Author: Nancy, PANews

The Bitcoin flywheel of the Japanese version of MicroStrategy, Metaplanet, is slowing down.

At the recently concluded shareholders' meeting in Tokyo, Japan, Metaplanet attempted to boost market confidence through a capital increase plan and new financing methods, with Eric Trump, son of former President Trump, making a personal appearance to support the event. Despite the lively atmosphere on-site, this grand "vote-seeking" effort seems to have not fully convinced investors, as the company faces dual challenges of internal financing cycle failure and narrowing regulatory arbitrage space. Whether the new financing strategy can reshape its growth logic remains to be seen.

Launching up to $3.8 billion in financing, aiming to become the second-largest Bitcoin treasury company

On September 1, Metaplanet President Simon Gerovich reviewed the company's transformation from a struggling hotel business to a Bitcoin treasury company at a special shareholders' meeting. He emphasized the achievements the company has made as a Bitcoin reserve company during its 16 months of operation and outlined plans to accumulate 210,000 Bitcoins by 2027, accounting for 1% of the total supply.

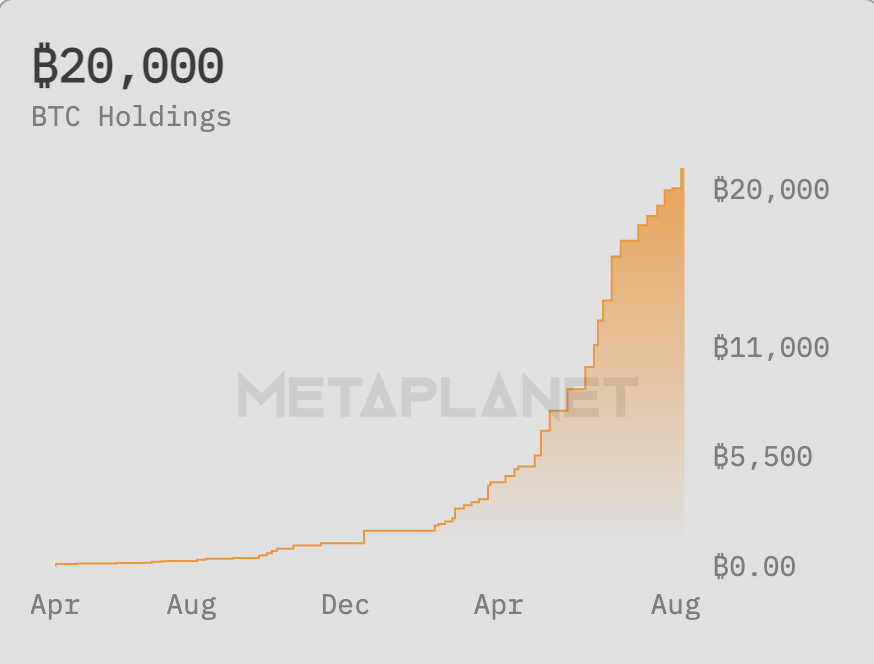

According to the latest data from BitcoinTreasuries.net, Metaplanet currently holds 20,000 Bitcoins, with an average holding cost of $102,607, making it the sixth-largest publicly listed company by Bitcoin holdings, following Strategy, MARA, XXI, Bitcoin Standard Treasury Company, and Bullish among U.S. listed companies. Based on current prices, Metaplanet's market capitalization has exceeded $2 billion, with Bitcoin returns nearing 7.5% as of September 2.

To this end, Metaplanet has been approved to raise up to $3.8 billion to purchase more Bitcoins. Over the next two years, the company plans to acquire 190,000 Bitcoins through its newly launched perpetual preferred stock product (Metaplanet Prefs). According to Simon, the preferred stock will not only become the core financing tool for Metaplanet to acquire more Bitcoins but will also establish a yield curve backed by Bitcoin, with potential returns that may even exceed traditional fixed-income products in Japan. In the context of limited returns in traditional markets, if Metaplanet successfully issues and promotes this innovative product, it is expected to become the largest Bitcoin-backed fixed-income issuer in Asia.

Previously, Strategy was the first to launch perpetual preferred stock, which typically does not carry voting rights but offers dividends superior to common stock. This model is uncommon in Japan, primarily due to the conservative financing structure of Japanese companies, strict legal and regulatory requirements, and investors' preference for fixed income.

It is understood that Metaplanet will issue two types of preferred stock (with a maximum dividend of 6%) targeting investors with different risk appetites: Class A preferred stock, similar to traditional fixed income, will offer a 5% yield; Class B will come with an option to convert to common stock but carries higher risk. Simon pointed out that these products have four major advantages: first, they provide new financing channels; second, they do not require frequent refinancing pressure; third, the financing cost is lower than most peers (benefiting from Japan's long-term low interest rates); and fourth, by controlling the issuance cap of preferred stock to 25% of Bitcoin net assets, it establishes a financial risk "safety valve" for the company.

At the meeting, Metaplanet shareholders also passed several resolutions, including increasing the statutory number of shares (the statutory cap was revised to 2,723,000,000 shares), allowing for online shareholders' meetings, and establishing authorized class shares. Simon also announced that Metaplanet's goal is to become the second-largest Bitcoin holding company globally, next to Strategy, and stated that Metaplanet's Bitcoin per share ratio has increased to 2274% over the past year, far exceeding Strategy's 86%.

Notably, Metaplanet's strategic advisor Eric Trump also attended this special shareholders' meeting. He holds 3.3 million shares of Metaplanet, supports the company's Bitcoin strategy, and highly praised Simon, stating, "Simon is one of the most honest people I have ever met in my life. You have an outstanding leader and a great product in Bitcoin; it's a successful combination." Additionally, Simon disclosed that Fidelity and Charles Schwab are the largest shareholders of Metaplanet, holding about 20% of the shares.

Stock price plummets by 60%, Metaplanet faces dual pressure

Contrary to the bustling scene at the shareholders' meeting, Metaplanet is experiencing constraints in its flywheel strategy.

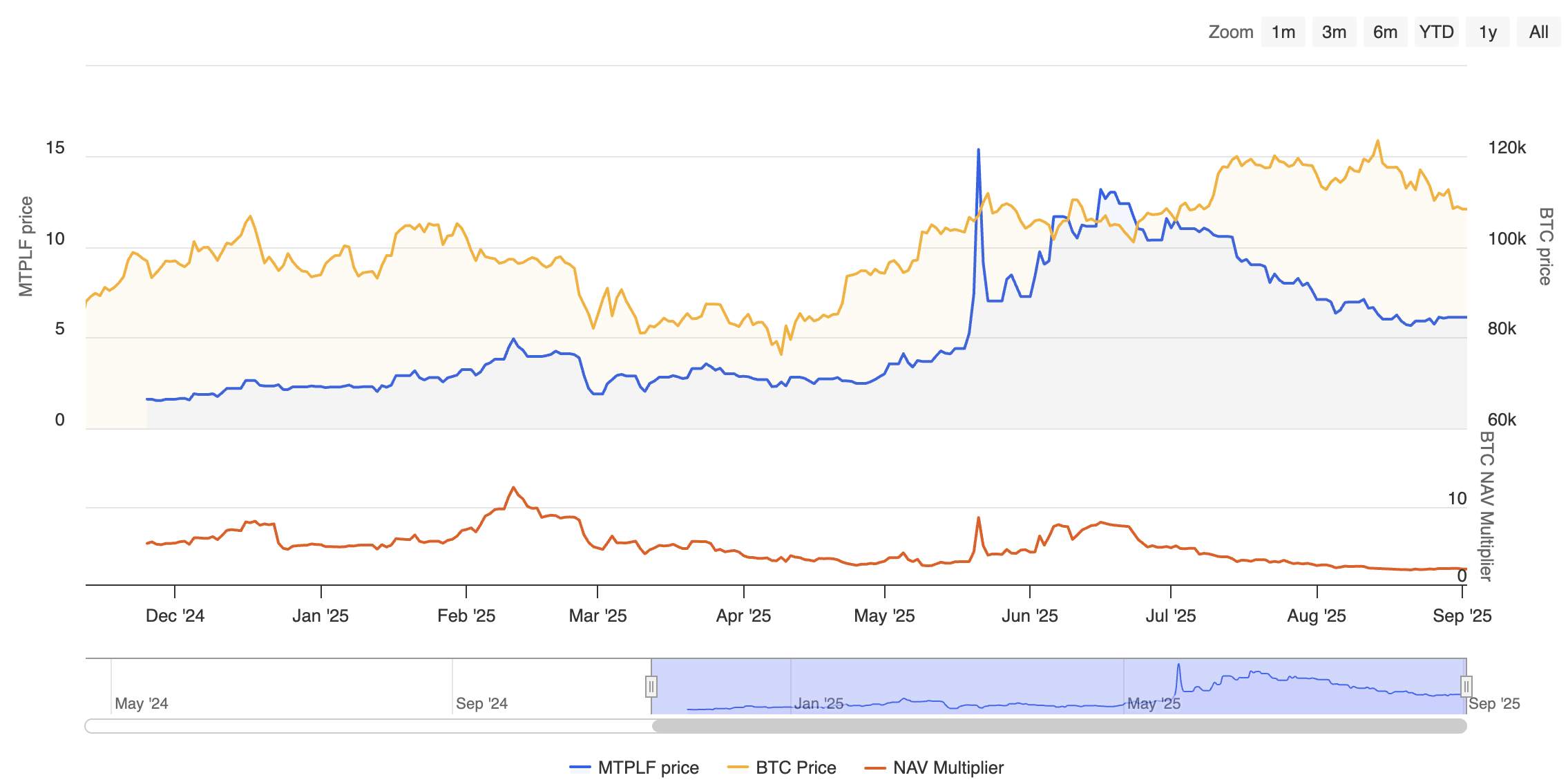

Although Metaplanet has become a leading Bitcoin reserve company, its new plans have had limited impact on boosting the stock price, which only rose 0.83% after the market opened today, indicating a relatively muted market response. In fact, since reaching a historical high of $15.35 in mid-May, its stock price has dropped by about 60.2% from its peak. Meanwhile, the growth rate of Bitcoin holdings has significantly slowed, with only about a 16.7% increase in the past month, compared to a previous month’s surge of 92.7%.

Moreover, Metaplanet's Bitcoin premium is narrowing. The so-called premium, which is the multiple of market capitalization to the company's book value of Bitcoin net asset value (NAV), is a key indicator of whether the "Bitcoin treasury model" can be established. A smaller premium means the company's advantage in issuing stock to finance Bitcoin purchases diminishes, leading to higher acquisition costs; conversely, a larger premium allows the company to buy Bitcoin at a lower cost through stock issuance, effectively expanding its Bitcoin holdings. Data shows that Metaplanet's NAV Multiplier (the ratio of market capitalization to net asset value) was as high as 8.5 times at the end of May but has now dropped to just 1.9 times. This indicates that investor confidence in its Bitcoin holdings is significantly weakening.

However, Metaplanet's challenges are not limited to the company level; the external environment is also changing.

Previously, Japanese investors preferred to buy crypto-related stocks rather than directly hold crypto assets partly due to regulatory arbitrage in the tax system. PANews previously reported that due to the heavy tax burden on crypto assets in Japan, while stock investments enjoy a more favorable tax regime, funds tend to favor buying crypto-related stocks. However, recent developments indicate that the Financial Services Agency (FSA) of Japan plans to adjust the tax rate on crypto assets from the current maximum progressive rate of 55% to a unified rate of 20%, consistent with stocks, in the 2026 tax reform. Once implemented, the tax difference between holding spot crypto and holding related concept stocks will significantly narrow, reducing the motivation to buy stocks as a substitute for holding cryptocurrencies.

It can be said that Metaplanet is facing dual pressure. On one hand, the internal flywheel is stalling, with narrowing premiums, falling stock prices, and slowing growth in Bitcoin holdings, limiting its financing model. Whether Metaplanet can attract overseas funds through the issuance of preferred stock remains uncertain; on the other hand, external arbitrage is disappearing, and tax reform has weakened the institutional appeal of crypto-related stocks, potentially leading investors to directly turn to spot or ETFs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。