Good Morning, Asia. Here's what's making news in the markets:

Welcome to Asia Morning Briefing, a daily summary of top stories during U.S. hours and an overview of market moves and analysis. For a detailed overview of U.S. markets, see CoinDesk's Crypto Daybook Americas.

BTC is pinned near $111,000 with volatility compressed to multi-month lows, the kind of calm that tends to precede decisive moves. Traders know what could break the lull: September’s U.S. inflation data and the Fed’s rate decision a week later.

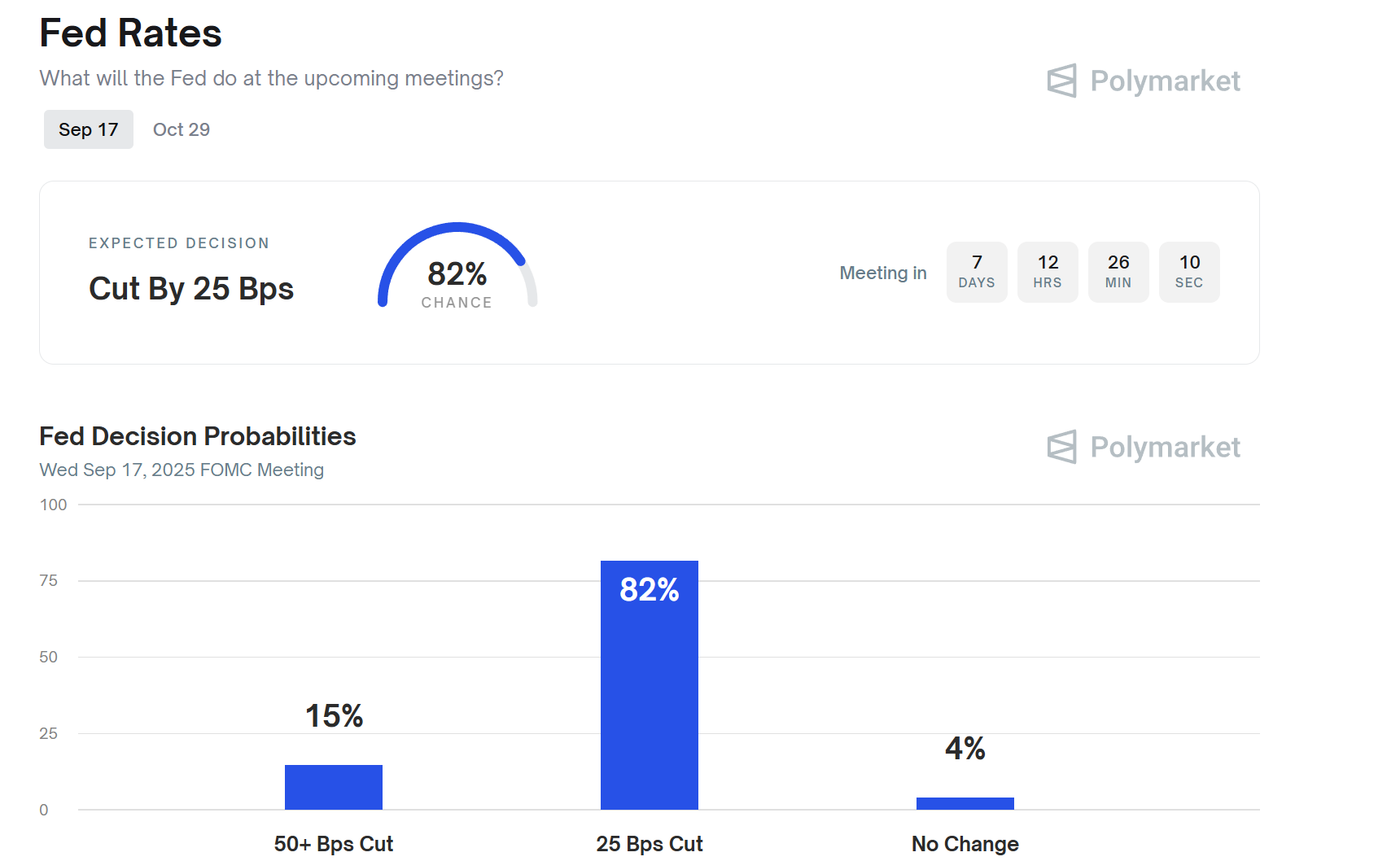

Prediction markets are leaning heavily toward easing. Polymarket bettors are assigning an 82% chance of a 25-basis-point cut on Sept. 17, leaving only slim odds for a deeper move or no change. Beyond that, October expectations are fractured, with nearly even probabilities for another cut or a pause. That divergence explains why volatility, though absent now, is unlikely to stay that way.

“Markets often look calm just before they move. Bitcoin is trading in one of its tightest ranges in months, and volatility across crypto has compressed to multi-month lows,” said Gracie Lin, OKX Singapore CEO. “With U.S. inflation data like Core CPI out on Sept. 11 and the Fed’s much-anticipated rate decision just ahead, this quiet period is setting the stage for the next decisive move. Whether the catalyst is an upside inflation surprise or a dovish signal from the Fed, what’s clear is that the absence of volatility is rarely permanent in digital assets; history shows the market will find its next direction soon enough.”

If a cut pulls money-market returns lower, the opportunity cost of sitting in cash rises, which is the pivot market maker Enflux says could send flows toward crypto.

“The real debate now is not if cuts come, but whether liquidity deployment shifts into BTC, ETH, and even riskier assets,” the firm told CoinDesk.

In other words, the Fed’s cut may grab headlines, but the real trade is whether sidelined cash rotates into digital assets — a shift that could fuel the return of volatility.

Market Movement

BTC: Bitcoin has dipped slightly intraday, trading between approximately $110,812 and $113,237, reflecting short-term volatility amid shifting investor sentiment and broader crypto market dynamics.

ETH: ETH is modestly up intraday, with a range between roughly $4,279 and $4,379, signaling steady demand and some renewed investor interest. Range, however, is limited with modest ETF flows and traders awaiting the Fed's next move.

Gold: Gold is rallying to record highs, fueled by mounting expectations of U.S. Federal Reserve interest rate cuts, a weakening U.S. dollar, and renewed safe-haven demand.

Nikkei 225: Asia-Pacific stocks opened mostly higher Wednesday, with Japan’s Nikkei 225 up 0.2%, as investors awaited China’s August inflation data showing an expected 0.2% CPI drop and a smaller 2.9% PPI decline.

S&P 500: U.S. stocks closed at record highs Tuesday, with the S&P 500 up 0.27% to 6,512.61, as investors looked past a record payroll revision that cut 911,000 jobs from prior figures.

Elsewhere in Crypto

- OpenSea Teases SEA Token With Final Phase of Rewards Amid App Launch (CoinDesk)

- California Man Sentenced in $36.9M Crypto Scam Tied to Infamous Huione Group (CoinDesk)

- Collector Crypt drives $150 million in randomized Pokémon card trades as CARDS token soars (The Block)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。