Author: Joel John, Sumanth Neppalli

Translation: Block unicorn

Today, everything can be achieved through APIs except for peace. As long as there are enough resources and developers fueled by coffee, you can build applications for one-click booking of taxis, hotels, and even therapy sessions. What if these APIs were used to reshape ancient institutions?

Today's article explores how legislative changes are splitting the banks we have long known. We believe that if blockchain is the orbit of currency and everything is a market, users will ultimately leave idle deposits in their favorite applications. In turn, this will accumulate and amass large balances distributed across applications.

In the future, everything could become a bank. But how is this achieved?

The GENIUS Act allows applications to hold dollars on behalf of users (in the form of stablecoins). It provides incentives for platforms to encourage users to save money and spend directly through the application. But banks are not just vaults for storing dollars. They are complex databases layered with logic and compliance. In today's article, we explore how the technology stack supporting this transformation has evolved.

In the early days of operating this media account, we had to change banking partners multiple times. After several changes, I realized a simple truth that should have been common sense. Most of the fintech platforms we previously used were essentially repackaged versions of the same underlying bank. Therefore, we began to build relationships directly with banks instead of chasing the next shiny payment product.

You cannot build a startup on top of another startup. You need to establish direct relationships with the entities that actually do the work, so when things go wrong, you are not stuck in layers of phone calls with intermediaries. As a founder, choosing a stable but slightly traditional vendor can save you hundreds of hours and countless back-and-forth emails.

But why is this important? Am I writing a guide for founders on managing operations? No. The entire process taught me two contradictory principles.

- In banking, where the money is stored, that’s where the big money can be made. Traditional banks hold billions in user deposits and may have internal compliance teams. In contrast, a startup founder worried about licenses may find banks to be a safer choice.

- At the same time, huge amounts of money can also be made in the thin layers of high-frequency trading. Robinhood does not "hold" stock certificates. Most cryptocurrency trading terminals do not custody user assets, yet they can generate billions in fees each year.

These are two opposing forces in the financial world. This is a struggle between wanting custody and being the layer where transactions occur. Your traditional bank may feel conflicted about asking you to trade meme coins with custodial assets because they make money through deposits. But at the same time, exchanges are also making money, convincing you that wealth is created by betting on the next animal token.

Behind this friction is a shift in the definition of a portfolio. My grandmother in Kochi, Kerala, would be satisfied with a portfolio of gold, land, and some stock certificates. In contrast, a savvy 27-year-old today might think that, in addition to gold and stocks, her portfolio includes a significant amount of Ethereum, music copyrights from Sabrina Carpenter, and streaming royalties from "My Oxford Year." (By the way, that movie is great.) While rights and streaming royalties have not yet been fully realized, the ongoing development of smart contracts and regulations is likely to make them possible in the next decade.

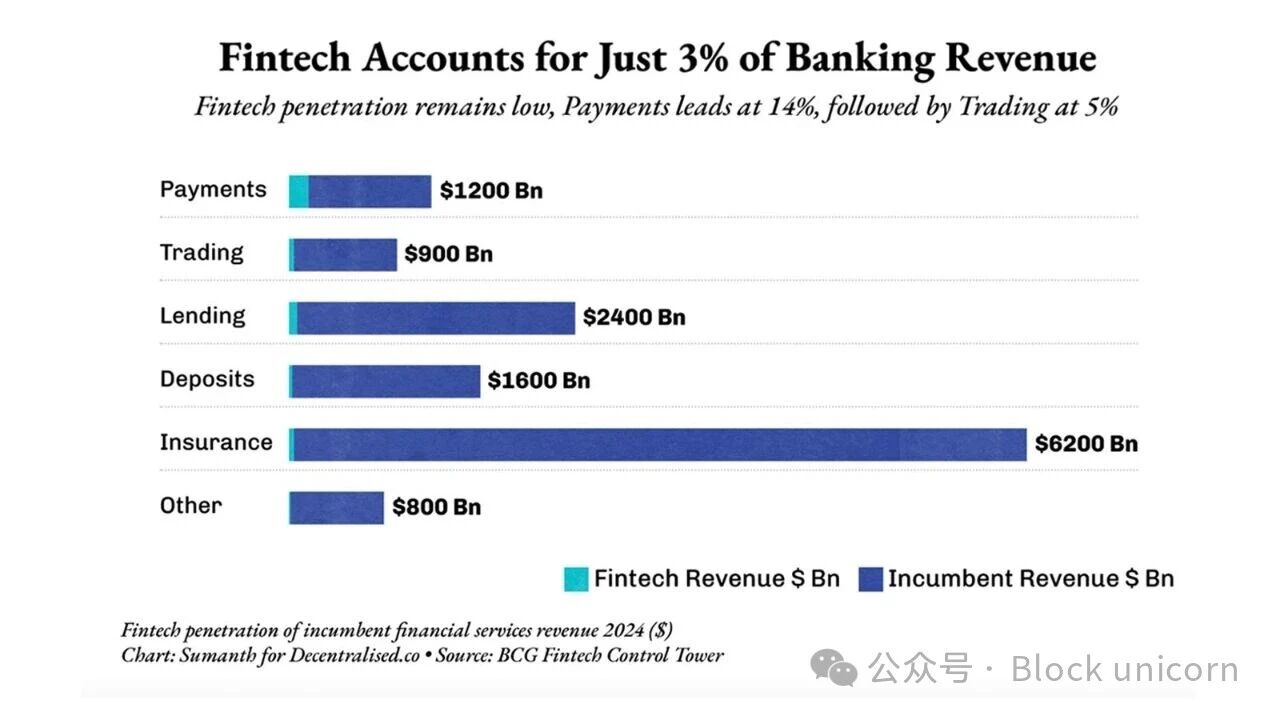

If the definition of a portfolio is changing, then where we store wealth will also change. Few places embody this shift more than today’s banks. Banks account for 97% of the banking industry's revenue, leaving only about 3% for fintech platforms. This is a classic Matthew effect. Banks generate most of the revenue because most of today’s capital is with them. But can businesses be built by stripping away monopoly status and owning specific functions?

We believe it is possible. This is also why half of our portfolio consists of fintech startups.

Today's article explores the rationale behind the splitting of banking operations.

New banks are not located in shiny offices in downtown areas. They exist in your social media feeds, in your applications, and may even reside in the cookies generated during your questionable searches last Friday night. Cryptocurrency has matured to a stage where it is no longer just related to early adopters. It is beginning to touch the boundaries of fintech, making the world a potential market for the products we build (TAM). But what does this mean for investors, operators, and founders?

We attempt to find answers in today’s article.

But first, let’s take a look at the graveyard of fintech startups.

The Genius of Liquidity

Warren Buffett is known as the "Oracle of Omaha." This is not without reason. His portfolio performance is nothing short of magical. But behind this magic lies some often-overlooked financial engineering. Berkshire Hathaway owns assets that can be considered permanent capital. In 1967, he acquired an insurance company with stable idle capital. In insurance terms, he could leverage this insurance float, which is the premiums paid but not yet claimed. It can be seen as an interest-free loan.

In contrast, most fintech lending platforms are different. LendingClub is a startup focused on peer-to-peer lending. In this model, liquidity comes from other users on the platform. If I lend money to Saurabh and Sumanth on LendingClub, and they both default, I may be less willing to lend to Siddharth. The reason is that by then, my trust in the platform's ability to screen, verify, and bring in quality borrowers will have diminished.

If you have an accident every time you take a taxi, would you continue to use it?

Apply this logic to lending. LendingClub ultimately had to acquire Radius Bank for $185 million to secure a stable source of deposits for issuing loans.

Similarly, SoFi spent nearly $1 billion over seven years to scale as a non-bank lender. Without a banking license, you cannot accept deposits and lend them to potential borrowers. Therefore, it had to fund loans through partner banks, which consumed most of the interest generated. Imagine I borrow money from Saurabh at a 5% interest rate and then lend it to Sumanth at a 6% interest rate. This 1% spread is my profit from issuing loans. But if I had a stable source of deposits (like a bank), I could earn more.

This is exactly what SoFi ultimately did. In 2022, it acquired Golden Pacific Bank in Sacramento for $22.3 million. This move was to obtain a national banking license, allowing it to accept deposits. This change brought its net interest margin (the difference between loan income and deposit payments) to about 6%, well above the typical 3-4% for U.S. banks.

Small bank packaging platforms cannot create a large enough profit margin to operate. What about large companies like Google? Google launched Plex, attempting to embed a wallet directly into the Gmail application. It partnered with several banks to handle deposits, including Citigroup and Stanford Federal Credit Union. But this project never launched. After two years of regulatory tug-of-war, Google terminated the project in 2021. In other words, you may have the largest inbox in the world, but it is still difficult to convince regulators why people should be allowed to move money where they send and receive emails. That is the reality.

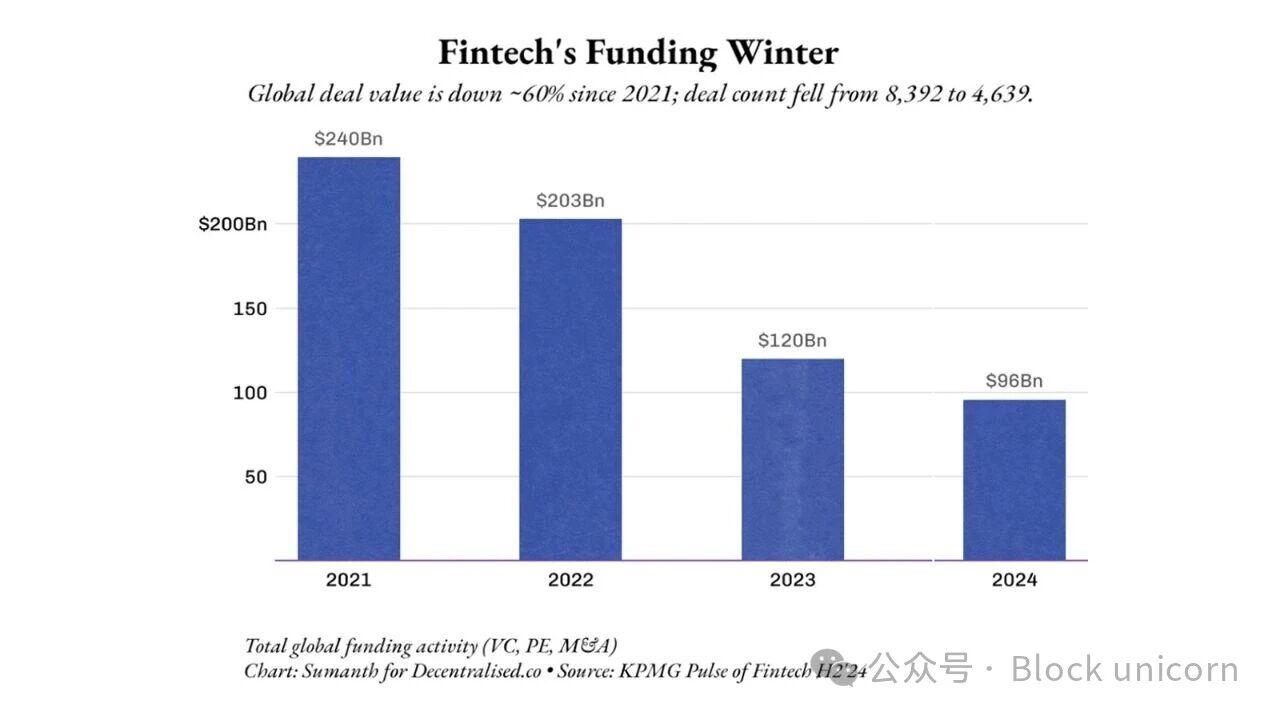

Venture capitalists understand this dilemma. Since 2021, the total amount of funding flowing to fintech startups has halved. Historically, the moat for fintech startups has largely come from regulation. That is why banks capture the largest share of banking industry revenue. But when banks misprice risk, they are gambling with depositors' money, as we saw in the Silicon Valley Bank incident.

The GENIUS Act weakens this moat. It allows non-bank institutions to hold user deposits in the form of stablecoins, issue digital dollars, and achieve round-the-clock payment settlements. Lending is still restricted, but custody, compliance, and liquidity have gradually shifted into the realm of code. We may be entering a new era where a new Stripe will emerge on top of these financial primitives.

But does this increase risk? Are we allowing startups to gamble with user deposits, or is it limited to traditional banks? Not necessarily. Digital dollars or stablecoins are often more transparent than traditional currencies. In the traditional world, risk assessment is done privately. In the on-chain world, it is publicly verifiable. We see similar situations when we can verify holdings in ETFs or DATs on-chain. You can even verify how much Bitcoin countries like El Salvador or Bhutan hold.

What we will witness is a transformation where products may look like Web2, but assets operate on a Web3 track. Imagine a Transferwise using stablecoins.

If blockchain tracks enable faster fund transfers, and digital primitives like stablecoins allow anyone to hold user deposits under appropriate regulatory frameworks, we will see the emergence of a new generation of banks with entirely different unit economics.

But to understand this transformation, we first need to understand the components that make up a bank.

Stable Building Blocks

What exactly is a bank? Its core functions consist of four elements.

Holding information about who owns how much asset — a database.

Enabling people to transfer funds between each other through transfers and payments.

Ensuring user compliance and confirming the legality of the assets held by the bank.

Leveraging database information to market loans, insurance, and trading products.

The way cryptocurrency encroaches on these areas is somewhat inverted. For example, stablecoins are not yet mature banks, but they have significant appeal in terms of transaction volume. Historically, Visa and Mastercard charged a "toll" on everyday transactions. Each swipe contributed a few basis points to their moat, as merchants had no choice.

By 2011, the average debit card fee in the U.S. was about 44 basis points, high enough to prompt Congress to pass the Durbin Amendment, halving those rates. In 2015, Europe set the fee caps even lower, with debit cards at 0.20% and credit cards at 0.30%, as Brussels deemed the two giants to be "coordinating rather than competing." However, today, unrestricted U.S. credit card fees still range from 2.1% to 2.4%, nearly unchanged from a decade ago.

Stablecoins have completely disrupted this economic model. On Solana or Base, the settlement fee for USDC transfers is less than $0.20, regardless of the transaction size. Shopify merchants accepting USDC can retain the 2% fee that would have been charged by credit card networks through self-custody wallets. Stripe has recognized this trend, now reporting a USDC checkout fee of 1.5%, lower than its 2.9% + $0.30 rate.

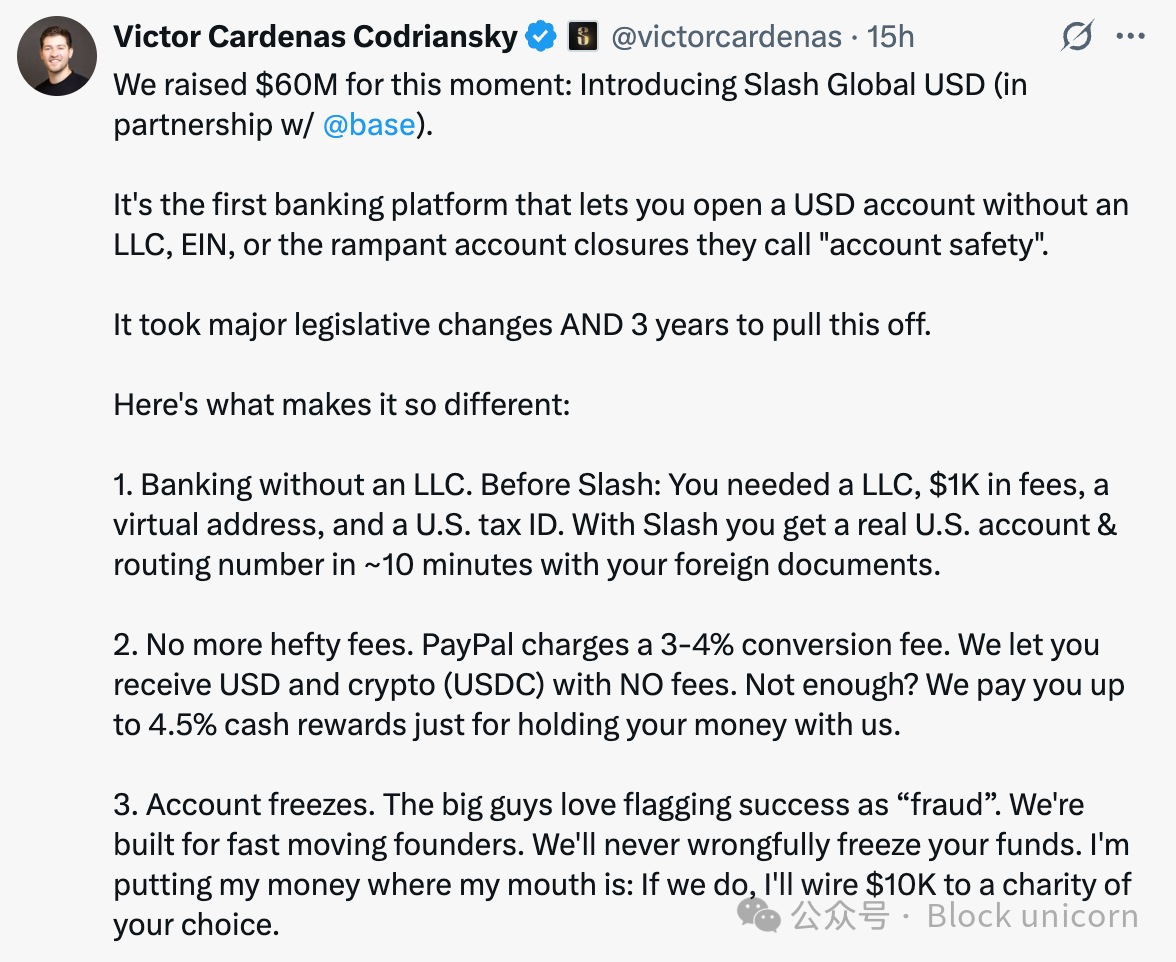

These channels attract new players at a lower cost. YC-backed Slash allows any exporter to start accepting payments from U.S. customers in five minutes—no Delaware C corporation, no acquiring contracts, no paperwork, no lawyer retainer fees, just a wallet. The warning to traditional payment processors is clear: upgrade to stablecoins or lose card swipe revenue.

For users, the economic logic is simple:

- Accepting stablecoins in emerging markets means avoiding the hassle and high costs of foreign exchange transactions.

- It is also the fastest way for cross-border remittances, especially for merchants needing to pay downstream for imports.

- You can save about 2% in fees that would normally go to Visa and Mastercard. Yes, there are cash-out costs, but in most emerging markets, the trading premium of stablecoins over the dollar is higher. For example, USDT in India is currently trading at 88.43, while the dollar rate offered by Transferwise is 87.51.

The reason stablecoins are accepted in emerging markets is that their economic logic is very straightforward: cheaper, faster, and safer. In regions like Bolivia, where inflation rates reach 25%, stablecoins provide a viable alternative to government-issued currency. Essentially, stablecoins allow the world to experience the potential of blockchain as a financial rail. The natural evolution will be to explore what other financial primitives these rails can enable.

Merchants converting cash to stablecoins will soon find that the challenge lies not in receiving funds but in operating a business on-chain. Funds still need to be secured, yesterday's transactions need to be reconciled, suppliers expect payments, payroll needs to be streamed, and auditors require proof.

Banks encapsulate all these pipelines through Core Banking Systems (CBS). This is a mainframe-era behemoth written in Cobol, maintaining ledgers, enforcing cut-off times, and pushing batch files.

Core Banking Systems (CBS) have two fundamental functions:

- Maintain a tamper-proof true ledger: who owns what, mapping accounts to customers.

- Securely expose that ledger to the outside world: enabling payments, loans, debit cards, reporting, and risk management.

Banks provide this software through vendors. These vendors are tech companies skilled in software, while banks excel in finance. This architecture originated in the 1970s with computerization, as bank branches transitioned from paper ledgers to interconnected data centers, gradually becoming rigid under heavy regulation.

The FFIEC is an agency that sets rules for all U.S. banks. It stipulates the rules that core banking software must follow: the primary data center and backup data center must be located in different geographical locations, maintain redundant telecom routes and power, continuously record transactions, and monitor any security incidents.

Changing a core banking system is akin to a DEFCON-level event because data—every customer balance and transaction—is trapped in the vendor's database. Migration means weekend switches, dual ledgers, regulatory drills, and a high probability that something will go wrong the next morning. This built-in stickiness makes core banking systems nearly permanent leases. The three major vendors—Fidelity Information Services (FIS), Fiserv, and Jack Henry—originated in the 1970s and still lock banks into contracts lasting about 17 years, serving over 70% of banks and nearly half of credit unions.

Pricing is based on usage habits: fees for retail checking accounts range from $3 to $8 per month, depending on transaction volume, and adding features like mobile banking increases costs. Enabling fraud detection tools, FedNow payment rails, or analytics dashboards further escalates fees.

In 2024 alone, Fiserv is expected to generate $20 billion in revenue from banks, about ten times the on-chain fees of Ethereum during the same period.

Placing the assets themselves on a public blockchain means the data layer is no longer proprietary. USDC balances, tokenized treasury bills, and loan NFTs are all stored on the same open ledger, accessible by any system. If a consumer application finds the current core system too slow or too expensive, it does not need to migrate terabytes of data; it simply points the new coordination engine to the same wallet address and continues operating.

Nevertheless, the switching costs have not dropped to zero; they have merely changed. Payroll providers, ERP systems, analytics dashboards, and audit processes all need to integrate with the new core system. Changing vendors means reconfiguring these connections, similar to switching cloud service providers. The core system is not just a ledger; it also runs business logic: mapping user accounts, cut-off times, approval processes, and exception handling. Even if balances are portable, re-coding this logic in the new stack still requires effort.

The difference is that these frictions are now software issues rather than data hostage situations. Coding workflows still require "glue work," but these are sprint cycle issues rather than years-long negotiations. Developers can even adopt a multi-core strategy, using one engine for retail wallets and another for financial operations, as both point to the same blockchain state. If a vendor has issues, failover can be achieved by redeploying containers without arranging midnight data migrations.

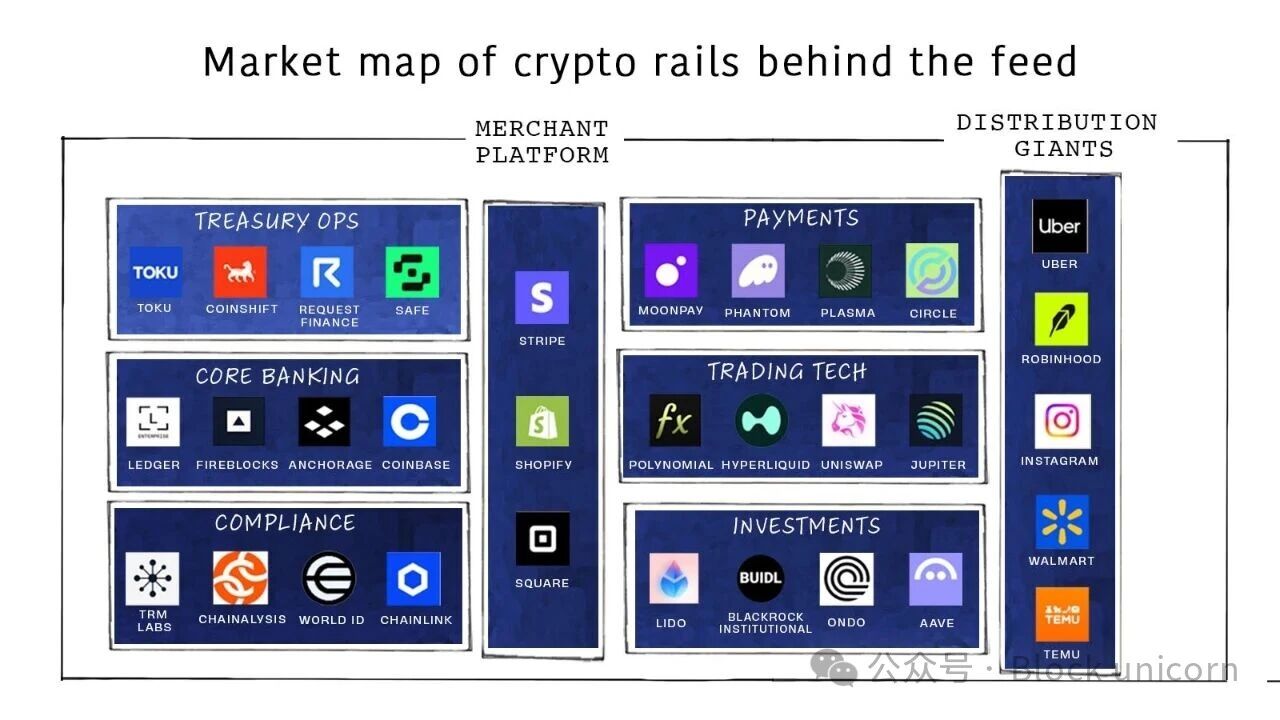

From these perspectives, the future of banking could look entirely different. These components exist separately today, waiting for developers to integrate them for retail users.

Fireblocks secures over $10 trillion in token circulation for banks like BNY Mellon. Its strategy engine can mint, route, stake, and reconcile stablecoins across more than 80 blockchains.

Safe manages about $100 billion in smart account funds; its SDK provides simple login, multi-signature strategies, gas abstraction, streaming payroll, and automatic rebalancing for any application.

Anchorage Digital is the first chartered crypto bank, leasing a regulated balance sheet using Solidity. Franklin Templeton directly custodies its Benji Treasury fund with Anchorage, settling shares on a T+0 basis instead of T+2.

Coinbase Cloud offers a single API for wallet issuance, MPC custody, and sanction-check transfers.

These participants possess elements lacking in traditional vendors: an understanding of on-chain assets, compliance AML hooks co-located within protocols, and event-driven APIs (rather than batch processing files). In contrast, the blockchain market is expected to grow from about $17 billion today to around $65 billion by 2032, so the answer is simple: blockchain projects that once belonged to Fidelity and its peers will now face competition, and those using Rust and Solidity instead of Cobol will gain the upper hand.

However, before they are truly ready for retail users, they need to combat the great demon that plagues all financial products—compliance. What will compliance look like in an increasingly on-chain world?

Compliance is Code

Bank compliance work primarily falls into four categories:

- Know Your Customer (KYC and due diligence).

- Identify counterparties (sanctions and politically exposed persons checks).

- Monitor funds (transaction monitoring, alerts, and investigations).

- Report to regulators (Suspicious Activity Reports (SARs) / Currency Transaction Reports (CTRs), audits).

This is a massive, expensive, and ongoing task. In 2023, global compliance spending exceeded $274 billion, and the burden is almost always increasing.

The scale of paperwork exposes its model. The U.S. Financial Crimes Enforcement Network (FinCEN) reported about 4.7 million suspicious activity reports and 20.5 million currency transaction reports last year—these are retrospective risk reports. The work is batch-oriented: collecting PDFs and logs, organizing narratives, submitting reports, and then waiting.

In on-chain transactions, compliance is no longer a pile of documents but begins to operate like a real-time system. The Financial Action Task Force (FATF) "transfer rules" require transfers to include information about the sender and beneficiary; crypto providers must obtain, hold, and transmit this data (traditionally applicable to "occasional transactions" over $1,000 / €1,000 thresholds). The EU goes further, applying the rules to all crypto transactions. On-chain, this data can be transmitted as encrypted data blocks along with the transfer, visible to regulators but not the public. Chainlink and TRM publish sanction lists and fraud oracles; transfers query the lists in transit, rolling back if the address is flagged.

Privacy is also protected, as once zero-knowledge wallets like Polygon ID or World ID can carry cryptographic badges proving, for example, "I am over 18 and not on any sanctions list." Merchants see the green light, regulators receive an auditable trail, and users do not need to disclose passport scans or street addresses.

If funds stagnate in backend paperwork, a fast-moving market is meaningless. Vanta is a prime example of a regtech startup that has shifted SOC2 compliance from consultants and screenshots to APIs. Startups selling software to Fortune 500 companies need SOC2 certification to prove they follow reasonable security practices and avoid storing customer data in unprotected public links like Tea.

Startups need to hire auditors, submit a massive spreadsheet requesting various screenshots from AWS setups to Jira tickets, then disappear for six months, only to return with a signed PDF that immediately becomes invalid. Vanta simplifies this painful process into an API. You don’t need to hire consultants; just integrate Vanta with AWS, GitHub, and HR tech stacks, and it will automatically monitor logs, generate screenshots, and provide them to auditors. This move has enabled Vanta to achieve $200 million in annual recurring revenue (ARR) and a $4 billion valuation. This is indeed useful, but still a form of "screenshot tax."

The founder of Linear lamented the state of compliance.

The financial sector will follow a similar trajectory: reducing folder management and increasing strategies that assess events in real-time while leaving encrypted receipts. Balances and fund flows will be transparent, time-stamped, and cryptographically signed, turning audits into an observation of behavior.

Oracles like Chainlink serve as truth bearers between off-chain rules and on-chain execution. Its Proof-of-Reserve data streams make reserve adequacy visible to contracts, allowing issuers and venues to set up automatically responsive circuit breakers. Ledgers no longer wait for annual checks but are continuously monitored.

Proof of reserves flows block by block; if the backing of a stablecoin falls below 100%, the minting function will automatically lock and send a message to regulators.

There is still a lot of work to be done in the future. Authentication, cross-jurisdictional rules, edge case investigations, and machine-readable policies all need to be strengthened. In the coming years, compliance work will no longer resemble paperwork but will be more like API version control: regulators will issue machine-readable rules, oracle networks and compliance vendors will provide reference adapters, and auditors will shift from sampling to supervision. As regulators gradually understand the potential of real-time audits, they will collaborate with vendors to develop new tools.

A New Era of Trust

Everything is bundled together and then gradually unbundled. The history of humanity is one of repeatedly seeking efficiency through the integration of things, only to find decades later that they are better off remaining independent. The current state of legislation around stablecoins and underlying networks (Arbitrum, Solana, Optimism) suggests that we will see multiple attempts to reshape banking. For instance, recently, Stripe announced its attempt to launch its own L1.

Two forces are at play in modern society.

- Rising costs due to inflation.

- The increasing memetic desire driven by a highly interconnected world.

In an era where people's consumption desires are increasing while wages stagnate, more individuals will take control of their finances. The GameStop frenzy, the rise of meme coins, and even the obsession surrounding the LaCroix or Stanley mugs are all byproducts of this shift. This means that applications with sufficient distribution and trust will evolve into banks. We will see builder code systems like Hyperliquid expand into the entire financial world. Whoever controls the distribution channels will become the bank.

If your most trusted influencer recommends a portfolio on Instagram, why would you still trust JPMorgan? If you can trade directly on Twitter, why bother with Robinhood? Personally? I’d rather save money on Goodreads to buy rare editions. My point is that with the implementation of the GENIUS Act, legislation allowing products to hold user deposits has changed. In a world where the components of banking become API calls, more products will mimic banks.

Platforms that own the information flow will be the first to make this transition. This is not a new phenomenon. Early social networks monetized through e-commerce platforms because that was where the money flowed. Users seeing ads on Facebook might purchase products on Amazon, generating referral income for Facebook. In 2008, Amazon launched the Beacon app, specifically designed to create wish lists through platform activity. Throughout internet history, there has always been a subtle balance between attention and commerce. Embedding banking infrastructure internally within platforms will be another mechanism closer to the flow of funds.

Will traditional financial giants adapt to the trend of digital assets? Existing fintech companies will not sit idly by, will they? Fidelity Information Services (FIS) is in talks with almost all banks, and they understand the intricacies involved. Ben Thompson presented a simple yet brutal point in his latest article: when paradigms shift, former winners find themselves in trouble because they want to continue doing what past winners did. They focus on old rules of the game, defend outdated KPIs, and make correct decisions for the wrong world. This is the "curse of the winner," which also applies to the trend of putting currency on-chain.

When everything becomes a bank, banks will cease to exist. If users do not trust a platform to hold most of their wealth, there will be a divergence in where the funds go. This has already happened with cryptocurrency-native users, who store most of their wealth on exchanges rather than banks. This means that the unit economics of bank revenue will change. Small applications may not require as much revenue as large banks because most of their operations may not need human involvement. But this means that the traditional banks we know will gradually fade away.

In 2001, a bookstore named Borders handed over most of its online book sales business to a small startup run by a former hedge fund manager that had been established for seven years. This startup was called Amazon. A decade later, most book purchases shifted to digital, and Borders had to close in the era of Kindle and iPad. Of course, giants like JPMorgan may survive and continue to thrive. The examples of Visa and Mastercard show that large players will lead the trend. But as with most technology cycles, smaller companies will eventually be consumed.

Perhaps, like life itself, technology is a cycle of constant creation and destruction, continuous bundling and unbundling.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。