Author: Castle Labs

Compiled by: AididiaoJP, Foresight News

What is Resolv

Resolv is an over-collateralized yield-bearing stablecoin protocol that can mint USR and RLP. The stablecoin USR earns interest through a delta-neutral strategy; RLP is a liquidity token that earns leveraged returns by taking on the inherent risks of these strategies.

The earnings for USR and RLP users come from the liquidity staking yields generated by ETH liquidity staking tokens (LST) and the funding rates obtained from shorting ETH on centralized exchanges.

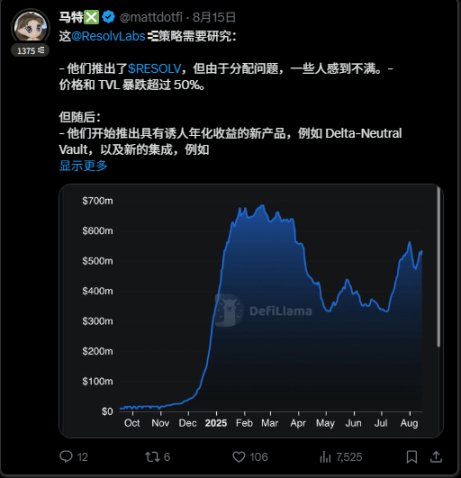

Resolv now has its own governance token RESOLV, which can be earned through staking rewards. The airdrop of this token did not receive much attention from the market, and many long positions were quickly liquidated, causing the TVL to drop by over 50% from its all-time high (ATH) within a few months.

Then the Resolv team began announcing new partnerships, strategies, and protocol integrations, as well as a fee switch (and token buybacks), leading to a rebound in price and TVL from recent lows.

Resolv's Buyback Plan

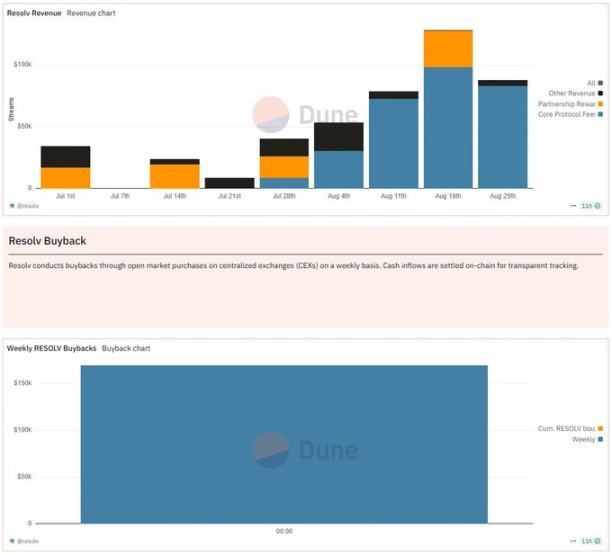

Last week, the Resolv Foundation launched a buyback plan for the RESOLV token, using the protocol's revenue for weekly buybacks.

But where does this revenue come from? The protocol earns 10% of the interest paid to the collateral pool, as well as incentives from external participants (such as EtherFi), thanks to the fee switch they enabled in July.

Currently, the project has generated over $22 million in interest for its depositors, and since the fee switch was enabled, the protocol has accumulated $226,000 in fees, of which 75% has been used for the buyback of RESOLV.

Benefits of the Plan

Buybacks are effective not only because they reduce the circulating supply, which can lead to an increase in token price, but also because of their significance to the community: the protocol is sacrificing a portion of the income that could have been earned by the team to support the project's token.

The tokens bought back will then be allocated to future plans to promote ecosystem development, effectively re-entering the economic system of the protocol.

Through buybacks, long-term support for its token is a reliable way to increase community member trust and plan for the token's future, thereby effectively retaining more supply in the long term.

Final Thoughts

Redirecting a small portion of revenue towards staking and buybacks is a necessary step to support a token that has yet to find its use case, as stakeholders currently cannot voice their opinions on the protocol's future.

While this move makes sense, I have some concerns about the execution of these buybacks. Weekly buybacks do not always align with market conditions (such as liquidity, trading volume, and spreads), and they may ultimately fill orders during price increases while providing limited support when needed.

On the other hand, there are ways to improve this, such as planning a strategy that uses market maker (limit) orders to support prices when necessary, such as during periodic downturns, prolonged stagnation, or low liquidity conditions that lead to price drops. Fluid and Raydium have already employed this strategy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。