Safety Shot and Bonk are engaged in a very new collaborative relationship.

Written by: Yanz, Deep Tide TechFlow

On August 11, 2025, Safety Shot, Inc. (NASDAQ: SHOT), a beverage company, announced a groundbreaking strategic alliance with the founding contributors of BONK, deeply integrating the company with the BONK ecosystem.

Through a private placement, the Bonk founding team provided $25 million worth of approximately 770 trillion Bonk tokens, while Safety Shot issued $35 million worth of convertible preferred stock (convertible into common stock of the company). With this approach, Safety Shot aims to transform from a traditional beverage company into a business that integrates DeFi (decentralized finance), but it also brings the risk of diluting existing shareholders' equity.

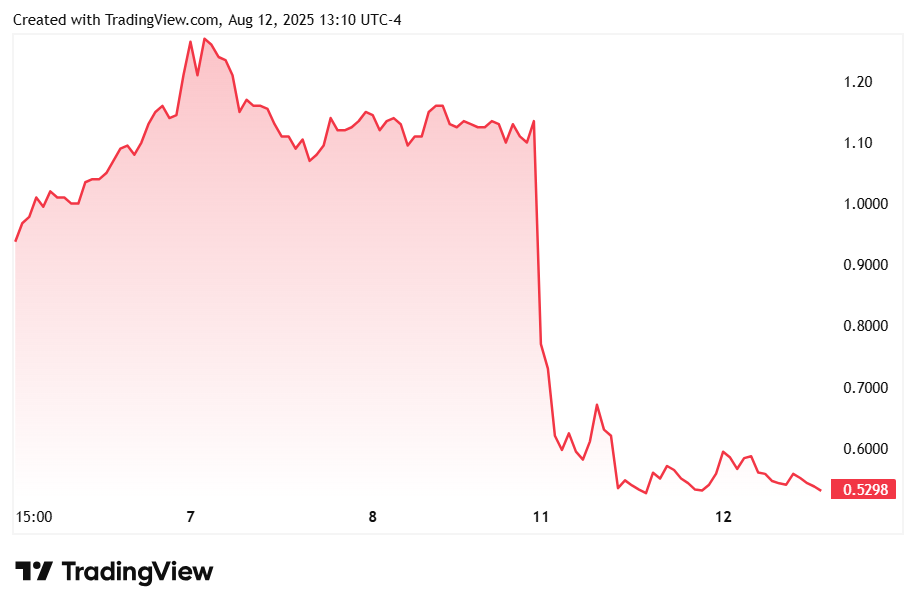

At first glance, this collaboration seemed like just another attempt by a publicly listed company to transform into a crypto reserve company, and the market reacted negatively, with Safety Shot's stock price quickly halving, plummeting by 55% after the announcement.

However, the situation is not that simple; Safety Shot and Bonk are engaging in a very new collaborative relationship.

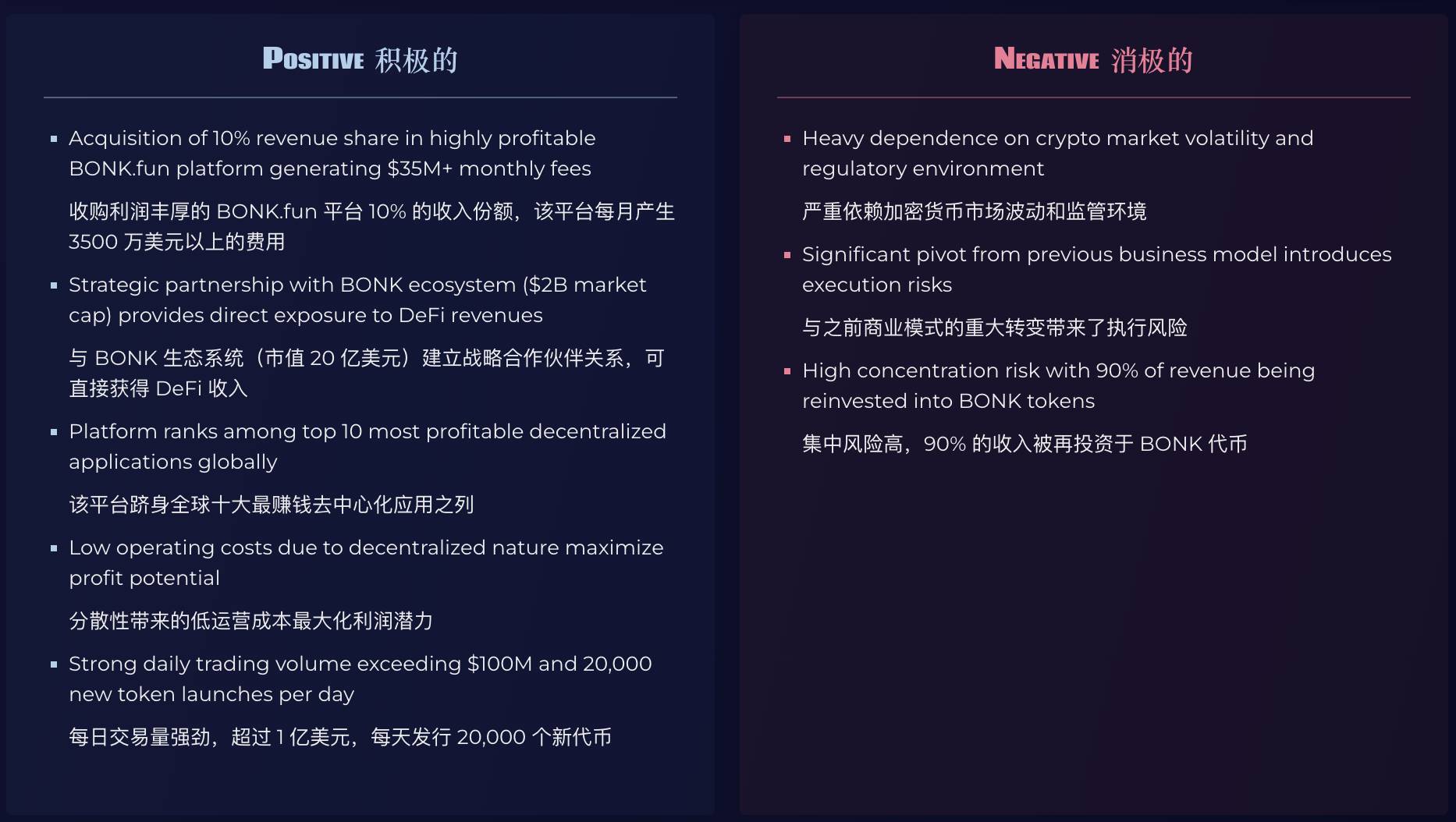

On August 12, Safety Shot further disclosed that it had acquired a 10% revenue-sharing interest in the core platform of the Bonk ecosystem, letsBONK.fun (BonkFun), and appointed core members of the Bonk founding team (such as Mitchell Rudy) to the board of directors, holding 50% of the board seats. Rudy will also guide the accumulation of $BONK in a strategic capacity and provide advice for on-chain operations. The company has also reserved the Nasdaq stock code "BNKK" for future strategic adjustments.

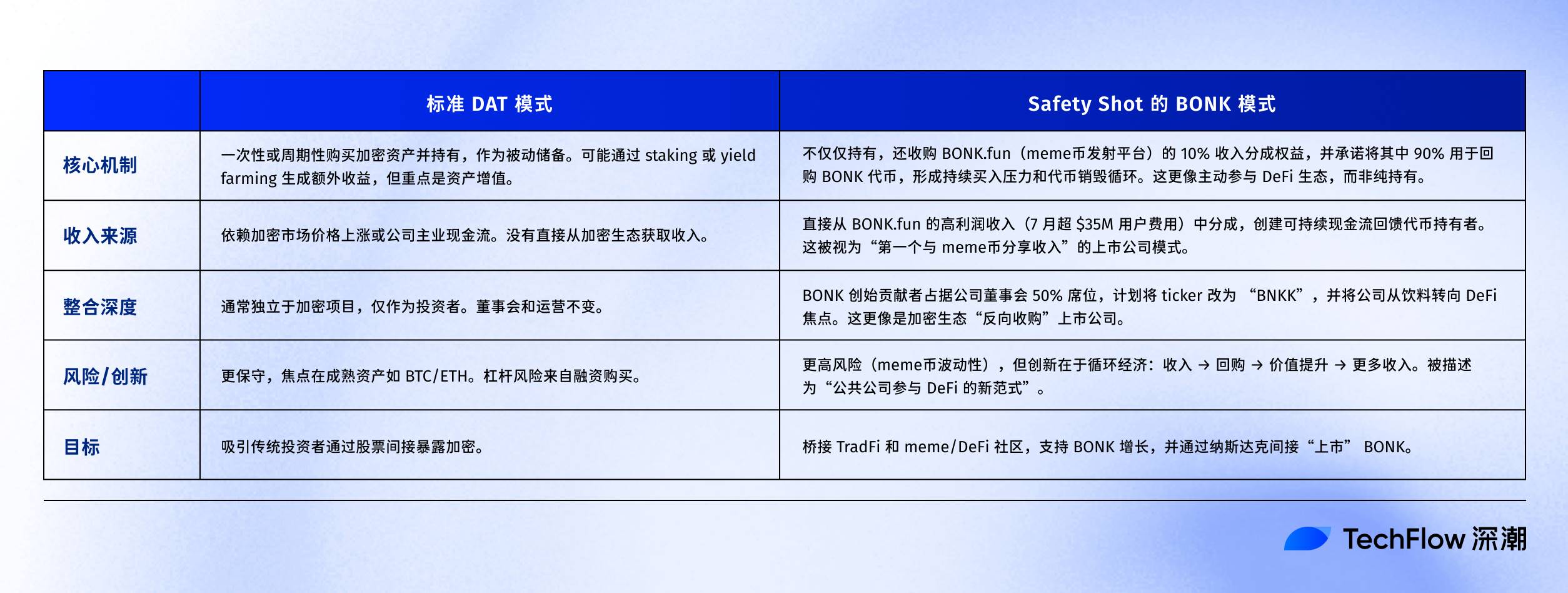

It appears that the collaboration between these two companies has transcended the traditional corporate strategy of "piggybacking" on buying tokens to enrich asset allocation.

Safety Shot will receive 10% of the revenue from BONK.fun and has committed to using 90% of the profits to repurchase BONK tokens, depositing them into the company treasury. This will create buying demand for BONK and support its value growth. At the same time, BONK.fun itself will also use part of its revenue to repurchase and destroy BONK tokens in the open market, further reducing supply and enhancing value.

Unlike other announced cryptocurrency reserve strategies, Safety Shot will generate revenue by participating in letsBONK.fun, rather than merely earning income from token trading.

Rudy stated, "Staking yields are relatively stable but limited and always subject to the price of the underlying token. Revenue sharing, on the other hand, offers unlimited exponential growth potential closely tied to the success of market-leading companies. This is a bet on the growth of the entire industry, not just a single asset. For Safety Shot investors, this means the company's value is linked to real, high-profit cash flows, which is much more powerful and exciting than merely holding tokens and hoping for their appreciation."

The impact of the collaboration on Safety Shot

Source: https://www.stocktitan.net/news/SHOT/safety-shot-acquires-10-revenue-sharing-interest-in-revenue-3axg64322ylq.html

This is seen as the first publicly listed company in Nasdaq history to "share revenue with a meme coin" and will also share profits with token holders, as the revenue ultimately flows into the BONK ecosystem, supporting the holders.

Safety Shot CEO Jarrett Boon stated, "This strategic partnership represents the first step in a broader corporate transformation for our company. By collaborating with one of the most exciting ecosystems in the digital asset space, we are taking a bold first step."

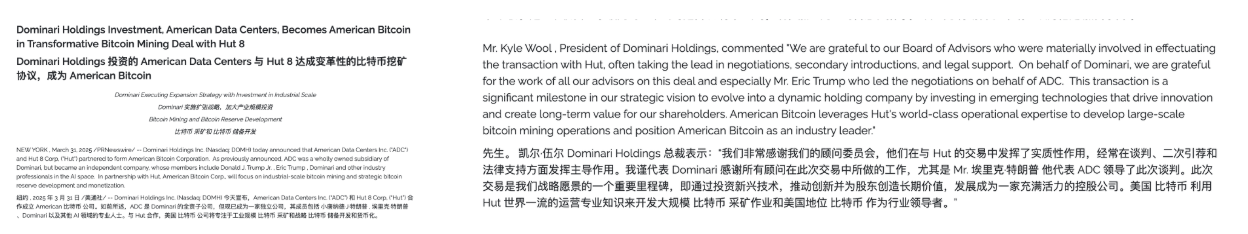

Interestingly, the investment advisor behind this bold collaboration, Dominari Securities, is not an unknown entity but a holding company associated with the Trump family, with its parent company, Dominari Holdings, Inc. (NASDAQ: DOMH), headquartered in Trump Tower.

As early as February 11, 2025, Dominari Holdings announced that Trump brothers Donald Trump Jr. and Eric Trump joined its advisory board and each invested approximately $1 million through a private placement. FactSet data shows that Trump's sons hold 6.7% of the company, each worth over $6 million.

Now, this company has become the preferred advisor for several transactions involving the Trump family, including projects in crypto, data centers, and manufacturing. Dominari Holdings President Kyle Wool praised the advisory board, particularly Eric Trump, for helping a subsidiary secure a Bitcoin mining partnership, namely the collaboration between American Data Centers and Hut 8.

Returning to the somewhat crazy and unsafe collaboration between Bonk and Safety Shot, the connection between Dominari and the Trump family makes it part of the Trump business network, adding some risk factors to this "very new collaboration," even though the Trump brothers are not directly involved.

This "Trump halo" has attracted widespread attention to Safety Shot and Bonk, further amplifying interest in both the crypto and traditional financial markets, but it has also raised concerns among investors about the speculative risks associated with the Trump connection.

As of September 1, the SHOT stock price is not optimistic, still showing signs of fatigue after the news release, and the future direction of the collaboration remains to be seen.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。