Written by: Tia, Techub News

Among many public chain projects, what sets Moonchain apart is that it is not just telling a "technical narrative," but is building an on-chain economic system with real financial applicability.

As a blockchain project invested by UOB (United Overseas Bank) in Singapore, Moonchain is backed by strong financial and industrial resources, naturally positioning itself strategically to support the large-scale application of RWA (Real World Assets) and stablecoins.

UOB not only brings a full range of resources from banking, securities, and more, but can also introduce efficient liquidity aimed at the Southeast Asian market for Moonchain in the future trend of digital currency and cross-border financial openness.

This means that Moonchain is not an isolated public chain, but a value channel with top-tier capital backing, strong financial entry points, and a clear business model, possessing long-term growth potential and systemic advantages.

High-Performance Layer 2 Infrastructure Based on zkEVM and Multi-Proof Based Rollup

Moonchain is a Layer 2 solution on the BNB Chain built on zk-rollup technology. The project adopts a zkEVM architecture, compatible with the Ethereum Virtual Machine (EVM), allowing developers to deploy existing Ethereum smart contracts and decentralized applications (dApps) on Moonchain.

To enhance decentralization and security, Moonchain introduces a Based Rollup architecture based on Taiko, employing a multi-proof mechanism that supports various zero-knowledge proof (zk-proof) technologies, such as Risc Zero and Succinct Labs' zk-proof, as well as Intel SGX Trusted Execution Environment (TEE) technology, achieving a multi-proof zk-rollup architecture without relying on a single trusted party.

Unlike traditional zkRollup that relies on independent sequencers, Based Rollup directly utilizes the consensus layer of Layer 1 (such as Ethereum/BNB) for ordering and block production, eliminating the single point of risk associated with centralized sequencers. Ordering and security are entirely inherited from L1, requiring no trust in additional entities while enabling synchronous composability. Users can enjoy an atomic interaction experience between the BNB main chain and Moonchain Layer 2, such as cross-contract combinations and RWA and stablecoin integrations.

In terms of data availability, Moonchain adopts a hybrid DA solution, storing transaction data in bulk within decentralized storage systems (such as IPFS/IPNS or a custom DA layer) and submitting data hashes and zk proofs on-chain. This ensures data immutability while significantly reducing gas consumption, saving over 70% compared to full on-chain storage methods. Additionally, this solution is particularly suited for large-scale Internet of Things (IoT) and DePIN data scenarios, allowing data generated by millions of devices to be efficiently brought on-chain without sacrificing security or verification efficiency.

Top-Tier Capital Support: Led by UOB, Comprehensive Empowerment from Traditional Finance

Moonchain is backed by a very strong investment lineup: OKX Ventures, CITIC Group, UOB, and JDI.

Among them, UOB's involvement provides Moonchain with international financial backing in the stablecoin and RWA sectors. As one of Southeast Asia's leading commercial banks, UOB's business spans retail banking, corporate finance, investment banking, securities, and asset management across the entire financial spectrum. Notably, UOB has a deep accumulation in real estate finance, being an important real estate development financing bank in the region and actively involved in residential mortgages, real estate securitization, and the REITs market over the long term. This means that as RWA gradually moves towards broader application scenarios such as real estate and real estate funds, Moonchain will be able to efficiently bring real assets on-chain by leveraging UOB's resources and experience.

While past public chains have been exploring business models on their own, Moonchain is inherently backed by a giant financial group, naturally possessing the rights to connect, distribute, and speak for the real world.

User Growth Flywheel: Initial Hardware Offering (IHO)

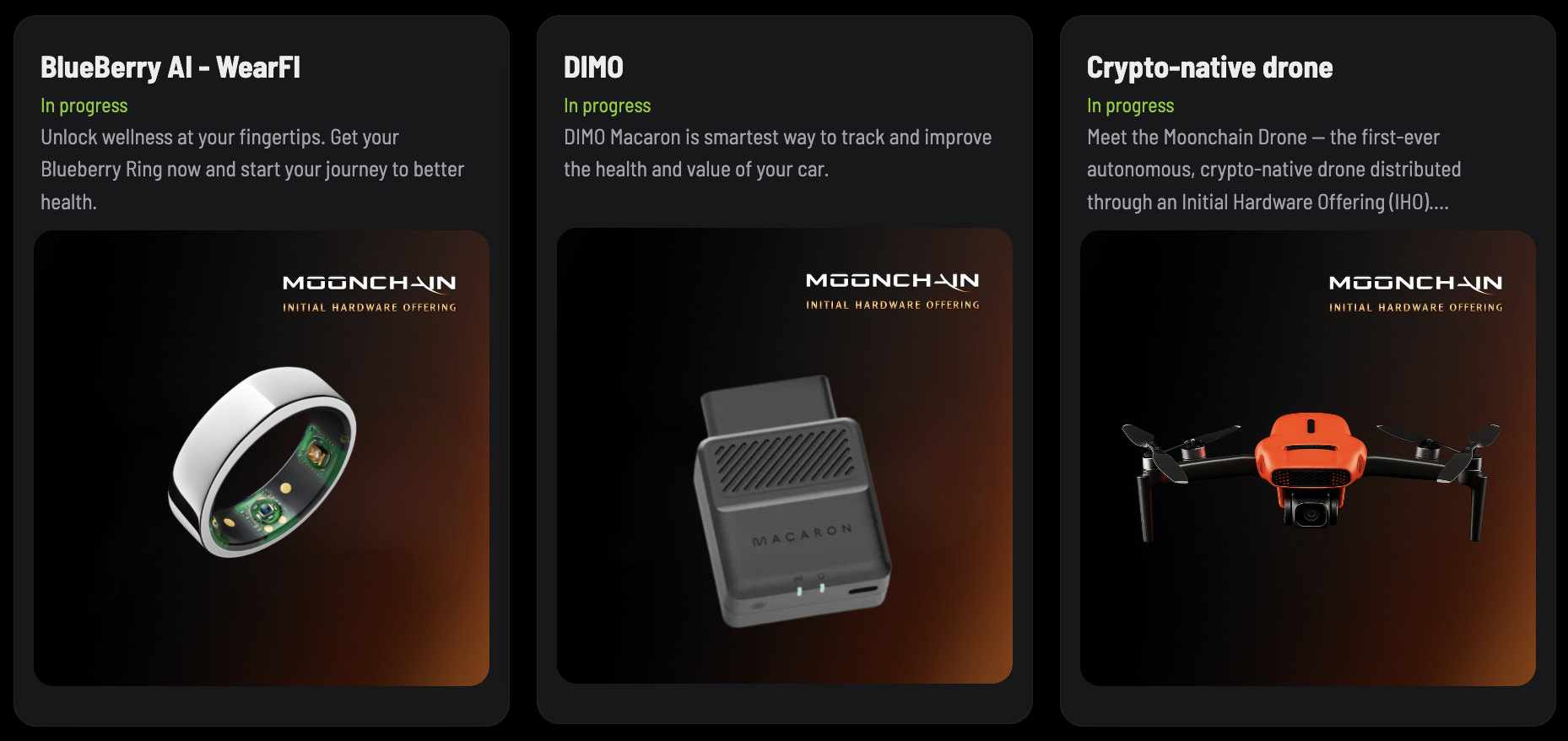

Moonchain's strategic approach is also quite unique: it not only focuses on the "chain," but has also built an ecosystem of hardware + on-chain participants. Its pioneering Initial Hardware Offering (IHO) — distributing smart hardware (such as smart rings and watches) through on-chain operations — serves as a cold start mechanism to activate hardware projects and users, while bringing real users and node operators to the network.

In the past, hardware manufacturers found it difficult to achieve a cold start. They either spent money to find KOLs to promote their products or turned to crowdfunding platforms for luck, often spending money with little effect. Moonchain offers a new path. It combines the project’s native token MCH with hardware cold starts and on-chain incentives. Users can lock tokens on Moonchain to receive hardware airdrops, such as Nothing headphones, smart rings, and more.

The logic behind this is simple:

Hardware manufacturers find real seed users;

On-chain users receive tangible rewards and actively participate;

Moonchain locks liquidity, forming a positive cycle.

This not only solves the cold start problem for hardware manufacturers but also gives Moonchain an automatically growing user pipeline. This model has already been successfully tested in the testnet phase.

Moonchain: The Triple Engine of Finance, Technology, and User Ecosystem

On the technical level, the high-performance Layer 2 infrastructure based on zkEVM and multi-proof Based Rollup allows Moonchain to achieve a unification of security, decentralization, composability, and large-scale data availability. This not only provides a seamless Ethereum-compatible environment for smart contract developers but also enables millions of IoT data to be efficiently and securely brought on-chain, forming a truly grounded application ecosystem.

Moonchain also innovatively binds hardware with on-chain incentives, constructing a self-growing user growth flywheel through the Initial Hardware Offering (IHO), allowing the network to have real users and node operators while locking liquidity and injecting vitality into the ecosystem.

Moreover, what sets Moonchain apart is not only its technological innovation but also its ability to realize real financial applicability in the real world. It is not merely a public chain that tells a "technical narrative," but is building a high-performance value channel that truly connects the real economy with the on-chain ecosystem.

As a blockchain project invested by UOB, Moonchain is inherently tasked with the strategic mission of supporting the large-scale application of RWA and stablecoins across the entire financial spectrum, including retail banking, corporate finance, investment banking, securities, and asset management.

While many are still debating which L2 is faster or cheaper, Moonchain has already positioned itself at the intersection of finance and reality.

Backed by traditional finance, Moonchain may become a giant ship aimed at the global market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。