Living under the power, allowing the wealth elevator to go directly to one's office.

Written by: David, Deep Tide TechFlow

In January 2025, Trump returned to the White House. Among the executive orders he signed, one stood out: allowing 401(k) retirement funds to invest in cryptocurrencies.

A month after the policy announcement, a company named American Bitcoin went public on Nasdaq. This company, claiming to become "the world's largest Bitcoin mining enterprise," has major shareholders including Trump's two sons, Eric Trump and Donald Trump Jr.

Connecting these events is a little-known company: Dominari Holdings.

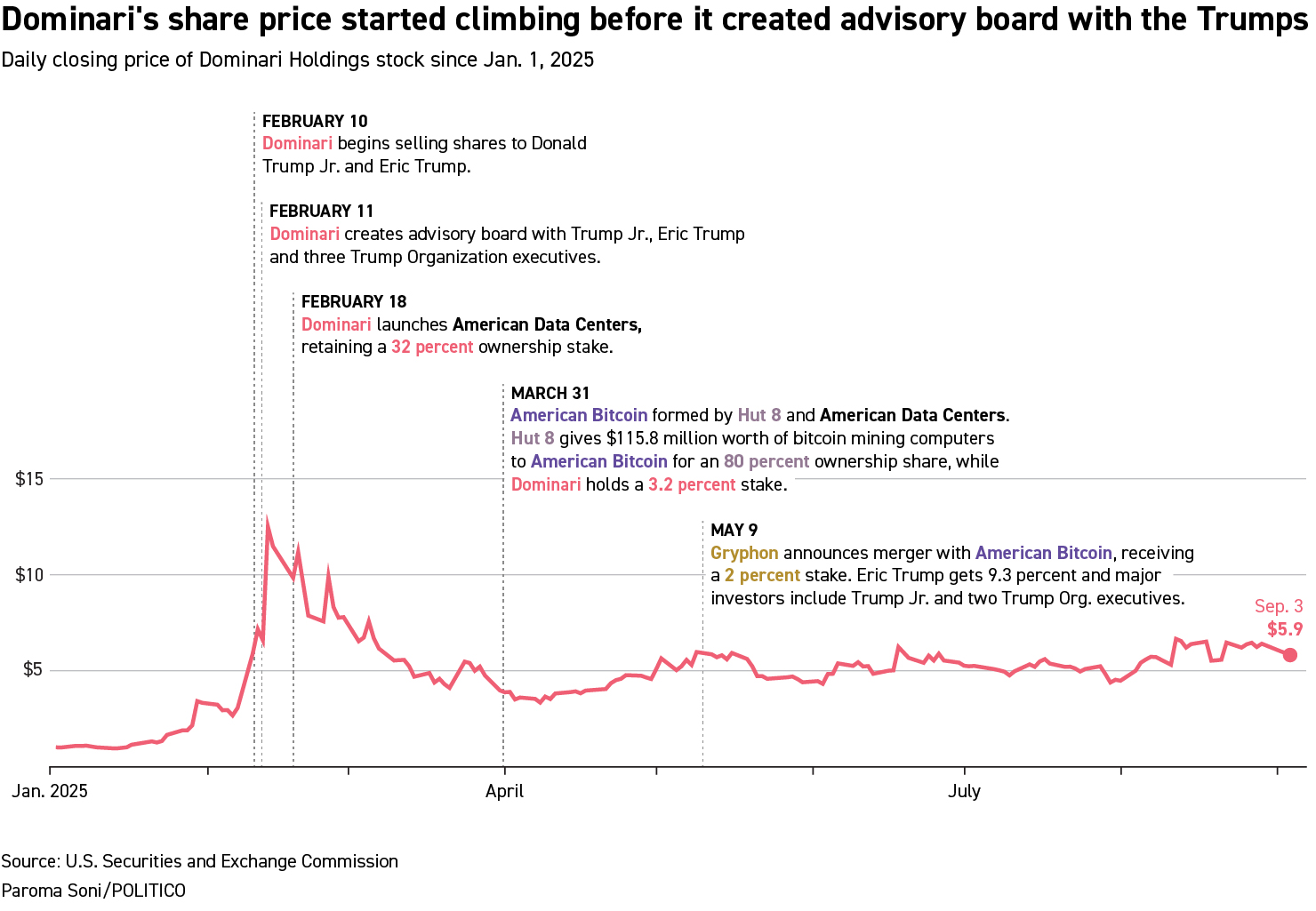

After getting involved with the Trump family and the crypto narrative, its stock price surged from $1.09 at the beginning of the year to $6.09, an increase of over 450%.

The transformation of this company was so drastic that many people forgot that just four years ago, it was a pharmaceutical company that had been losing money for years.

This is a story about how to leverage a $750,000 annual rent to unlock a multi-million dollar business. The protagonists are not crypto tycoons or Wall Street giants, but two savvy middle-aged men: lawyer Anthony Hayes and Wall Street veteran Kyle Wool.

Their secret to wealth is simple: move into Trump Tower and become neighbors with Trump's sons.

An Expensive Decision

In 2021, Anthony Hayes faced a mess.

When he took over, the company was not called Dominari Holdings but AIkido Pharma, a biopharmaceutical company. Like many similar companies, it had burned through years of funding on drug development without any products hitting the market. According to SEC filings, by the end of 2023, the company had accumulated debts exceeding $223 million. Its stock price had long hovered around $1.

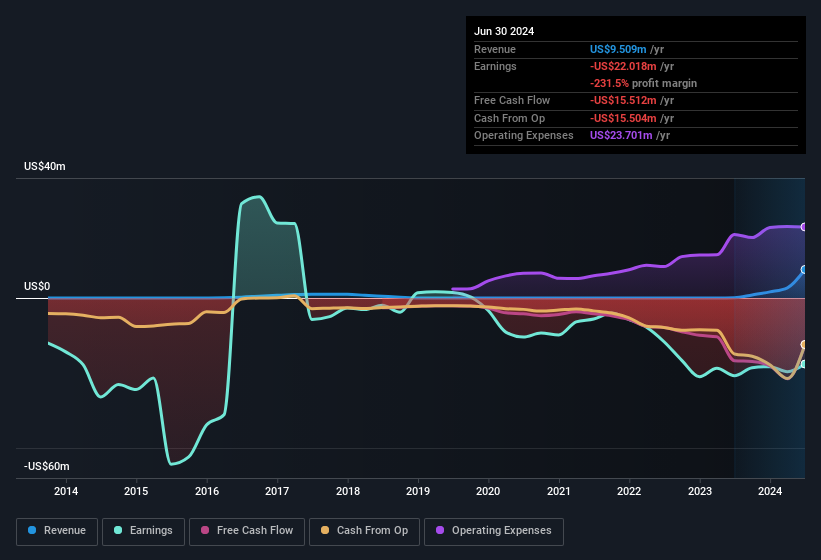

(Source: NasdaqCM:DOMH Earnings and Revenue History August 12th 2024)

Hayes is not a pharmaceutical expert; he is a lawyer who was a partner at a top 100 law firm in the U.S. and later founded a company specializing in intellectual property transactions. After taking over AIkido, he made two decisions:

First, to abandon the pharmaceutical business, and second, to move the company into Trump Tower.

To do this, he brought in Kyle Wool. Wool had spent over 20 years on Wall Street with a glittering resume: former executive director at Morgan Stanley, managing director at Oppenheimer, and responsible for Asian wealth management. He frequently appeared on Fox Business and was a regular guest on Maria Bartiromo's morning show.

What does moving into Trump Tower mean?

According to the company's annual report, rental expenses skyrocketed from $140,000 in 2022 to $773,000 in 2023. At that time, the company had only about 20 employees. By Manhattan standards, this amount was enough to rent an entire floor of a prime office building.

More critically, the company was still operating at a loss. In the first half of 2025, it lost $14.8 million. Spending so much on office rent seemed unreasonable.

But Hayes and Wool were not focused on the office environment. Trump's two sons, Eric and Donald Jr., worked just upstairs. The elevator ride could lead to "chance encounters," and they could share a table at mutual friends' dinners.

In Trump Tower, they might have the opportunity to become part of Trump's business ecosystem.

Business Upstairs and Downstairs

Building relationships takes time and skill.

According to a report from The Wall Street Journal, after moving into Trump Tower, Hayes and Wool began a long "social investment." Golf tournaments, charity dinners, private gatherings—any occasion where they could "naturally" meet Trump's sons was not to be missed.

This investment bore fruit in February 2025. Dominari announced that Donald Trump Jr. and Eric Trump joined the company's advisory board. Also joining were three executives from the Trump Organization.

The brothers' involvement was not merely symbolic. They each invested $1 million through a private placement to purchase about 216,000 shares, and additionally received 750,000 shares as compensation for their advisory roles. Once the news broke, Dominari's stock price soared from $1.09 to $13, with a peak increase of over 1200%.

Even though there was a subsequent pullback, the brothers' investment multiplied several times. According to Bloomberg data, Eric Trump currently holds about 6.3% of the shares, valued at over $5 million.

But this was just the beginning. On March 31, Dominari announced a partnership with Canadian-listed company Hut 8 to establish American Bitcoin. The positioning of this company is interesting: not just mining Bitcoin, but also promoting "Made in America," aligning with Trump's "America First" policy.

In this deal, Hut 8 contributed $115 million worth of mining equipment and took 80% of the shares. Dominari only received 3%. While this seems like a small percentage, that 3% was valued at $32 million by the end of June, becoming one of Dominari's most important assets.

More importantly, through this platform, the Trump family officially entered the Bitcoin mining industry. Eric Trump personally holds an additional 9% stake in American Bitcoin.

On August 27, Dominari established a cryptocurrency advisory board, hiring two heavyweight figures:

Former BitPay executive Sonny Singh, who helped BitPay obtain a cryptocurrency license in New York and launched the first cryptocurrency debit cards; and DeFi developer Tristan Chaudhry, an early investor in Litecoin and Dogecoin.

“Digital assets are no longer on the fringes of finance; they are moving to the center,” CEO Hayes said when announcing the formation of the board.

This statement may inadvertently reveal the truth: during the Trump era, cryptocurrencies indeed moved from the margins to the mainstream, and those who positioned themselves correctly early on are reaping huge rewards.

Dancers in the Gray Area

On Wall Street, connections often speak louder than financial statements. The shareholder list and relationship network of Dominari sketch a picture of navigating the gray area.

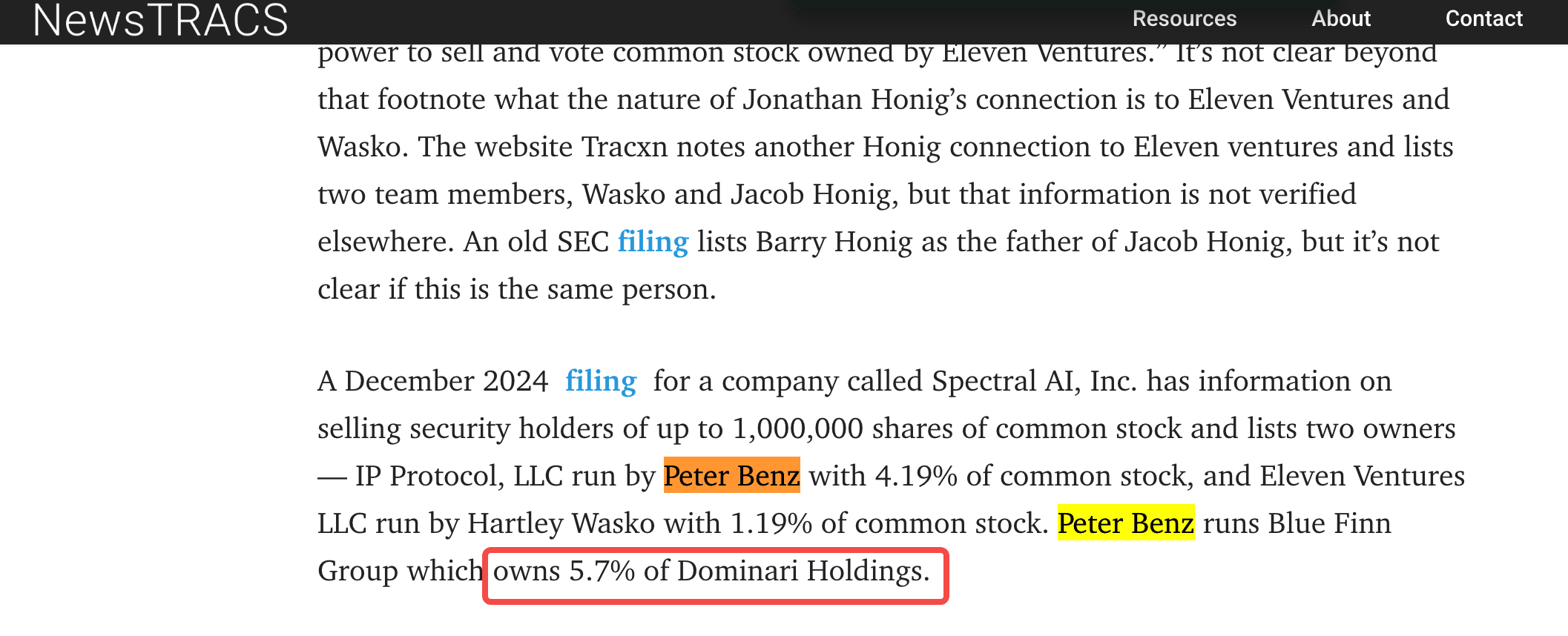

In March 2025, an investor named Peter Benz became a 5.7% major shareholder of Dominari through Blue Finn Group. Interestingly, Benz had served on the boards of several companies, including IDI, Inc. The executives of this company, Michael Brauser and Philip Frost, were later charged by the SEC for their involvement in a $27 million stock fraud case.

Although Benz himself has never been accused of any wrongdoing, this tenuous connection illustrates the ecosystem in which Dominari operates: full of opportunities but also skirting regulatory edges.

Even more subtle is Kyle Wool's background.

During his time at Morgan Stanley, his team handled business related to Devon Archer, who was a former business partner of Hunter Biden. From serving the Democratic circles to now operating for the Trump family, Wool has witnessed and participated in the polarized power games in the U.S.

But the real issue is not these relationships, but the company's financial logic.

According to a report from Bloomberg, in the second quarter of 2025, Dominari reported revenue of $34 million, a year-on-year increase of 452%; however, the management expenses during the same period were $53.5 million. Among these, the stock options for CEO Hayes and President Wool were valued at $26.1 million.

In other words, every penny the company earns is not enough to cover operational costs, let alone generate profit. Its biggest asset is the 3% stake in American Bitcoin, a newly established Bitcoin mining company, and its profitability remains uncertain.

But investors do not care.

What they are buying is not current profits, but a concept: the Trump family's agents in the crypto world. This may also be the true business model of Dominari, converting political capital into market valuation.

The Courtier Broker

Dominari's ambitions go far beyond its own investments. Its real value lies in acting as a "super connector" between the Trump family and the crypto world. The Wall Street Journal has described it as the Trump family's "go-to dealmaker."

Three cases illustrate this point best.

The first is the complex entanglement between World Liberty Financial (WLFI) and Sun Yuchen.

In September 2025, when WLFI tokens began trading, entities controlled by the Trump family held 22.5 billion tokens, which, at the time's price, increased their paper wealth by about $5 billion.

But this project nearly failed. According to a report from Bloomberg, WLFI's initial sales were dismal, with a completion rate of only 7%, failing to meet the minimum threshold for payments to Trump. At a critical moment, Sun Yuchen stepped in with a $30 million investment, allowing the project to cross the threshold.

Subsequently, Sun Yuchen's investment increased to $75 million, making him the largest investor in the project.

More importantly, Dominari Securities facilitated Tron’s listing on Nasdaq through a reverse merger. On June 16, 2025, SRM Entertainment announced an agreement with Tron; on July 24, the renamed Tron Inc. rang the bell on Nasdaq, officially completing its listing. In this deal, Sun Yuchen's Tron acquired a toy manufacturer that supplied Disney and Universal Studios.

Dominari served both the Trump family and Sun Yuchen, becoming a bridge connecting the interests of both parties. When Sun Yuchen needed access to the U.S. capital markets, Dominari provided it; when the Trump family's projects needed rescue funds, Sun Yuchen appeared.

The second case involved Dominari directly orchestrating the recent marriage between the publicly listed company Safety Shot and BONK.

On August 11, 2025, Nasdaq-listed Safety Shot announced a $35 million equity swap for $25 million in BONK tokens. The exclusive financial advisor for this transaction was Dominari Securities.

Dominari led the entire transaction structure: Safety Shot received a 10% revenue share from the BONK.fun platform, the stock ticker was changed to BNKK, and the BONK team secured 50% of the board seats.

Kyle Wool, president of Dominari Holdings, later publicly praised the advisory board, particularly Eric Trump, for helping facilitate the relevant cooperation. This statement effectively acknowledged the Trump family's key role in these transactions.

The third case is the previously mentioned layout of the Trump family in data centers and Bitcoin mining.

In the establishment of American Bitcoin, Eric Trump holds about 7.5% of the shares, becoming the largest individual investor. Dominari Holdings owns about 3% of American Bitcoin shares. The two Trump sons also serve as advisors to Dominari, each holding about 6-7% of the company.

Behind every major transaction, there is the presence of Dominari. Sometimes it acts as the front-line financial advisor, sometimes as the behind-the-scenes coordinator, and it is also the operator, designer, and executor of the Trump family's crypto empire.

A New Order in Trump Tower

Dominari's official website shows that the company is headquartered on the 22nd floor of Trump Tower. Wool's office overlooks Central Park. Their current monthly rent is $62,242.

Above in the building, Trump's sons hold political resources and the family brand; downstairs, Dominari provides Wall Street expertise and execution capabilities; and deals are brewing and being finalized in the elevator rides between floors.

Every successful transaction may reinforce this symbiotic relationship.

While traditional investment banks are still seeking projects through formal channels, Dominari has found a more direct path: living under the power, allowing the wealth elevator to go directly to its office.

On August 14, Kyle Wool stood at Nasdaq ringing the opening bell and said:

“This has been an exhilarating journey. In the words of our President Trump, the best is yet to come.”

This statement may be true. As Trump rolls out more crypto-supportive policies and more traditional companies seek to enter Web3, Dominari's brokerage business will only become more prosperous.

Spending several times the market rate on rent to move into Trump Tower now seems like the shrewdest investment of Wool and Hayes' careers.

The expensive annual rent bought not just a ticket into the Trump family's business circle, but also physical proximity, social integration, and commercial binding.

From a bankrupt pharmaceutical company to an investment firm valued at nearly $100 million; from an obscure tenant to the Trump family's crypto broker, Dominari's transformation is, in some ways, a microcosm of American capitalism in the Trump era.

In this era, the boundaries between politics and business are more blurred than ever. This company acts like an invisible conductor, converting political capital into business opportunities and turning power relationships into real money.

In Trump's America, the best business is not doing business itself, but becoming the connector of all businesses.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。