A new round of Crypto prosperity is becoming a consensus.

From August 17 to 23, I participated in a study tour organized by Uweb for the 2025 U.S. Silicon Valley Crypto industry. I had never fully participated in this form of study tour before; this was my first time. Previously, I had a distant view of such study tours, and distance created prejudice, leading to a sense of skepticism. A group of strangers, each with different purposes, coming together temporarily to have a whirlwind experience in a short time—what could be learned from that? I was quite doubtful. Especially when I saw some overly emotional and exaggerated summaries written by others, which felt very much like advertisements, making them even more suspicious.

This time, however, my personal full participation turned out to be unexpectedly rewarding. Silicon Valley is the center of global technological innovation, and I have quite a few old friends there, having visited multiple times. Particularly in the past year, I have gone several times for both work and personal reasons, so my expectations for this trip were not high. A place I frequently visit, it is a popular destination for Chinese people making a pilgrimage to American technology, and having seen so much sincere sharing and boasting content, what new insights could I gain? However, under the leadership of Principal Jia Ning, I spent a week with over twenty fellow travelers, experiencing a rich and information-packed journey. To be honest, I felt a strong sense of gain. Afterward, I asked myself why, despite having visited several times and met many people, I had not gained as much. The answer seems obvious: when I go to Silicon Valley, I can only utilize a portion of my own resource network, while a study tour can aggregate and amplify the resource networks of the organizers and all participants, creating an energy field that triggers many collisions with the ideas in my mind and sparks a lot of reflection. After returning to Australia and reflecting for a few days, I now feel it is necessary to summarize some of the main gains from this study tour in writing to share with readers.

Due to this study tour, I have also delayed writing a series of summary articles from my previous trip to Hong Kong. However, as the saying goes, "a blessing in disguise," my trip to Silicon Valley provided a comparison that has clarified my understanding of the Crypto situation in Hong Kong. During this period, I will focus on writing the summary articles for both the Silicon Valley and Hong Kong trips. But while the memory is still fresh, I want to jump the queue and first publish the summary of my Silicon Valley trip. Some readers have been urging me to update my Hong Kong trip summary; please bear with me, I will not let you down this time.

The content of this study tour was very rich, and it is impossible to record everything completely. I will summarize several points that I felt most deeply about in writing. Each section has a theme and can be viewed as an independent article. These represent only my personal thoughts and cannot fully or objectively reflect the entirety of this study tour, nor do they constitute any investment advice.

A new round of Crypto prosperity is becoming a consensus

The main discovery from my trip to Silicon Valley is that the American tech community has generally reached a consensus that a round of Crypto prosperity is about to arrive. Everyone we met and communicated with, regardless of their level of involvement in Crypto or their understanding of it, including some who hold biases against Crypto, believes that Crypto is on the verge of a prosperous period. In reaching this conclusion, they did not consider the attitudes of other countries and regions, such as whether China and Europe would follow suit; rather, they believe that even if other regions of the world do not respond, the policies, capital, and technological conditions in the U.S. alone are sufficient to spark such an industry boom.

The source of this optimism is, without a doubt, primarily the new Crypto policies of the Trump administration. In addition to actively promoting the stablecoin legislation (GENIUS Act) and market structure legislation (CLARITY Act), core members of the Trump team have publicly supported Crypto in various settings and have deeply engaged in related businesses. Therefore, as various conditions gradually converge, people in Silicon Valley generally believe that the Crypto industry is about to enter a long-term, large-scale prosperity, and that the U.S. will not only be the source of this round of Crypto prosperity but also its center.

This judgment conveys a sense of urgency.

On the last day of the trip, I visited the Huang Renxun Building at Stanford University's School of Engineering and saw the following exhibit: the first Google server, hand-built by the two founders in a Stanford graduate student dormitory in 1996, with its outer casing made from many Lego blocks. This is a famous exhibit at Stanford's School of Engineering, and I believe many people have seen it. However, for someone my age, seeing it evokes a different feeling. Someone who understood the history of the internet in China once told me that around the time this server was born, China was fortunate to choose the right direction for managing the internet. At that time, there was a proposal for the telecommunications department to manage the internet in the same way it managed fixed-line telephones. If that path had been taken, today's Chinese internet would likely be indistinguishable from others, and the past twenty years of China's story would certainly be unrecognizable. Fortunately, China made the right choice at that time, and the internet industry has achieved great success over the past thirty years. Times change, and I wonder if people thirty years from now will still be able to discuss China's blockchain industry with a sense of confidence that "we did not miss the opportunity."

The "stablecoin war" has not arrived as expected

When the U.S. stablecoin legislation passed in July, it sparked a global discussion about stablecoins. At that time, I had a judgment that once the legislation was passed, all institutions and companies capable of issuing dollar stablecoins would quickly do so, leading to a stablecoin war in a short time. One of my purposes for going to Silicon Valley was to understand whether this situation was occurring.

Why is this important? Because it relates to the speed of the adoption of "stablecoin payments." Those familiar with this field know that stablecoins offer significant efficiency improvements in cross-border payments compared to traditional payments. However, traditional payments are currently a fully competitive field, with powerful players in every sector. While stablecoin payments are advanced, there has yet to be a strong solution provider, making it difficult to find a foothold. What can truly drive stablecoins to rapidly impact traditional payments is the proactive issuance of stablecoins by existing payment companies and banks. A stablecoin war could create a sense of urgency and greatly accelerate this process.

Unfortunately, my trip to Silicon Valley forced me to admit that my original view was incorrect. We did not see the occurrence of a "stablecoin war." This does not mean that new stablecoins are not being planned and designed; as I write this, Hyperliquid has announced plans to issue a new dollar stablecoin, USDH, which certainly proves that new players will continue to join the stablecoin arena. However, there has not been the imagined "rush" situation, especially among banks and major internet platforms, which could have gained the most from issuing stablecoins and could strongly promote stablecoin payments into the real economy, but so far they have remained quite restrained and calm.

Why has the stablecoin war not arrived as expected? I have three guesses.

First, it is possible that these banks and internet companies are not yet ready. The election of Trump caused U.S. stablecoin policy to undergo a 180-degree turn in just six months, and these large institutions may not have had time to make decisions.

The second reason is that the thresholds set by the legislation have acted as obstacles. During the study tour, the organizer invited a senior legal advisor from Coinbase to communicate with us. This person mentioned that Coinbase has effectively influenced the strategic direction of the U.S. Crypto industry through political donations, including the legislation of acts like GENIUS, thereby incorporating some targeted blocking measures into the legislation to precisely hinder potential competitors from entering the dollar stablecoin market. This can be seen as a self-protection strategy by the "first movers" in the Crypto industry, which, while sounding unethical, is actually reasonable.

The third reason, possibly the most profound, is the "innovator's dilemma" revealed by Christensen, which states that due to the significant conflict between new technologies and the current main business and existing interests of companies, the innovation departments of market-leading large enterprises are often suppressed in corporate politics, making it difficult to promote disruptive innovation internally, especially when such innovation is controversial. This effect has been widely discussed, with bloody examples like Kodak and Nokia serving as cautionary tales, but it is still very difficult to overcome.

Stablecoin payments are a typical example of a controversial disruptive technology. If there were a consensus like with AI, the innovator's dilemma would not arise. The fear is that the blockchain, a technology with diverse opinions, is most likely to trap large organizations in the innovator's dilemma. Even now, many people still express skepticism about the technology and economic value of blockchain payments, and some stubbornly deny it. They often assert that compared to their long-cultivated proprietary technologies, blockchain payments have no advantages. Ordinary users cannot understand the powerful yet "abstract" forces of open systems and network effects, and based solely on superficial user experiences, they cannot discern right from wrong or convey clear signals to decision-makers. As a result, the blockchain departments within large enterprises are often very weak, losing out in the competition for internal resources, and it is difficult for them to present any substantial business achievements to persuade the CEO. I have encountered many blockchain departments in banks and payment companies, and they are almost always struggling on the margins of the entire company, finding it hard to initiate meaningful change internally. To this day, many outsiders still believe that the opportunity for stablecoin payments belongs to those large banks or internet payment companies with strong user bases, while I believe that exchanges and cross-border e-commerce companies have a much higher probability of winning in stablecoin payments than banks and internet payment companies.

However, I must admit that the anticipated stablecoin war has not occurred immediately. But I still believe that such a situation will emerge; it is just still in the brewing stage.

The Crypto industry is entering the RWA cycle and is about to undergo large-scale fundraising

One of my biggest questions before going to the U.S. was whether there would still be a "shanzhai season." I hoped to form a clear judgment through this exchange.

The so-called "shanzhai season" is a shorthand for the "shanzhai coin bull market" within the industry. Originally, "shanzhai coins" referred to all digital currencies other than Bitcoin, but as Ethereum and other digital currencies have stood the test of time, "shanzhai coins" now correspond to an asset category alongside "mainstream coins," generally referring to those digital assets with small market capitalizations, low liquidity, and lower rankings. In the past two major bull markets, there have been instances where shanzhai coins collectively surged dozens or even hundreds of times, which is referred to as the "shanzhai season."

The typical pattern of a Crypto bull market is that Bitcoin first recovers its price, then breaks through previous highs, experiencing significant increases, followed by Ethereum awakening and growing at a speed and scale that surpasses Bitcoin, subsequently leading to the arrival of the shanzhai season. Typically, the shanzhai season is the climax phase of the bull market, creating new assets for the industry, incubating a new generation of mainstream projects, while also laying the groundwork for market collapse.

Since the onset of this bull market, Bitcoin, Ethereum, and other mainstream digital currencies have successively achieved breakthroughs, and the aforementioned pattern has progressed halfway. The key question now is whether the shanzhai season will arrive as expected.

During this trip to Silicon Valley, we interacted with numerous Crypto institutions and experts. Through these exchanges, I reached a clear judgment that this bull market will not experience a "shanzhai season." In other words, while there may still be a "shanzhai season" in this bull market, the chips involved will be different from previous ones; they will no longer consist of a variety of dazzling and bizarre Crypto shanzhai coins, but rather RWA concept assets, and thus cannot be referred to as a "shanzhai season."

I have three reasons for this judgment.

First, the dominant players have changed. The last bull market occurred against the backdrop of unprecedented global monetary easing and governments in multiple countries directly distributing cash to households, which empowered retail investors to an unprecedented degree, allowing them to play a major role in the bull market. They not only ignited a massive bull market in cryptocurrencies but also competed with mainstream institutions on Wall Street. However, starting in 2022, monetary policy entered a tightening cycle, and the market crash wiped out most of the wealth held by retail investors, leaving only institutional investors with capital. Therefore, since 2023, it has become very clear that Wall Street and institutional investors have become the main players in the market. After the shift in U.S. Crypto policy, a large number of professional institutions have entered the fray, further solidifying the dominance of institutions in the Crypto market. The entry of these professional institutions will lead to fundamental changes in the market's liquidity preferences and compliance awareness. I am skeptical that the past shanzhai projects, which relied on a few demos to tell grand stories, can gain recognition from dominant institutions.

Second, the market mentality has changed. With the entry of mainstream institutions and capital, the mindset of entrepreneurs and investors has also shifted. Some Silicon Valley Crypto VCs I used to know have adjusted their aesthetic preferences, focusing more on projects related to stablecoins and RWA, and placing greater importance on equity investments. Recklessly issuing shanzhai coins is now seen as a negative indicator.

Third, the industry theme has changed. This bull market is undoubtedly themed around RWA. It is important to note that in the Chinese community, when RWA is mentioned, many people quickly think of very "real" and "tangible" assets like real estate, forests, and minerals. However, in reality, bonds, equity, copyrights, securities, and other "virtual assets" in the real world are the larger and more manageable RWA. From the implementation logic of RWA, it is necessary to first put these already virtualized, homogenized, and securitized RWAs on the blockchain before gradually moving on to those very "real" assets that can be seen and touched. Currently, in the U.S., the hot topic of RWA is particularly specific and focused on U.S. stocks. If we broaden the scope a bit, high-quality equity in unlisted companies is also within the focus.

During our time in Silicon Valley, we realized that if all types of company equities can issue tokens, then the competitiveness of pure shanzhai coins in the crypto circle is very weak. Most of them are still entirely based on the trading and speculation of digital assets, with little or no connection to the real world, and their teams lack real-world resources and experience. In contrast, there are a large number of high-quality company stocks, equities, and other rights in the traditional market that have yet to be tokenized. If high-quality projects in AI, biomedicine, new energy, and smart hardware issue tokens for their equity and enter the Crypto market, can those shanzhai coins that "hide in small buildings" compete with them?

Of course, I also know that there are some experienced "whales" in the Crypto circle who are adept at playing the game of hype and profit-taking during bull markets, and they always manage to gain something in each bull market. However, overall, I believe that with the influx of high-quality RWA assets, the market theme will shift to RWA assets, as liquidity is limited.

Currently, the process of putting RWA on the blockchain is still in the brewing stage, as the CLARITY Act has not yet passed. However, institutions interested in Crypto have already begun to adjust their aesthetic preferences in advance, and I believe the market will soon undergo a large-scale reshuffling. For shanzhai projects, it is essential to seize the opportunities presented by RWA in some way; otherwise, the future situation will be even less optimistic.

From the perspective of the development of the Crypto industry, moving towards RWA is very beneficial, as it signifies that the Crypto industry is returning to an open system.

Looking back at the development of Crypto, from 2009 to 2017, although the Crypto industry was in its infancy, with very primitive blockchain infrastructure and many scammers entering the space, Crypto at that time was an open system where people thought about how to use new technologies to transform the world. However, after 2018, as major countries adopted negative policies towards Crypto, it gradually became disconnected from the real world, turning into a closed system where most Crypto projects revolved around speculative gambling "demand," leading the entire industry to become increasingly hollow. This is also the inevitable fate of a closed system: after stopping energy exchange with the outside world, it gradually increases in entropy, ultimately falling into "heat death," with no meaningful physical laws. By the end of 2024 and early 2025, when meme culture is rampant, the entire Crypto market will appear to lack any discernible patterns, completely trapped in a robotic K-line gambling game between whales and retail investors, which is a typical dead end for a closed system. Fortunately, the Crypto industry did not linger on this path for too long. With the launch of stablecoins and RWA, the entire system is moving back towards openness, beginning to exchange energy with the real world. Many may not realize that this is actually the path to the rebirth of Crypto.

Three Major Hotspots in U.S. Crypto

In summary of our exchanges with the Crypto industry in Silicon Valley, there are currently three hotspot themes in the U.S. Crypto industry: the linkage between coins and stocks, U.S. stocks on the blockchain, and the "Exchange for Everything."

The so-called linkage between coins and stocks refers to a resonant relationship formed between the stock market and the coin market in some way. Currently, this linkage has substantial effects in both the U.S. and Hong Kong stock markets, although the development stages of the two markets are different. The linkage in the Hong Kong stock market is still in the stage of speculation around blockchain and digital asset themes, while in the U.S., the main form currently is Digital Asset Treasury (DAT) companies. During this trip, we encountered several professional institutions in the U.S. that are actively exploring and operating DAT listings. This model has become the most mature and effective path in the market due to the successful practice of MicroStrategy. However, from the perspective of the linkage between coins and stocks, the degree is relatively shallow, not deeply integrated into the business level, and has not yet harnessed the power of token economics, so it can only be considered "entry-level." Recently, DAT has rapidly retraced in the market, raising concerns about the sustainability of this model. Some institutions in Silicon Valley with experience in the crypto circle have already begun planning a DAT 2.0 model, but interpretations of what this 2.0 entails vary. Ultimately, which model will succeed must be tested in the market. I firmly believe that the development of the DAT model will inevitably lead to a deep coupling of token economics and business.

However, even with a simple DAT, there are still many details to manage. During our time in Silicon Valley, we learned about the practical paths of DAT from some institutions with operational experience, such as SPAC mergers and RTO (reverse takeover), and found it to be quite challenging and costly. I believe there should be more ideas emerging regarding the linkage between coins and stocks, and it will not be limited to DAT.

U.S. stocks on the blockchain is currently a clear hotspot in the making. Coinbase, Robinhood, and Kraken have all announced explicit plans. Among them, Robinhood is moving quickly, launching U.S. stock tokens based on Arbitrum in Europe, with over 200 U.S. stocks and ETF products being tokenized and sold on the blockchain. Kraken has introduced the xStocks product for non-U.S. clients, enabling continuous trading on the Solana main chain, currently supporting over 50 U.S. stocks and ETFs. Coinbase is deeply focused on the domestic U.S. market, viewing stock tokens as part of its grand "Exchange for Everything" strategy, actively seeking compliance pathways from the SEC, including requesting no-action letters or enforcement exemptions to facilitate legal tokenized stock trading.

I initially thought that after the stablecoin legislation passed, the entire industry would take some time to digest the results of stablecoins and fully promote the implementation of stablecoin payments. However, it now seems my judgment was incorrect; the entire industry is not fixated on stablecoins but is directly advancing towards U.S. stocks. Promoting the implementation of stablecoin payments would disrupt the business of banks and traditional payment companies, involving many aspects, and can only be pursued gradually. The frontier of the entire industry will undoubtedly follow the path of least resistance, which is to quickly bring more high-quality assets onto the blockchain to form trading pairs with stablecoins. U.S. stocks are undoubtedly the current hotspot. I believe that in a few months, stock tokenization will become the hottest topic in the industry.

The third hotspot is the so-called "Exchange for Everything." During our time in Silicon Valley, we took a serious look at the directions that venture capital firms are focusing on, and found that exchanges are a highlight in the spotlight. This is not difficult to understand. Exchanges are the leaders in the entire Crypto industry ecosystem and sit at the top of the food chain, but competition in this sector is extremely fierce, making it difficult for newcomers to emerge. However, whenever the market reshuffles and new asset classes appear, it brings new game rules, new user groups, and new market structures, providing opportunities for reshuffling in the exchange sector. The Bitcoin boom of 2011, the rise of shanzhai coins represented by Litecoin in 2013, and the explosion of Ethereum ERC-20 tokens in 2017 all gave birth to dominant exchange giants. If this pattern continues to hold, then when the entire industry reshuffles towards RWA, a new generation of exchanges will inevitably emerge.

So what will this new generation of exchanges look like? In several speeches about Crypto by the new SEC Chair Gary Gensler, he mentioned the so-called "super app," which is a super platform that can trade all asset types within a single application. This super platform was subsequently rebranded as the "Exchange for Everything" by the U.S. Crypto industry, and it has become an absolute hotspot in U.S. Crypto venture capital.

Currently, the Exchange for Everything has two main paths. One is the centralized Exchange for Everything represented by Coinbase's "Project Diamond," and the other is the decentralized Exchange for Everything represented by Hyperliquid. Both have put forward clear plans to aggregate all trading varieties, including digital assets, stocks, bonds, gold, foreign exchange, and even the Polymarket prediction market, demonstrating ambitious and bold aspirations.

Whether we appreciate this gluttonous monster or not, the Exchange for Everything aligns with market principles and the principle of network effects. Aggregating all trading varieties, liquidity, information, and users on a single platform is undoubtedly the holy grail of trading markets and the most efficient market. In reality, such an exchange cannot exist, but the process of marching towards this goal will undoubtedly create giant platforms and profoundly transform the structure and rules of the industry.

I hope that the Chinese Crypto industry can prepare for and position itself in line with this trend.

Silicon Valley forms a unique innovation zone through "familiar circles"

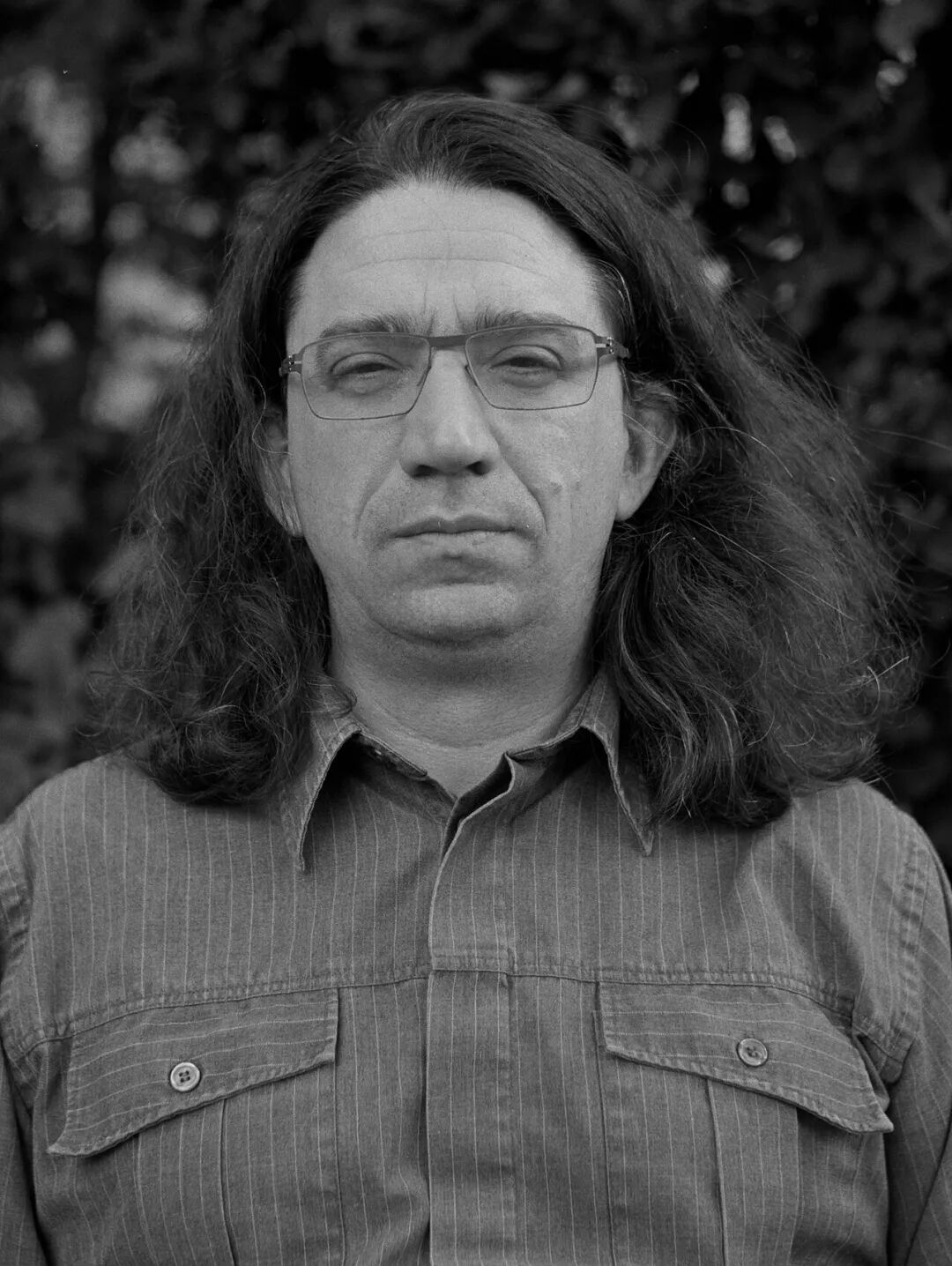

During this study tour, the organizers fully considered the characteristics and richness of Silicon Valley, and did not concentrate all resources solely on Crypto. Instead, they arranged a considerable number of exchanges related to AI and other innovative technologies. In the first session of the entire study tour, we invited the renowned technology expert and tech writer, Wu Jun, to provide a comprehensive introduction to the basic situation of Silicon Valley and global technology innovation trends. Following that, several heavyweight guests were arranged to communicate with us, helping us understand the situation in Silicon Valley.

I have visited Silicon Valley many times and am quite familiar with some of its data. For example, Silicon Valley, including San Francisco, covers a total area of 4,800 square kilometers, with the core built-up area being just over 500 square kilometers. The total population of the Bay Area is around 9 million, but the population of the Silicon Valley tech belt is only about 3 million. Wu Jun provided more detailed statistics, such as a total employee count of 1.7 million, 150,000 software engineers, an average household annual income of $200,000, and first-generation immigrants accounting for 40%, with Chinese and Indian immigrants each making up 6%. These are quite interesting figures. We often say that Singapore is a small country, but in terms of built-up area and population, Silicon Valley is even smaller than Singapore, yet it has achieved such remarkable accomplishments. I believe that the vast majority of visitors to Silicon Valley have a question in their minds: "Why is this place so magical?"

Silicon Valley is undoubtedly the most successful and innovation-friendly tech innovation zone on Earth. In terms of venture capital, Silicon Valley and the San Francisco Bay Area attracted $69.7 billion in venture capital in 2024, a year-on-year increase of 125%, accounting for 52% of the total venture capital in the United States. In addition to the well-known publicly listed tech giants, Silicon Valley has nearly 300 unicorn companies that are not publicly listed, accounting for nearly 40% of the total in the U.S. In a private conversation, a Chinese VC manager in Silicon Valley proudly told us that 20% of the world's successful venture capital opportunities are within a 40-minute drive from us. A Wall Street investment banker friend of mine told me that Wall Street does not look at startups unless they come from Silicon Valley or Israel.

What factors contribute to Silicon Valley's strong innovation capability?

The discussion on this question is extensive, with a variety of viewpoints even in Chinese literature. Some emphasize the role of Stanford University, others attribute it to the influence of early tech companies like HP, Fairchild, Intel, and Apple on Silicon Valley's culture, while many simply explain it as a gathering of the world's smartest minds.

However, these explanations are not very convincing to me, as I feel that many of them are cases of confusing cause and effect. Take the "smart minds" aspect, for instance; it is not that Silicon Valley's environment contains some mutated microorganisms that cultivate a large number of geniuses, but rather that talents from all over the world continuously gather in Silicon Valley. In fact, to be realistic, a significant amount of technological innovation that is attributed to Silicon Valley originally comes from outside the region, and even outside the United States, and later comes to Silicon Valley to undergo the transformation from innovation to entrepreneurship. As one local investor in Silicon Valley mentioned during this study tour, the most impressive aspect of Silicon Valley is not technological innovation itself, but rather its ability to "process" innovation, talent, capital, and systems into successful startups. Therefore, my question is, what factors make Silicon Valley particularly adept at incubating and nurturing startups?

I raise this question largely based on my entrepreneurial experiences over the past few years. These years of practice have made me deeply aware that entrepreneurship cannot be separated from venture capital, which is based on trust, and trust is the most difficult quality to judge in investment. For a startup to win the trust of investors, secure fresh cash, and then navigate a game where they can walk away even after losing all the money or creatively pocketing it, while also overcoming various difficulties and resisting temptations to solidly develop their project, is indeed a very counterintuitive task that requires immense willpower and self-encouragement. On one hand, without sufficient financial support, the vast majority of startups cannot reach that turning point. On the other hand, for investment institutions, identifying trustworthy and capable entrepreneurs is indeed a super difficult task. Therefore, in China's venture capital industry, clauses such as "betting" and "buyback" are often introduced to protect investors' rights. However, this practice completely shifts the entrepreneurial risk onto the entrepreneurs, deviating from the essence of venture capital and only suppressing innovation. I have previously complained about these distorted "venture capitals" in many occasions, thinking it was a "Chinese characteristic." But after going abroad, I found that in Hong Kong, Singapore, and Malaysia, most of the so-called "venture capitals" in Asia come with various toxic clauses. In contrast, the authentic venture capital in Silicon Valley is the real deal and is an exception. This has made me even more curious about how Silicon Valley balances trust and constraints, becoming a unique incubator for startups in the world.

This trip to Silicon Valley has given me some new insights on this issue. Through my limited interactions with the Silicon Valley venture capital circle, I seem to feel that Silicon Valley's venture investment is actually based on "familiar circles." Entrepreneurs and investors often connect through classmates, colleagues, and shared interests, coupling together through strong relationships that are well understood, linking, selecting, and eliminating each other over a long period of time with very high standards, transmitting trust, providing commitments, and imposing constraints, forming a clearly defined trust circle. For investors, the entrepreneurs who successfully get selected into these circles have already undergone screening and long-term scrutiny, and are subject to various soft constraints, making them trustworthy. For entrepreneurs, once they reach this point, they can gain trust and resource support that is hard to find elsewhere—money when they need it, people when they need them, connections when they need them—naturally increasing their chances of success, while the consequences of "sabotage" are extremely severe, leading to a rational choice to follow the right path.

In other words, although Silicon Valley produces the world's top tech innovation companies, the mechanisms it relies on are very old familiar social and circle cultures, rather than advanced game mechanisms or innovative financial tools. It is precisely by compressing the two groups of entrepreneurs and investors into a small circle for constant interaction that a powerful innovation incubation mechanism is formed, guiding and forcing entrepreneurs to stay on the right path while providing maximum resource pressure to help them succeed. Many people find Silicon Valley's "smallness" magical, but in fact, Silicon Valley's success is precisely because it is small enough to allow the mechanism of familiar circles to function effectively.

I discussed this "familiar circle theory" with several friends in Silicon Valley, and they recognized it. My question is, can this experience be replicated?

How does Silicon Valley view the "AI Bubble Theory"?

When in Silicon Valley, one cannot only talk about Crypto. In Silicon Valley, one cannot avoid AI. In fact, the center of U.S. Crypto is in New York, while the absolute theme of Silicon Valley is AI. Before this study tour, I had already made up my mind to understand how Silicon Valley views the now rapidly growing "AI Bubble Theory."

When it comes to the "AI Bubble Theory," many people may still be unfamiliar with it. From my readings on Chinese networks, the current sentiment towards AI is overwhelmingly positive, almost evolving into a form of political correctness. However, in fact, concerns about the AI bubble have been increasingly amplified over the past few years. Since the breakthrough of ChatGPT 3.5, a group of experts led by Meta's Chief AI Scientist Yann LeCun has been publicly skeptical and even critical about whether large language models (LLMs) can achieve artificial general intelligence (AGI). With the release of ChatGPT 5, the slowdown in the development of core capabilities of large models has become very apparent, and under these circumstances, the "AI Bubble Theory" has recently begun to ferment, with its representative figure being American cognitive scientist and NYU psychology professor Gary Marcus.

Gary Marcus has been a long-time critic of Silicon Valley and the AI connectionist approach. His criticisms of Silicon Valley and artificial intelligence mainly focus on three aspects. First, he believes that Silicon Valley excessively chases short-term commercial interests, touting artificial intelligence as a "panacea," while ignoring the true limitations of the technology and the social risks involved. Second, he criticizes the technical path of large models for overly relying on massive data and computing power, mocking deep learning as "drug-fueled auto-completion," lacking in-depth research on common-sense reasoning, causal understanding, and transparency, leading to AI often exhibiting "sophisticated speech without understanding" in real-world applications. Third, he points out that Silicon Valley companies lack sufficient ethical responsibility, being keen on capital market speculation and narrative packaging, yet unwilling to confront the safety, bias, and regulatory issues that AI may bring. These are all long-standing views of Gary Marcus, but after the release of ChatGPT 5, he has become particularly active, eagerly accepting various media interviews, claiming that the potential of large models is about to be exhausted and that the bubble is about to burst.

So how do people in Silicon Valley view the "AI Bubble Theory"?

During my study tour in Silicon Valley, I encountered three different attitudes.

The first attitude is to scoff at it, believing that the AI bubble does not exist at all and that the prospects are bright. Some investors express strong confidence in the development prospects of AI; although they do not deny that ChatGPT 5 has not met expectations, they remind us that the revenues of leading AI companies are rapidly increasing, and valuations are soaring, with the possibility of a valuation of $500 billion or even higher for some unlisted AI companies by next year.

The second attitude is a firm belief that AI has a bubble, and it is a significant one. A well-known scholar, whose name I cannot disclose, responded to my inquiry on this matter by saying that the level of bubble in today's Silicon Valley AI companies is no lower than that of China's "AI Four Little Dragons" back in the day. While he does not know when the bubble will burst, he believes that once it does, Silicon Valley will suffer a heavy blow. Another emerging investor in Silicon Valley has predicted the timing of the AI bubble's burst and has already begun making corresponding investment arrangements, preparing to turn bad situations into good ones.

The third attitude is that while AI does have a bubble, the bubble is not a bad thing; AI will "dance with the bubble" and continue to move forward. This view is more moderate and represents the opinion of the majority.

In principle, I support the third view, but I do have my own concerns about the current AI development model.

The biggest characteristic of AI, centered on deep learning, is its opacity; it is the first "inexplicable" black box in the history of human technological development. The most advanced AI models today have artificial neural networks with hundreds of layers, exceeding anyone's ability to explain. Therefore, no one knows why it is so smart, nor do they know why it is not smart enough. One direct consequence of this "inexplicability" is that when AI's capabilities fall short of expectations, people have no better solution than to keep piling on computing power. Each time a bit of computing power is added, the results improve slightly. If the results are still not good enough, then more computing power is added. No one knows where the endpoint of this technical route lies, or whether it can truly lead to AGI before exhausting available energy resources. We can hear various optimistic or pessimistic views in social media and at dining tables in Silicon Valley, but these views are based on personal beliefs, and no one can delve into those hundreds of layers of neural networks to explore the truth.

In August, the U.S. reported a fixed asset investment growth rate of 5.4%, surpassing China for the first time in over thirty years. However, nearly half of this fixed asset investment is directly or indirectly related to AI infrastructure. A significant amount of resources is being allocated to build extremely large computing centers, while the available data across the entire internet has long been exhausted. The current model involves the entire industry dedicating itself to constructing grander temples, hoping to summon the deity of AGI, which poses a significant test of patience for people.

Is Silicon Valley concerned about this? I believe divisions have already emerged. If the core capabilities of large models cannot regain the momentum of rapid improvement, and if they cannot quickly produce intelligent advancements that the public can clearly perceive, but instead continue to expand applications at the existing level, then it is likely that soon Wall Street and the American public will become angry about the endless investments in computing power that easily reach hundreds of billions of dollars.

Silicon Valley also has its limitations

As the study tour was coming to an end, I summarized the gains of this trip with several fellow travelers, and we unanimously felt that Silicon Valley also has its own insularity and limitations. Silicon Valley is indeed passionate about technological innovation, filled with the piety of tech pilgrims, but this passion and piety come with a flip side: a significant indifference to many major issues in the outside world, especially concerning ordinary people.

Recently, at a technology leaders summit hosted by Trump, Silicon Valley tech leaders, led by Zuckerberg and Cook, proposed technology investment plans totaling over a trillion dollars, which delighted Trump. However, some U.S. media pointed out that these massive plans, often amounting to hundreds of billions of dollars, are mostly invested in data centers, AI chips, and supporting energy, which are large in scale and advanced in technology but do not significantly improve employment in the U.S.

Does Silicon Valley care? Not really. Silicon Valley has its own concerns, and it almost only cares about these issues. There is a self-sufficient neglect towards the outside world, a kind of indifference that suggests "it doesn't concern us." Startups in Silicon Valley only raise money from within Silicon Valley, and the enormous wealth generated before going public is almost exclusively distributed within Silicon Valley. People in Silicon Valley do not entertain themselves much, eat rather ordinarily, and despite nominally high salaries, most lead quite dull lives. However, these leisure activities are not considered important in Silicon Valley. What truly matters is whether one can gain an advantage in the technological race, secure the next round of financing, see the valuation curve rise, improve algorithm performance, expand infrastructure, and prove oneself as a true talent in fierce competition. As for whether these efforts can genuinely address external issues like education, healthcare, and wealth disparity, or even exacerbate these problems, they rarely care. For Silicon Valley, the outside world is an abstract object awaiting their technological magic for transformation and optimization, rather than a community composed of billions of people who share responsibilities and burdens.

In recent years, a popular ideology in Silicon Valley, represented by programmer and well-known blogger Curtis Yarvin, is known as Dark Enlightenment, also summarized as "new reactionism," which is categorized in the political spectrum as a branch of neo-fascism. This school of thought opposes democracy, supports Trump, and likens the state to a corporation efficiently governed by managers elected by "shareholders," rather than relying on universal voting and party competition. Since Curtis Yarvin uses "Mencius Moldbug" as a pen name, many in the Chinese community refer to him as "Mencius Yarvin."

The ideas of Mencius Yarvin, bolstered by Silicon Valley tycoons like Peter Thiel, have accelerated with Trump's election victory, subtly influencing many people both inside and outside Silicon Valley. Some of the people we encountered in Silicon Valley, although they may not have read Mencius Yarvin's articles or even know who he is, have many thoughts shaped by his influence. For example, they prioritize technological supremacy, efficiency, and elite governance. They do not concern themselves with the issues troubling the American public and the world; instead, they focus more on how to establish a "tech innovation microcosm" in the Bay Area. The order they envision often emphasizes replacing political consultation with technological means, using capital and computing power as sources of legitimacy, while public responsibility is simplified to investment returns, and society is imagined as a company that needs to be managed and optimized. Some have summarized this arrogant worldview of Silicon Valley as "technocratic aristocracy."

Personally, I believe that having such a self-important, infinitely creative independent microcosm in a small area of the Earth is a pride of human civilization. There is no need to expect people from every corner of the world to be so enlightened. As long as they can continue to innovate, let them be arrogant. However, we should also recognize that not all problems can be solved in Silicon Valley, and many issues are ones that Silicon Valley does not care about or pay attention to.

There is a viewpoint that Silicon Valley was never, and will not become, the center of Crypto, because Crypto focuses on fairness, while Silicon Valley focuses on efficiency. The fundamental spirit of Crypto is equality before cryptography and smart contracts, which is contrary to Silicon Valley's technocratic aristocracy.

I am not sure if this viewpoint is correct. For the Crypto industry, one should not expect to find all the answers in any one place. However, I believe in Silicon Valley's inclusiveness. Although Silicon Valley is not large, it should be able to accommodate both AI and Crypto.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。