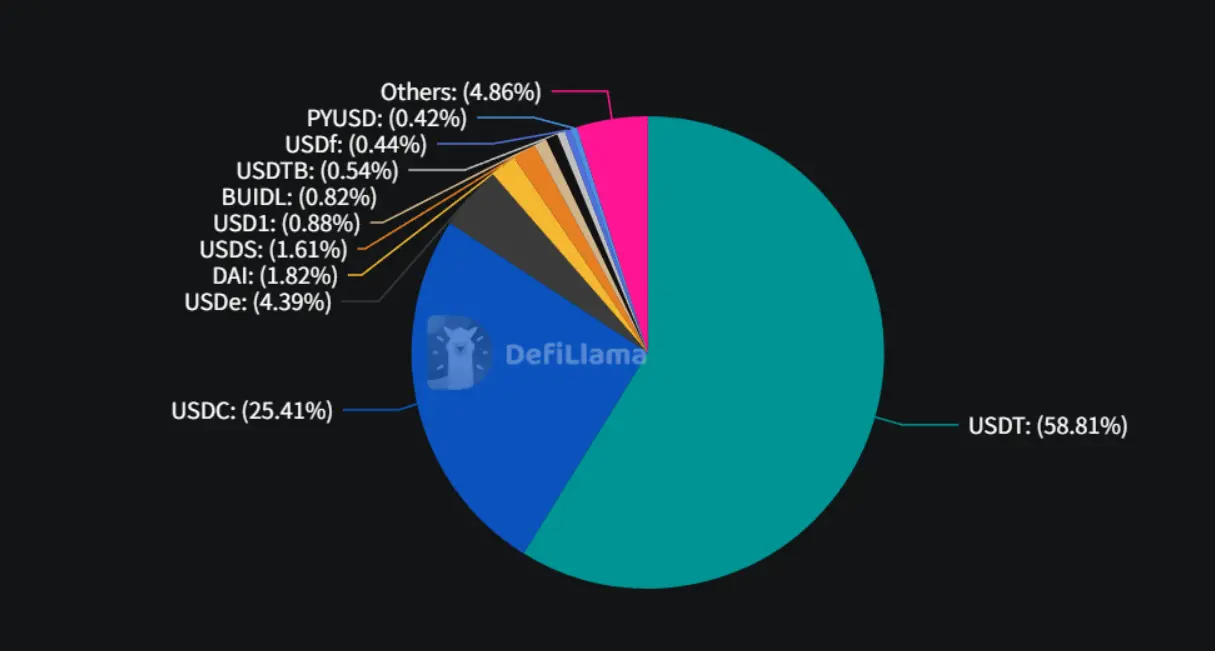

In the evolution of the cryptocurrency market, stablecoins have always been the most important infrastructure. From the earliest USDT to today's USDC, DAI, and the emerging USDe, stablecoins have become the core carriers of trading volume and liquidity. However, a trend that is accelerating is that stablecoin issuers are no longer satisfied with just being "tokens" but are starting to build their own public chains. To date, the three giants of stablecoins, Tether, the issuer of USDT, will support a Bitcoin sidechain called Plasma focused on stablecoin scenarios starting at the end of 2024, while in early June this year, it announced a new L1 chain called Stable supported by the unified liquidity protocol USDT0 from Bitfinex and USDT. Circle, which is conducting an IPD in the US stock market, also announced the development of Arc, designed specifically for stablecoin finance and programmable currency. The new stablecoin giant USDe, supported by its issuer Ethena, will also launch a testnet for Converge this fall.

Stablecoin Market Capitalization Distribution Chart (Source: DefiLlama)

Why Do Stablecoins Need Public Chains?

In the past, stablecoins mostly relied on Ethereum, Solana, and other mainstream public chains. This model seems to leverage the liquidity of an open ecosystem, but it also means a high dependence on the underlying technical rules and transaction fees. As the size of the cryptocurrency market continues to expand, stablecoin issuers are beginning to reassess this pattern: is there a need to have a completely controllable underlying infrastructure to further consolidate their market position?

From an overall industry development perspective, there are three core logics behind this trend:

Stablecoins Have Become Ecological Entrances: In the crypto world, stablecoins play the role of "digital dollars," and almost all on-chain activities rely on them. Buying Bitcoin requires USDT or USDC, and the liquidity pools for participating in DeFi mining are also denominated in stablecoins. Many people even use stablecoins as their daily digital wallets. The daily trading volume of stablecoins is often several times that of Bitcoin, making them the liquidity cornerstone of the entire crypto ecosystem. If stablecoin issuers also have their own public chains, it means they simultaneously control the "currency issuance rights" and "financial infrastructure," which will make their position even more unshakable.

Strategic Value of the Settlement Layer: Public chains are essentially huge "toll booths," where every transaction incurs a fee. Currently, transferring USDT on Ethereum incurs fees of several dollars or even tens of dollars, all of which go to Ethereum. With daily trading volumes of USDT reaching hundreds of billions of dollars, the fee income is astronomical. Tron (TRX) has become a top public chain largely because it offers nearly free USDT transfers, attracting a large number of users from Ethereum. If Tether had initially created its own public chain, these users and revenues would have been theirs. With their own public chain, stablecoin issuers can not only collect transaction fees but also provide cheaper transfer services, and more importantly, control pricing power—no longer "dependent on others," they can optimize network performance according to business needs.

Ecological Stickiness and Bargaining Power: In the crypto world, developers follow users wherever they go. Solana has attracted a large number of projects due to its low transaction fees and fast speeds, and users have flocked to it. If stablecoin issuers have their own public chains, they can actively attract developers to build ecosystems, such as providing specialized development tools, offering token incentives for new projects, or promising permanently low fees. Once a scale is formed, it will create a snowball effect, and stablecoin issuers will no longer just be "money printing factories" but platform-level enterprises. More importantly, their voice will be elevated—currently, Circle or Tether's cooperation with traditional banks is essentially "asking for favors," but if they have a thriving public chain ecosystem with millions of users and thousands of applications, their position at the negotiation table will be completely different, potentially even prompting traditional financial institutions to seek cooperation actively.

Directions and Differentiation of the Three Giants' Public Chains

Plasma: Ensuring Security with Bitcoin

A dedicated public chain for stablecoin payments. Plasma is a blockchain specifically designed for stablecoin payments, which can be understood as the "stablecoin version of Alipay." Its biggest feature is its deep integration with Bitcoin—users can directly use real Bitcoin to participate in smart contracts without needing to go through complex wrapped tokens. More conveniently, when transferring on Plasma, you can directly use USDT or Bitcoin to pay transaction fees, without needing to buy native tokens like on other public chains. The design philosophy of this chain is clear: to make stablecoin payments as simple as WeChat transfers. For teams looking to develop payment applications, they can directly utilize Plasma's infrastructure without having to build complex underlying systems from scratch. In simple terms, Plasma aims to solve the problem of making stablecoin payments faster, cheaper, and safer while lowering the usage threshold for ordinary users and developers, promoting the adoption of stablecoins in everyday payment scenarios.

Converge: Ingeniously Merging Traditional Finance and DeFi Applications

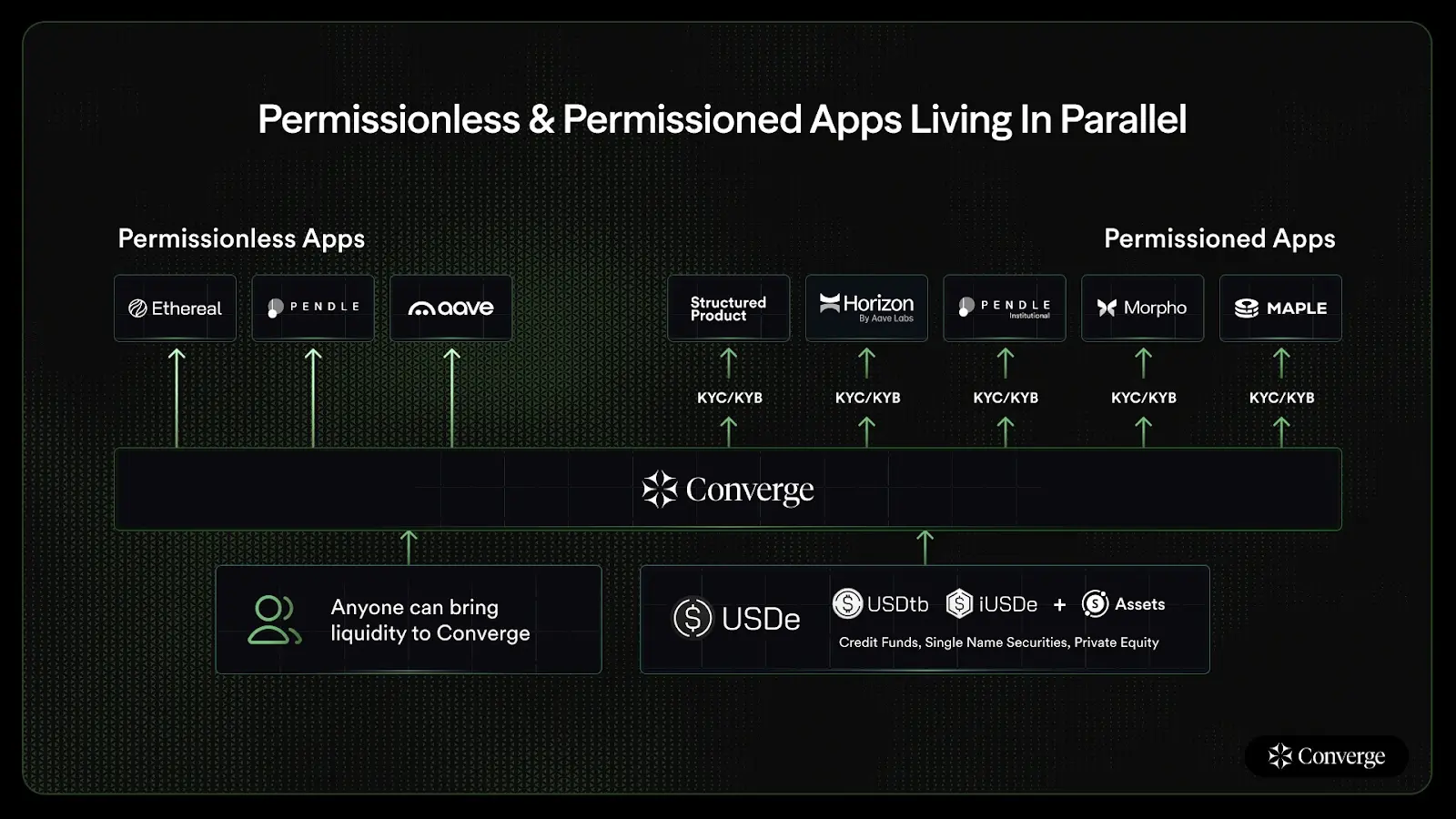

Converge is a very interesting blockchain, characterized by its "duality"—it can be a completely open DeFi paradise or a strictly compliant financial platform, allowing users to choose different modes as needed. Imagine a public chain where retail investors can freely participate in various DeFi mining and trading, while institutions like banks and funds can conduct regulated digital asset businesses at a compliance level, with both sides not interfering but benefiting from each other. In terms of fees, Converge supports direct payment of transaction fees using stablecoins like USDe and USDtb, making costs completely controllable. This design is particularly suitable for projects that want to serve both retail and institutional clients—retail users can enjoy high yields and innovative gameplay in DeFi, while institutional users can participate in digital asset investments while meeting compliance requirements. In simple terms, Converge aims to break down the barriers between traditional finance and DeFi, allowing the two worlds to coexist harmoniously and promote each other.

Stable: An L1 Created for Institutions Using USDT

Stable is a blockchain entirely built around USDT, specifically serving the transfer needs of hundreds of millions of USDT users worldwide. Its biggest innovation is making USDT the "lifeblood" of the network—users do not need to pay any transaction fees when transferring and do not need to prepare other tokens in advance; they can complete all operations directly with USDT, making it as simple as using a bank transfer. For privacy-conscious users, Stable also offers encrypted transfer features to ensure transaction information is not leaked. More importantly, it has designed a complete payment solution specifically for enterprises and institutions, including bulk transfers, merchant payments, and debit card integration, allowing businesses to use USDT for daily operations just like traditional banking systems. At the same time, Stable maintains good compatibility with other mainstream public chains, allowing users to easily transfer assets across different networks. In simple terms, Stable aims to make USDT truly the dollar of the digital world, not just a trading tool but a complete payment infrastructure.

Arc: Designed for Institutional Finance

A compliance bridge for institutional finance. Arc is a blockchain tailored by Circle for enterprises and financial institutions, which can be seen as the "Wall Street version of a stablecoin public chain." Its biggest advantage is its deep roots in traditional finance through Circle, giving Arc a natural compliance advantage that other public chains find hard to match. For enterprises, conducting business on Arc is like operating in a regulated financial environment, with controllable risks and compliance with regulatory requirements. Technically, Arc allows enterprises to pay all fees directly with USDC, making financial accounting simple and transparent, without the headache of complex token conversions. More importantly, Arc has designed various financial tools specifically for institutional needs, such as allowing enterprises to easily tokenize traditional assets like real estate and equity or build their own digital payment systems. For traditional enterprises that want to embrace blockchain but are concerned about compliance risks, Arc provides a relatively safe entry point.

Comparison of Features and Technical Parameters

From the introduction of the core concepts of each stablecoin public chain, it is clear that Ethena's Converge has significant differences from the other three. In terms of positioning, Plasma, Stable, and Arc define themselves as payment infrastructures, focusing on making stablecoin transfers simpler and cheaper, essentially using blockchain technology to transform traditional payment experiences. In contrast, Converge clearly positions itself as a DeFi innovation platform, which aligns with Ethena's own DNA. Unlike traditional stablecoins like USDC and USDT, which are backed by cash and government bonds, USDe maintains price stability through a delta-neutral strategy, making this innovative mechanism naturally more suitable for users deeply involved in DeFi or interested in on-chain financial innovations.

The more important differences lie in growth strategies and interpretations of "openness." Plasma emphasizes native Bitcoin integration, Stable pursues a zero-fee experience, and Arc relies on Circle's compliance advantages, all of which are optimizations within the existing framework. The first three mainly attract traditional users by lowering usage thresholds—no fees, simplified operations, compliance guarantees, etc., adopting a typical "first build a large user base" strategy. Converge, on the other hand, has chosen a completely different path: attracting crypto natives by providing higher yields and more innovative opportunities, and then expanding outward through an optional compliance layer, reflecting a "first create deep user value" growth philosophy. The most forward-looking innovation of Converge lies in its "optional permission" model. By default, the network is completely open, allowing anyone to freely bridge assets, deploy applications, and participate in DeFi activities, fully maintaining the innovative vitality of decentralized finance. However, when it comes to RWA tokenization or meeting KYC/KYB requirements, relevant applications can selectively enable the compliance layer. This design cleverly balances the open spirit of DeFi with the compliance needs of traditional finance, ensuring that innovation is not stifled by excessive regulation while also not deterring institutions due to complete laissez-faire. In simple terms, the other three chains are using new technology to do traditional things, while Converge is building infrastructure for the future financial ecosystem.

Converge Optional Permission Architecture (Source: Converge)

Challenges and Future Outlook

Stablecoin public chains need to support large-scale transfers, settlements, and payments, requiring extremely high stability and security. Any vulnerabilities or interruptions will undermine the trust foundation of stablecoins. At the same time, ecological cold starts are another major challenge; latecomers must rely on differentiated functions and incentive mechanisms to compete against the network effects of existing public chains like Ethereum and Solana. In the future, the integration of stablecoins and public chains will blur the boundaries between "currency" and "infrastructure," evolving from a single token into an ecological operating system. Projects that succeed in balancing compliance and openness are most likely to become bridges between traditional finance and crypto finance, occupying a key position in the global financial infrastructure competition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。