Daily market key data review and trend analysis, produced by PANews.

1. Market Observation

The market is at a critical crossroads, with a series of employment reports, key inflation data, and the Federal Reserve's interest rate decision set to arrive in the next two weeks, which will set the tone for the market. Historical data shows that September is usually the worst-performing month for U.S. stocks, yet the current Cboe Volatility Index (VIX) is at an unusually low level, and the S&P 500 index has not seen significant pullbacks for several days, creating a strange calm that worries some Wall Street analysts. Tom Lee, chairman of BitMine, predicts that the market will experience a 5% to 10% pullback in the fall, followed by a rebound by the end of the year. Ed Yardeni of Yardeni Research questions the possibility of a rate cut in September, suggesting that persistent inflation risks may keep the Federal Reserve's rates unchanged, leading to short-term impacts on the market.

Notably, the price of spot silver has surpassed $40 per ounce for the first time since 2011, with an increase of over 40% this year. The U.S. Geological Survey has proposed adding silver to the "critical minerals list," which Citibank interprets as a precursor to potentially imposing import tariffs of up to 50%, maintaining a bullish outlook for silver prices at $43 per ounce. Meanwhile, thanks to strong performance and growth in AI chip shipments, Goldman Sachs has once again raised the target price for Cambricon to 2104 yuan within a week, optimistic about its leadership position in China's AI chip sector.

In the cryptocurrency market, Bitcoin is facing a critical test. Overall market sentiment is cautiously bearish, with a report from Greeks.live indicating that Bitcoin's performance is weak, lacking strong support at the critical price level of $108,000. The current market adjustment is attributed to "market fatigue" or potential manipulation, with attention on the volatility that the non-farm payroll data on September 5 may trigger. Pessimism is mainly focused on concerns over key support levels. Analyst Ted believes Bitcoin may have formed a short-term top at $124,000 and plans to short when the price rebounds to the $115,000 to $120,000 range. Both Big Smokey and Altcoin Sherpa see risks of short-term prices dropping to $105,000 or lower, pointing out that long-term whale wallet sell-offs, stagnant spot ETF inflows, and weakness in traditional markets are major sources of pressure, with short-term key support at $104,000. A more pessimistic forecast comes from trader Roman, who warns that if the price falls below the $98,000 to $100,000 range, it could "officially confirm the end of the bull market"; AlphaBTC also notes that if the bearish crossover signal on the daily chart reoccurs, it could lead to a price retracement to $92,000, or even drop to the low of $80,000. However, there are also optimistic voices in the market. Michaël van de Poppe views the $102,000 to $104,000 range as an ideal entry point. CrypNuevo believes the current situation is more likely a market deviation rather than a deep correction, expecting large funds to buy in using panic sentiment before interest rate adjustments, even if the price may test $107,200 or retrace to $94,000 in the short term, but he believes the CME gap at $117,000 will eventually be filled.

In contrast to Bitcoin's weakness, Ethereum shows relative strength. Analyst Ted points out that although Ethereum has recently outperformed Bitcoin, it may still face pressure to test the key support level of $4,000 in the short term. On-chain data shows that an ancient Bitcoin whale is continuously swapping its held Bitcoin for Ethereum, having recently accumulated over 837,000 ETH through BTC sales. Analyst Axel Bitblaze believes that the current lack of market liquidity is a major issue, but as the Federal Reserve begins to cut rates and ends quantitative tightening, liquidity is expected to return in October or November, paving the way for a market rebound and setting the stage for a new bull market in 2026.

In market dynamics, the WLFI token will be the focus of TGE at 9 PM tonight, and its ecological projects Blockstreet (BLOCK) and Dolomite (DOLO) are also gaining popularity. On-chain data indicates that the well-known market maker Jump Crypto has likely become a market maker for WLFI. The project has received investments from several institutions, including DWF Labs ($25 million), Aqua One Fund ($100 million), and Nasdaq-listed ALT5 Sigma ($1.5 billion), with partners from Momentum 6 also stating they hold seven-figure positions.

2. Key Data (as of September 1, 12:00 HKT)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, Tomars)

- Bitcoin: $107,863 (YTD +15.24%), daily spot trading volume $30.48 billion

- Ethereum: $4,397.19 (YTD +31.69%), daily spot trading volume $23.75 billion

- Fear and Greed Index: 47 (Neutral)

- Average GAS: BTC: 1 sat/vB, ETH: 0.274 Gwei

- Market Share: BTC 58.05%, ETH 14%

- Upbit 24-hour trading volume ranking: XRP, ETH, BTC, SOL, POL

- 24-hour BTC long/short ratio: 49.88%/50.12%

- Sector performance: GameFi down 7.76%, AI down 5.38%

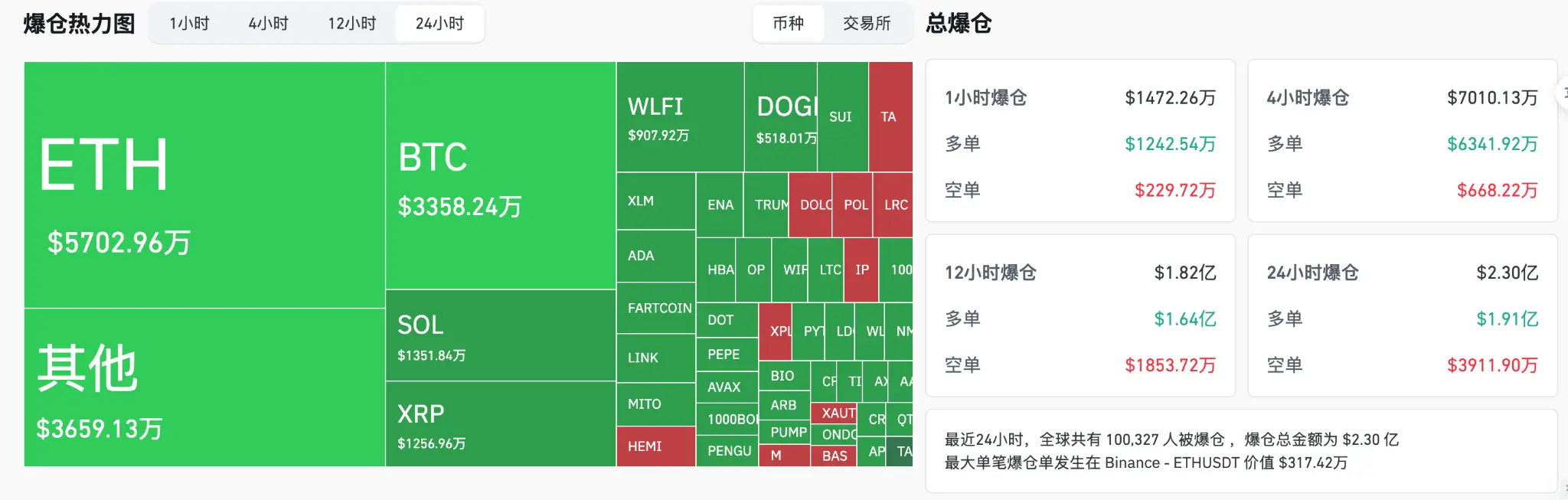

- 24-hour liquidation data: A total of 100,327 people were liquidated globally, with a total liquidation amount of $230 million, including $33.58 million in BTC, $57.02 million in ETH, and $13.51 million in SOL

- BTC medium to long-term trend channel: Upper line ($112,577.10), lower line ($110,347.85)

- ETH medium to long-term trend channel: Upper line ($4,477.41), lower line ($4,388.75)

*Note: When the price is above the upper and lower lines, it indicates a medium to long-term bullish trend; conversely, it indicates a bearish trend. When the price is within the range or fluctuates through the cost range in the short term, it indicates a bottoming or topping state.

3. ETF Flows (as of August 29)

- Bitcoin ETF: -$127 million, first net outflow after four days of net inflow

- Ethereum ETF: -$165 million

4. Today's Outlook

- U.S. stocks will be closed on September 1

- WLFI will launch on the Ethereum mainnet on September 1, with early investors unlocking 20%

- Starknet will reach an important stage of decentralized ordering on September 1,and will support Bitcoin staking in the coming weeks

- Binance Wallet's 36th TGE will launch Forest (FOREST)

- Binance Alpha will launch Quack AI (Q) on September 2

- Eric Trump, son of Donald Trump, will attend the special shareholders' meeting of Metaplanet on September 1

- Sui (SUI) will unlock approximately 44 million tokens at 8 AM on September 1, accounting for 1.25% of the current circulation, valued at about $145 million;

- ZetaChain (ZETA) will unlock approximately 44.26 million tokens at 8 AM on September 1, accounting for 4.55% of the current circulation, valued at about $8.4 million

- Ethena (ENA) will unlock approximately 40.63 million tokens at 3 PM on September 2, accounting for 0.64% of the current circulation, valued at about $27.1 million;

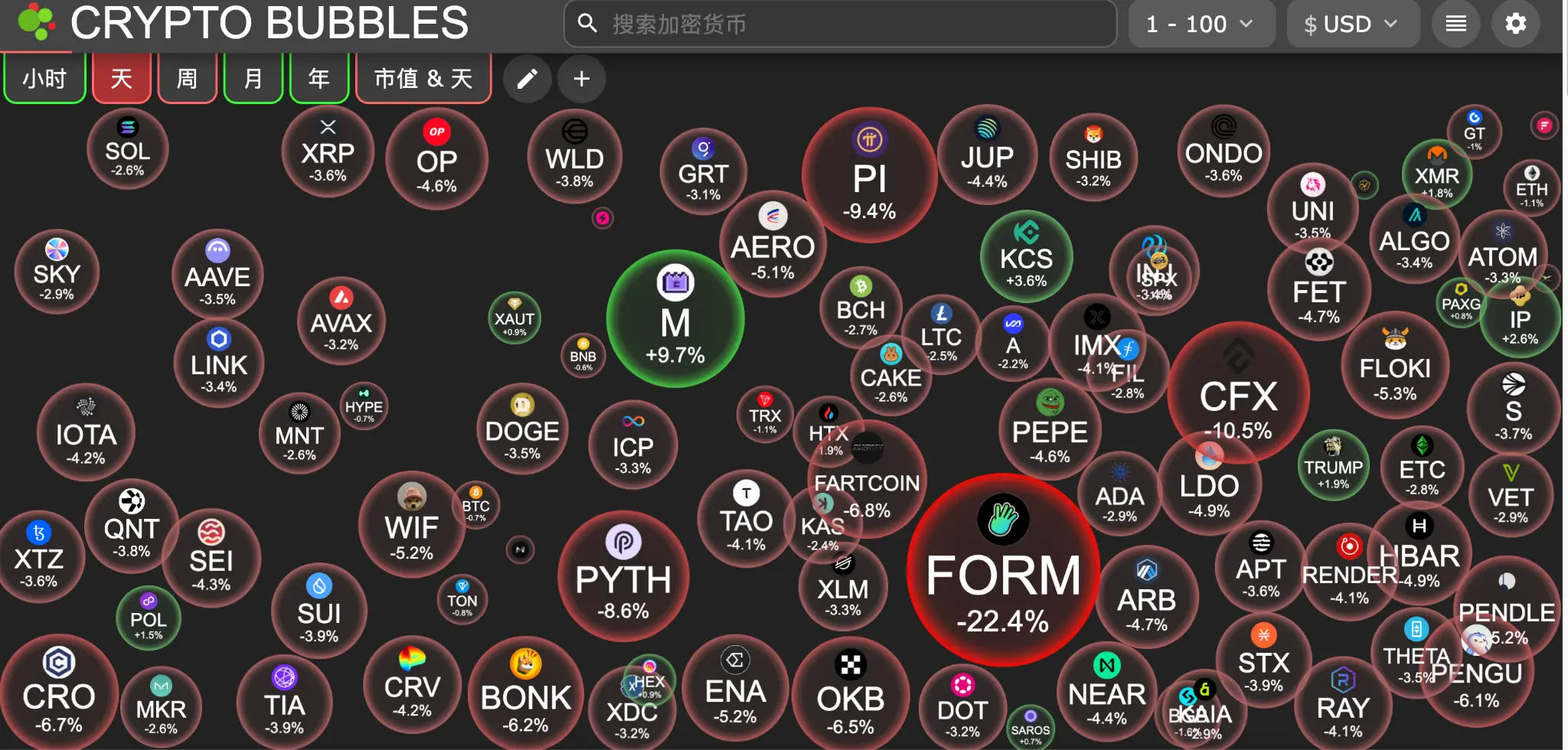

The largest declines among the top 100 cryptocurrencies today: Four.meme down 22.4%, Conflux down 10.5%, Pi Network down 9.4%, Pyth Network down 8.6%, Fartcoin down 6.8%.

5. Hot News

- Data: SUI, ENA, IMX and other tokens will see large unlocks, with SUI unlocking valued at approximately $145 million

- This Week's Preview | WLFI launches on the Ethereum mainnet, early investors will unlock 20%; September 5 non-farm payroll data may bring significant market volatility

- This Week's Macro Outlook: Trump's "Power Game" with the Federal Reserve Intensifies, 25 Basis Point Rate Cut Expectations Resurrected

- An ancient Bitcoin whale has once again deposited 1,000 BTC into HyperLiquid to exchange for ETH

- Binance will list World Liberty Financial (WLFI) and add a seed label for it

- Solana's Alpenglow proposal has been voted through, reducing the final block confirmation time to 150 milliseconds

- Trend Research has deposited $4.72 million in ENS into Binance, and $4.78 million in PENDLE has been transferred to Binance

- ZhongAn Online: ZhongAn Technology plans to increase capital for ZhongAn International, which has signed share purchase agreements with Cosmos, OKG, and others

- Japanese nail salon operator Convano plans to raise $3 billion to support its Bitcoin treasury reserves

- Bonk.fun has partnered with WLFI, becoming the official Launchpad platform for USD1 on Solana

- The Ethereum Community Foundation has launched the ETH burn proof token BETH

- China Financial Leasing Group has disclosed investments in BlackRock and Bitcoin and Ethereum ETFs listed in Hong Kong

- Celebrity investor Kevin O'Leary: Personal BTC and crypto-related assets account for over 10% of his portfolio

- Japanese gaming giant Gumi plans to invest approximately $17 million to purchase XRP

- International Commercial Settlement Holdings plans to raise HKD 500 million, with 90% allocated to exploring cryptocurrency investment opportunities

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。