Metaplanet Stock Faces Heavy Dilution Risk Amid Bold Bitcoin Strategy

According to Bloomberg, Metaplanet Stock has plunged over 50% since mid-June 2025, sending serious alarm among investors. The Japanese company, already active for its huge Bitcoin stakes, is now taking even more aggressive steps to broaden its crypto strategy.

Source: Wu Blockchain

Most market analysts are referring to this as one of the most significant corporate moves in Japan's financial history.

New Fundraising Plan

To bolster its finances, the firm has proposed raising $884 million by selling shares overseas. Meanwhile, it will ask shareholders for approval on September 1, 2025 to issue as many as 555 million preferred shares. If approved, Metaplanet hopes to raise close to $3.8 billion in new financing.

A majority of the funds will be channeled directly into BTC purchases. Approximately $837 million has been allocated towards Bitcoin purchases from September to October 2025, while another $44 million will go towards Bitcoin-related financial transactions.

Existing Bitcoin Holdings and Future Aspiration

Currently, the firm already owns 18,991 BTC worth approximately ¥314.6 billion ($2.1 billion) as of late August 2025. With its latest strategy, the company is aiming for a total of 30,000 BTC by year-end.

This risky move indicates the company's firm conviction that Bitcoin is the future of currency. In its assessment, gold is losing its luster, government bonds are no longer reliable, and it is the sole scarce and borderless alternative remaining to hedge against inflation and the fiat.

Effect on Metaplanet Stock and Investors

Though long-term plans appear solid, there are definite risks involved. Creating 555 million new shares will dilute the company's total shares from 722 million to 1.27 billion. This dilutive load may create extreme volatility in Metaplanet Stock.

The company also imposed a 60-day lock-up period, so CEO Simon Gerovich and MMXX Ventures' shares are off-limits for sale for two months. Nevertheless, without a price stabilization plan in place, the shares prices may continue to fluctuate violently in the near term.

Role of Eric Trump

With another twist, Eric Trump, the son of U.S. President Donald Trump, has been awarded 3.3 million shares (metaplanet stock) as an advisor company. His arrival has brought new hype in world markets, with analysts speculating that his name would bring in new investors and Metaplanet Stock hype.

Market Reaction

Social media sentiment towards Metaplanet Stock remains largely positive, with most crypto enthusiasts lauding the company's vision.

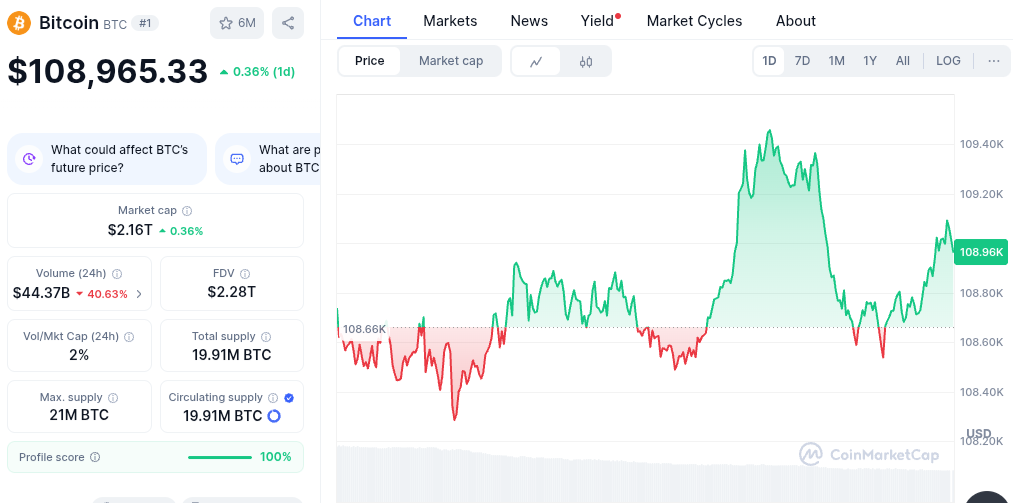

Bitcoin price charts, however, indicate potential short-term caution, before any evident rally.

Source: CoinMarketCap

The coin is now trading at $108,965 with an increase of 0.36%, while trading volume decreased by 40% to reach $44.37 billion.

If the plan is approved by the shareholders on September 1 , it might unleash yet another round of institutional Bitcoin purchases throughout Asia.

Conversely, if the plan is voted down, the expansion strategy of the company may be derailed, and the effect on BTC in the short term might be adverse.

Conclusion

Metaplanet Stock has plummeted by over half, but the company won't slow down. With a strategy to raise billions and invest further in its Bitcoin holdings, it is doubling down on its faith in crypto as the future. The September 1 referendum will determine whether this risk becomes Japan's riskiest financial success or its greatest risk.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。