Based on stablecoins, Layer 1 conquers fintech.

Written by: Terry Lee

Translated by: Saoirse, Foresight News

In less than 12 years, stablecoins have evolved from niche cryptocurrency experiments to an asset class exceeding $280 billion. As of September 2025, their growth momentum continues to accelerate. Notably, the rise of stablecoins is driven not only by demand but also by a clearer regulatory environment — the U.S. recently passed the GENIUS Act, and the European Union has introduced the Markets in Crypto-Assets (MiCA) regulation. Today, major Western countries have officially recognized stablecoins as a legitimate cornerstone of the future financial system. Interestingly, stablecoin issuers are not only "stable" but also highly profitable. Driven by the high-interest rate environment in the U.S., USDC issuer Circle announced that its revenue for the second quarter of 2025 reached $658 million, primarily from interest generated by reserves. As early as 2023, Circle had already achieved profitability, with a net profit of $271 million.

Source: tokenterminal.com, current stablecoin circulating supply data

This profitability has naturally sparked competition. From Ethena's launch of the algorithmic stablecoin USDe to Sky's issuance of USDS, numerous challengers have emerged, attempting to break the dominance of Circle and Tether. As the focus of competition shifts, leading issuers like Circle and Tether are beginning to adjust their strategies, working to build their own Layer 1 blockchains with the goal of controlling future financial channels. These financial channels not only deepen their competitive advantages and generate more fees but also have the potential to reshape the circulation of programmable money on the internet.

A trillion-dollar question arises: Can industry giants like Circle and Tether withstand the impact of disruptors like Tempo (non-stablecoin native entrants)?

Why Choose Layer 1 Blockchain? Background Analysis and Differentiating Features

Essentially, Layer 1 blockchains are the foundational protocols that support the entire ecosystem, responsible for processing transactions, completing settlements, achieving consensus, and ensuring security. For readers in the tech field, it can be understood as the "operating system" of the cryptocurrency realm (e.g., Ethereum, Solana), upon which all other applications are built.

For stablecoin issuers, the core logic behind laying out Layer 1 blockchains is to achieve "vertical integration." They no longer rely on third-party blockchains like Ethereum, Solana, or Tron, nor do they depend on Layer 2 networks; instead, they actively create their own channels to capture more value, strengthen control, and better align with regulatory requirements.

To understand this "struggle for control," we can look at the Layer 1 blockchains of Circle, Tether, and Stripe: they share common characteristics while following different development paths.

Common Characteristics

Using their issued stablecoins as native currencies, there is no need to hold ETH or SOL to pay gas fees. For example, on Circle's Arc blockchain, transaction fees must be paid in USDC; in some scenarios (like Tether's Plasma chain), fees are completely waived.

High throughput and fast settlement: These Layer 1 blockchains all promise "sub-second finality" (transactions become irreversible shortly after completion), with transaction processing speeds (TPS) reaching thousands — from Plasma chain's 1000+ TPS to Stripe's Tempo with over 100,000 TPS.

Optional privacy protection and compliance environment: These blockchains create a "curated crypto ecosystem," offering stronger privacy protection and higher compliance, but this advantage comes at the cost of a certain degree of centralization.

Compatibility with the Ethereum Virtual Machine (EVM): Ensures that developers can build applications based on familiar development standards, lowering the technical barrier.

Core Differences

Circle's Arc: Designed for both retail and institutional users. Its self-developed foreign exchange engine is highly attractive for capital market trading and payment scenarios, aiming to become the "Wall Street's preferred channel" in the crypto space.

Tether's Stable chain and Plasma chain: Centered on "accessibility," they introduce a zero gas fee design, making the trading process smoother and frictionless for retail and peer-to-peer (P2P) users.

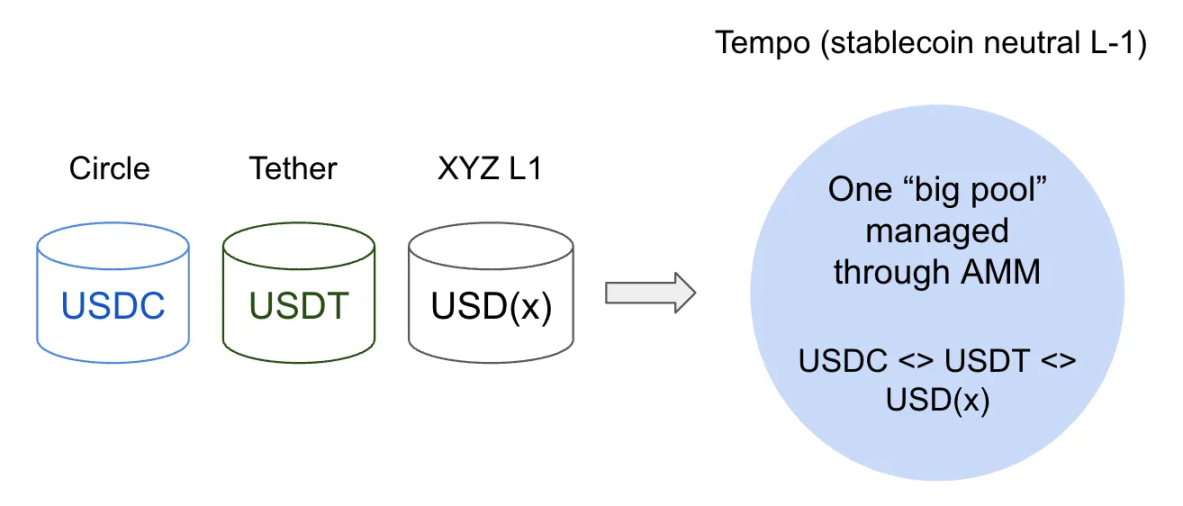

Stripe's Tempo: Chose a different path, maintaining "stablecoin neutrality." It does not bind to any specific stablecoin but supports multiple dollar-pegged stablecoins through built-in automated market makers (AMM), which may be more attractive to developers seeking flexibility and users not limited to a specific dollar token.

Trends in the Application of Layer 1 Blockchains

Based on my analysis, three major trends are currently emerging:

Trend 1: Traditional Financial Integration — Trust Building and Compliance Adaptation

For stablecoin issuers, the key goal of building their own Layer 1 blockchains is to "gain trust." By controlling the channels or ecosystems rather than solely relying on third-party networks like Ethereum or Solana, Circle and Tether can more easily provide "compliance-ready" infrastructure, ensuring they meet the regulatory framework requirements of the U.S. GENIUS Act, EU MiCA, and others.

Circle has positioned USDC as a "compliant product": institutions responsible for USDC and dollar redemptions must adhere to KYC and anti-money laundering (AML) compliance frameworks. Its newly launched Layer 1 blockchain Arc goes further by combining "auditable transparency" with "privacy protection features," making it a potentially reliable choice for institutional users. Tether also adopts a similar strategy through its Stable chain and Plasma chain, aiming to become the "infrastructure pillar" for banks, brokers, and asset management companies.

In this trend, the "ideal application scenario" could be foreign exchange trading. With Circle's Arc blockchain — sub-second finality, 1000+ TPS throughput, and foreign exchange processing capabilities — market makers and banks can achieve instant settlement for foreign exchange transactions. This creates opportunities for them to tap into the foreign exchange market, which has an average daily volume exceeding $7 trillion, thereby forming a strong network effect. Stablecoins like USDC and EURC are expected to become "native settlement assets," firmly locking developers into their ecosystems. At the same time, this could open doors for DeFi applications: supporting institutional-level "quote systems," reducing counterparty risk through smart contracts, and achieving rapid settlement.

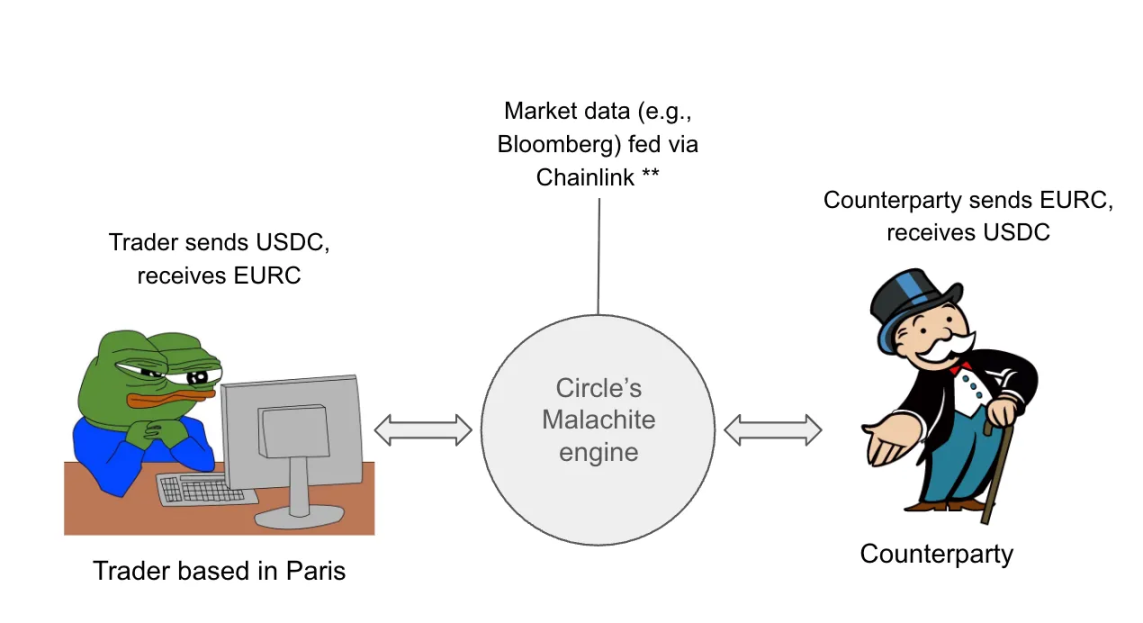

(Note: This scenario is an example, assuming the use of Chainlink oracles to obtain data)

(Illustration: The process of a trader completing a transaction through Circle's Layer 1 blockchain)

For example, a foreign exchange trader in Paris could use the USDC/EURC trading pair on the Arc blockchain to complete a $10 million USD to Euro exchange using the Malachite foreign exchange engine. Assuming real-time exchange rates are obtained via Chainlink oracles (e.g., 1 USD = 0.85 EUR), the entire transaction could be completed within 1 second — shortening the traditional foreign exchange transaction settlement period from "T+2" (2 days after the transaction) to "T+0" (real-time settlement). This is the transformation brought about by technology.

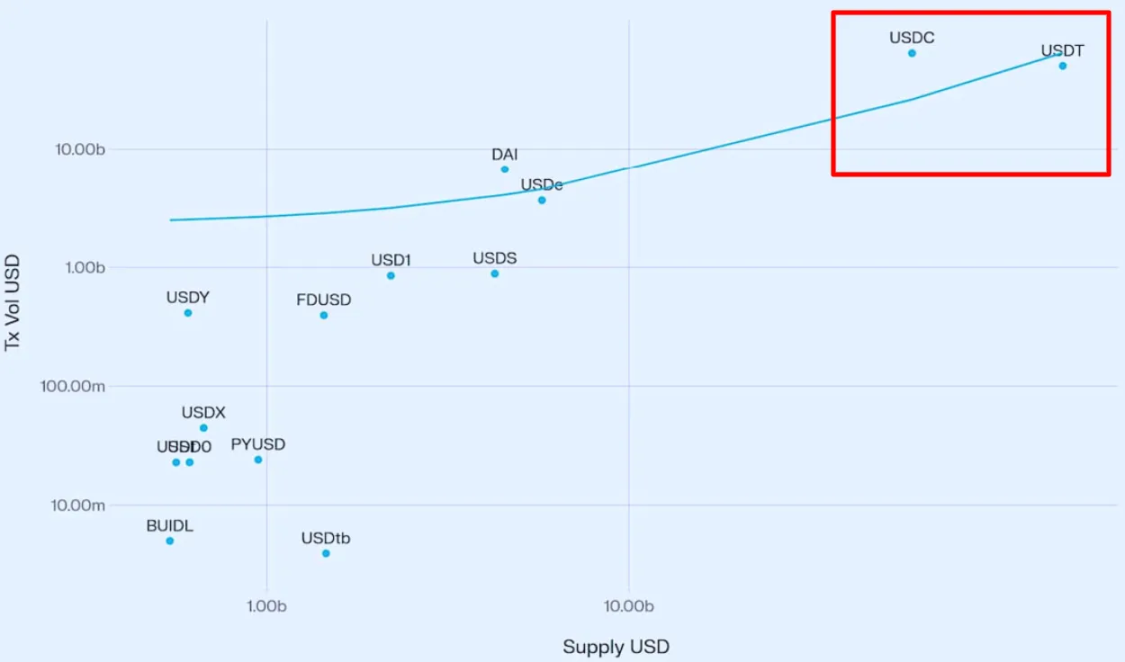

Source: Vedang Ratan Vatsa's "Stablecoin Growth and Market Dynamics"

Research data also supports this direction. Vedang Ratan Vatsa's study shows a significant positive correlation between the supply and transaction volume of stablecoins: the larger the supply, the deeper the liquidity, and the higher the degree of application implementation. As two leading issuers, Tether and Circle undoubtedly have the advantage of capturing this institutional capital flow.

However, the integration of traditional finance and blockchain channels still faces significant challenges: coordinating regulatory agencies, central banks, and regional laws requires navigating a complex environment (for example, achieving compatibility with multiple central banks may take years); issuing stablecoins for emerging market currencies is more difficult — if the product does not match market demand, it may lead to slow adoption or even lack of interest; even if these obstacles are overcome, banks and market makers may be cautious about migrating "critical infrastructure" to new channels — migration may increase costs (not all currencies have been fully digitized, and institutions need to maintain both traditional and crypto systems), and there is uncertainty involved. Additionally, as Circle, Tether, Stripe, and even banks launch their own blockchains, the risk of "liquidity fragmentation" increases: if no single channel can achieve sufficient scale and liquidity, it may struggle to dominate the average daily $7 trillion foreign exchange market.

Trend 2: Can Stablecoin Chains Pose a Threat to Established Institutions in Traditional Payment Channels?

As Layer 1 blockchains attract traditional financial institutions with their "programmability," their rise may also impact traditional payment giants like Mastercard, Visa, and PayPal. This is because Layer 1 blockchains can provide "instant, low-cost" settlement services through various decentralized applications. Unlike the "closed single platform" of traditional payment giants, these blockchain channels are "open and programmable": they offer developers and fintech companies a flexible foundation, similar to "renting AWS cloud services" rather than "building their own payment infrastructure." This shift enables developers to quickly launch applications for cross-border remittances, AI-driven payments, tokenized assets, and more, while achieving "near-zero fees" and "sub-second settlements."

For instance, developers could build an "instant settlement payment DApp" on a stablecoin chain: merchants and consumers can enjoy fast, low-cost transactions, while Layer 1 issuers like Circle, Tether, and Tempo serve as the "core infrastructure" to capture value. The biggest difference is that this model eliminates intermediaries like Visa and Mastercard, allowing developers and users to directly gain more benefits.

But risks also exist: as more issuers and payment companies launch their own Layer 1 blockchains, the ecosystem may fall into "fragmentation" — merchants may have to deal with "dollar tokens" from different chains, and these tokens may be difficult to interoperate. Circle's "Cross-Chain Transfer Protocol (CCTP)" attempts to address this issue, aiming to maintain a "single liquid version" of USDC across multiple chains, but this protocol only applies to Circle's tokens, limiting its coverage. In this "oligopolistic competition" market, "cross-chain interoperability" may become a key bottleneck.

Recently, Stripe announced the launch of Tempo (a stablecoin-neutral Layer 1 blockchain incubated by Paradigm), further changing the market landscape. Unlike Circle and Tether, Stripe has not yet launched its own stablecoin but supports multiple stablecoins for payments and gas fees through built-in AMMs. This "neutrality" may be highly attractive to developers and merchants — without being tied to a single stablecoin, there is greater flexibility, which also allows Stripe to potentially break into the "crypto-native company-dominated" space.

Trend 3: A Dual Oligopoly — Competition Between Circle and Tether

As Layer 1 blockchains challenge traditional players, they are also reshaping the stablecoin market landscape. As of September 2025, Circle and Tether dominate the stablecoin market, collectively controlling nearly 89% of the issuance — with Tether accounting for 62.8% and Circle for 25.8%. By launching Layer 1 blockchains like Arc and Stable/Plasma, both further consolidate their advantages and set high entry barriers (for example, the token sale "gold reserve deposit" cap for Tether's Plasma chain reaches $1 billion, significantly increasing the difficulty for new players to enter). Measured by the "Herfindahl-Hirschman Index (HHI)" (a market concentration indicator), the current stablecoin market HHI stands at 4600 (62.8² + 25.8² ≈ 4466), far exceeding the traditional market "antitrust review threshold" (2500).

However, a potential threat is emerging — "stablecoin-neutral Layer 1 blockchains." Stripe's Tempo lowers the entry barriers for merchants and alleviates regulatory concerns about "market concentration." If the "neutral model" becomes the industry standard, Circle and Tether's "closed competitive advantages" will turn into disadvantages: they may lose network effects and market attention. At that point, the current "dual oligopoly" may shift to a "multipolar oligopoly," with different channels occupying their respective niche markets.

Conclusion

In summary, stablecoins have become an important sector exceeding $280 billion, with issuers enjoying substantial profits; meanwhile, the rise of Layer 1 blockchains based on stablecoins is presenting three key trends: (1) driving traditional finance to access crypto-native channels, tapping into the continuously growing foreign exchange market; (2) reshaping the payment sector by removing intermediaries like Mastercard and Visa; (3) pushing the market structure from a "dual oligopoly" (HHI 4600) towards an "oligopoly." These transformations collectively point to a grander direction: stablecoin issuers like Circle and Tether, along with new entrants like Stripe's Tempo, are no longer just "bridges between cryptocurrencies and fiat currencies," but are gradually positioning themselves as "the core of future financial infrastructure."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。