撰文:Luke,火星财经

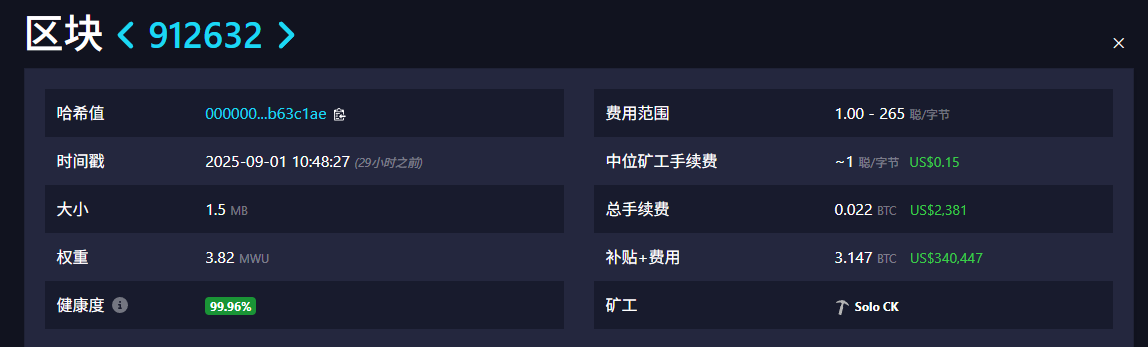

在由亿万台机器构建的、每秒奔涌着数百亿亿次计算的比特币网络中,一个近乎于统计学上「不可能」的事件发生了。区块高度 912632 被成功打包,价值超过 34 万美元的奖励没有流向任何一个庞大的矿池,而是被一个通过知名独立挖矿服务平台 Solo CK Pool 进行挖矿的节点完整捕获。

当这则消息在加密世界的「信息高速公路」上传开时,它带来的并非仅仅是对幸运的艳羡,更多的是一种夹杂着惊奇与怀旧的复杂情绪。这仿佛是工业化浪潮下一个手工作坊的意外胜利,是钢铁洪流中一株悄然绽放的野花。在算力日益集中的今天,这一个区块的归属,像一声遥远的回响,将人们的思绪拉回到了那个更简单、更纯粹,也更富理想主义色彩的「创世时代」。

这个故事的魅力,源于其发生的概率之低。要真正理解这一点,我们必须先用数字来丈量这个「奇迹」的尺度。

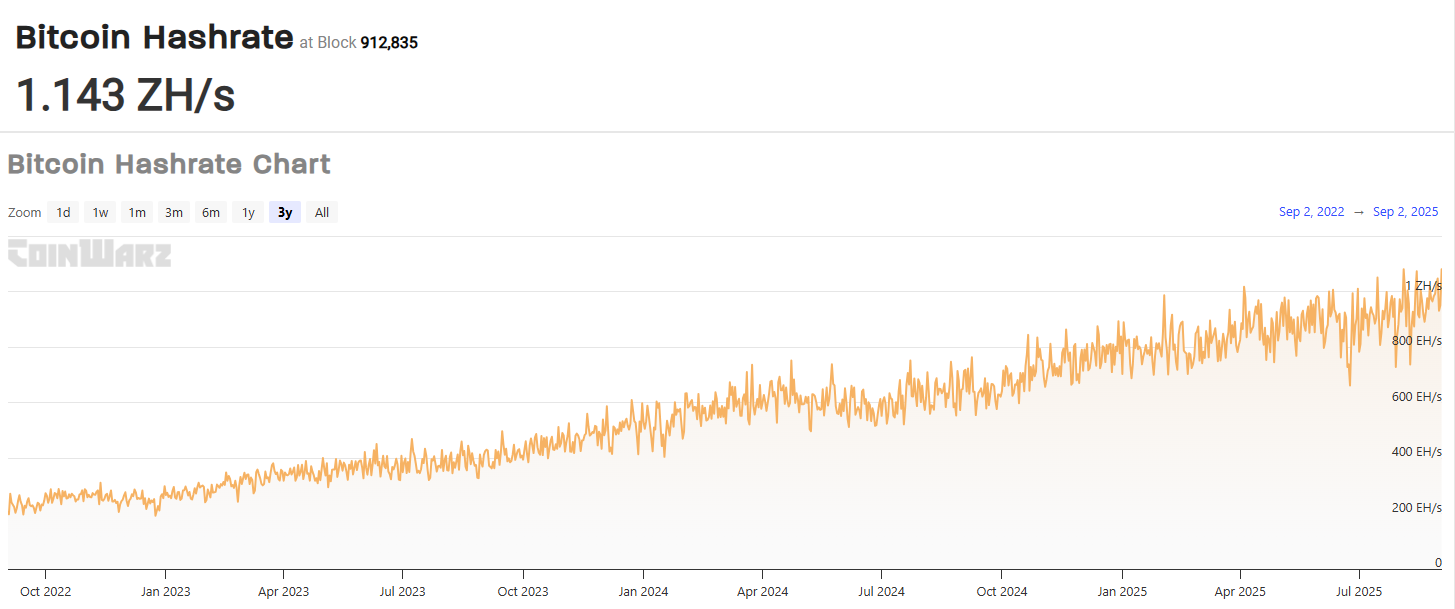

当前比特币全网算力(Hashrate)一年以来都维持在 600 EH/s 以上。1 EH/s 是什么概念?它是 10 的 18 次方次哈希 / 秒,即每秒一百亿亿次计算。而这位矿工所使用的,大概率是一台或数台顶级的 ASIC 矿机。以市面上最新的比特大陆 Antminer S21 为例,其算力约为 200 TH/s(即 200 万亿次哈希 / 秒)。

进行一次简单的计算:(200 * 10^12) / (600 * 10^18) ≈ 0.00000033。

这意味着,在任何一个区块周期(约 10 分钟)内,他能成功挖到区块的概率,大约是三百万分之一。加密货币思想家与教育家 Andreas M. Antonopoulos 曾试图用一个比喻来形容这种难度:「这相当于让你在整个太阳系里寻找一个特定的原子,并且要在十分钟内找到。」

然而,比特币的协议,恰恰为这个「不可能的任务」保留了一丝火种。

黄金时代的余晖:从「一 CPU 一票」到芬尼的暖风

回到 2009 年,当中本聪发布比特币白皮书时,其设想的共识机制被命名为「工作量证明」(Proof-of-Work)。其核心思想,正如其在邮件组中所言,是构建一个「基于 CPU 算力的点对点系统」,实现「一 CPU 一票」的去中心化愿景。

在这个「田园时代」,挖矿更像是一场智力游戏和一场社会实验。世界上第一位接收到比特币转账的传奇人物哈尔・芬尼(Hal Finney),在 2009 年 1 月 11 日发布了一条极具历史意义的推文:「Running bitcoin」。他后来在论坛上回忆道:「当我还是除了中本聪之外唯一一个运行比特币程序的人时,我的电脑只用了几天就挖出了不少区块…… 但风扇的噪音和电脑的升温让我最终关掉了它。回想起来,真希望我能一直让它运行下去。」

芬尼当时所烦恼的「风扇噪音」,在今天看来,竟成了一种奢侈的烦恼。那时的独立挖矿是常态,是协议设计的初衷。每一个用个人电脑参与进来的早期信徒,都是网络的守护者,也是潜在的受益者。然而,随着比特币的价值被发现,这场宁静的实验迅速演变成了一场无声的「军备竞赛」。

变化的序幕由一位名叫 Laszlo Hanyecz 的程序员拉开 —— 是的,就是那位用一万枚比特币购买了两份披萨的传奇人物。2010 年,他第一个意识到,用于处理图形的显卡(GPU)拥有数百个并行处理核心,在执行比特币的哈希算法时,其效率远超 CPU。他成功编写了第一个 GPU 挖矿程序,在不经意间,打开了专业化挖矿的「潘多拉魔盒」。

GPU 的入场,让 CPU 挖矿迅速成为历史。而真正将这场竞赛推向工业化巅峰的,是 ASIC(专用集成电路)的诞生。这种芯片被设计出来的唯一目的,就是执行比特币的 SHA-256 算法。它的出现,彻底宣告了个人电脑挖矿时代的终结,将算力门槛提升了数万倍。

巨鲸的时代:矿池的崛起与个人矿工的抉择

ASIC 的出现,如同在冷兵器时代投入了坦克。庞大的资本开始涌入,在电力廉价的地区,一座座由成千上万台 ASIC 矿机构成的「矿场」拔地而起,机器的轰鸣声取代了芬尼的风扇声,成为比特币网络心跳的背景音。

在这样的算力壁垒面前,拥有少量矿机的个人矿工发现,他们可能连续数年都无法幸运地找到一个区块。收入的极度不确定性,催生了比特币世界一项至关重要的发明——矿池(Mining Pool)。

矿池的逻辑很简单:「众人拾柴火焰高」。它像一个开放的联盟,允许全球各地的矿工将自己的算力接入一个共同的服务器。大家一同「猜谜」,无论最终是联盟里的哪台机器猜中了答案,获得的区块奖励都会按照每个成员贡献的算力比例进行分配。

剑bridge大学替代金融研究中心(CCAF)的数据显示,如今全球超过95%的比特币算力都集中在各大矿池中,例如Foundry USA、AntPool等。加入矿池,意味着放弃了获得完整区块奖励的「头奖」机会,以换取稳定、可预测的「按劳分配」收入。这是一种理性的经济选择,因为它极大地平滑了收益曲线,降低了不确定性。

至此,独立挖矿(Solo Mining),从一种常态,变成了一种近乎信仰的坚持。

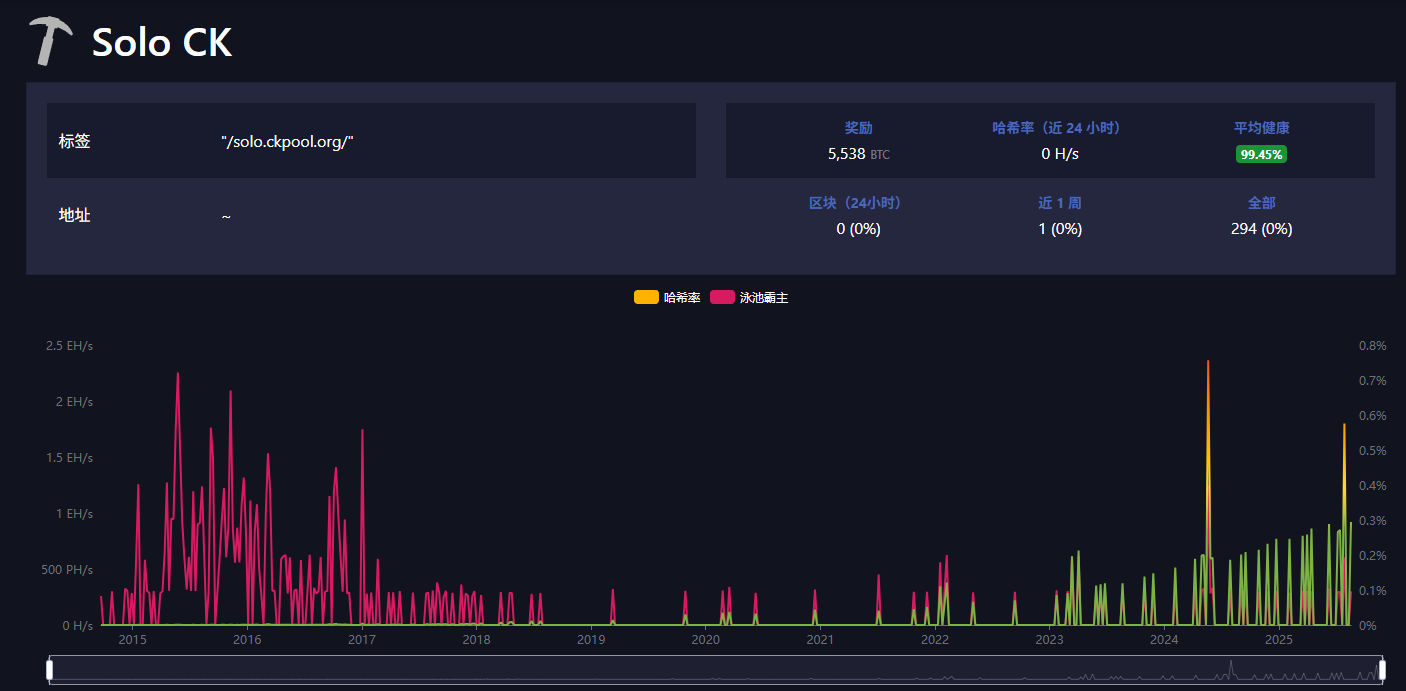

Solo CK解构:一个名字背后的千军万马

在探讨这位匿名矿工的胜利时,一个名字反复出现,引发了人们的好奇与疑问:Solo CK Pool。在区块浏览器上,这个名字似乎频繁地与「幸运区块」一同出现。这自然引出一个核心问题:Solo CK到底是谁?它是一个极其幸运的个人,还是一个庞大的实体?为什么它频繁「出矿」,却被认为是个人行为的集合?

在其官方网站上,一行醒目的注释揭示了它的本质:「请注意:尽管名字里有‘Pool’(矿池),但它并不是一个矿池;它是一项允许矿工独立挖矿的服务……」

这正是关键所在。Solo CK并非传统意义上汇集算力、分享奖励的合作社,而更像一个「淘金服务站」。它为那些想要「单打独斗」的淘金者提供最先进的工具(免去自行搭建和维护比特币全节点的复杂技术工作),但淘金者们依然是各自为战。它的机制是开放且透明的:任何人都可以匿名地将自己的矿机指向它的服务器;矿工用自己的比特币钱包地址作为登录的「用户名」。这意味着,当任何一个使用其服务的矿工幸运地挖到区块时,区块奖励会直接打入这位矿工自己的钱包。平台方自始至终不经手这笔巨款,仅仅从中抽取2%作为技术服务费。

因此,我们看到的许多区块都标记着「Solo CK」,并非是同一个实体连续中奖,而是成百上千个不同的、匿名的独立矿工,恰好都使用了这个平台提供的「工具」而已。区块浏览器上的「Solo CK」标识,更像是一个「品牌认证」,证明又有一位使用其服务的独立淘金者,在这片广袤的数字荒野中找到了属于自己的金块。

即便理解了其运作模式,一个更深层次的、符合加密世界「Don't Trust, Verify」(不要信任,要验证)精神的疑问随之而来:这会不会是一场精心设计的伪装?一个大型矿池,有没有可能在背后扮演着Solo CK的角色,以营造去中心化的假象?

这种怀疑是健康的,但从经济动机到技术证据,多重线索都指向了否定的答案。

首先,经济动机完全不符。大型矿池的核心商业模式是追求确定性,通过聚集海量算力来平滑收益,赚取稳定的服务费。它们存在的意义就是为了消除「运气」成分。而Solo CK的模式则完全相反,它服务的对象是那些愿意拥抱极端不PWM确定性,以博取小概率暴富机会的矿工。一个大矿池去伪装成Solo CK,无异于一家保险公司去开赌场,这与其根本的商业逻辑背道而驰。

其次,链上数据提供了最直观的证据。通过追踪那些由Solo CK「挖出」的区块奖励,可以清晰地看到,这些比特币被发送到了大量不同的、毫无关联的钱包地址中。如果其背后是一个单一实体,我们理应观察到这些资金在不久后被系统性地归集到少数几个地址,但这并未发生。这些资金的后续流向,呈现出的是符合成千上万个独立个人行为的、分散而无序的特征。

最后,项目的声誉提供了侧面佐证。Solo CK Pool的创办者是Con Kolivas,一位在技术圈享有盛誉的开发者。他创建此平台的初衷更多是出于一种技术理想主义和对普通矿工的支持,其网站也明确标注为「非营利(NOT-FOR-PROFIT)」性质。

因此,Solo CK频繁出现在公众视野,非但不是中心化的证明,反而恰恰说明:在算力高度集中的今天,依然有大量坚定的个体,在默默地进行着一场孤独而伟大的概率游戏。

法则的终极胜利

当拨开所有迷雾,我们再回头审视区块912632的这次成功,其意义便愈发清晰。

这位匿名矿工的胜利,不仅是一个孤立的幸运事件,更是比特币底层协议稳固如初的最高赞誉。工作量证明的核心,并非「强者恒强」,而是「概率公平」。矿池的优势在于它每秒可以投掷亿万次骰子,而独立矿工可能只能投掷几次。但比特币协议从未剥夺任何人投掷的权利,只要你遵循规则,每一次计算,都是一次被网络承认的、平等的尝试。

2022年1月,那个算力仅有126 TH/s的矿工通过Solo CK Pool挖出一个区块的「神迹」,与今天的事件遥相呼应。它们共同证明了,无论地面上建起了多么高耸的摩天大楼(巨型矿场与矿池),比特币协议这块基石依然坚不可摧。

它向每一个潜在的参与者宣告:这个系统的大门依然向你敞开,无论你多么渺小,只要你愿意贡献工作量,你就是这个网络平等的一份子,并永远保留着创造奇迹的可能。

这,或许就是这个价值34万美元的区块,所带来的最宝贵的启示。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。