Pyth Network is transitioning from DeFi data infrastructure into its second phase of development, aiming to reconstruct the $50 billion market data industry by launching institutional-grade subscription services, becoming the "source of truth" for financial data.

Since its establishment in 2021, Pyth has been redefining the infrastructure and distribution of financial market data. Its goal has always been to become the "source of truth" for financial data. Today, Pyth is entering its second phase: planning to launch products for institutions, expand token use cases, and integrate more deeply with traditional finance (TradFi).

The original intention of Pyth was to bring "the price of everything" to "everywhere"—a concept that seems simple but has historically been difficult to achieve. The internet has democratized content access: CDs have been replaced by streaming, and local media has been replaced by global applications; however, this paradigm shift has yet to truly occur in the financial data infrastructure sector.

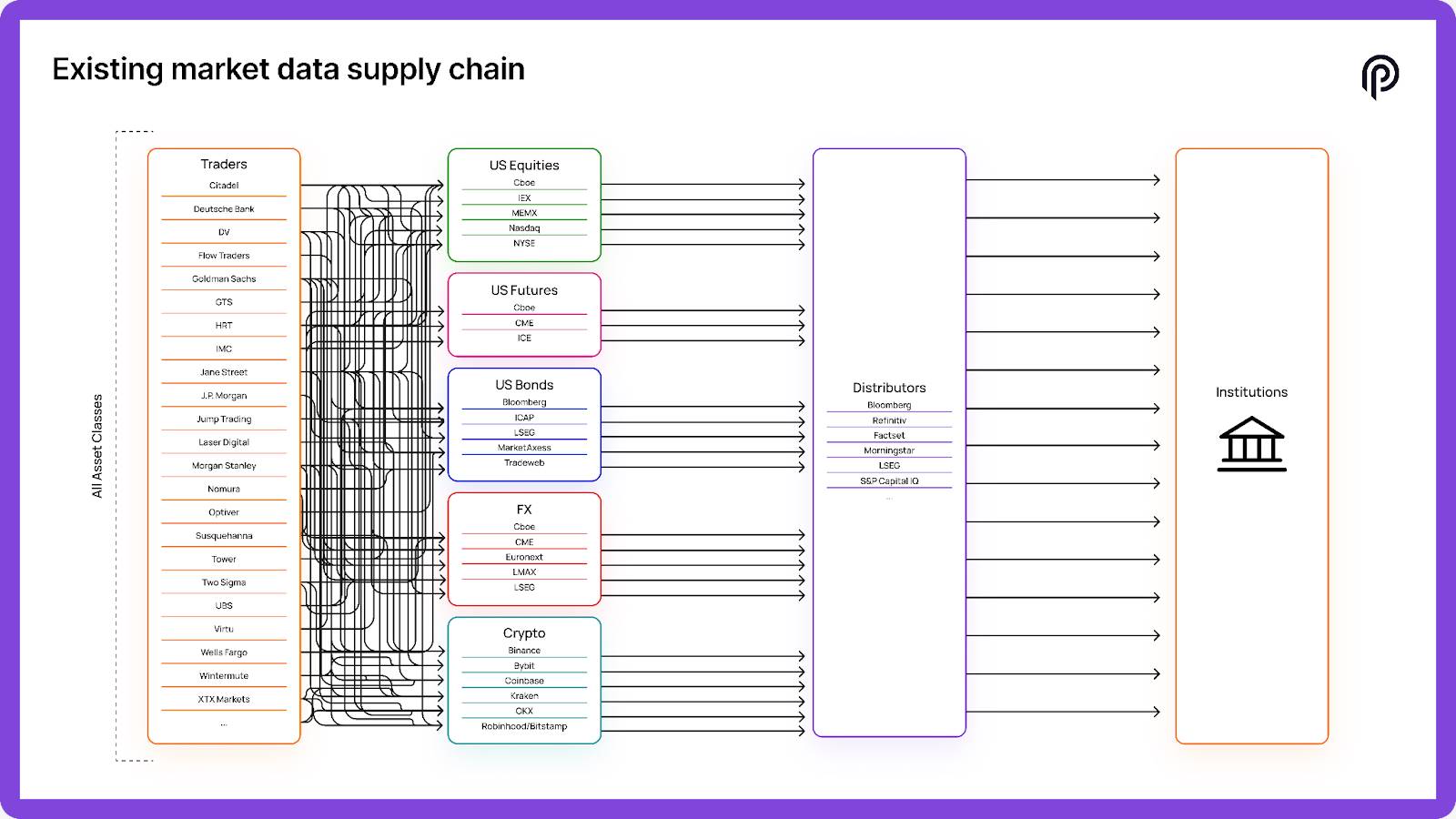

Current institutions are still constrained by legacy systems, forced to pay billions of dollars annually to intermediaries like Bloomberg and Refinitiv. These aggregators obtain data from various exchanges—exchanges that themselves present an island-like structure in terms of geography, asset classes, and trading venues, leading to fragmented data. The result is that, even though other fields have widely digitized, the market data ecosystem remains conservative and fragmented.

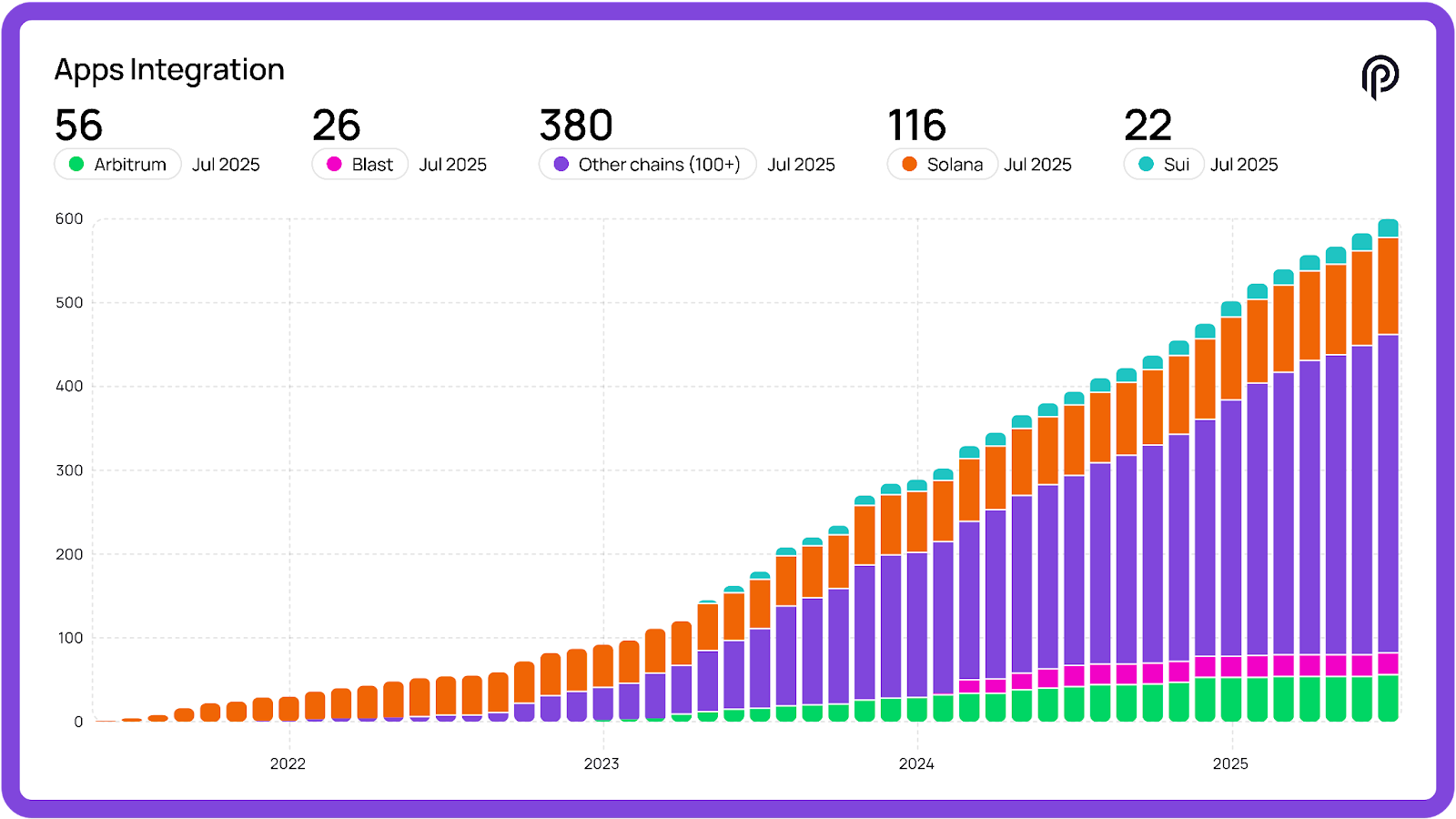

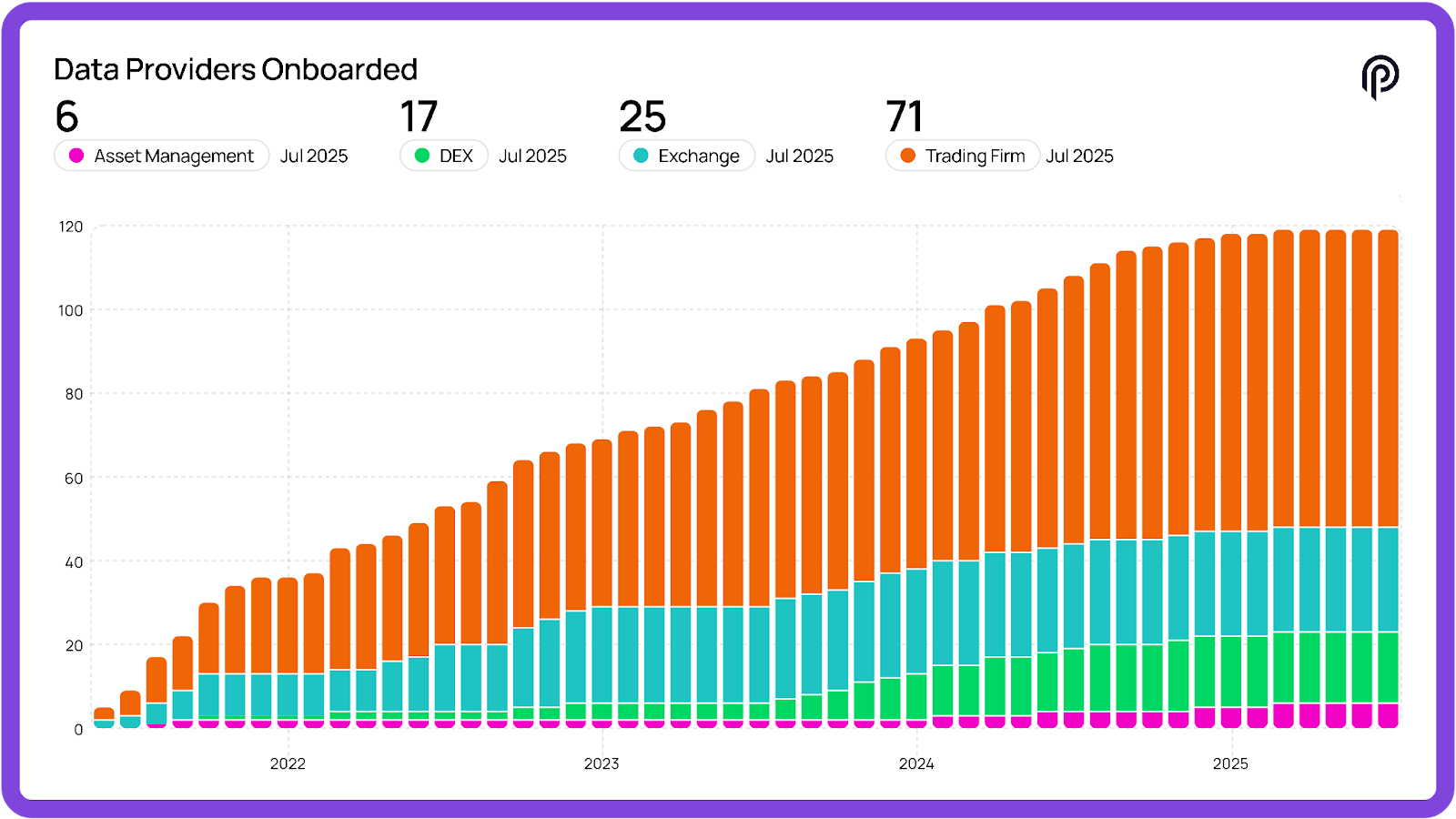

Pyth adopts blockchain technology to build the "source of truth" because existing systems cannot provide trustworthy data in a permissionless environment. Initially, Pyth was merely aggregating data between a group of trading firms and exchanges, but it has now evolved into hundreds of institutions publishing their proprietary market data onto the same network. Cumulative trading volume has exceeded $1.6 trillion, holding over 60% market share in the DeFi derivatives space, completing over 600 integrations, and establishing cooperation with the U.S. Department of Commerce. Pyth's distribution coverage has placed it among the most influential protocols.

More importantly, Pyth has become the world's most robust and valuable institutional-grade market data repository.

Phase 1 validated product-market fit within the DeFi ecosystem and laid the foundation for Phase 2 by creating a new market data economic model. The proposed next phase focuses on: expanding DAO revenue, exploring adjacent markets, and enhancing the overall value accumulation of the Pyth network.

What is the most intuitive proof of its value proposition?—an increasing number of on-chain and off-chain applications are actively seeking to pay for Pyth data, as Pyth reshapes the market data supply chain.

Crucially, institutions are actively seeking Pyth data; we have entered the final stage of new product development, which could redefine the market data landscape of the entire financial industry.

Institutions spend approximately $5 billion annually on "all required market data." From pricing billions of dollars in trades to driving trading floor displays, market data is the fuel for institutional financial operations. However, the current model is slow, expensive, and extremely fragmented. If Pyth can capture just 1% of this, it would mean $500 million in annual recurring revenue (ARR). But Pyth's goal is not just this $500 million; it aims to win this market and bring sustainable value to the entire network.

Phase 1: Building Infrastructure, Dominating DeFi, Establishing the Most Valuable Data Source

Pyth's first chapter focused on one goal: to build and expand verifiable, distributable institutional-grade data on-chain infrastructure.

The contributor team is steadily achieving this mission, and the data itself is compelling. With over 60% market share in DeFi derivatives and a cumulative trading volume of $1.6 trillion, Pyth is in an optimal position: as more real-world assets (RWA) are tokenized, it will capture exponential growth and value accumulation. Our envisioned future: all data, including economic data from the U.S. Department of Commerce, is verified through the Pyth Network and published to every blockchain. This part of the business model will continue to thrive and reinforce its positioning as the "on-chain source of truth" for data.

As time progresses, when data is transmitted to various smart contracts in the form of proof-backed secured messages, on-chain fees will gradually increase. Earlier this year, the DAO approved a gradual increase in verification fees across dozens of blockchain networks, a process that will continue with more data access. Pyth's adoption speed will accelerate with the following drivers: accessing more blockchains, entering new markets, enhancing trust parameters, and the upcoming trend of "mass tokenization." We expect more data to continue going on-chain, most of which will utilize Pyth for verification and distribution.

So far, Pyth has achieved the following milestones:

Integrated 600+ protocols, covering 100+ blockchains

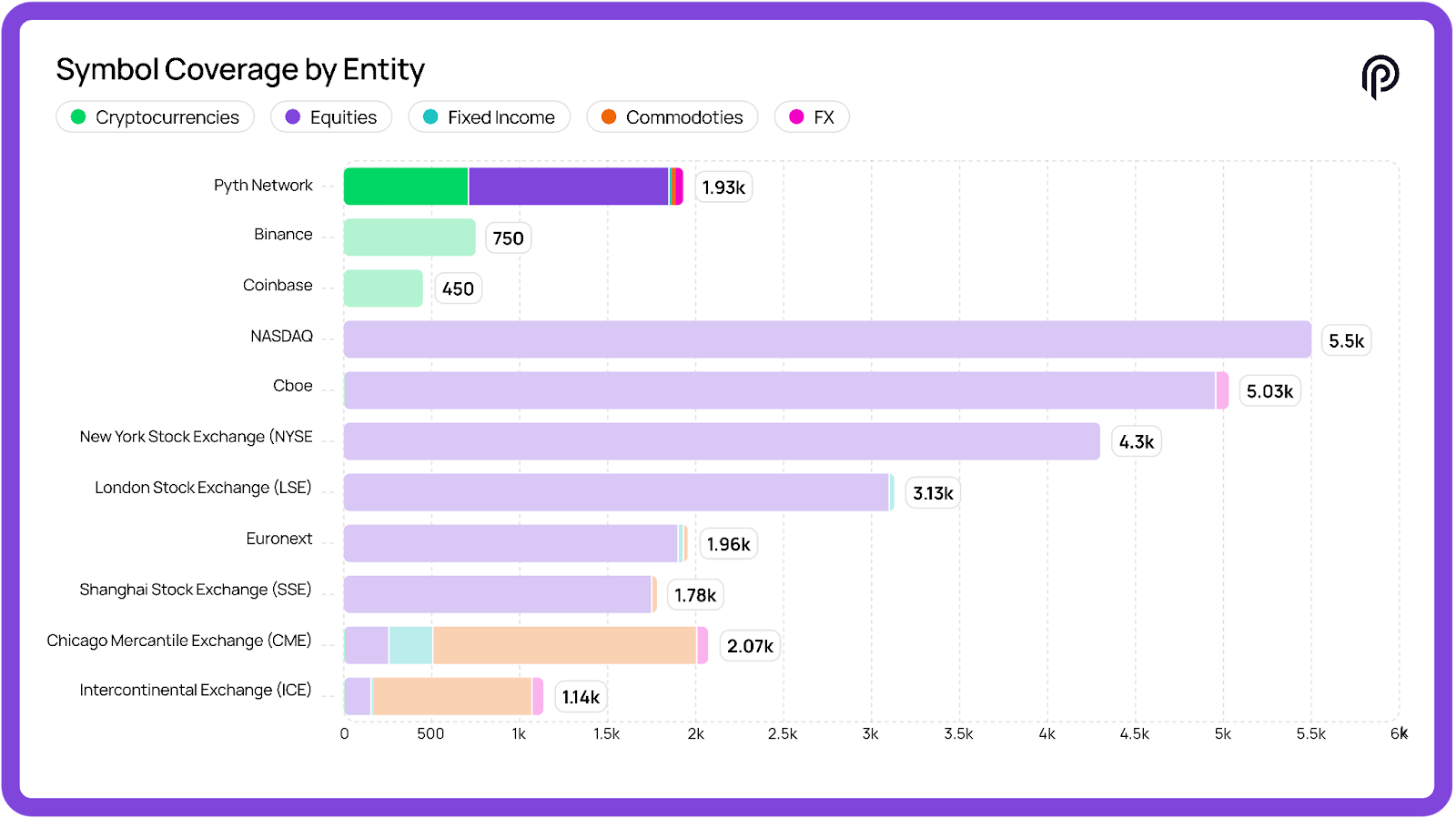

Provided 1,800+ price feeds, of which 900+ are real-world assets

Became the leading oracle by trading volume across major blockchain ecosystems

Pyth's differentiated advantages:

Proprietary data from top global trading firms and exchanges: DRW, Jump, Jane Street, Optiver, HRT, SIG, IMC, Virtu, GTS, Flow, Cboe, LMAX, MEMX, MIAX, IEX, etc.

Cross-asset coverage: crypto assets, stocks, forex, commodities, interest rates—delivered through a unified network

Global perspective: breaking down geographic data silos, unifying multi-regional quotes

Millisecond-level updates: meeting the demands of high-performance trading environments

Selected by the U.S. Department of Commerce for on-chain verification and distribution of U.S. economic data

Phase 1 proved that the product is effective at scale. Now entering Phase 2: redefining the market data economy and becoming the "source of truth" across the financial industry.

Phase 2: Unlocking $50 Billion Market Opportunities

Pyth is now ready to enter Phase 2, starting with: monetizing the first "market data network built by institutions, for institutions."

The global market data industry exceeds $50 billion annually, dominated by a few traditional giants that:

Have raised prices by over 50% in the past three years

Charge some clients up to five times more for the same product

Artificially fragment access paths by geography and asset class

Set barriers for new entrants in the professional financial services space

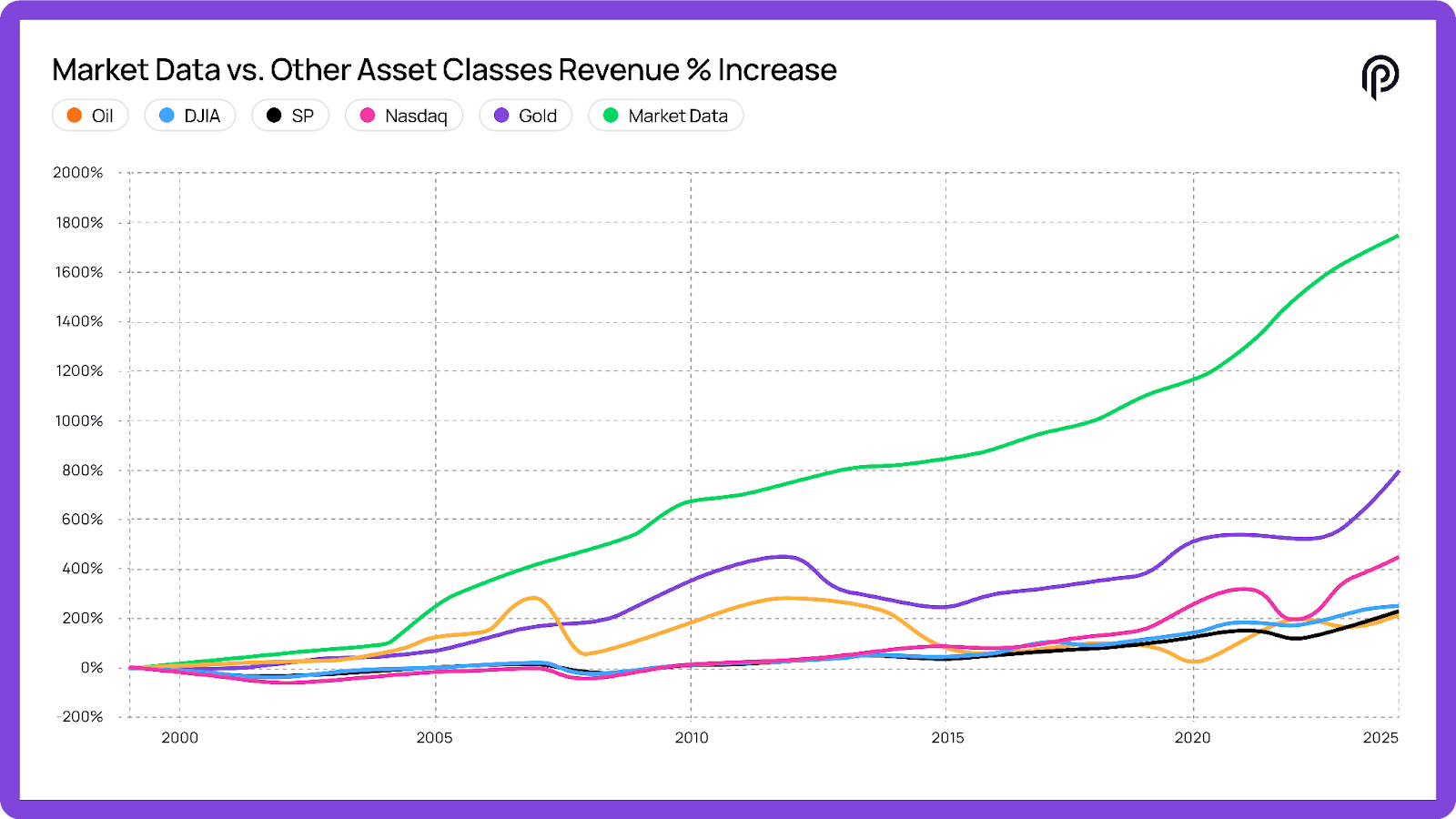

The increase in market data costs over the past 25 years has far outpaced other major asset classes.

The field has matured to a point where it can be "reconstructed"; companies responsible for pricing and driving market operations globally are collaborating with Pyth to build solutions. Here are their pain points:

Exchanges can only see their own order books (market slices), often limited to one region or asset class

Proprietary data streams sold by exchanges ignore transactions from other venues, creating blind spots

Data giants like Bloomberg and Refinitiv patch together these incomplete data sets and sell them in expensive, bundled, and inflexible formats

Trading firms that generate the fastest and most accurate prices cannot benefit from the commercial value of their data

Core structural flaws:

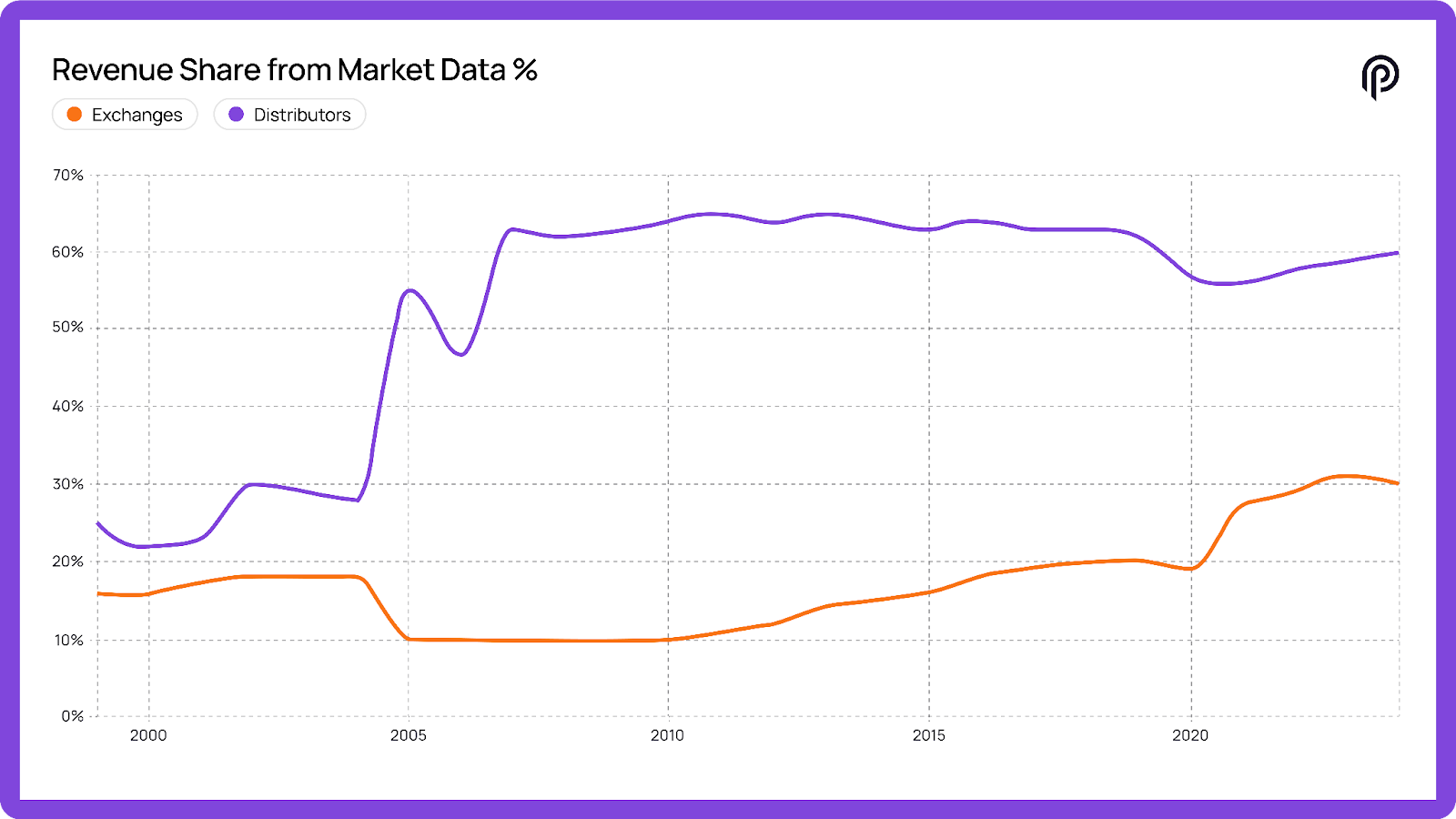

- The most valuable prices are generated "upstream" (before reaching the exchanges), but most revenue flows to downstream intermediaries and redistributors.

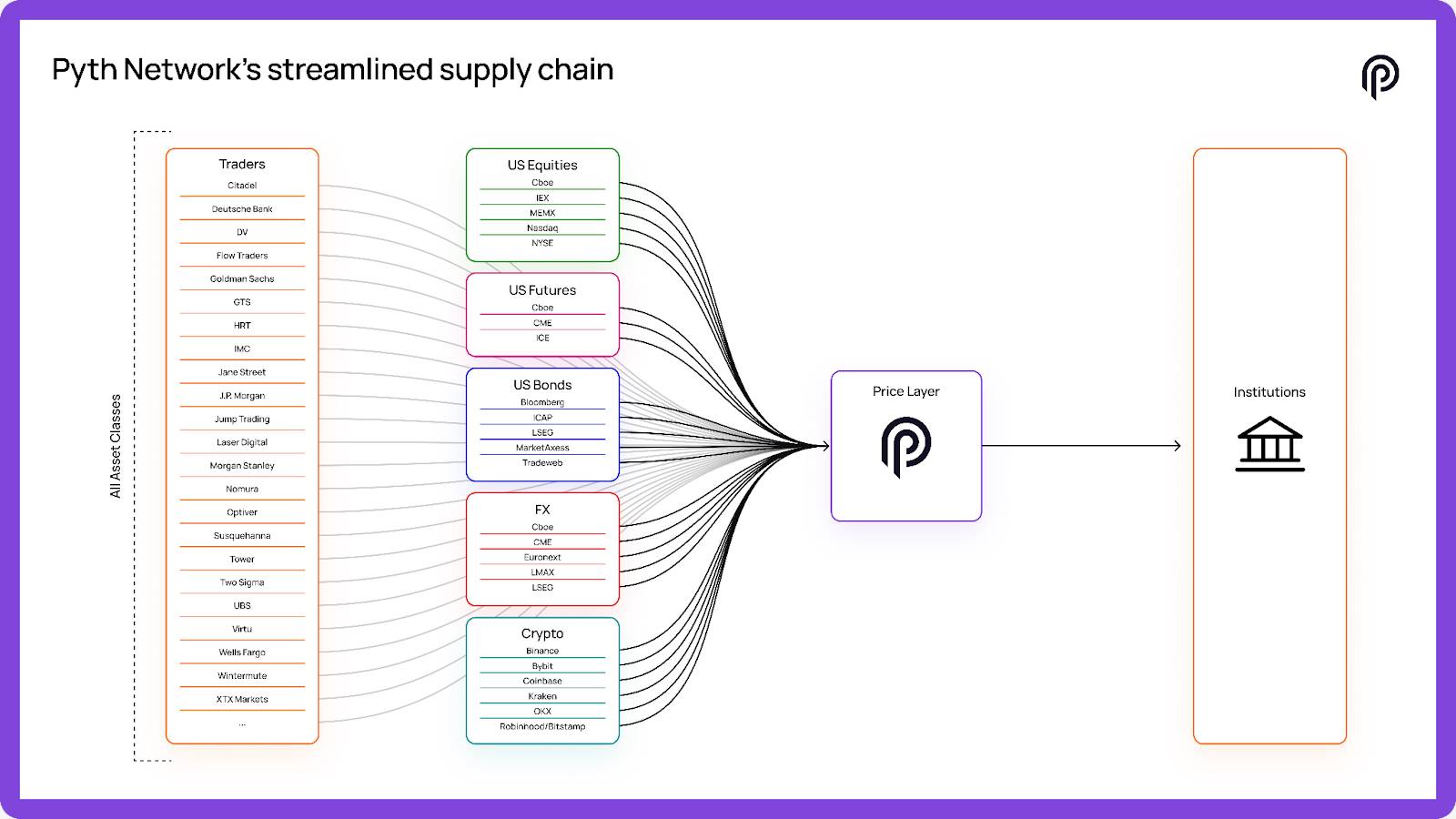

Pyth's new product has the potential to simplify global market data access paths, empowering institutions to use more specialized data and reshaping the market data economic structure.

This product continues Pyth's innovative model of directly collecting institutional-grade data from the "source" and enhances dimensions such as performance, accessibility, and asset coverage. This "upstream-first" model fixes the fundamental flaws of traditional market data: capturing its value before the data is sliced, marked up, or delayed, and returning that value to the true producers of the data.

The proposed subscription product will deliver pure market data directly into existing workflows off-chain, applicable scenarios include:

Risk modeling and analysis

Clearing and settlement systems

Government regulation and compliance processes

Accounting and reporting tools

Market display and terminal screens

Historical data research

Imagine a world where anyone, from the largest institutions to individual traders, can purchase comprehensive and customized professional market data through the Pyth Network. Payment methods can vary: USD, on-chain stablecoins, or PYTH tokens. This flexibility allows potential subscription users to expand into the millions.

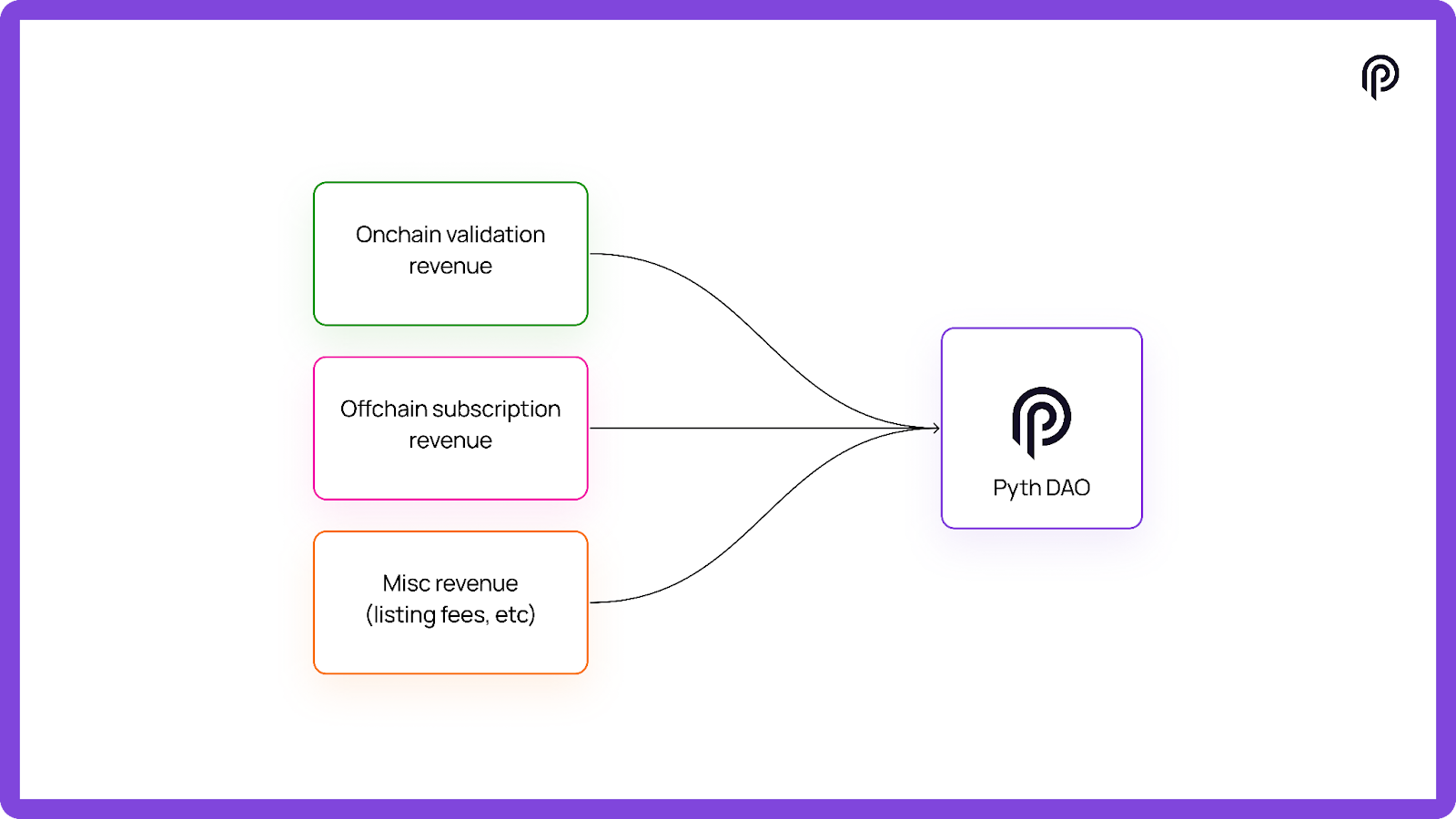

In the proposed plan, subscription revenue will flow into the Pyth DAO, which will decide how to optimally redeploy it to strengthen the network and align contributor incentives. Possible paths being discussed in the governance forum include: token buybacks, revenue-sharing models, and rewarding publishers, users, stakers, and holders, among other mechanisms. As adoption increases, this feedback loop can amplify network coverage, enhance data quality, and compound value for all participants.

Pyth has the conditions to enter and win this market in terms of quality, speed, and coverage. With new products entering DAO discussions, accelerating demand, and a clear path to the $50 billion industry, Phase 2 lays the financial and structural foundation for Phase 3 (becoming the global price layer for all markets).

Phase 3: Global Scale Expansion

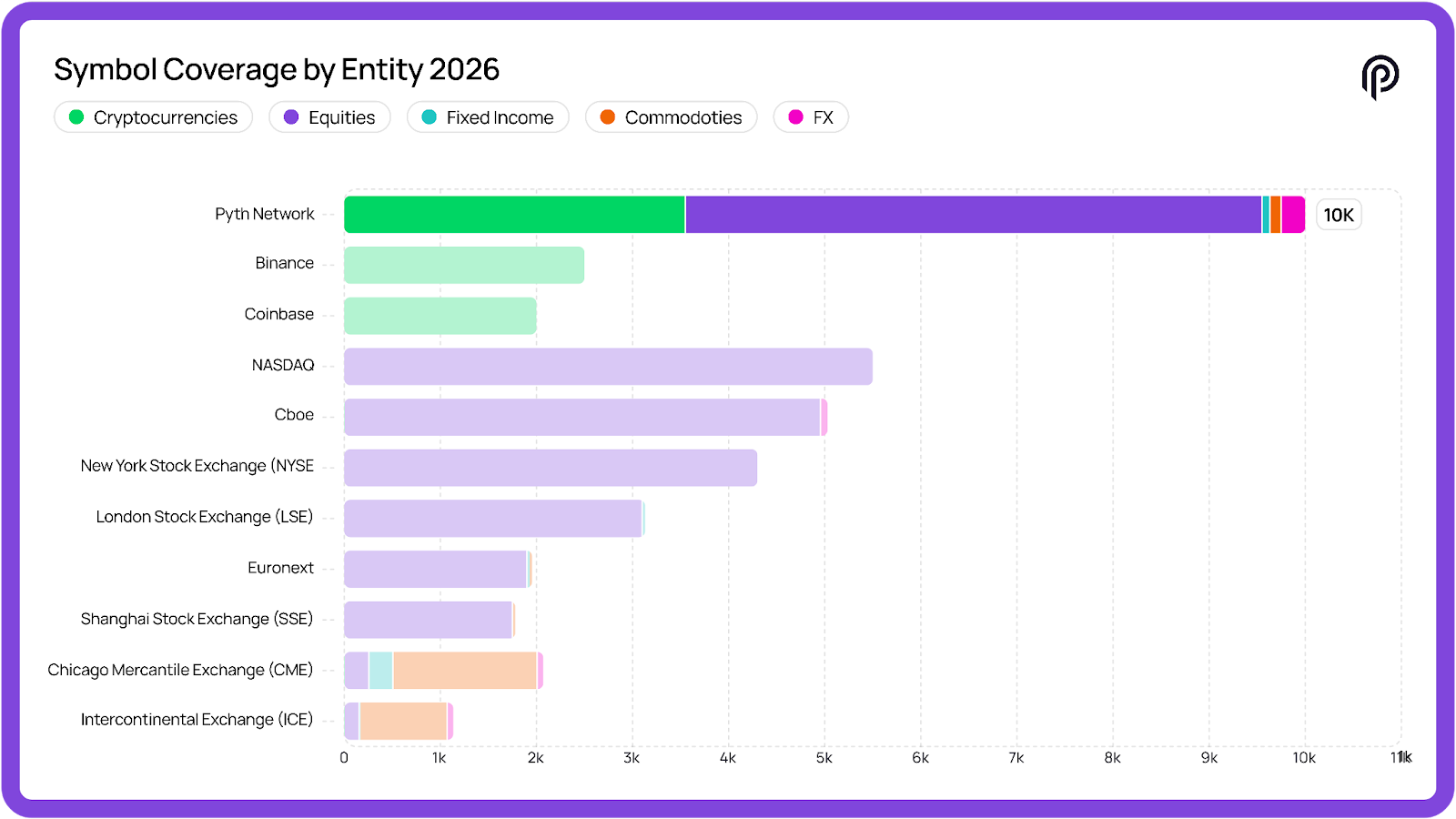

After the infrastructure is built and the subscription data model is launched, Phase 3 will pursue "comprehensive market coverage":

Adding 200–300 new assets each month

By 2025: 3,000+ assets

By 2026: 10,000+ assets

By 2027: 50,000+ assets

Achieving full coverage:

Trading Venues

Permissioned DeFi

Unpermissioned DeFi

Over-the-Counter (OTC) markets

The importance lies in:

Building the most comprehensive financial data layer globally

Eliminating multiple gaps in geography, asset classes, and vendor complexity

Like Spotify, the catalog continues to expand—but unlike traditional providers, contributors share in the growth benefits

Current position of Pyth:

Expected target position by the end of next year:

Each new data source will attract more builders and institutions, driving adoption and subscription revenue; this revenue strengthens the Pyth DAO and expands incentives for contributors; higher incentives attract more data sources, accelerating the positive cycle.

The path ahead is very clear: with its dominant position in DeFi and accelerated penetration into TradFi, Pyth Network is expected to capture a significant share of the $50 billion global market data industry. But this is not the end—Pyth has the potential to grow into the "single source of truth for global finance."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。