HTX DAO: A New Paradigm for Building Resilient Financial Infrastructure

In the evolution of crypto assets, we have witnessed the rise of centralized finance (CeFi) and decentralized finance (DeFi).

The former has been the primary liquidity hub in the crypto market, leveraging the product design, risk control systems, and large user base of centralized platforms. The latter emerged from the "DeFi Summer" of 2020, where new protocols for decentralized lending, DEX, and liquidity mining rapidly exploded, continuously expanding more experimental and autonomous financial applications.

With the rise of Ethereum and DeFi, liquidity pools and lending protocols have improved capital turnover efficiency, but assets are still mainly concentrated in native crypto assets like BTC and ETH. Entering a new phase, RWA tokenization introduces broader real-world liquidity to the market, while CeFi gradually extends on-chain, participating in the decentralized ecosystem in an open manner while providing foundational liquidity and user entry points.

The boundaries between on-chain and off-chain finance are being broken, and the complementary development of CeFi and DeFi is also influencing the tone of the evolution of the crypto financial ecosystem. This is fundamentally a shift in the sources of liquidity.

New Landscape of Web3 Liquidity

How to continuously provide liquidity in the Web3 market has become the core focus of industry competition. Unlike the early days when liquidity relied solely on crypto assets like BTC and ETH, today's sources of liquidity are becoming more diversified:

● CeFi Platforms: CeFi platforms, primarily exchanges, remain the largest entry point for users and funds. They not only aggregate a large user base and capital pool but also provide the initial liquidity needed for DeFi protocols to launch and expand, acting as a "canal" for liquidity.

● Compliant Stablecoins: As a funding anchor for on-chain transactions, payments, and settlements, stablecoins not only ensure the certainty of capital inflows and outflows but also provide low-friction infrastructure for cross-border payments and institutional settlements. According to Coingecko, the market value of stablecoins is expected to continue growing, surpassing $283.5 billion by 2025, becoming the "hard currency" of the crypto market.

● RWA Tokenization: By mapping traditional financial assets like bonds, notes, and real estate onto the blockchain, RWA opens up a value channel between the real market and blockchain, releasing new liquidity from previously stagnant assets. Boston Consulting Group predicts that the RWA market size will rise to $16 trillion by 2030, with 30% to 50% of stablecoin market share flowing into RWA assets.

● Institutional Capital Entry: As the crypto market gradually moves towards compliance, traditional institutions like funds and investment banks are beginning to enter, bringing not only large-scale capital inflows but also the stability of long-term capital and the power to drive the entire ecosystem towards a healthier and more sustainable direction.

It can be seen that the intersection of CeFi's user base, DeFi's governance mechanisms, and the involvement of traditional finance is forming a synergy: ensuring both the efficiency and safety of funds while expanding the breadth and depth of liquidity. This evolution from "early attempts" to "diverse integration" not only reveals the core propositions of the industry but also provides a solid practical foundation for the combination of CeFi and DeFi.

Governance: The Engine of Web3 Liquidity

If liquidity is the fuel for the development of the crypto financial ecosystem, then governance is the engine that allocates this fuel. Whether it is Aave V4 dynamically adjusting interest rates based on collateral quality and market liquidity to ensure that capital pools are utilized efficiently while avoiding systemic risks, or MakerDAO maintaining the stable peg of DAI through governance mechanisms based on stable fee rates and collateral ratios during market fluctuations, both essentially reflect the balancing role of decentralized governance between "asset liquidity" and "market stability."

It has been proven that in a rapidly iterating and highly dynamic risk market, the governance structure of DAOs is often more flexible and resilient than traditional CeFi.

In the current macro context, this governance advantage is particularly crucial. The uncertainty of the external environment, the demand for security and liquidity from users, and the trend of integration between CeFi and DeFi are all forcing the market to seek more resilient governance methods.

HTX DAO is proposing answers at this pivotal moment: on one hand, drawing on successful practices from Aave, MakerDAO, etc., to dynamically adjust risk and liquidity through on-chain governance mechanisms; on the other hand, leveraging Huobi HTX to combine the user scale and capital entry advantages of CeFi with the open governance and self-evolution capabilities of DeFi, forming a governance structure that is both robust and efficient.

From Platform Entry to Ecological Co-Governance: The Governance Evolution Path of HTX DAO

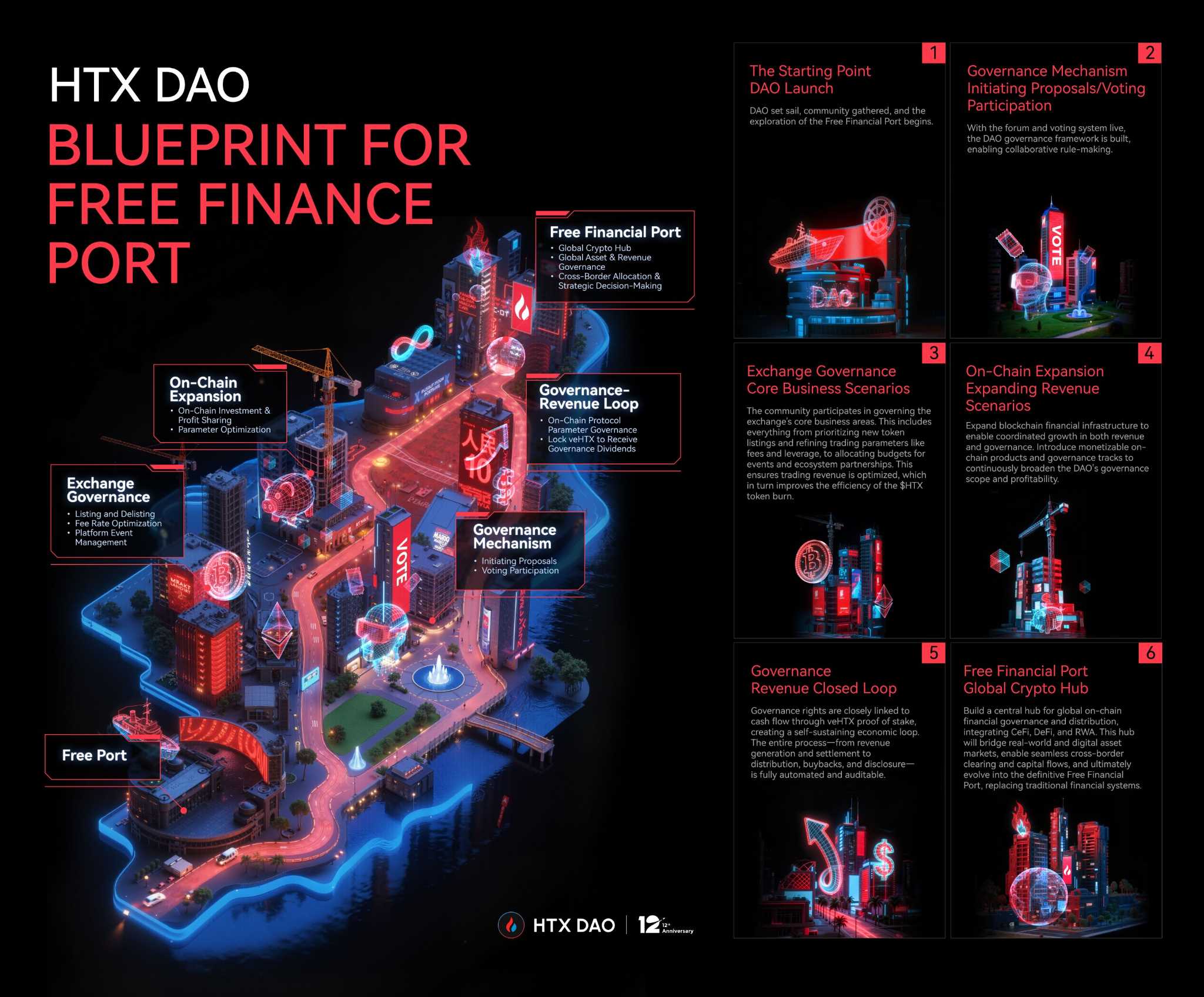

Recently, HTX DAO completed an upgrade of its white paper. The latest white paper clearly outlines a governance evolution path from "platform entry governance" to "ecological financial co-governance," driven by an open mechanism of "holding tokens equals governance," along with behavioral incentives and deflationary mechanisms to encourage user participation.

In this model, users are not only "users" of the platform but also "builders" and "owners." The scale effect of CeFi and the transparent governance of DeFi have achieved a true integration:

● True Power Decentralization: Through the veHTX (Vote-escrowed HTX) token, HTX DAO has delegated core operational decision-making power to the community. Users who hold and lock HTX tokens can obtain veHTX, thereby gaining voting rights on key operational parameters such as coin listing reviews, trading pair adjustments, fee parameters, and incentive weights. This marks a fundamental shift in the operational model of exchanges from centralization to on-chain governance.

● Deep Binding of Revenue and Governance: The veHTX token not only grants users governance rights but also brings them on-chain dividends. This model closely ties users' economic interests to the long-term development of the ecosystem, incentivizing them to actively participate in decision-making and jointly maintain the health of the ecosystem.

● Bridging the Gap Between CeFi and DeFi: The governance mechanism of HTX DAO essentially provides a direct access channel for the large user base of CeFi to DeFi governance. Users can enjoy the transparency and fairness brought by decentralized governance through a familiar platform without facing complex on-chain operations.

Thus, from exchange governance to on-chain expansion, from mechanism design to a global financial hub, the governance framework of HTX DAO not only addresses the inefficiencies and compliance issues of traditional DAOs but also builds a truly user-centered "free financial port" that can achieve economic value distribution and institutional co-governance.

HTX DAO is building the next generation of CeFi × DeFi governance network

HTX DAO: A New Paradigm for Building Resilient Financial Infrastructure

It is foreseeable that the future market will no longer be a single on-chain lending or trading scenario, but a more complex financial network of cross-chain, multi-asset, and cross-border flows. In this context, how to coordinate liquidity through governance and how to maintain the robustness and openness of capital pools in an uncertain macro environment become long-term propositions that DAOs must address.

HTX DAO aims to play the role of "on-chain governance hub" in this landscape.

According to the blueprint outlined in the white paper, HTX DAO will not only be a governance platform but also a hub that can span CeFi and DeFi, on-chain and off-chain: on one hand, continuing to strengthen on-chain governance capabilities, promoting risk parameters and liquidity management of multi-asset, cross-chain capital pools; on the other hand, exploring connections with the real market—including compliant stablecoins, RWA assets, and even on-chain governance models for mapped products like US stocks and bonds. The ultimate goal is to build an open, evolvable, cross-market governance network, making DAOs not just tools for adjusting internal mechanisms but long-term forces driving the reshaping of the global financial structure.

This is a grand narrative, no longer a zero-sum game between centralization and decentralization, but a symbiosis and evolution of both at a higher dimension. We are witnessing the rise of a new, more resilient financial infrastructure.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。