanet + Nakamoto $30M Deal — BTC Bulls Alert!

Nakamoto Holdings, a subsidiary of KindlyMD, will invest $30 million in Metaplanet through its international equity offering.

Source : Nakamoto

This marks Nakamoto’s largest single investment and supports firm’s accumulation strategy in Japan’s emerging Bitcoin-treasury landscape.

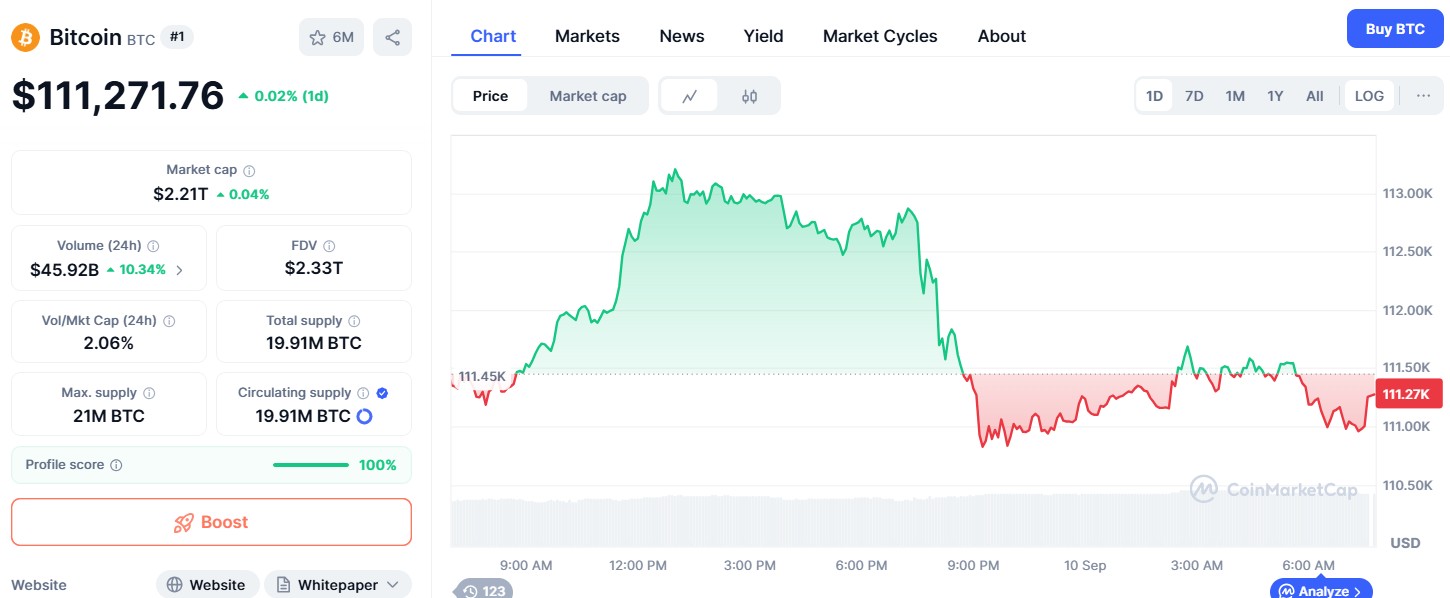

Bitcoin Price Prediction

The token is trading at $111,271 with slight highs and lows between $111k-$113k. The 24hr capital volume gained by 10% and now at $45B. Investors can closely watch the simple range of $110k–$125k in the coming weeks if buying continues and macro conditions stay stable; volatility could push price outside this range.

Source : Coinmarketcap

Metaplanet can create positive sentiment and short-term demand. Expect price pressure upward if the company begins buying quickly and markets view the purchases as real demand.

This move follows a wave of public companies and funds adding cryptocurrency to their balance sheets. When a listed firm announces a large purchase plan, it can push attention and momentum toward digital gold . Still, real market impact depends on how frequently it buys and how big other flows are turning in.

Also read: Crypto Market RoundUp Sept 10: Worldcoin Climbs 129%, MYX Up 15%免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。