Will Bitcoin Q4 Prediction Turn Real? BTC Bullish Reversal Analysis

Every final quarter has been special for BTC. Back in 2023, ETF approval sent the price soaring. In 2024, Trump’s election victory became the spark. Now, Q4 2025 looks even bigger, with several powerful factors lining up at the same time.

Crypto market strategist Cas Abbe summed it up perfectly: “Being bearish on BTC going into Q4 is a crime.” Many traders agree, saying the bitcoin Q4 prediction is pointing toward one of the strongest runs we’ve seen.

Why BTC Q4 2025 Price Prediction Looks Different

This time it isn’t just one event driving the coin—it’s a whole list of bullish triggers working together:

-

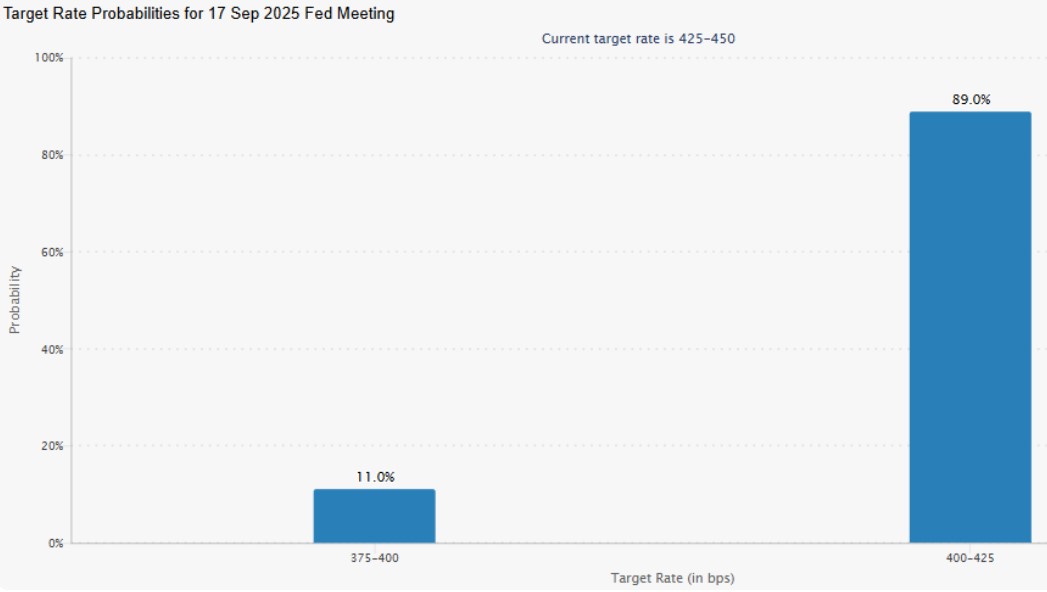

September Fed Rate Cut: Markets expect the Fed to cut rates on 17 September 2025, with an 89% chance of 25 bps and an 11% chance of 50 bps. In short, cheaper money is equal to higher risk cravings.

-

Pro-Crypto Regulation – The U.S. is finally making crypto rules clearer. This is giving confidence to big investors who were waiting for legal clarity before entering the market.

-

BTC Retirement Funds Access – Slowly, pension plans and 401(k) accounts are adding this coin as options. This means ordinary people saving for retirement can now invest in this currency too.

-

$7 Trillion+ in Money Market Funds – Right now, trillions of dollars are parked in money market funds.

-

Treasury Stealth QE – The U.S. Treasury is quietly adding liquidity to the system, which supports risk assets like this currency.

All of these bitcoin bullish catalysts 2025 together create one of the strongest setups investors have seen in years.

Current Bitcoin Price Performance: Short Term Fall Only?

At the time of writing it is trading at $110,708.48, down 1.34% in the past 24 hours.

-

24h Volume: $48.71B (a drop of 27.77%)

-

1-Year Rally: +97%

Well-known trader Crypto Lord emphasized that despite the short-term dip, it continues to print higher lows—a bullish structure that usually signals momentum building for quater 4 prediction breakout.

Until the token closes a 3D candle below $98K, the bull run remains intact. History suggests that support retests during rallies are healthy.

We saw this in April before the token touched new all-time highs, and the btc bullish reversal analysis indicates a repeat could be in motion.

Macro Tailwinds: Why Rate Cuts Could Supercharge BTC

The Fed’s decision is at the center of the September rate cut Bitcoin price forecast . It has a history of thriving when policy eases.

-

2017 Rally: The Bitcoin price 2017 jumped as liquidity improved.

-

2023 & 2024 Runs: ETF approval and Trump’s victory sparked massive rallies.

Now adding to Bitcoin Q4 prediction 2025 , similar macro factors are in play—only this time with even stronger catalysts backing them.

Conclusion: Will September Spark a Breakout?

The last quarter has repeatedly been the strongest for this currency. With the BTC q4 2025 prediction pointing to multiple bullish drivers—rate cuts, regulatory clarity, retirement funds, and massive cash reserves—investors have reason to stay optimistic.

The big question for investors: will it breakout in September? With this kind of setup, the odds look higher than ever. Temporary dips don’t change the bigger story. The bitcoin Q4 prediction for 2025 points to one of the strongest rallies in crypto’s history.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。