Source: Coin Metrics; Compilation: Golden Finance

Key Points

Demand for Bitcoin Exposure: Continuous capital inflow into spot Bitcoin ETFs and the performance of digital asset treasury tools like "Strategy" highlight the demand from investors for exposure to Bitcoin (BTC). Although this may lead to concentration of holdings among a few institutions, such products have broadened investment channels for traditional investors.

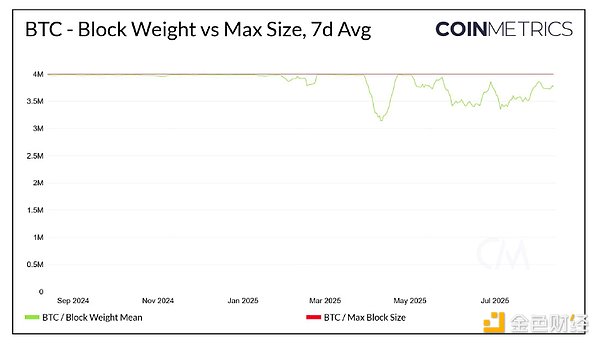

Lagging Activity: Despite Bitcoin's price reaching an all-time high, its blocks have not remained consistently full. This has allowed low-value transactions to be included in blocks, enhancing network accessibility, but it has also raised concerns about miners' profitability—limited transaction fee income undermines miners' motivation to maintain network security.

Expanding Use Cases for Bitcoin: Wrapped Bitcoin products and emerging native Bitcoin applications are creating new revenue opportunities for holders and driving network activity. However, since August 2024, transaction fees have remained low, never exceeding $150. In the long term, fee income needs to play a greater role in sustaining miner incentives and network security.

I. Introduction

The development of regulated Bitcoin investment tools and a series of supportive cryptocurrency legislations have led to a significant increase in Bitcoin prices. While investor security has improved, the sustainability of the underlying network has been overlooked. Without considering network activity, the long-term investment logic of Bitcoin is incomplete.

In September 2024, we released our first "Bitcoin Asset Analysis Report," emphasizing Bitcoin's increasingly scarce characteristics, its advantages in modern portfolio theory, and the rise of Bitcoin ETFs. Today, Bitcoin's price has surpassed $124,000, with ETF capital inflows on the rise. In this updated report, we will delve into the recent demand for Bitcoin exposure through ETFs and treasury companies, the impact of this demand on network activity, and emerging trends in the Bitcoin ecosystem for 2025 and beyond.

II. Factors Driving Bitcoin Attention

(1) Continuous Capital Inflow into U.S. Spot Bitcoin ETFs

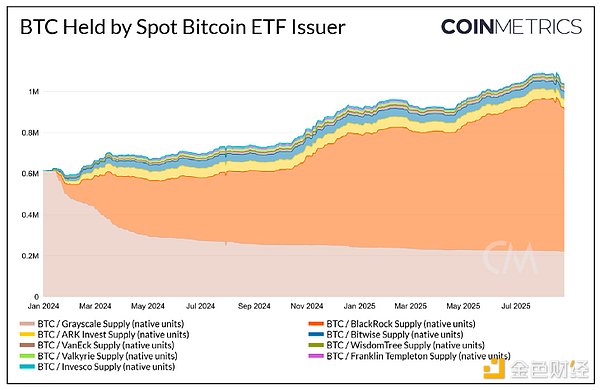

Since the approval of the U.S. spot Bitcoin ETF in January 2024, market attention has fluctuated. Currently, the total amount of Bitcoin held by Bitcoin ETFs has exceeded 1 million coins, accounting for over 5% of the current Bitcoin supply. As Bitcoin prices hit an all-time high, institutional investors and traditional portfolios are once again focusing on ETFs, eager to increase their Bitcoin exposure.

The increase in Bitcoin ETF capital inflows can be explained by the following factors:

Support from Modern Portfolio Theory: This theory posits that investing in Bitcoin helps enhance risk-adjusted returns. The low correlation of Bitcoin with gold and stocks can help diversify portfolios and hedge against market downturns.

Simplified Custody Process: Self-custody of Bitcoin requires significant resources for managing mnemonic phrases and securing multi-signature wallets, while ETFs avoid these custody complexities.

Convenient Access Channels: Investors can participate in ETF investments through traditional brokerage platforms without needing to access new cryptocurrency exchanges or engage in peer-to-peer trading, aligning with their existing investment habits.

(2) The Rise of Strategy: Leveraged Bitcoin Investment Tools

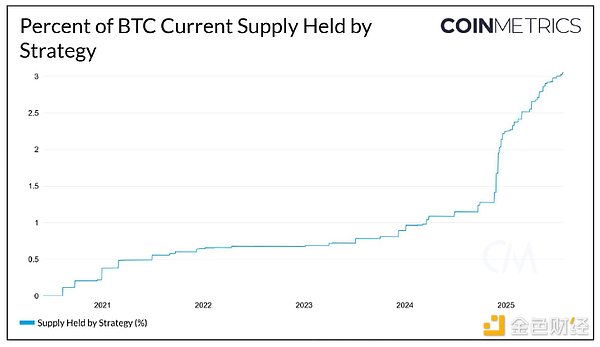

Investors seeking higher Bitcoin exposure have begun to focus on publicly traded companies that concentrate on building Bitcoin treasuries, with Strategy (NASDAQ: MSTR) being a representative example.

Compared to Bitcoin ETFs, the stock performance of Strategy is more volatile, thus offering investors higher potential returns. This is due to Strategy's model of recursively leveraging Bitcoin: the volatility of its stock allows it to continuously issue low-interest convertible bonds (experienced investors can hedge against these bonds) and use the raised funds to purchase Bitcoin. Strategy's core goal is to increase the number of Bitcoins corresponding to each share of common stock (i.e., "BTC yield"). Investors expect Strategy to continue increasing its Bitcoin holdings, which creates a premium in its stock price relative to its underlying treasury value.

Currently, Strategy holds over 628,000 Bitcoins, accounting for 3% of the current Bitcoin supply. For reference, this amount is only 100,000 coins less than the total Bitcoin held by BlackRock's Bitcoin ETF for millions of investors.

Currently, Strategy holds over 628,000 Bitcoins, accounting for 3% of the current Bitcoin supply. For reference, this amount is only 100,000 coins less than the total Bitcoin held by BlackRock's Bitcoin ETF for millions of investors.

Strategy employs the concept of "BTC risk" to measure the probability that the Bitcoin value supporting the issued bonds falls to the bond's face value. If Bitcoin prices decline over the long term, this risk, once realized, could weaken Strategy's future financing ability to purchase Bitcoin, potentially forcing it to sell off Bitcoin to meet debt obligations.

III. Is Network Activity Related to Bitcoin Demand?

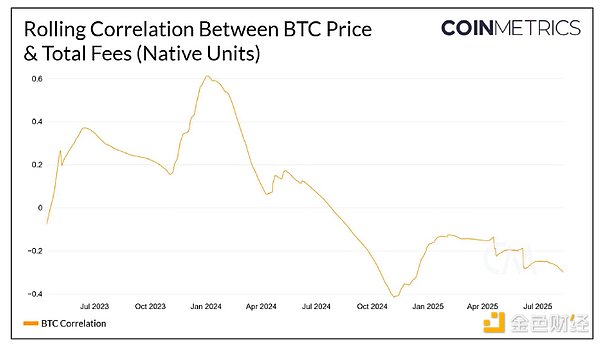

Just as a company's revenue determines its stock price value, transaction fees are also considered a key factor in determining token prices. Fees not only reflect network usage but are also the core return that incentivizes miners to maintain network security.

Passive holding of Bitcoin reduces network activity and fee income, thereby threatening network security. If miners cannot earn sufficient Bitcoin from block rewards and transaction fees, they may cease operations to avoid losses, leading to a concentration of hash power among a few operators. By analyzing changes in fee activity, we can clearly determine whether it is driving Bitcoin prices upward.

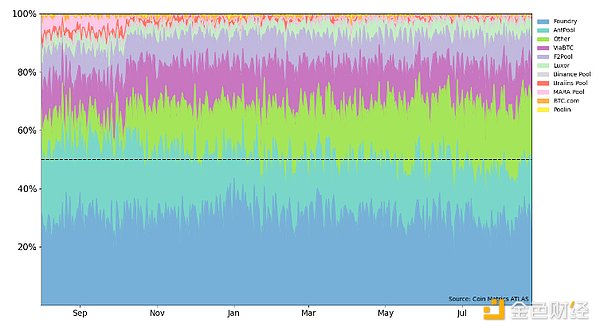

(1) Continued Dominance of Mining Pools

Since we released our first "Bitcoin Asset Analysis Report," the control pattern of leading mining pools over total hash power has remained stable. The U.S. mining pool Foundry controls about 30% of the hash power, followed by the Chinese pool Antpool, which accounts for 18%. Miners are continuously competing for hash power control and network dominance to maximize profits. The current block generation difficulty is at an all-time high, indicating that mining pools are still investing in new mining machines to maintain their position in the network.

Bitcoin Mining Pool Share Chart (August 2024 to Present)

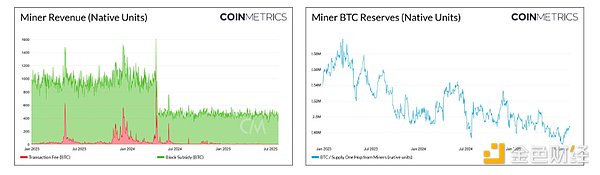

(2) Unsustainable Miner Income

Although mining pools dominate the network, individual miners' income is increasingly dependent on Bitcoin prices. After the fourth Bitcoin halving in April 2024, the proportion of transaction fees has continued to decline, currently accounting for less than 1% of miners' total income. The amount of Bitcoin held by individual miners has decreased, partly due to operational safety considerations and partly because they need to sell Bitcoin to cover operational costs.

Bitcoin is expected to undergo its fifth halving in 2028, at which point miners will only receive 1.5625 new Bitcoins per block. The significant drop in income may lead some miners to exit the market due to an inability to maintain profitability. The exit of miners poses a threat to Bitcoin's decentralization and network security.

In this context, the role of fee income in incentivizing miners to maintain network security and prevent hash power concentration will become increasingly important. To fill the income gap caused by the reduction in Bitcoin block rewards, two approaches are needed: one is a surge in network activity driving up fees, and the other is the development of new applications creating additional demand for block space.

IV. The Issue of Lagging Activity

Since January 2025, the availability of Bitcoin block space has significantly increased compared to the average level in 2024. Block weight is used to measure the scale of transactions included in a block—complex transactions have a higher weight and occupy more block space than simple transactions. Currently, as long as there is more transaction demand, blocks still have enough space to accommodate more transactions.

The sluggish demand for block space has led to low fees, allowing many fee-sensitive users to participate in network transactions. Although low fees enhance the inclusivity of value transfer in a censorship-resistant network, there is almost no correlation between the demand for Bitcoin assets and institutional investors' demand for block space.

Bitcoin is increasingly viewed as "digital gold" and a store of value. Its appeal does not stem from the fees generated by the network but from its ability to hedge against fiat currency inflation and serve as an alternative means of storing or transferring value.

V. Development of Bitcoin Use Cases in 2025

(1) Emerging Wrapped Bitcoin Alternatives

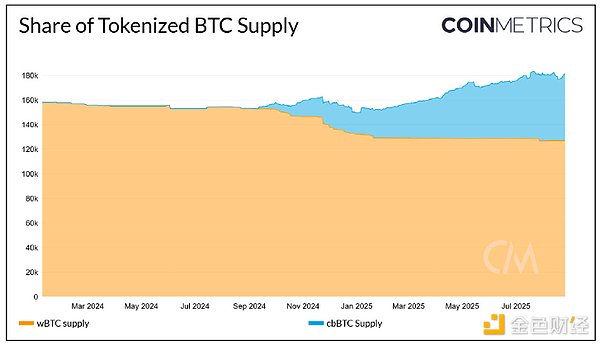

As BitGo adjusts its custody of Wrapped Bitcoin (wBTC), the supply of cbBTC launched by Coinbase has surged. Users can lock up Bitcoin to obtain tokens like cbBTC and wBTC that represent the underlying asset, seeking yield opportunities in other networks.

Although BitGo previously held a significant share of the tokenized Bitcoin market, its announcement in August 2024 to adjust its custody model in collaboration with BitGo Singapore Ltd. and BiTGlobal raised concerns about its reserve management. As a result, the supply of Bitcoin held by BitGo has stagnated, with wBTC supply stabilizing at around 127,000 coins, down from last year's total supply of 153,000 coins.

Meanwhile, since its launch in August 2024, the supply of cbBTC has grown to over 52,000 coins. Although BitGo still custodies the majority of Bitcoin for users, Coinbase is continuously capturing market share.

(2) Continuous Development of Native Bitcoin Applications

Developers are actively creating related applications to reduce users' reliance on custody and cross-chain bridges when using Bitcoin for yield. Holders can interact with these applications through native Bitcoin without needing to hold tokenized Bitcoin.

Babylon Genesis Chain provides security for external Proof of Stake (PoS) networks by incentivizing miners to stake Bitcoin with operators. By leveraging the Bitcoin network to verify state changes in the PoS network, it not only enhances the security of the PoS chain but also creates additional fee income for Bitcoin miners. Bitcoin stakers can retain ownership of their Bitcoin while earning rewards from PoS networks that require operator assistance to verify network status.

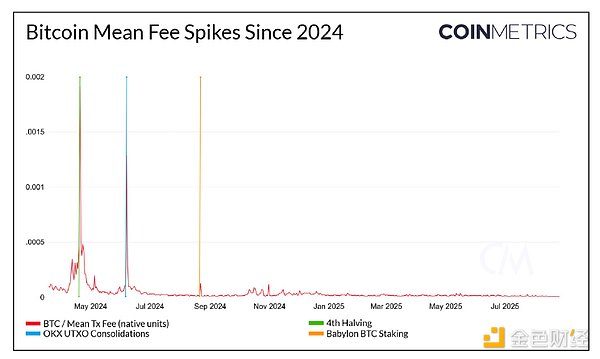

On August 22, 2024, when Babylon's staking service opened for deposits, the demand for block space surged significantly, and network transaction fees briefly exceeded $150, setting a new single-block fee record since the consolidation of unspent transaction outputs (UTXO) by OKX in June 2024. This phenomenon fully reflects the market's expectations for Babylon's staking service.

Since the launch of Babylon's staking service triggered the rise in transaction fees, the peak Bitcoin transaction fee has not exceeded $150 again. Unless new factors prompt users to rush to include transactions in the next block, the proportion of fees in miners' income will continue to remain at a low level. The instability of fee income forces miners to rely more on newly issued Bitcoin block rewards to maintain operations.

VI. Outlook

The growth in Bitcoin demand generated through ETFs and Digital Asset Treasuries (DATs) is the main reason for Bitcoin's strong performance recently. However, this demand has not translated into increased network activity.

The persistently low fee income casts uncertainty on the healthy outlook of the Bitcoin network. As the number of newly issued Bitcoins decreases, the importance of transaction fees in incentivizing miners to maintain network security will become increasingly prominent. If miners are forced to exit the network due to prolonged losses, the decentralization and censorship resistance of Bitcoin will be at risk, and its core value proposition will be lost.

The emergence of more native Bitcoin applications is expected to redirect fee income back to miners, rather than allowing related activities to flow to other blockchains. If Bitcoin is to match its high valuation, network activity and miner incentive mechanisms must be improved as soon as possible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。