Quick Start to DeFi: Analyzing Returns and Risks of Different Strategies Using Real Data from DeFi Whales

Abstract

Recently, with changes in the regulatory environment, DeFi protocols have achieved interest rates far exceeding those in traditional financial wealth management scenarios, thanks to on-chain traders' enthusiasm for crypto assets. This has positive implications for two groups of users. First, for some traders, after the prices of most blue-chip crypto assets have broken historical highs, appropriately reducing leverage and seeking low alpha risk wealth management scenarios is a good choice. At the same time, as we enter a macroeconomic interest rate reduction cycle, for most non-crypto working individuals, allocating idle assets in DeFi can also yield higher returns. Therefore, the author hopes to start a new series of articles to help friends quickly get started with DeFi, analyzing the returns and risks of different strategies using real data from DeFi whales, and hopes for everyone's support. In the first issue, the author intends to start with the recently popular interest rate arbitrage strategy and analyze the opportunities and risks of this strategy in conjunction with the capital allocation of AAVE whales.

What is Interest Rate Arbitrage in the DeFi World?

First, for those unfamiliar with finance, let’s introduce what interest rate arbitrage is. Interest Rate Arbitrage, also known as Carry Trade, is a financial arbitrage strategy that focuses on profiting from the interest rate differences between different markets, currencies, or debt instruments. In simple terms, this business follows a path: borrow at low interest, invest at high interest, and earn the interest spread. In other words, arbitrageurs borrow low-cost funds and then invest them in higher-yielding assets to earn the spread profit.

Taking the most favored strategy by hedge funds in traditional financial markets as an example, that would be the USD/JPY Carry Trade. We know that Japan has maintained extremely low bond yields under the YCC policy, with real interest rates even at negative levels. Meanwhile, the USD remains in a high-interest environment, creating a spread between the two different financing markets. Hedge funds choose to use high-yielding US Treasury bonds as collateral to borrow Japanese yen from various financing channels, and then either purchase high-dividend assets from Japan's five major trading companies or convert back to USD to buy other high-return assets (PS: one of Buffett's favorite strategies). The advantage of this strategy is that it can increase the efficiency of capital leverage. Just this arbitrage path alone can reach a scale sufficient to influence global risk asset prices, which is why, after the Bank of Japan abandoned YCC last year, each interest rate hike significantly impacted risk asset prices.

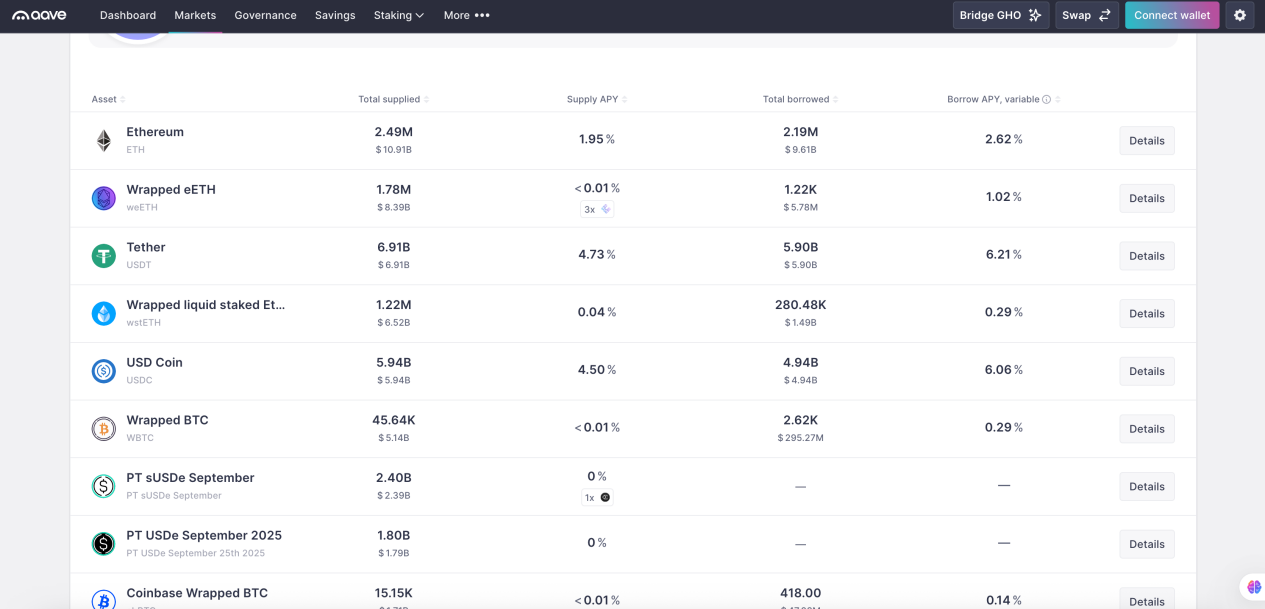

In the DeFi world, there are two main categories of core innovations: the first is decentralized exchanges (DEX), and the second is decentralized lending protocols. The former guides "price difference arbitrage strategies," which we will not discuss in this article, while the latter is the main source of "interest rate arbitrage strategies." Decentralized lending protocols allow users to borrow one type of crypto asset by using another type as collateral. The specific subdivisions will vary based on liquidation mechanisms, collateral requirements, and interest rate determination methods, but we will focus on the most mainstream "over-collateralized lending protocols" to introduce this strategy. Taking AAVE as an example, you can use any supported crypto asset as collateral to borrow another crypto asset. In this process, your collateral still enjoys native yields and the lending yields represented by Supply APY. This is because most lending protocols adopt a Peer To Pool model, where your collateral automatically enters a unified liquidity pool, serving as the source of lending funds for the platform. Therefore, borrowers who need your collateral type will pay interest to this liquidity pool, which is the source of lending income. What you need to pay is the borrowing interest corresponding to the asset you borrowed, represented by Borrow APY.

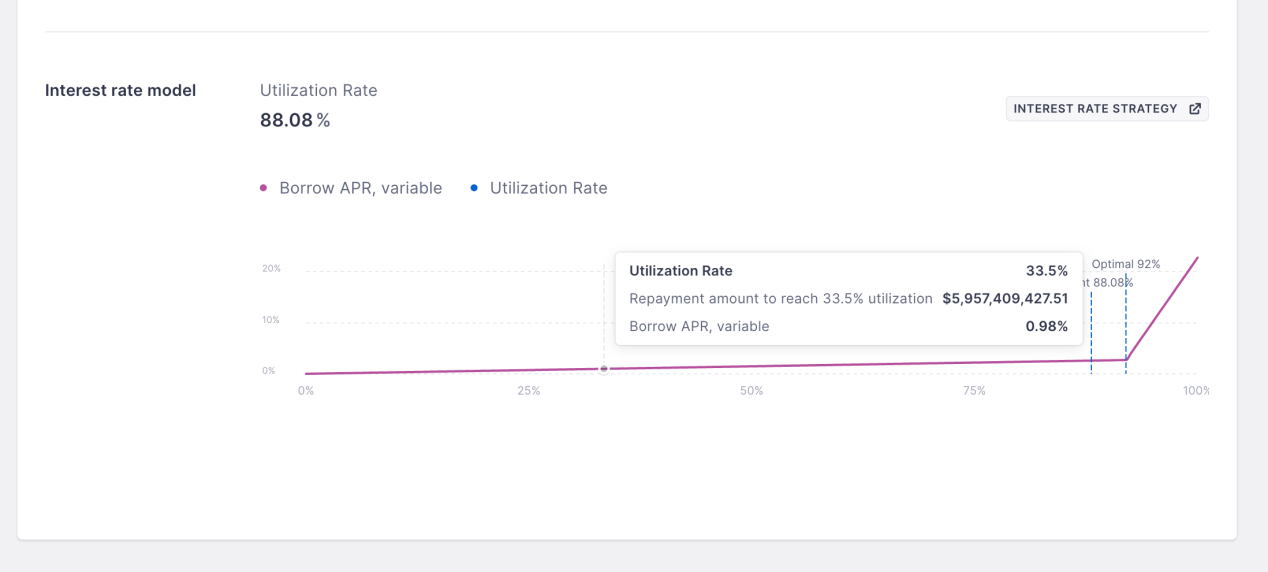

These two interest rates are variable and determined by the interest rate curve in AAVE. In simple terms, the higher the utilization rate of the liquidity pool, the higher the corresponding interest rate level. This design is intended to simplify the complexity of the protocol, as borrowing in Peer To Pool lending protocols does not have a concept of maturity date like in traditional financial markets. The benefit of this approach is that the liquidity of the lender's funds is relatively high, and they do not need to wait until the debt matures to retrieve the principal. However, to ensure sufficient constraints on the borrower's repayment, the protocol requires that as the remaining liquidity in the pool decreases, the borrowing interest rate increases, compelling borrowers to repay and ensuring that the remaining liquidity in the pool remains in a dynamic balance, reflecting the true market demand to the greatest extent.

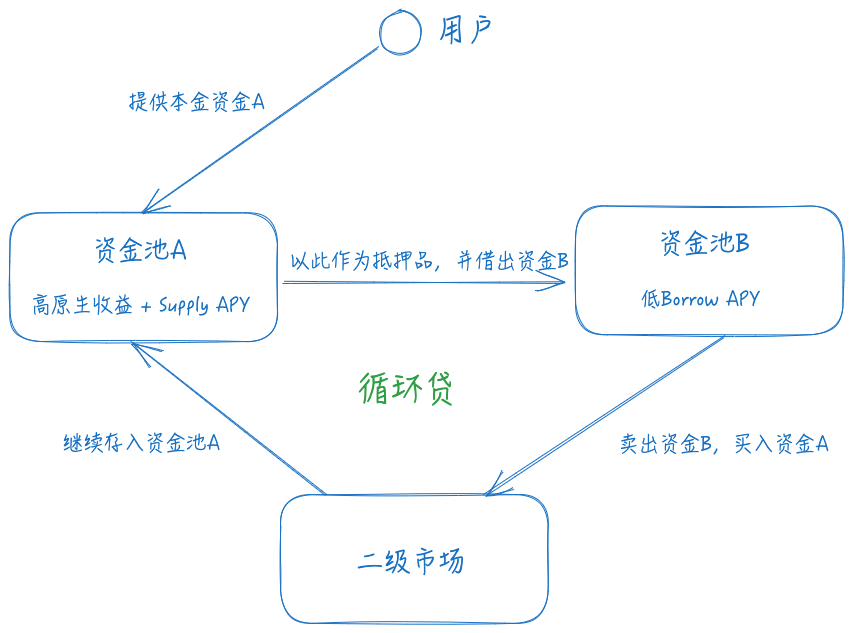

After understanding these basics, let's introduce how interest rate arbitrage is achieved. First, you need to find assets with high native yields + Supply APY as collateral. Next, find a suitable borrowing path with a low Borrow APY to lend out the assets. Finally, use the borrowed funds to purchase collateral again in the secondary market and repeat the above operations to increase capital leverage.

Those with financial knowledge can easily identify two risks in this path:

- Exchange Rate Risk: If asset A depreciates relative to asset B, it can lead to liquidation risk. For example, if your collateral is ETH and the borrowed funds are USDT, when the price of ETH falls, your collateralization ratio may become insufficient, leading to liquidation.

- Interest Rate Risk: If the Borrow APY of liquidity pool B exceeds the total yield of liquidity pool A, the strategy will be in a loss state.

- Liquidity Risk: The exchange liquidity of assets A and B determines the establishment and exit costs of this arbitrage strategy. If liquidity decreases significantly, the impact can still be substantial.

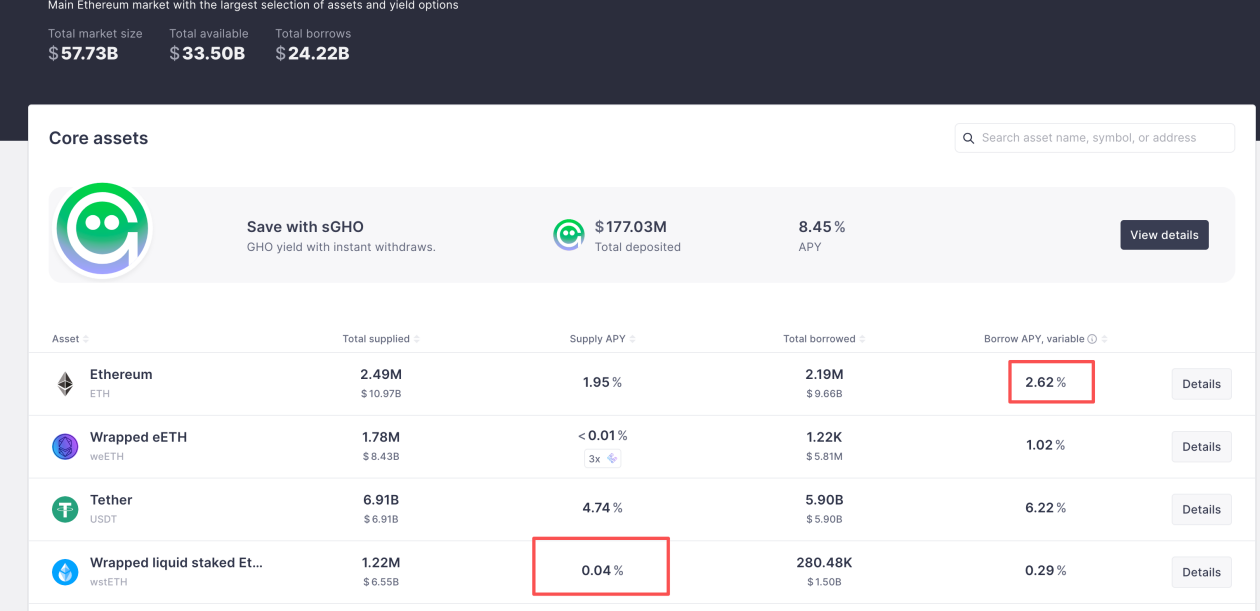

To mitigate exchange rate risk, we see that most DeFi interest rate arbitrage strategies are designed with two types of funds that need to have a certain correlation in price, avoiding significant deviations. Therefore, the main asset choices in this track are two: LSD path and Yield Bearing Stablecoin path. The difference depends on what the managed funds are based on. If it is based on risk assets, aside from interest rate arbitrage, it can still retain the ability to earn native asset alpha returns. For example, using Lido's stETH as collateral to borrow ETH. This arbitrage path was very popular during the LSDFi Summer period. Additionally, choosing correlated assets has the benefit of allowing for a higher maximum leverage multiple, as AAVE sets a higher Max LTV for correlated assets, known as E-Mode. With a setting of 93%, the theoretical maximum leverage is 14 times. Therefore, based on the current yield rates, taking AAVE as an example, the lending yield rate for wsthETH is 2.7% (ETH native yield) + 0.04% Supply APY, while the Borrow APY for ETH is 2.62%. This means there is a 0.12% interest spread, making the potential yield of this strategy 2.74% + 13 * 0.12% = 4.3%.

As for interest rate risk and liquidity risk, they can only be mitigated by continuously monitoring bilateral interest rates and related liquidity. Fortunately, this risk does not involve immediate liquidation, so timely liquidation is sufficient.

How AAVE Whales Use $10 Million to Achieve 100% APR Through Interest Rate Arbitrage

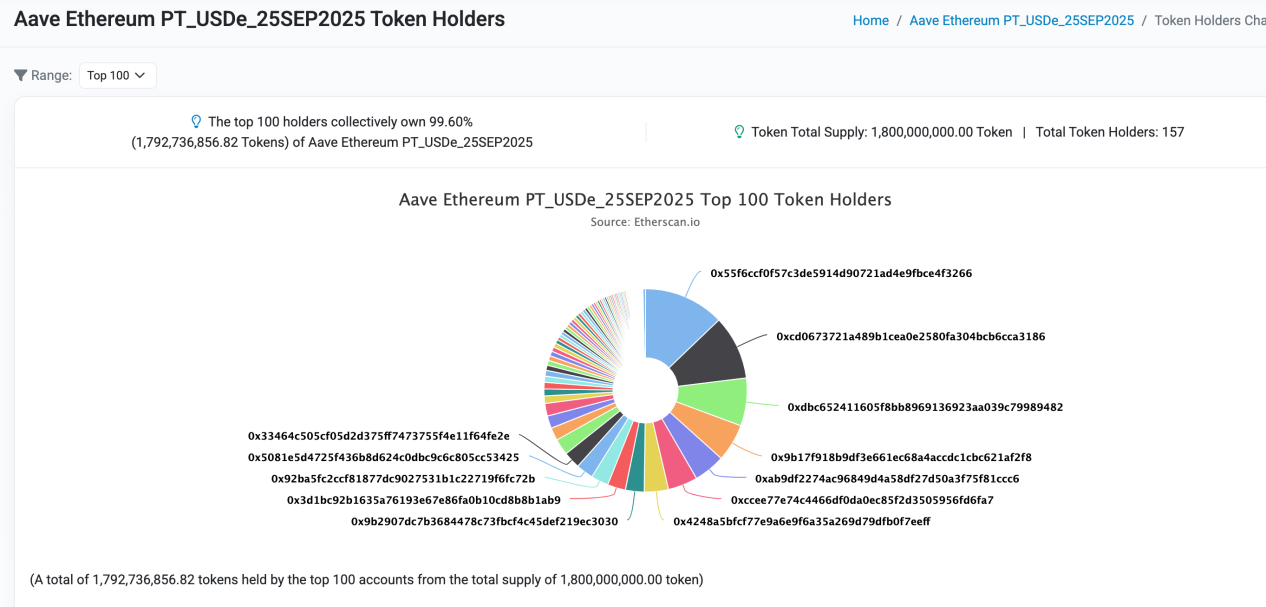

Next, let's look at how DeFi whales utilize interest rate arbitrage to achieve excess returns. In previous articles, it was mentioned that AAVE accepted PT-USDe issued by Pendle as collateral a few months ago. This has completely stimulated the profitability of interest rate arbitrage. We can find that PT-USDe has always been at the supply limit on the AAVE official platform, indicating the popularity of this strategy.

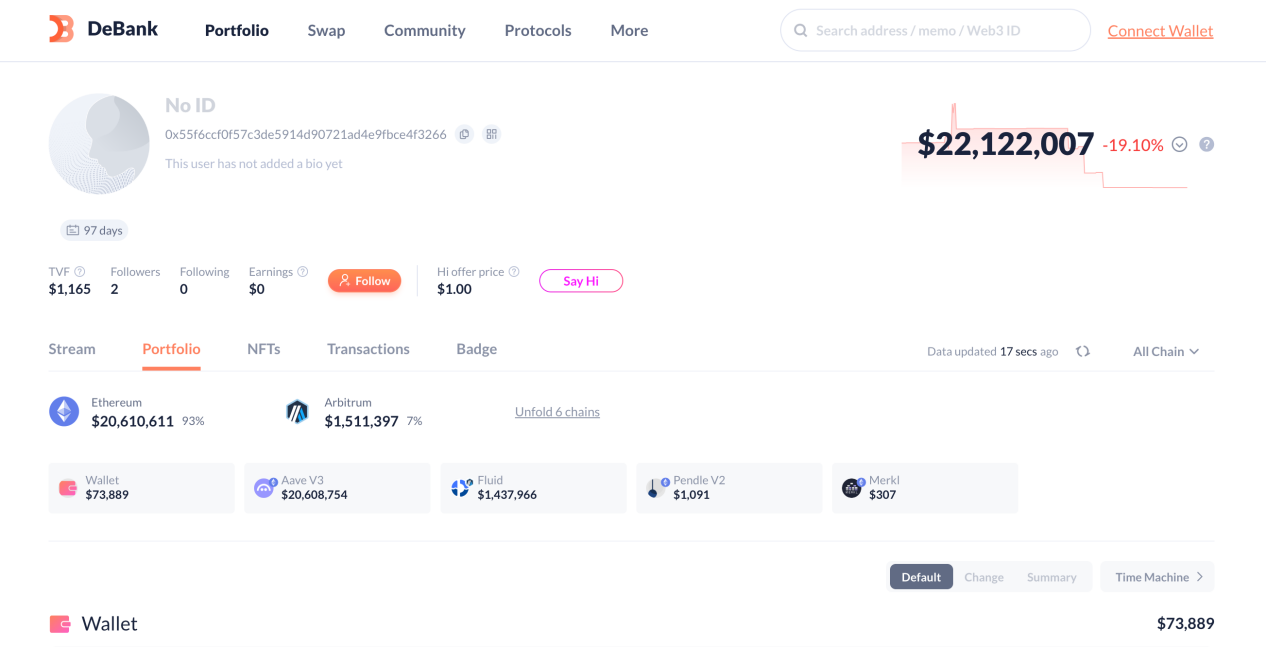

We choose the largest DeFi whale in this market, 0x55F6CCf0f57C3De5914d90721AD4E9FBcE4f3266, to analyze its capital allocation and potential yield rate. This account has a total asset scale of $22M, most of which is allocated to the aforementioned strategy.

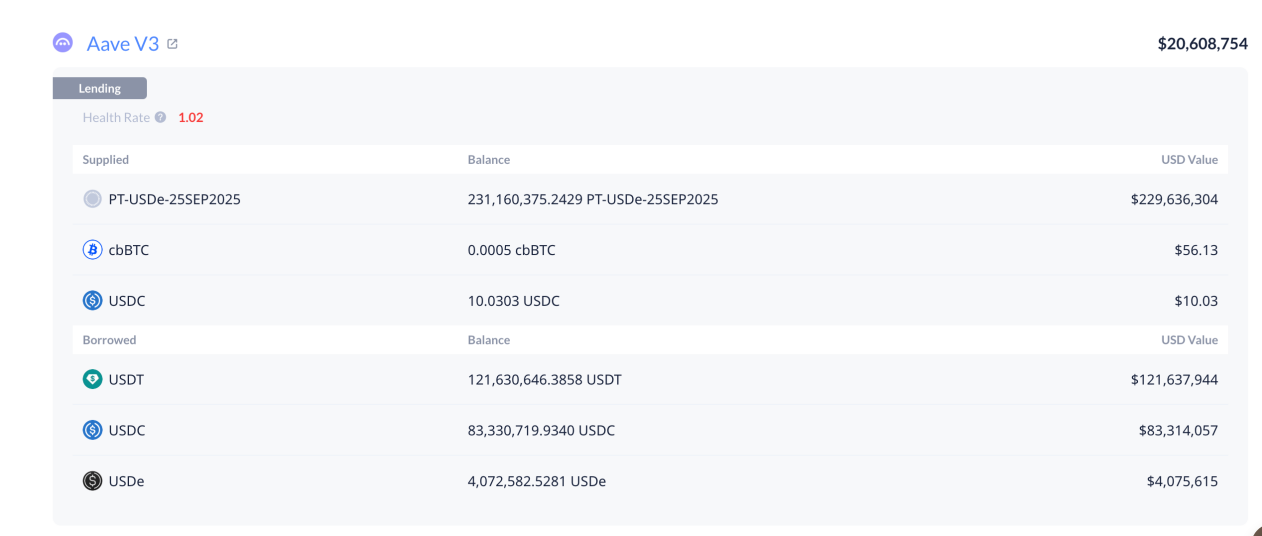

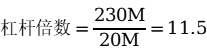

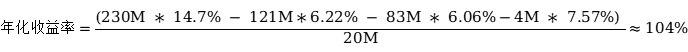

It can be seen that this account has allocated funds through two lending markets, with $20.6M allocated in the AAVE ecosystem and $1.4M in Fluid. As shown in the figure, this account has leveraged approximately $230M of PT-USDe assets using $20M of principal in AAVE, with the corresponding borrowing distribution being $121M USDT, $83M USDC, and $4M USDe. Next, let's calculate its APR and leverage multiple.

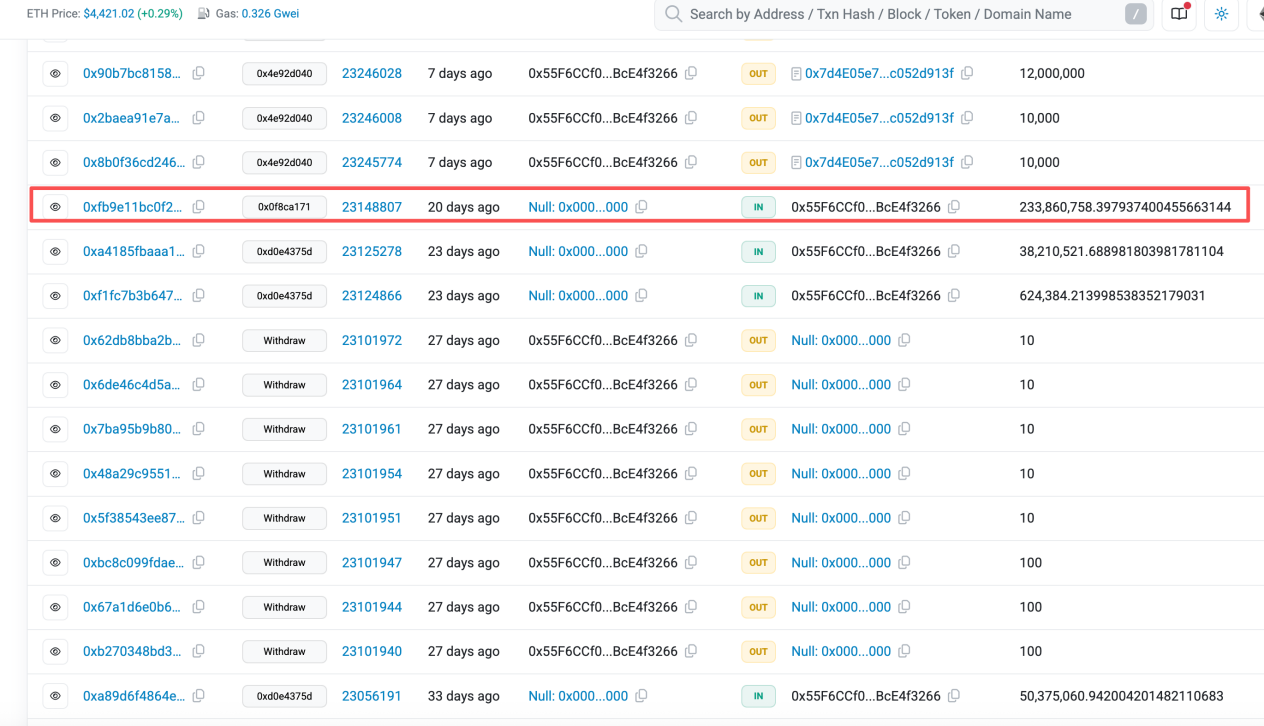

Based on the PT-USDe interest rate at the time of its position establishment, the main locked interest rate occurred on August 15 at 20:24, indicating that the account's position establishment interest rate was 14.7%.

Currently, the borrowing interest rates in AAVE are 6.22% for USDT, 6.06% for USDC, and 7.57% for USDe. We can calculate its leverage multiple and total yield rate to be 11.5 times and 104%. What attractive numbers!

How DeFi Newbies Can Replicate Big Players' Strategies

In fact, for DeFi newbies, replicating such interest rate arbitrage strategies is not difficult. There are already many automated interest rate arbitrage protocols in the market that can help ordinary users avoid the complex logic of circular lending and open positions with one click. Here, since the author is approaching this from a buy-side market perspective, specific project names will not be introduced; everyone can collect information in the market on their own.

However, the author needs to remind you of the risks associated with this strategy, which can be divided into three main aspects:

- Exchange Rate Risk: In previous articles, the design logic of the AAVE official community regarding the PT asset Oracle has been introduced. Simply put, when the oracle is upgraded to capture changes in PT assets in the secondary market, the strategy needs to control the leverage multiple to avoid liquidation risks when the expiration date is far off and market prices fluctuate significantly.

- Interest Rate Risk: Users need to continuously monitor changes in the interest rate spread. If the spread converges or even turns negative, they should adjust their positions to avoid losses.

- Liquidity Risk: This mainly depends on the fundamentals of the target yield-bearing asset project. If a major trust crisis occurs, liquidity will quickly dry up, and the slippage losses incurred when exiting the strategy will be significant. Users should also maintain a certain level of vigilance and keep an eye on the project's progress.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。