本期看点

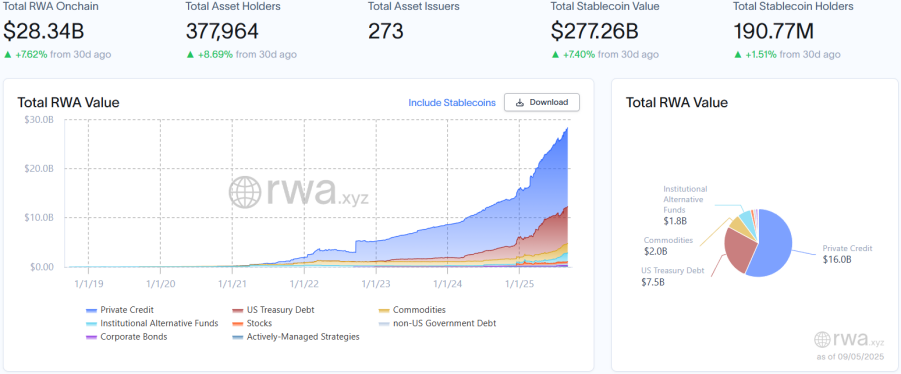

本期周刊统计周期覆盖2025年8月29日-9月4日。本周RWA市场延续强劲增长,链上总市值达283.40亿美元,持有者数量同步上升8.69%,中小投资者参与度持续提升;稳定币市场规模扩张至2772.60亿美元,但月活地址骤降22.10%,表明散户交易萎缩而机构大额结算主导市场。欧盟监管强调透明度与投资者权益保护的重要性,RWA生态正从金融资产向医疗领域渗透,机构参与深化及监管合规并行为核心趋势。

数据透视

RWA 赛道全景

RWA.xyz 最新数据披露,截至2025年9月5日,RWA 链上总市值为283.40亿美元,环比上月同期上升7.62%,保持稳健增长;资产持有者总数约37.80万,环比上月同期上涨8.69%,资产持有者增速高于RWA链上总市值增速,反映中小投资者参与度提升;资产发行方总数增至273家。

稳定币市场

稳定币总市值为2,772.60亿美元,环比上月同期增长7.40%;月度转账量为3.53万亿美元,环比上月同期上涨7.05%;月活地址总数骤降至3,182.00万,环比上月同期下滑22.10%;持有者总数约1.91亿,环比上月同期微增1.51%,两者形成尖锐背离,表明散户交易活性急剧萎缩而机构大额结算成为市场主导力量。头部稳定币为USDT、USDC及USDe,其中USDT市值环比上月同期微涨4.24%;USDC市值环比上月同期大涨12.36%;USDe市值则继续保持快速上涨趋势,环比上月同期增幅为30.81%。

监管消息

据Cryptoslate报道,欧洲证券和市场管理局(ESMA)执行董事Natasha Cazenave示,代币化股票作为一种新型数字资产,其价格与上市公司股价挂钩,但可能会让投资者产生虚假的所有权认知,进而削弱市场信心。Cazenave提醒称,目前在欧盟推广的许多代币化股票产品并未赋予投资者实际的股东权益,如投票权或股息分配权。她表示,由于这些资产在呈现方式上缺乏透明度,散户投资者可能会误以为自己持有公司股票,而实际上并非如此。

Cazenave强调,尽管代币化具备零散份额交易和全天候市场准入等特性,但所有权权益的缺失会带来“投资者误解的特定风险”。支持者认为,代币化能够通过降低成本和拓宽资产获取渠道(涵盖股票、债券到房地产等各类资产)来推动金融现代化。Cazenave承认这一潜力,但她指出,目前大多数现有项目规模有限、流动性不足,远未实现支持者所宣称的效率提升。

本土动态

新城发展发布公告,宣布将结合现有业务积累与 RWA 代币化技术,推动相关 RWA 应用之战略布局。此外,将于 8 月 29 日在香港成立新城发展数字资产研究院,该研究院设立旨在统筹推进集团 RWA 代币化等关键工作。

美年健康:全资子公司与国富量子、京北方签署数字资产业务合作框架协议书

据智通财经报道,日前,美年大健康产业控股股份有限公司全资子公司美年大健康产业有限公司与国富量子创新有限公司、京北方信息技术股份有限公司签署《数字资产业务合作框架协议书》,三方将依托各自资源禀赋,在数字资产RWA领域开展全方位业务探索与合作,探索健康医疗领域设备、数据资产价值释放新范式,助力大健康产业的升级与创新发展。

A股上市公司三未信安正积极布局Web3.0应用场景,聚焦RWA与稳定币

三未信安在互动平台表示,公司在区块链安全领域拥有多年技术积累,牵头制定国内首个区块链密码行业标准《区块链密码应用技术要求》。其研发的区块链密码机已通过国家商密认证,并应用于多个区块链基础设施项目中。

此外,公司符合国际认证的FIPS HSM可提供安全的数字资产托管服务,硬件钱包产品已应用于数字货币交易所。作为香港Web3.0标准化协会副理事长单位,三未信安正积极参与稳定币和RWA等Web3.0应用场景的标准制定,并在RWA数据上链、冷热钱包及资产托管环节提供产品与解决方案。

福田投控宣布在香港通过以太坊公链成功发行全球首单RWA公募上市数字债券,债券规模5亿元人民币,期限2年,票面利率2.62%,Token名称为FTID TOKEN 001(福币),惠誉评级为A-。

据云锋金融公告,云锋金融与蚂蚁数字科技(蚂蚁数科)签署战略合作协议,并对专注机构级RWA应用的Layer1公链Pharos进行战略投资。双方将在合规前提下,依托Pharos高性能公链,拓展现实世界资产(RWA)代币化及Web3相关领域,推动区块链与现有金融业务融合。蚂蚁数科与Pharos均为云锋金融独立第三方。

据The Block报道,总部位于香港的复星财富控股(Fosun Wealth Holdings)已推出在港交所上市的以色列公司Sisram Medical的代币化股票,这些股票市值约3.28亿美元,已通过Vaulta、Solana、以太坊和Sonic平台发行。该公司表示,该计划利用了Vaulta的“银行操作系统(Banking OS)”,并将Solana纳入其技术架构中,用于股票的发行与结算。Sisram Medical是一家以色列医疗科技公司,股票代码为1696.HK,是该计划纳入的首只股票。复星还计划未来对更多公司债券和股票进行代币化处理,但尚未明确具体涉及哪些公司及时间表。

项目进展

Kraken与Backed合作将xStocks上线以太坊,Moonshot宣布上线xStocks代币化股票

据CoinDesk报道,Kraken与瑞士机构Backed宣布将旗下代币化股票产品xStocks上线以太坊主网,用户可通过ERC-20代币形式在以太坊链上存取xStocks,并实现与DeFi协议的互通。xStocks此前已在Solana、BNB Chain及TRON上线,累计交易量达35亿美元。

据官方消息,Moonshot宣布上线xStocks代币化股票,用户已可通过xStocks参与传统市场和交易资产(例如 NVDAx、COINx和TSLAx)。该服务在部分国家/地区提供,目前不适用于美国用户。

MyStonks 与 Paimon Finance 达成战略合作,将协作共建 RWA 生态

去中心化 RWA 交易平台 MyStonks 与 RWA 协议 Paimon Finance 达成战略合作,双方将在 RWA 生态建设与应用探索上展开多方位协作,同时 Paimon 即将上线新产品 Stockpad,计划支持用户以折扣价在链上购买代币化股票。

据悉,MyStonks 已上线 180+ 美股代币,累计交易量突破 12.5 亿美元,用户数接近 4 万;Paimon Finance 专注将高潜力资产代币化,此前相继入选 BNB Chain MVB 第八季加速器计划、YZi Labs 孵化计划。

Galaxy Digital宣布在Solana链上实现股权代币化

据The Block报道,纳斯达克上市公司Galaxy Digital与Superstate合作,将其SEC注册股票GLXY在Solana区块链上进行代币化。持股人可通过Superstate的Opening Bell平台将GLXY股票代币化并在DeFi平台转让,限已通过KYC的投资者参与。Superstate称,这是首例纳斯达克上市公司股票在公链上直接发行和交易。

据The Block报道,Ondo Finance及Ondo Foundation已在Ethereum链上推出超过100种美股和ETF通证,24小时可链上交易。Ondo Global Markets平台面向亚太、欧洲、非洲及拉美合格用户开放,年底计划扩展至1000种资产,并将支持BNB Chain和Solana。平台支持资产铸造、赎回及链上转账,合作方包括OKX Wallet、Bitget Wallet、Gate等,Chainlink提供价格预言机。

RWA商业借贷协议Kasu从XDC Network获得100万美元战略投资

据官方消息,RWA商业借贷协议Kasu宣布从XDC Network获得100万美元战略投资。

据介绍,Kasu是一个信贷基础设施平台,连接DeFi资本与经过审核的现实世界信贷机会。在机构贷方的支持下,并与合规的RWA协议集成,Kasu通过智能合约和结构化分层为存款人提供收益生成的信贷市场访问。

洞察集锦

深挖RWA技术细节,为什么ERC-3643是最合适的代币标准?

PANews概述:ERC-3643被誉为最适合RWA代币化的标准,因为它巧妙地在区块链的效率和传统金融的合规之间取得了平衡。它通过内置的链上身份验证系统(ONCHAINID),确保只有完成KYC/AML的合格投资者才能持有和交易代币,从而自动、实时地执行监管规则。这不仅大幅降低了发行和长期合规的成本,还能应用于股票、债券、房地产乃至碳信用等多种资产,为传统资产上链并提供全球流动性铺平了道路,因此得到了像美国SEC在内的监管机构的高度关注和认可。

PANews概述:蚂蚁数科与国泰君安的合作是一次雄心勃勃的尝试,旨在通过区块链技术将传统金融资产代币化并跨链至以太坊,以提升效率、吸引全球资本并探索新业务。然而,这个看似美好的愿景背后充满了巨大挑战:技术上依赖中心化的跨链桥,存在安全风险;商业上成本高昂,难以大规模推广;最关键的是,它游走在中国严格的数据主权、资本管制与香港及全球监管规则之间的模糊地带,面临巨大的政策不确定性。因此,这并非一次成熟的革命,而是一次在多重矛盾中寻求平衡的、脆弱且高风险的战略实验,其最终成败高度依赖监管机构的最终定义和认可。

Ondo叩响新大门,股票代币化是“旧酒新瓶”还是金融市场的下一场革命?

PANews概述:股票代币化是通过区块链技术将传统股票转化为数字代币,旨在提升交易效率、降低跨境投资门槛,并打通传统金融与加密世界的连接。Ondo Finance凭借其持有的美国三大金融牌照(转让代理TA、经纪自营商BD、另类交易系统ATS),构建了合规框架下的全流程服务,试图在监管严苛的环境中推动这一创新。尽管前景广阔,但股票代币化仍面临流动性、合规性和市场接受度等挑战。它究竟是金融市场的下一场革命,还是仅仅是“旧酒新瓶”,仍有待时间和市场的检验。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。