Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

First, warm congratulations on the 80th anniversary of China's victory in the War of Resistance. In this context, the price of gold futures in New York has historically surpassed $3600 per ounce, and spot gold has also broken through $3546, setting a new historical high. David Tait, CEO of the World Gold Council, stated that the council is promoting the digitization of gold to revolutionize the $900 billion physical gold market in London and expand the application of gold. Morgan Stanley analysts pointed out that the expected interest rate cut cycle by the Federal Reserve starting in September, the continuously weakening dollar, and strong demand for physical gold and ETFs are creating a "perfect storm" for precious metals, predicting a target price of $3800 for gold and $40.9 for silver by the fourth quarter of 2025.

Bridgewater Associates founder Ray Dalio issued a rare warning, stating that the national intervention actions of the Trump administration are pushing the U.S. towards a governance model reminiscent of the 1930s, and noted that Wall Street remains largely silent out of fear of retaliation. Dalio also expressed concerns about the loss of the Federal Reserve's independence and a potential debt crisis the U.S. may face in about three years, observing that international investors have begun shifting from U.S. Treasuries to gold. Additionally, regarding tariff policies, Trump stated that the government will appeal to the Supreme Court on Wednesday to address the federal appellate court's ruling that deemed his tariff policy's invocation of emergency law improper. This ruling involves "reciprocal tariffs" on goods from multiple trading partners, including tariffs imposed on Chinese, Canadian, and Mexican goods under the pretext of combating cross-border fentanyl trafficking. Trump claimed that if the ruling ultimately nullifies the tariff policy, it would have a severe impact on the U.S. economy and could lead to the refunding of trillions of dollars in tariffs.

Bitcoin is currently approaching around $112,000, with trader Roman believing that after Bitcoin fell below $112,000, that level may have turned into resistance, and the price could touch the support range of $100,000 in the coming days. Network economist Timothy Peterson also emphasized, based on historical data, that there is a 100% probability of a Bitcoin correction in the third week of September. However, CryptoQuant analyst Darkfost pointed out that the current correction of about -12% is within the normal range during a bull market, which helps the healthy development of the market. In the current bull market cycle, since first reaching a historical high in March 2024, the maximum correction has been -28%, while the average correction has been between -20% and -25%. Looking ahead, analyst KillaXBT has built a position at $109,500, with a short-term target of $112,000 to $113,000. Biraajmaan Tamuly stated that if it can break through $113,600, it will pave the way for reaching $116,300, $117,500, and $119,500. If it fails to break through effectively or continues to weaken, the price may retreat to the range of $105,000 to $100,000. Delphi Digital researcher that1616guy believes that the upcoming interest rate cut by the Federal Reserve is a key variable, predicting that the next rebound peak may be in the range of $118,000 to $120,000. Meanwhile, David Bailey, CEO of Nakamoto Company, provided a more optimistic forecast, suggesting that once the two major whales complete their sell-off, the price of Bitcoin could rise to $150,000.

Optimism around Ethereum has also declined in recent days, with trader Eugene observing that due to the compression of net asset values among market makers, Ethereum's upward momentum is weakening. Analysis from Matrixport corroborated this, showing that its trading volume plummeted from $122 billion to $57 billion, with speculative long positions being heavily liquidated, and ETF fund inflows also showing signs of slowing down, making the possibility of a short-term return to $5,000 limited. Despite short-term pressure, crypto analyst Ted pointed out that from a more macro perspective, the ETH/BTC exchange rate has successfully broken through a long-term downward trend and turned resistance into support, predicting a new round of increases in the fourth quarter of this year.

In the altcoin market, trader Eugene mentioned that he has made a small long position in SOL, predicting that market attention may be shifting from mainstream tokens to newer projects like Solana with smaller holdings, but he emphasized that he will use the $110,000 price level of Bitcoin as a strict risk control line. Additionally, Linea announced a partnership with Brevis to launch the ecological incentive program "Ignition," which will distribute a total of 1 billion LINEA tokens across the Etherex, Aave, and Euler protocols. This news stimulated a 25% increase in the price of its ecological project Etherex, but LINEA's own pre-market price fell by 17%.

2. Key Data (as of September 3, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

Bitcoin: $110,835 (YTD +15.24%), daily spot trading volume $48.331 billion

Ethereum: $4,326.20 (YTD +31.69%), daily spot trading volume $33.228 billion

Fear and Greed Index: 55 (Greed)

Average GAS: BTC: 1 sat/vB, ETH: 0.27 Gwei

Market share: BTC 58.54%, ETH 13.83%

Upbit 24-hour trading volume ranking: XRP, ETH, BTC, SOL, POL

24-hour BTC long-short ratio: 49.49%/50.51%

Sector performance: RWA up 3.23, NFT up 2.12%

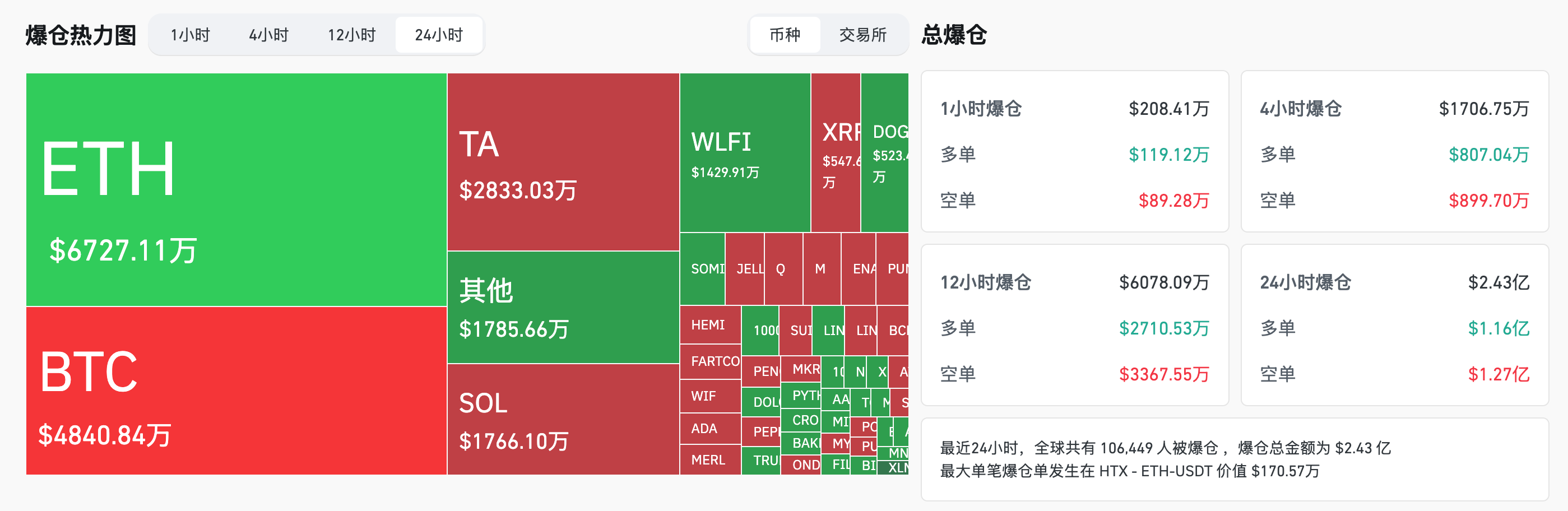

24-hour liquidation data: A total of 106,449 people were liquidated globally, with a total liquidation amount of $243 million, including $48.408 million in BTC, $67.27 million in ETH, and $17.66 million in SOL.

BTC medium to long-term trend channel: upper line ($112,607.17), lower line ($110,377.33)

ETH medium to long-term trend channel: upper line ($4,437.98), lower line ($4,350.10)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of September 2)

Bitcoin ETF: +$333 million, with Fidelity FBTC net inflow of $133 million leading the way

Ethereum ETF: -$135 million, with none of the nine ETFs showing net inflows

4. Today's Outlook

Binance Wallet will launch Hyperbot (BOT) token generation activity on September 3

Binance Alpha will launch Moonchain (MCH) on September 3, Portal To Bitcoin (PTB)

Ondo Finance: will launch an on-chain U.S. stock trading platform on September 3

Binance Futures will delist LEVERUSDT perpetual contract on September 3

Binance Alpha will launch Tradoor (TRADOOR) on September 4, Gata (GATA), Union (U)

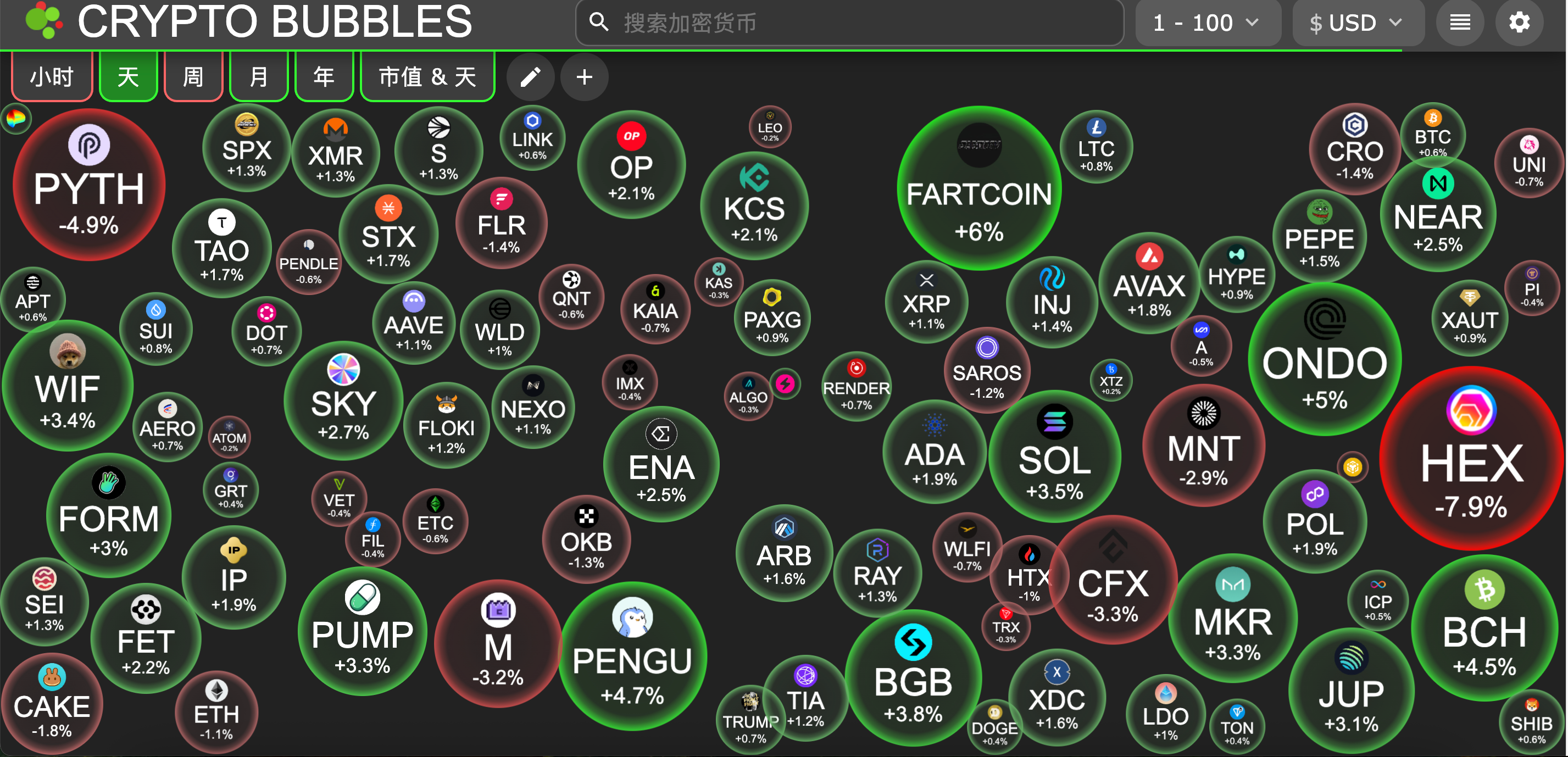

Today's top gainers among the top 100 cryptocurrencies by market capitalization: Fartcoin up 6%, Ondo up 5%, Pudgy Penguins up 4.7%, Bitcoin Cash up 4.5%, Bitget up 3.8%.

5. Hot News

Morgan Stanley disclosed its purchase of $188 million in Bitcoin ETFs in Q2

WLFI has burned 47 million WLFI from the unlocked treasury wallet

pump.fun launched the "Project Ascend" update plan, introducing dynamic fees V1 version

The Ethereum Foundation has deposited 10,000 ETH into Kraken

The Venus protocol has fully recovered, and the $27 million lost funds have been retrieved

Yunfeng Financial: purchased 10,000 ETH, with a total investment cost of $44 million

ETHZilla announced that $100 million in ETH will be used for re-staking in EtherFi

Strategy added 4,048 BTC, bringing the total holdings to 636,505 BTC

BNC's BNB holdings increased to 388,888, aiming to reach 1% of the supply by the end of the year

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。