"Although the PUMP token will not be unlocked until July 2026, there is still significant growth potential in the future."

Written by: Nico

Translated by: Saoirse, Foresight News

As everyone has likely noticed, Pump.fun has recently regained its market dominance. In the previous article, I focused on the current status of competitors and trading terminals; in this article, I will concentrate on the bullish logic of Pump.fun and the vast market opportunities emerging in the CCMs (Creator Capital Markets) through the native launch platform (Launchpad).

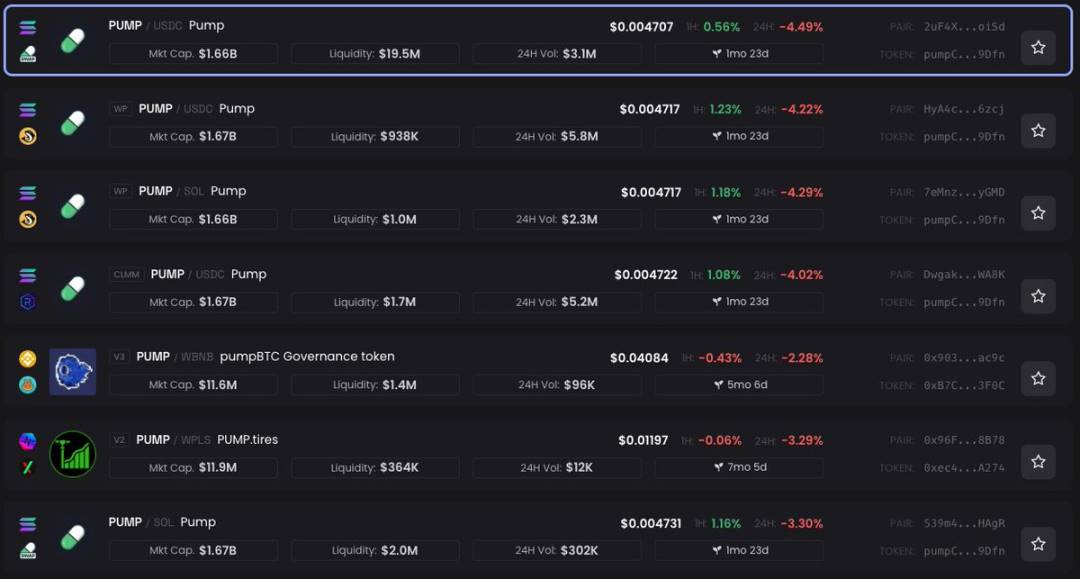

Currently, the price of the PUMP token is steadily above the ICO fundraising price, and the platform has launched several updates, indicating a positive outlook. Next, we will delve into the details.

The Income Flywheel of PUMP

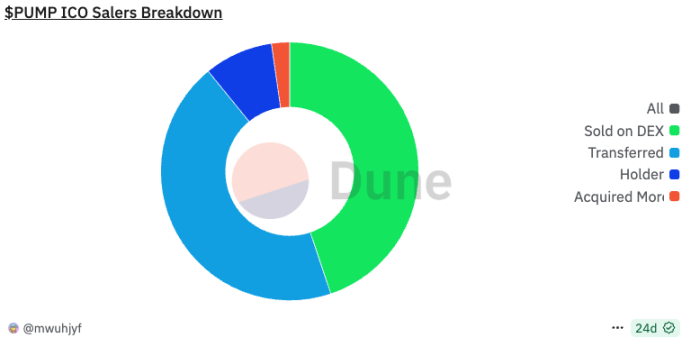

Since the ICO, more than half of the participants have sold their held tokens, and a large number of tokens have been transferred to other wallets—likely to sell the tokens in batches to different buyers through one or more KYC-verified wallets.

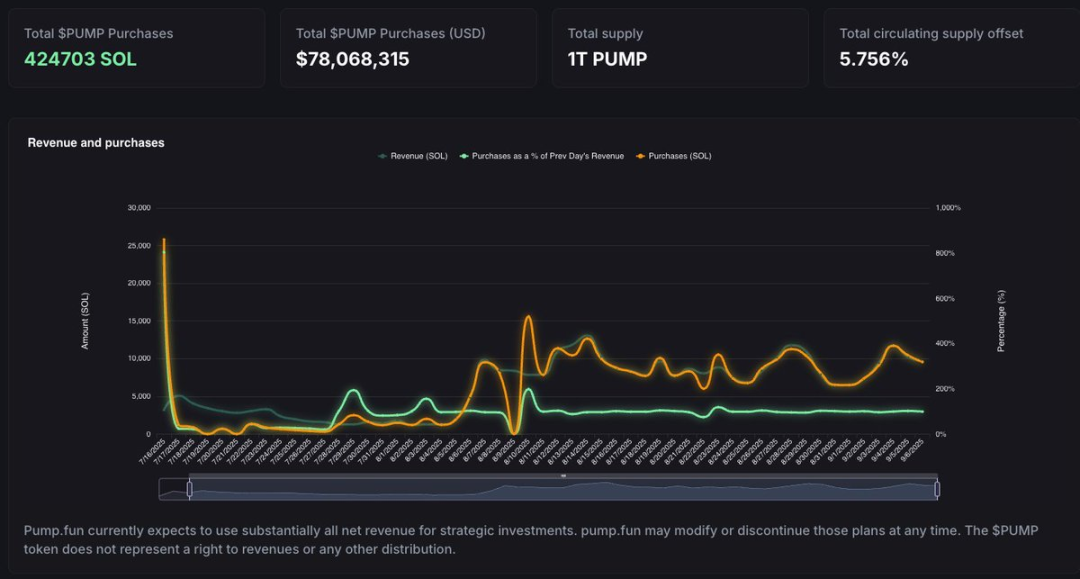

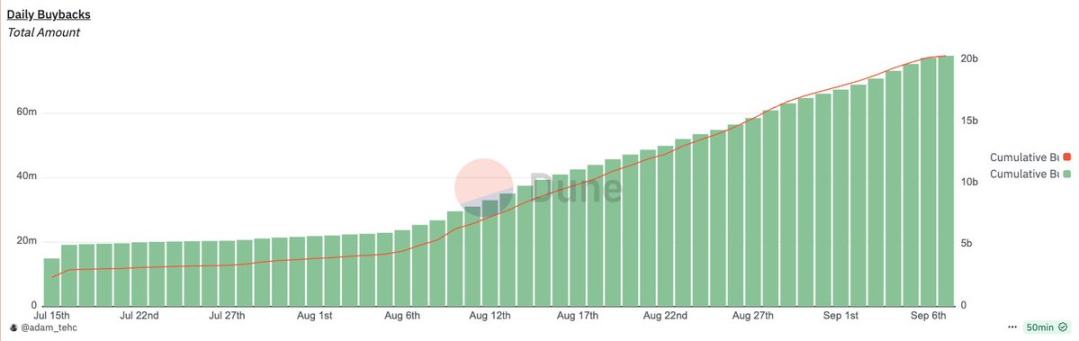

After the token was launched, there was a price drop, prompting Pump.fun to initiate an "income buyback" mechanism, with the daily buyback amount typically accounting for over 90%-95% of the total daily revenue. As of now, the total buyback amount has exceeded $78 million; the daily buyback amount and "supply offset ratio" (currently offsetting 5.75% of the circulating supply) can be viewed through the official Pump.fun buyback dashboard.

I previously suggested that the Pump.fun team add a "cumulative buyback curve" to the dashboard to visually display the growth trend of the buyback scale. Before the official update, everyone can refer to the unofficial dashboard created by @Adam_Tehc.

From the data, it can be seen that Pump.fun's daily buyback amount reaches $1 million to $2.5 million, and the scale is rapidly growing—this forms a complete "income flywheel": Pump.fun uses revenue to buy back tokens → attracts more users, driving up trading volume and transaction fees → the platform gains higher revenue, further increasing buyback efforts, and keeps the flywheel turning.

Currently, the liquidity pool of the PUMP main chain has a fund scale of about $20 million to $30 million, and such buyback strength is sufficient to offset the selling pressure from existing holders. Additionally, the liquidity pool paired with USDC enhances its resistance to SOL price fluctuations.

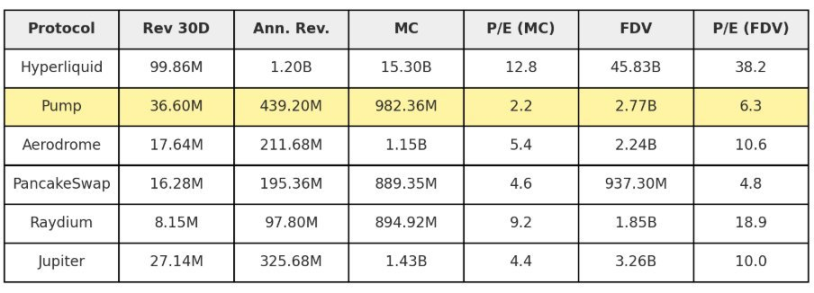

From the P/E ratio data comparison organized by @jermywkh, it can be seen that Pump.fun's valuation is severely undervalued compared to competitors with higher market capitalizations but lower revenues. If the market environment improves, PUMP is expected to achieve valuation parity.

Competitive Landscape

The "flywheel effect" of Pump.fun and the core difference from recent competitors like Bonk and Heaven Dex lies in the "native community" and "ecological culture" it has accumulated in the Solana meme coin space.

These competitors lack past performance support and do not have sufficient profit reserves. The Pump.fun team, with its established ecosystem and past achievements, holds a significant first-mover advantage in future development.

Now, with the launch of the fully functional Pump.fun mobile application, the introduction of live streaming features, and a substantial increase in creator fees, Pump.fun has further solidified its position as the "preferred platform for meme coin issuance and trading"—we will break down these initiatives in detail next.

I personally believe that one of the highlights of Pump.fun is that it "does not force developers, traders, or ordinary users to operate in a specific way," but rather allows the community to independently decide the product's development direction and potential uses. However, in terms of "providing developers with better tools to facilitate project building based on Pump.fun," there is still room for improvement.

In terms of financial reserves, Pump.fun has achieved approximately $800 million in revenue before buybacks, and with the $500 million raised during the PUMP ICO phase, the team currently holds about $1.3 billion in funds—this scale is unmatched by any competitor.

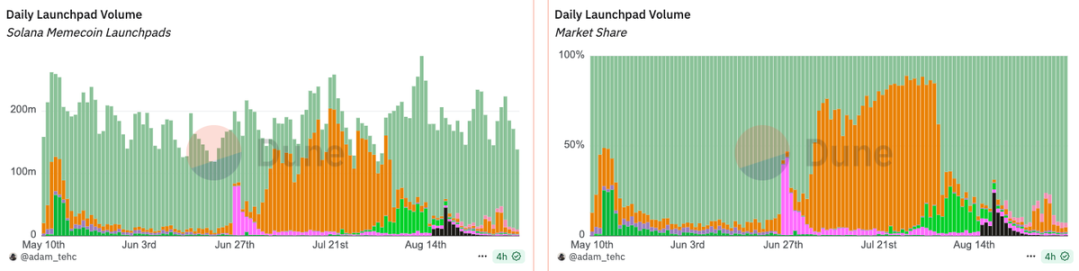

To summarize the current market share: Pump.fun has regained over 80%-90% of market dominance, Bonk's leading advantage continues to weaken, Heaven Dex briefly rose but quickly fell silent, and Believe poses almost no competitive threat.

Key Project Analysis

Ascend: A New Solution to Increase Creator Income Tenfold

The biggest pain point in meme coin issuance is "the difficulty in maintaining the ecosystem after the hype fades." The core goal of the Ascend project is to provide continuous motivation for creators by "increasing creator fees tenfold"—allowing them to have a stable income source for long-term promotion of the token.

In Pump.fun, issuing tokens is completely free, and during the "pre-binding phase" (with a token market value of $0-$85,000, calculated at approximately $200 based on SOL price), creators can earn a 0.3% share of the trading volume as a fee.

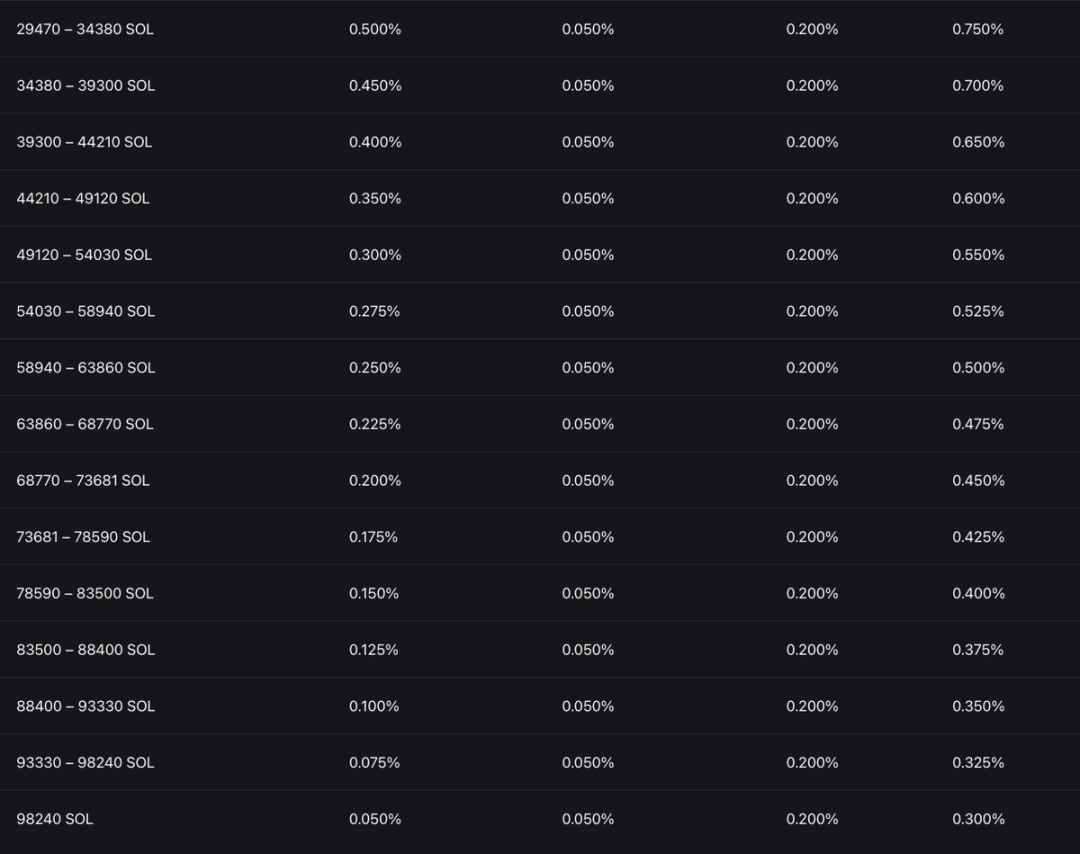

Regarding the fee structure: Pump.fun charges a 0.93% fee during the pre-binding phase (close to 1%), and after binding, a fixed fee of 0.05% is charged, along with an additional 0.2% liquidity pool (LP) exchange fee.

Creator fees will be dynamically adjusted as the token market value increases: when the market value is in the range of $10 million to $11 million, the fee fluctuation range is 0.3%-0.9%; as the market value approaches $20 million, the fee will gradually decrease to 0.05% (still calculated at approximately $200 based on SOL price).

This mechanism has brought significant changes: during the low market value phase (below $10 million), fees are heavily tilted towards creators, allowing many creators of newly issued tokens to achieve extremely high returns. In the past, a token "remaining in a low market value range for a long time" would be seen as a bearish signal; now, it may instead become a bullish signal—because creators have a stronger incentive to maintain the token ecosystem.

Theoretically, when the token market value reaches a high level, large traders need not worry about high fee issues (they can confidently increase trading volume); however, there are currently not many high market value tokens to validate this point. It is worth noting that tokens issued before the launch of the Ascend project can now also receive higher fee shares—this is a significant benefit for existing token ecosystems.

As a reference, the following chart shows the changes in creator fees for recently popular tokens before and after the Ascend project.

Glass-Full Foundation

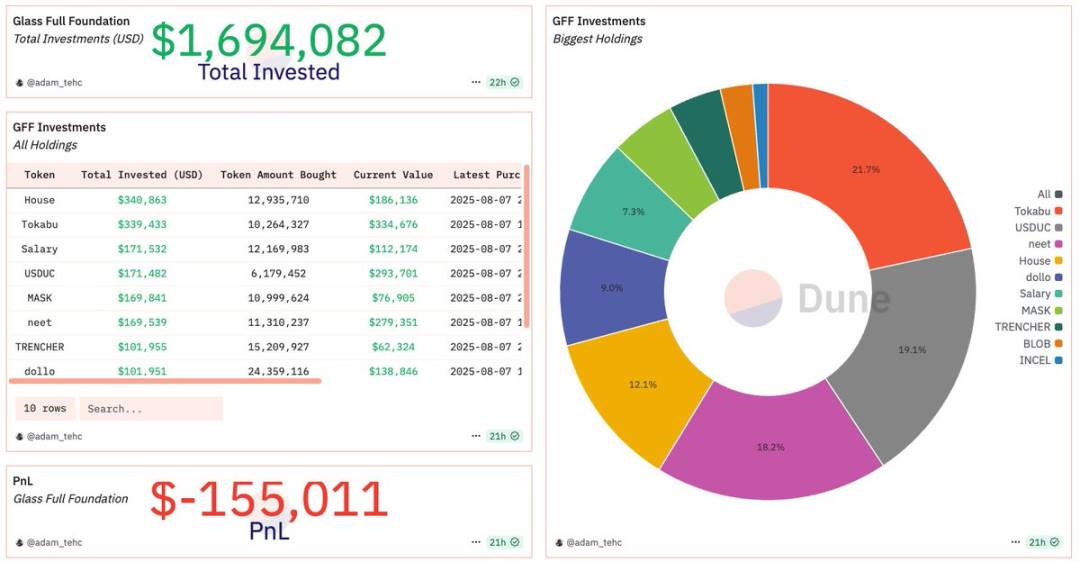

Earlier, the Pump.fun team launched the "Glass-Full Foundation," planning to use part of the revenue to buy back popular tokens on the platform and incorporate these tokens into the platform's balance sheet.

Although this initiative is quite sincere, it is essentially just "a small support for the ecosystem," more like a short-term strategy to respond to a similar competitive proposal launched by Bonk at the time—over the past month, the foundation has not conducted any new buybacks, which confirms this point. However, the community's response to the foundation remains positive.

As of now, the foundation has repurchased $1.6 million worth of popular Pump.fun tokens, with an overall loss of only 10%; and these tokens are unlikely to be sold, effectively "destroying" (reducing circulating supply).

The repurchased tokens include: TOKABU, USDUC, NEET, DOLLO, INCEL.

Live Streaming and CCMs (Creator Capital Markets)

Pump.fun recently announced growth data for its live streaming service—new live streaming platforms often struggle to quickly gain user recognition, but Pump.fun's performance is impressive, with data proving its attractiveness.

The optimization of creator fees has not only greatly incentivized "live streaming of popular events" but has also attracted "non-crypto streamers" to try this new way of monetizing traffic: on traditional live streaming platforms, streamers face fierce competition and must meet thresholds such as "minimum follower count" and "minimum viewer count" to monetize, and even after monetization, high earnings are not guaranteed.

In contrast, on Pump.fun, streamers can stand out more easily—they can quickly attract attention through "token-related interactions," leverage popular events for traffic bursts, and earn high returns through creator fees and initial token supply (if they choose to sell for profit).

I believe that "micro-influencers entering Pump.fun live streaming" is just getting started: on one hand, issuing tokens on Pump.fun is completely free; on the other hand, live streaming can be easily initiated through the mobile application—this low-threshold model will lead to sustained growth in demand for this scenario.

I personally plan to start live streaming on Pump.fun soon; after team research, we hope Pump.fun can provide more support for streamers: such as more comprehensive development tools (to facilitate building features based on the platform), more detailed data analysis functions, and more live streaming features.

Mobile-First Strategy: Focusing on Top Traders and Developers

Pump.fun has consistently emphasized a "mobile-first" approach and has integrated rich social features into its native application: including KOL/top trader leaderboards, token-specific chat rooms (visible only on the app), real-time chat during live streams, and even private messaging between users.

It is easy to foresee that as user penetration increases, these social features will continue to optimize, further reinforcing the positioning of "Pump.fun as the preferred platform for meme coin trading and issuance."

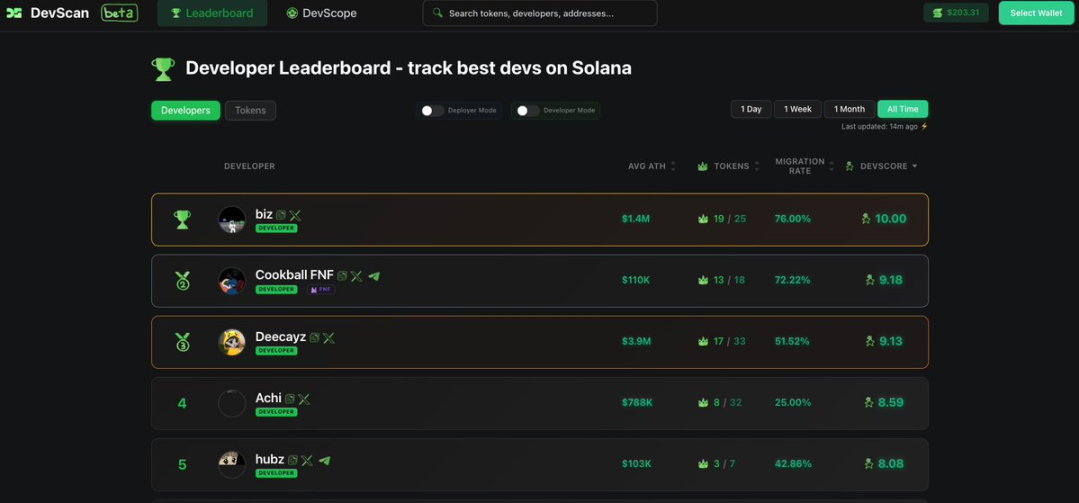

It is important to note that developers are the core of the meme coin ecosystem—without developers, there are no new tokens. In the future, Pump.fun is likely to increase support for developers: for example, by promoting quality creators and providing them with exclusive display platforms similar to "KOLSCAN."

Currently, websites like https://devscan.wtf and https://www.devscan.tech have made preliminary attempts to showcase "top high-frequency issuers" and their related data.

Summary and Outlook

The future prospects of Pump.fun are bright: the community is highly active, and the token economic model is logically clear; through "protocol design that aligns with the ecosystem" and "transparent communication," Pump.fun has undoubtedly regained the trust of the community.

Although the PUMP token will not be unlocked until July 2026, there is still significant growth potential in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。