The tokenization of stocks depicts a future landscape where traditional finance and the digital world are deeply integrated.

Written by: Lacie Zhang, Researcher at Bitget Wallet

On September 3, 2025, Ondo Finance officially launched its stock tokenization platform "Ondo Global Markets," with over 100 tokenized stocks going live in the first batch, and plans to expand to 1,000 by the end of the year. This move not only represents a solid step in Ondo's strategic layout but is also widely regarded in the industry as a key validation of the transition of stock tokenization from theory to large-scale practice.

As the century-old trading rules of Wall Street confront the trustless technology of blockchain, a profound transformation regarding efficiency, liquidity, and compliance is brewing. In this article, the Bitget Wallet Research Institute will return to fundamentals, systematically sorting and presenting the current stock tokenization market from three core dimensions: value logic, realization path, and compliance framework.

The Imagination of a Trillion-Dollar Market: Analyzing the Value Logic Behind Stock Tokenization

Stock tokenization is not a new concept, but the potential it embodies is sufficient to reshape the existing financial landscape. Currently, the total market value of all tokenized stocks is less than $400 million, which pales in comparison to NVIDIA's single stock value of over $40 trillion. This enormous contrast reveals both the early-stage challenges of the sector and its unparalleled growth potential, with its core value primarily reflected in three aspects.

First, it aims to disruptively optimize the traditional trading and settlement system. The current mainstream "T+N" delayed settlement mechanism is a significant bottleneck for capital market efficiency, meaning that investors' funds remain frozen for one to two days after a trade is completed. This ineffective occupation not only limits the reinvestment capacity of capital but also generates counterparty risk during the settlement process. Stock tokenization, through "atomic settlement," allows for the simultaneous transfer of asset ownership and payment of funds. This model not only supports a global trading market that operates around the clock but also liberates a significant amount of capital tied up in the clearing process, bringing a qualitative leap in the overall market's circulation efficiency.

Second, stock tokenization helps dismantle the complex barriers of traditional cross-border investment. In the traditional model, a cross-border securities investment must penetrate a network of intermediaries composed of custodians, clearinghouses, and brokers, with each step adding both time and money costs. Tokenization technology offers a new approach, allowing compliance logic such as Know Your Customer (KYC) and Anti-Money Laundering (AML) to be directly programmed into the asset protocol layer. This effectively endows the asset itself with the ability for "compliance self-check," significantly reducing the need for trust intermediaries and manual review processes in the transaction flow, paving the way for a flatter, more efficient, and lower-cost global capital market.

Finally, from a more macro perspective, its ultimate value lies in serving as a key bridge between the two parallel worlds of traditional finance (TradFi) and decentralized finance (DeFi). On one hand, it provides a low-threshold "on-chain" channel for the vast traditional capital accustomed to existing investment targets, allowing them to enjoy the efficiency dividends brought by blockchain technology without diving into entirely unfamiliar DeFi protocols. On the other hand, it injects much-needed stability and value support into the crypto ecosystem that originated in the digital world. These blue-chip assets, which possess real profitability and strong fundamental support, can effectively hedge against the inherent high volatility of the crypto market while injecting new robust collateral into on-chain DeFi. This bidirectional value empowerment positions it to become a core pillar of the future new financial system.

Three Different Paths, One Common Destination: Decoding the Realization Path of Stock Tokenization

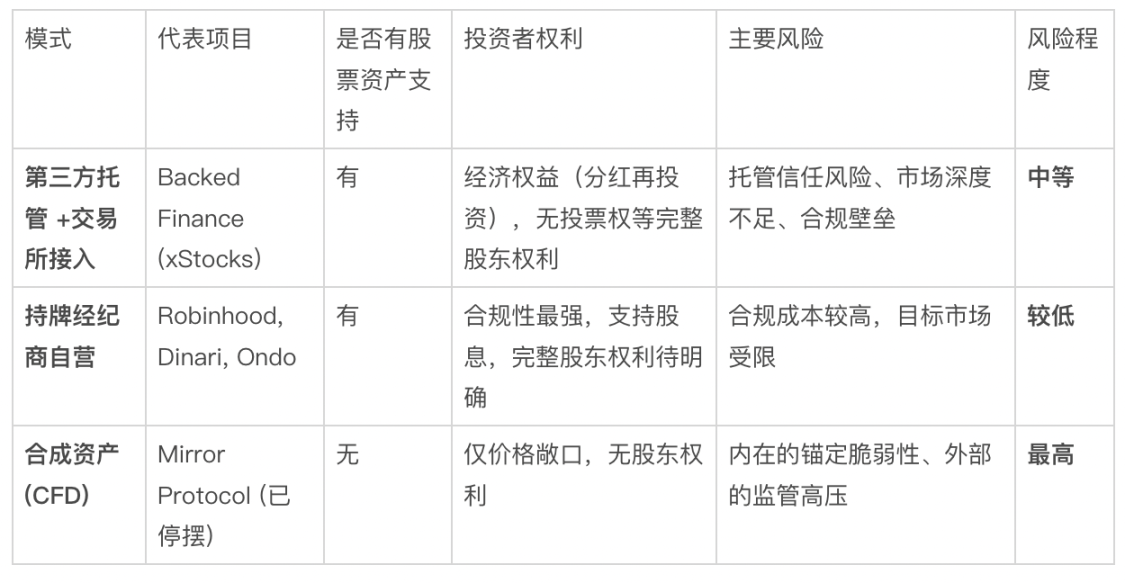

Despite the broad prospects, how to safely and compliantly map stock rights from the real world onto the blockchain has always been the core exploration of the industry. Currently, the mainstream issuance models in the market can be roughly categorized into three types, which differ significantly in asset support, investor rights, and risk levels.

Overview of Three Issuance Models

The first path is the "third-party custody and external channel" model. A typical example is Backed Finance's xStocks series, which operates by establishing an independent legal entity (SPV) to hold real stocks, with third-party institutions providing off-chain asset custody and auditing, ultimately reaching users through mainstream exchanges. The trust foundation of this model lies in the credibility of the custodian and the transparency of the assets, but investors typically receive economic rights linked to the underlying assets rather than full legal shareholder status.

The second path is the "licensed institution self-operated" model, regarded as the most rigorous route in terms of compliance. Its essence lies in entities holding the appropriate securities licenses personally creating a vertically integrated system covering the entire process from asset issuance, trading matching to clearing and settlement. Institutions such as Robinhood, Ondo Finance, and Dinari are all positioned along this path. This model has the highest legal and technical barriers but correspondingly provides investors with the highest level of legal protection.

The third path is the "synthetic derivatives" model, which carries the greatest risk exposure. A once-active but now dormant example is Mirror Protocol, which does not issue tokenized stocks but rather financial derivative instruments that simulate stock price performance, lacking real stocks as 1:1 value support. Users only gain risk returns from price fluctuations and do not possess any shareholder qualifications. Due to the absence of physical asset anchoring, such platforms face dual pressures of asset decoupling and compliance.

It is worth noting that these models are not distinctly separate in practice but exhibit a trend of dynamic evolution. Licensed issuers often combine third-party custody and exchange access strategies to enhance liquidity; meanwhile, unlicensed project parties actively seek licenses to align with compliant self-operated models. This reflects a clear industry consensus: compliance is the only ticket to the future.

Holding the "Trump Card": Why Compliance is the Ultimate Moat for Ondo

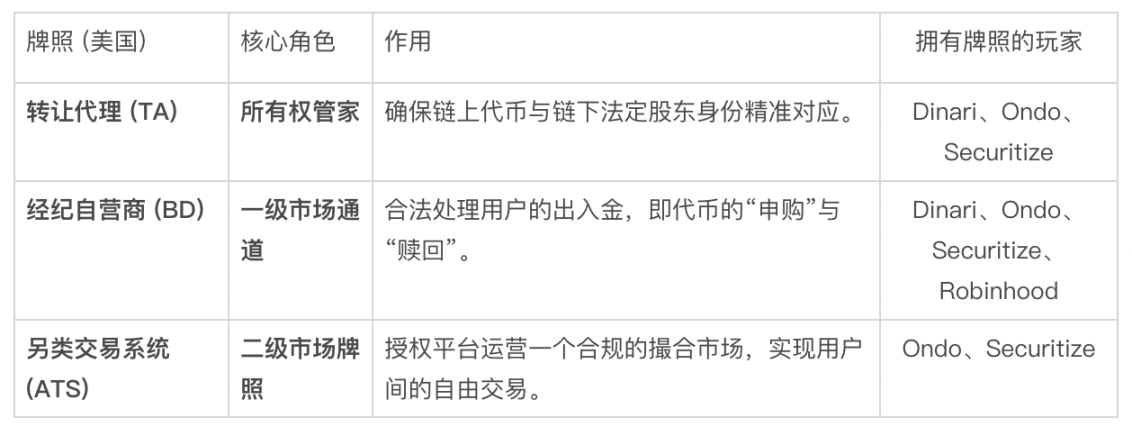

Among the aforementioned exploration paths, Ondo Finance's choice is particularly prominent. As a leading player in the tokenization market, its core strategy targets the highest barrier in the industry—creating a fully compliant stock tokenization system within the stringent regulatory framework of the United States. To achieve this goal, holding three key financial licenses is a prerequisite, and Ondo is one of the few institutions in the market that has crossed this threshold.

Overview of the Three Major Compliance Licenses in the U.S.

The first license is the Transfer Agent (TA). Its core function is to serve as the official "shareholder registry custodian" for the issuer, accurately recording the ownership of securities. In the tokenization business, the TA is the cornerstone that ensures the precise mapping of on-chain digital certificates to off-chain legal rights, forming the trust foundation of the entire compliance system.

The second license is the Broker-Dealer (BD). This is the passport for engaging in all securities business. In the tokenization scenario, whether users purchase tokens with fiat currency (minting) or sell tokens to retrieve funds (redemption), the underlying stock transactions must be executed by entities holding BD licenses. It is the core compliance hub connecting investors to the primary market.

The third license, which is the most difficult to obtain, is the Alternative Trading System (ATS). It authorizes entities to operate a regulated secondary market trading platform. Without an ATS license, a platform can only handle issuance and redemption, and users cannot engage in legal peer-to-peer trading. Therefore, the ATS is the key to unlocking the true liquidity of tokenized stocks and is the ultimate solution to the industry's long-standing liquidity dilemma.

By strategically acquiring all three types of licenses, Ondo has built a powerful business closed loop. This not only distinguishes it from competitors relying on European regulatory frameworks or holding only a single license but also means it has the potential to provide investors with a full-process compliance service from primary market subscription to secondary market trading in the U.S. This "moat" constructed by licenses is Ondo's core competitive advantage.

Conclusion: Innovation or "Old Wine in New Bottles"?

The tokenization of stocks paints a picture of a future where traditional finance and the digital world are deeply integrated—a global value network that transcends time zones, enables instant settlement, and offers infinite possibilities. What it may leverage is the digital migration of hundreds of billions of dollars in traditional assets and a complete reshaping of the global capital landscape. However, the collision of the two ecosystems brings not only the sparks of an efficiency revolution but also intense friction with regulatory rules and investment culture.

Ondo Finance's compliance-first approach appears to be a directional exploration at this uncertain intersection. Can it leverage its strong licensing advantages to carve out a path for the market within the stringent regulatory framework and truly attract incremental capital from both worlds? Will this grand financial innovation ultimately give rise to a new efficient market, or will it become yet another story of "old wine in new bottles" due to "incompatibility"? The answer will depend on the ongoing game of market pioneers and the final judgment of time.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。