Author: Duo Nine

Compiled by: Tim, PANews

The performance of altcoins this year has been quite disappointing, with most showing poor trends, but there is one major exception: HYPE.

What makes Hyperliquid different? What are its development prospects?

I will answer that question later. In the meantime, in the past 24 hours, HYPE has broken through its historical high of $50 and is expected to set new highs this year.

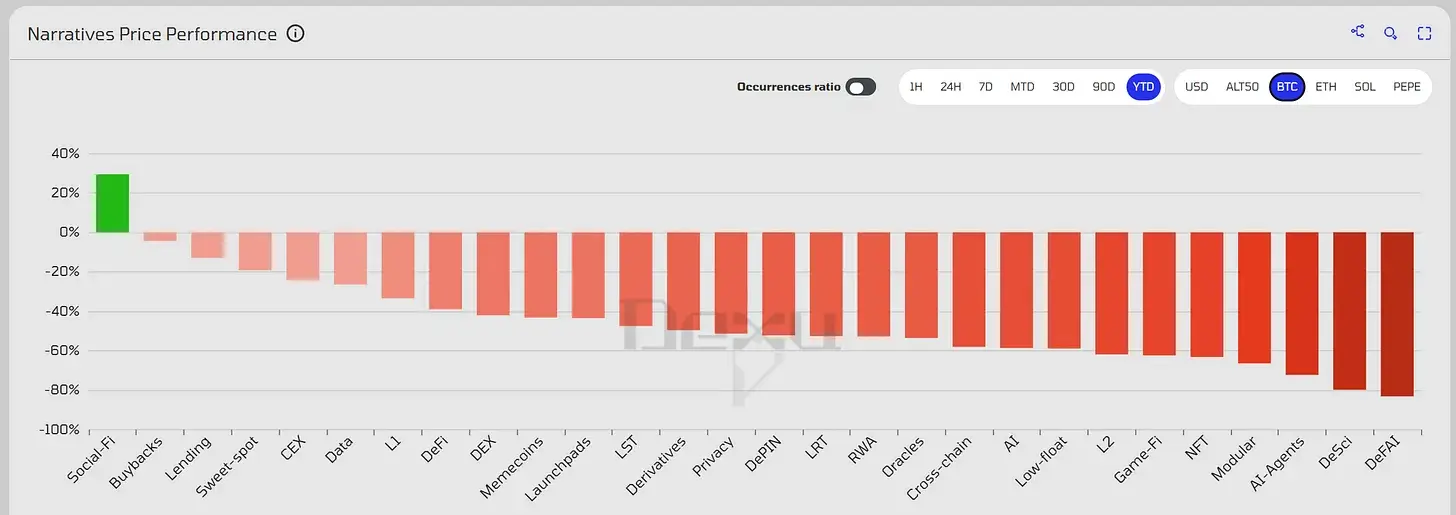

First, let’s quickly review the year-to-date performance of most altcoins relative to Bitcoin. Notice anything in the chart below? All sectors are down except for SocialFi.

In other words, holding only Bitcoin in 2025 is a wiser choice. The exception among SocialFi projects includes tokens like Cookie, Kaito, and Zora, the latter of which has recently surged by 15 times, which I reported in the last Alpha Post.

Image from dexu.ai

Once we compare altcoins with Bitcoin's performance and filter out the winning coins, the options become very limited, and HYPE is one of those few coins; it is the governance token of Hyperliquid. Let’s explore this from the very beginning.

Why is Hyperliquid different?

TLDR: Most cryptocurrencies are about extracting value from users, while Hyperliquid does the opposite and takes a different approach.

Before we discuss some examples, it’s important to define the term "extractive." It refers to protocols or chains that extract funds from users without ever giving back to their ecosystem. These funds ultimately disappear into the project team's bank accounts.

This practice reappears every so often under new brands and narratives, with the same operators behind it, who continuously repeat their tricks to legally defraud users of their money.

Let’s look at a few recent examples to illustrate this:

- The Pump.Fun platform earned billions in fees by massively issuing meme coins on the Solana chain. Subsequently, they raised huge amounts of money from investors in a pre-sale before the token launch. However, the PUMP token plummeted 67% right after its listing. They extracted a lot from users but gave back very little.

- Cronos: Crypto.com created the CRO token in 2018 with an initial issuance of 100 billion tokens. In 2021, to support the token price, the project burned 70 billion tokens. However, in March 2025, after a vote led by insiders, they reissued 70 billion tokens. This operation sacrifices user interests rather than creating value for users.

- TRUMP/MELANIA/YZY: These celebrity coins are a textbook example of extractive operations. Once a celebrity agrees to collaborate, the token is created privately and allocated to insiders. When the token is listed, those tokens obtained at no cost are sold off for hard currency. The entire process returns nothing to the users, taking everything away.

Now let’s take a look at Hyperliquid.

They launched a decentralized exchange, initially kickstarting the project by paying rebate fees to all those providing liquidity for the order book (whom we call market makers). Specifically, market makers earn by creating limit orders, with their profits coming from sharing the fees paid by takers on the Hyperliquid platform (this model is still available on the Grvt platform).

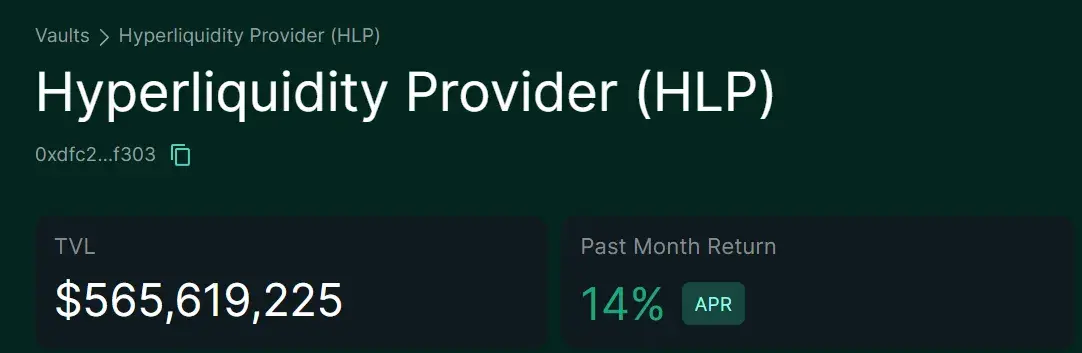

To further enhance the exchange's liquidity, Hyperliquid also created an HLP staking vault, where users can deposit USDC to earn liquidation fee dividends while also enjoying other trading fee revenues. In contrast, centralized exchanges like Binance or Coinbase pocket all liquidation fees.

Prior to this, there was no HYPE token. However, all users trading on Hyperliquid were accumulating points. Later, these points were converted into HYPE token airdrops, distributed to all users who had traded on the exchange.

The first airdrop (with more possibly to come) distributed 31%, or 310 million HYPE tokens, to users of Hyperliquid. This airdrop coincided with the launch of its spot market. Unsurprisingly, the HYPE price skyrocketed from $2 to its current $51. Users who received the airdrop obtained these tokens "for free" based on their trading metrics.

They (the users who received the airdrop) belong to the insiders, and this move fundamentally changed the trajectory of Hyperliquid's development.

Additionally, Hyperliquid is currently using 97% of its revenue to buy back its own tokens and plans to increase this ratio to 99%. This means that the fees users pay when trading on Hyperliquid will be used to buy back HYPE tokens and drive up their price.

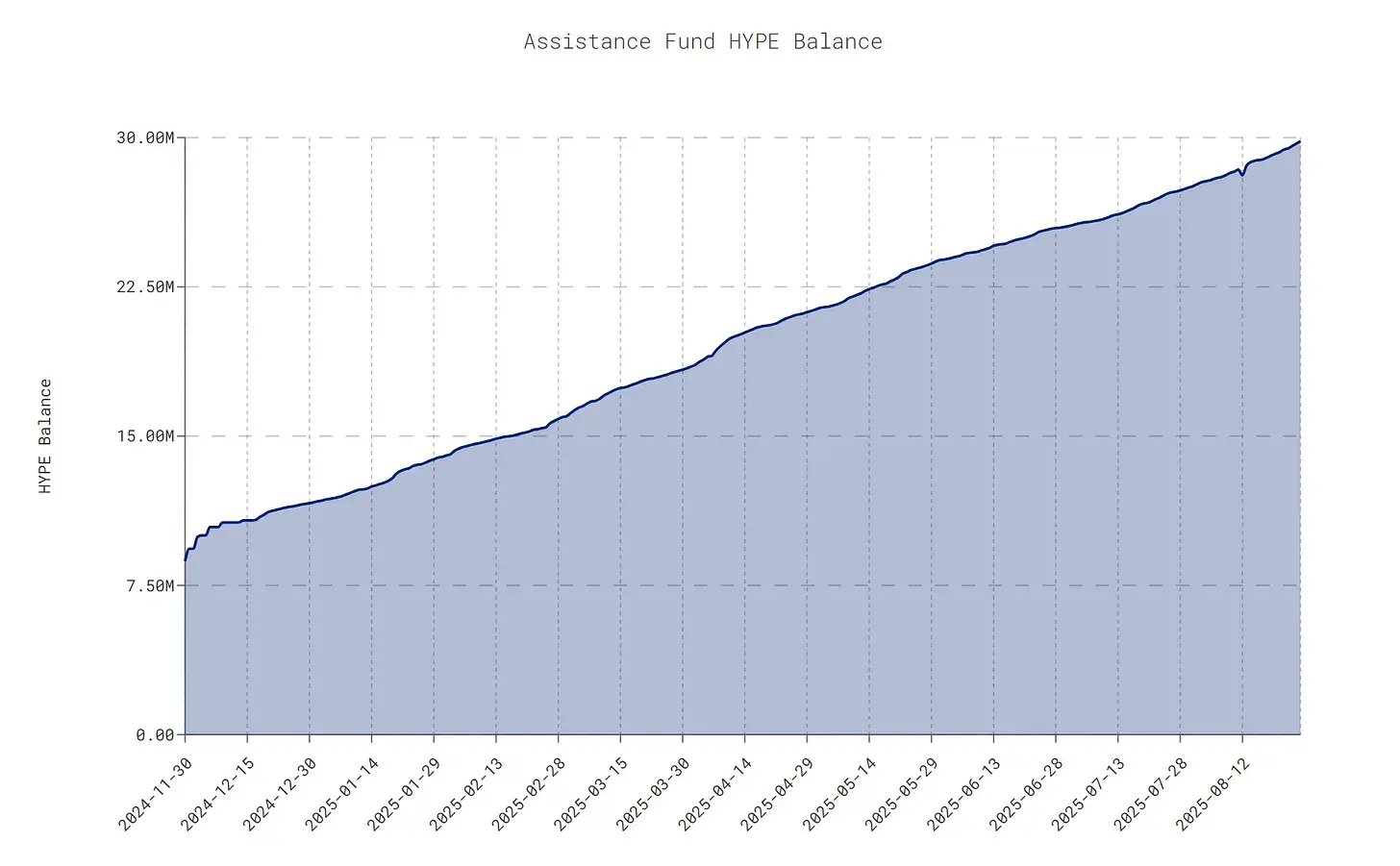

If you happen to stake a large amount of HYPE to receive trading fee discounts, you are effectively paying fees for yourself by trading on the platform. So far, the Hyperliquid assistance fund has purchased approximately $1.5 billion worth of nearly 30 million HYPE tokens.

Image from data.asxn.xyz

While other platforms charge users hefty fees and may return a portion, Hyperliquid returns 97% and soon to reach 99% of the funds users invest back to them. Users have noticed this difference, which is why HYPE has become an outlier in the industry and will continue to capture market share from centralized exchanges that primarily charge users fees.

These competitors happen to be the same ones claiming that the Hyperliquid team will eventually sell the 30 million HYPE in the assistance fund.

That’s impossible!

I believe the Hyperliquid team is more likely to burn these tokens, which would cause the price of HYPE to skyrocket by 2 to 5 times overnight.

Why would they burn the tokens in the assistance fund?

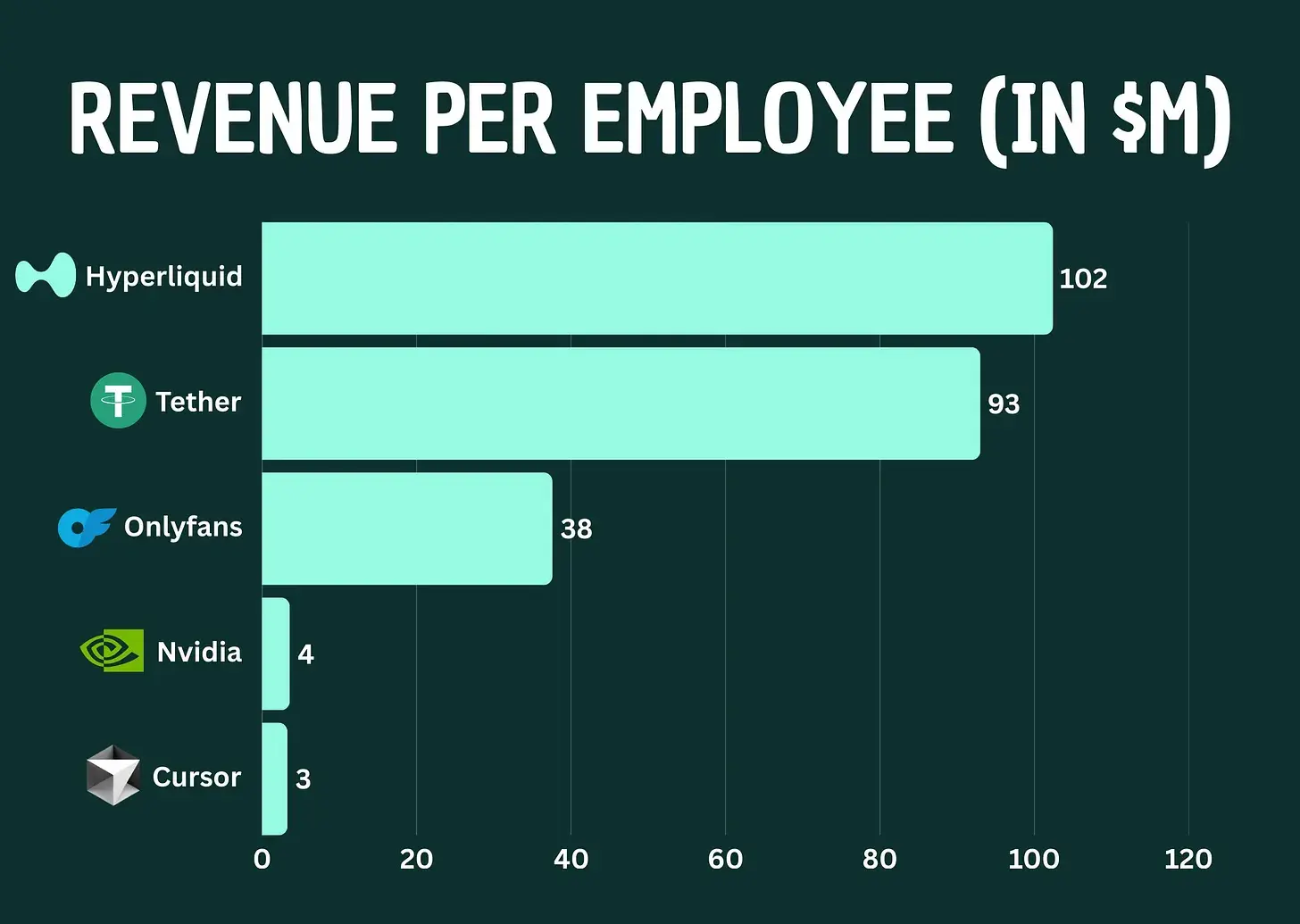

Because it benefits their users and ecosystem. It’s worth noting that Hyperliquid is managed by 11 people, with an average income of $102 million, the highest in the world!

I’ll say it again, it’s eleven people! Most of the Hyperliquid team’s income also comes from market making. They don’t need to sell HYPE tokens to be profitable; they just need to operate a successful exchange, and they have already achieved that.

That said, let’s take a look at the price trend of HYPE.

Where will the HYPE price peak?

As shown in the chart, the price is in an upward channel, with the channel range between $40 and $60. If the price breaks through $63 (the upper boundary of the channel), its significance will far exceed the current breakout at $50.

I believe a target price of around $109 or $100 has a magnetic effect, and market enthusiasm will eventually reach that level, likely after breaking through $63.

It’s worth noting that compared to the surge from April to June, the current price trend is showing weakened momentum. Despite millions of dollars being repurchased daily, the market cap of HYPE has reached a considerable scale, making the impact of such repurchase operations still significant but not as pronounced as before.

Excluding stablecoins, HYPE's market cap has also entered the top ten cryptocurrencies, which is a huge achievement in itself. If HYPE rises to $100 in the future, its market cap will double, approaching Dogecoin, second only to Solana.

I see this as a peak in this cycle. The price of HYPE may continue to rise, but this depends on the growth of its protocol ecosystem and user base on HyperEVM. If all goes well, this will fully explode in the next cycle.

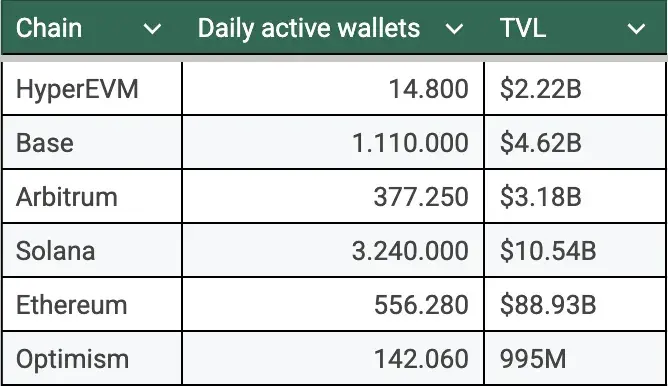

So far, the number of users on HyperEVM is about 15,000, most of whom are traders from the Hyperliquid DEX itself. Compared to Solana or other chains (like Ethereum or Arbitrum), this number is negligible. Unless this situation changes, the upward potential of HYPE will be limited to the performance of its exchange.

Currently, guiding new users to use Hyperliquid DEX has become very easy. However, the situation with HyperEVM is not the same; its user experience still has many issues, although it has improved with the recent introduction of integrated services like native USDC functionality.

Moreover, mainstream exchanges like Coinbase or Binance have yet to list the HYPE token. This has become a limiting factor for HyperEVM in attracting new users. The success of Hyperliquid has sparked envy among many peers, and its rapid development has also made many established exchanges uneasy.

In a market dominated by takers, the emergence of Hyperliquid has completely reversed the situation. This has allowed them to stand out and become a favorite among users. If they can continue to maintain this momentum and avoid black swan events (as Hyperliquid is still very centralized), HYPE has only one direction to go: up.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。