Safe, Professional, Trustworthy - This is the essence of OKX C2C.

"I was quite annoyed when my card was frozen at first, but I got used to it later," said a cryptocurrency user named Long. When he was first limited, he had to explain to the bank and the police station with a thick stack of transaction records, transfer screenshots, identification documents, etc., almost missing his mortgage payment. Over time, he treated it as "routine." For newcomers, sudden card freezes can cause anxiety; while experienced users will conduct strict self-checks and pay more attention to safe trading.

Crypto C2C is a user-driven peer-to-peer trading model. Fiat currency is often transferred outside the platform via banks or payment tools, while cryptocurrencies are held in escrow within the platform, released only after payment confirmation. Since users can choose their trading counterparties, they need to assess the other party's credibility and compliance, being wary of fake documents, third-party payments, and funds of unclear origin. Compliant platforms can reduce risks, but it is difficult to completely isolate the chain effects of upstream abnormal funds, which can trigger account risk control or even card freezes in severe cases.

To address these real pain points, leading platforms in the industry are continuously enhancing the trading experience through risk control systems and post-event guarantees. OKX C2C, as a top-tier product in the industry, has long waived transaction fees, relying on its large trading volume and user base; its merchants maintain an average order completion rate of over 95%, with fraud and card freeze rates continuously declining, and it has recovered over ten million USDT in losses for users with capital loss orders. Behind these metrics is the platform's systematic investment in identifying black and gray market activities, verifying fund paths, and managing merchant access.

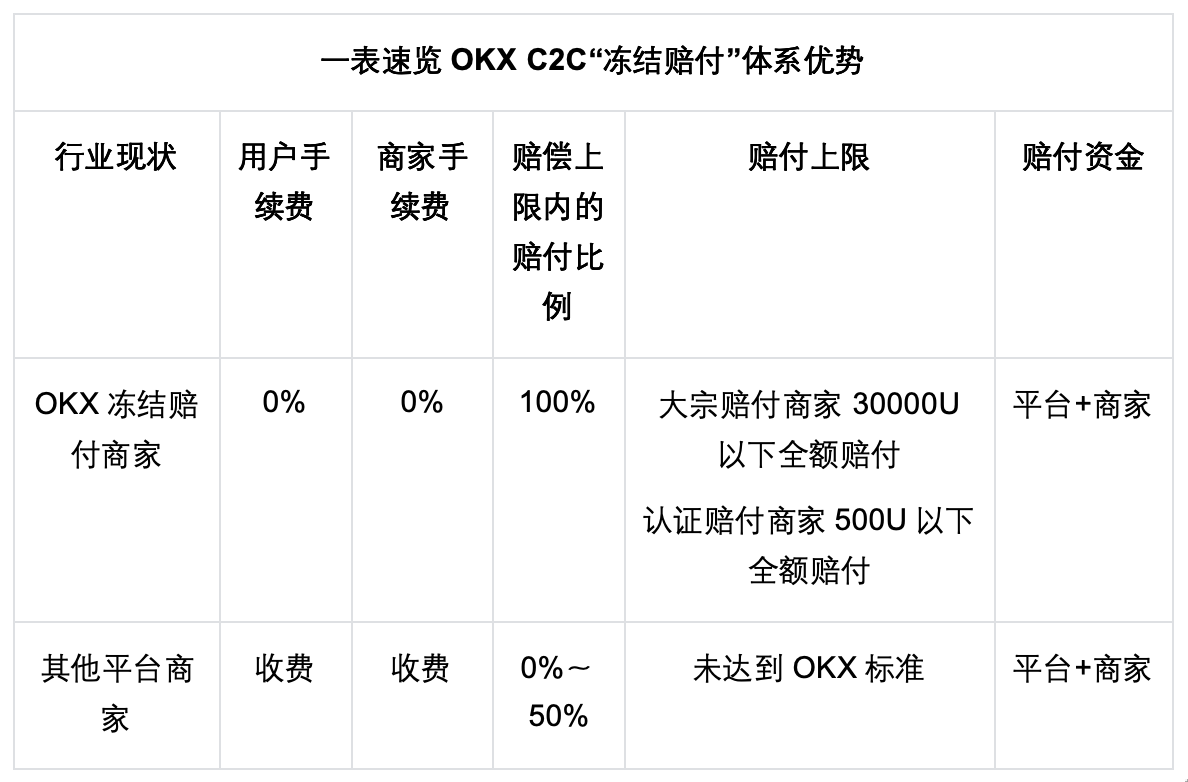

On this basis, OKX C2C is continuously upgrading and has officially launched the "Frozen Compensation" system, further preemptively hedging risks into the user experience: users can complete transactions with merchants marked with "Frozen Compensation" in the C2C trading area, still without transaction fees; if their receiving account is frozen due to the other party's payment, they can receive compensation according to platform rules, with a maximum compensation ratio of 100% and a single transaction cap of 30,000 USDT. Compared to existing protection schemes in the industry, this compensation amount is higher, reflecting the platform's determination and capability in ensuring user fund safety.

Next, this article will delve deeper, exploring what efforts OKX C2C has made for user safe trading.

How can a C2C transaction lead users into non-real-name and "pig-butchering" traps?

Marry (pseudonym) is an OG user in the crypto industry and has always been adept at C2C trading. However, a recent transaction led her into an unexpected turmoil. The incident began with a routine transaction. The merchant suddenly claimed during the operation that "the payment account balance is insufficient," requesting to use a friend's account for payment, assuring Marry that this was just a temporary measure and would not affect fund safety. Trusting the merchant, Marry agreed to this arrangement and successfully completed the transaction. However, just a few hours later, she was notified that her bank account had been frozen. The bank's customer service reported that the funds were flagged as "high-risk source," triggering the bank's risk control mechanism.

This incident forced Marry to interrupt her daily trading and enter a long and complicated unfreezing process. She realized that the merchant's inducement to accept non-real-name payments was the core reason for the problem. Fortunately, Marry decisively contacted OKX C2C customer service for help. The OKX C2C customer service team quickly intervened, assisting her in communicating with the merchant and requesting cooperation in providing proof of funds. With the strong support of OKX C2C, Marry ultimately completed the unfreezing process, while the merchant was banned from trading for violating transaction regulations.

Tom (pseudonym) had a slightly different experience, going through a more severe "pig-butchering" transaction (referring to scams that use emotions or trust to induce investment). Tom, who had just entered the crypto space, originally planned to complete a regular transaction through C2C. However, this seemingly simple operation turned into a nightmare. After reaching a transaction agreement with an OKX C2C merchant, the merchant suggested adding WeChat for "more convenient future transactions." Trusting the merchant, Tom accepted the invitation. A few days later, the merchant enthusiastically shared market analysis with him in the chat and recommended a "higher-yield" small exchange. The merchant sent a registration QR code and promised to guide him through the process. Following the merchant's guidance, Tom registered and deposited funds, only to find that the exchange's funds could not be withdrawn shortly after, and the merchant had completely disappeared. It was then that he realized he had become a target of the "pig-butchering" scam.

Tom requested assistance from OKX C2C. Although the issue was caused by individuals and other platforms, the OKX C2C team quickly formed a special group to investigate. On one hand, the group assisted Tom in collecting and organizing key evidence to support him in approaching relevant institutions or banks; on the other hand, decisive measures were taken against the violating merchant according to merchant behavior rules.

Some merchants exploit users' trust to lure them into illegal trading chains. OKX C2C repeatedly reminds users to remain vigilant during transactions, avoid trading with unfamiliar merchants outside the platform, refrain from accepting non-real-name payments, and avoid using payment methods not supported by OKX C2C. Otherwise, users are likely to incur losses in a pig-butchering scheme or encounter risky funds.

User Bob (pseudonym) often trades Bitcoin through OKX C2C. Once, Bob placed an order to sell Bitcoin worth 10,000 USDT. A certified merchant quickly accepted the order and agreed to pay via bank transfer. However, when Bob received the payment, he found that the amount was 10% less than expected. Although the system indicated that the transaction status was completed and the Bitcoin had been transferred, Bob's receipt was clearly inconsistent. This left him feeling helpless and questioning the merchant's integrity. Bob immediately submitted a problem report to OKX C2C, attaching the bank transfer screenshot and order details. Given the user capital loss issue, the OKX C2C customer service team launched an investigation immediately.

Within less than 24 hours, OKX C2C customer service provided a solution: the merchant had made an operational error during the transfer and failed to pay the full amount. The merchant has now been asked to make up the difference, and their account will undergo further review and education. Ultimately, Bob successfully received the remaining payment and received an apology from the OKX C2C merchant.

If users encounter such negative trading experiences, including non-real-name payments and other violations or fraud risks, they can seek help from OKX C2C customer service or report immediately.

Image: OKX C2C Violation Merchant Reporting Process

Proactive Risk Control, Strengthening Merchant Review and Transaction Monitoring

"When I first got involved with OKX C2C, I almost gave up," Evan admitted, stating that the process of registering as an OKX C2C merchant was stricter than any platform he had previously experienced. He had to submit personal identification and even provide proof of trading experience as a merchant. However, it was this "trouble" that ultimately led Evan to choose OKX. "Although the review is strict, it gives me confidence in OKX's professionalism and safety. After all, the stricter the rules, the more they attract high-quality users, which means lower risks."

In the past few years, C2C merchant Evan has encountered multiple "phishing" buyers and fraudulent activities on other products. "Once, a buyer quickly revoked the transfer, causing me to suffer losses of tens of thousands," Evan recalled. However, since switching to OKX C2C, this situation has not occurred again. "The risk control system of OKX C2C is very intelligent," Evan mentioned, noting that OKX C2C not only monitors suspicious accounts but also conducts manual reviews to ensure the authenticity of each transaction. "Once, a buyer's payment was delayed for several hours, and I thought I had been scammed, but the OKX C2C customer service team quickly intervened and confirmed that the buyer was indeed delayed due to network issues. This made me feel very secure."

Evan observed that OKX C2C's strict review and risk control mechanisms not only protect merchants but also enhance users' trading experiences. "When users know they are trading on a safe product, they are naturally more willing to use it long-term. This sense of trust is irreplaceable." Now, Evan has become a quality merchant on OKX C2C, easily completing several transactions daily. He stated that he rarely considers other products anymore. "OKX's rigor saves me a lot of trouble; I just need to focus on improving my service quality."

"Sometimes, strict rules may seem inconvenient, but in the long run, they are the guarantee that C2C products can go further," Evan summarized. In his view, OKX is not just a trading platform but a trustworthy choice for C2C merchants.

How has OKX C2C achieved a continuous reduction in fraud transactions and card freeze rates? Unveiling the high threshold for becoming an OKX C2C certified merchant.

One of the main reasons for C2C withdrawal card freezes may be the involvement of funds with unclear sources or suspected illegal activities (so-called "dirty money") during transactions between users and merchants, which can lead banks or relevant institutions to intercept or freeze accounts for investigation due to anti-money laundering requirements. Therefore, in C2C trading, the qualifications and behavior of merchants are key to ensuring transaction safety.

OKX C2C has formulated the "OKX Platform Certified Merchant Trading Behavior Norms" based on specific market conditions, clarifying behavioral guidelines and red lines for merchants in C2C trading, covering aspects such as payment norms, account anomalies, and order disputes, allowing merchant behavior to be regulated. Violations will face penalties ranging from warnings to account freezes or even permanent removal. Meanwhile, mechanisms are in place to prioritize user rights protection through locking and risk control.

OKX's screening of certified merchants begins even before the application, first employing a rigorous account filtering and risk control strategy to prioritize the exclusion of potential high-risk users, ensuring that the qualifications of applying merchants are reliable. For example, the application conditions require one-on-one reviews by specialists, including identity verification, order completion rates, order volumes, and other hard requirements, along with a security deposit to ensure merchants understand and agree to the platform's behavioral guidelines. Additional filtering measures are taken for new applicants to prevent unqualified merchants from entering.

The initial threshold for primary merchants is just the beginning; to upgrade to certified merchants, they must meet even stricter conditions. For instance, they need to have more than 16 days of trading, serve over 50 users, and not trigger risk control.

Even after certification, merchants face ongoing risk control monitoring and strict management. The OKX C2C risk control team constructs dynamic risk control models through multi-dimensional data analysis to monitor merchants throughout the process, analyzing real-time data from their behavior patterns, transaction amount fluctuations, and more. Utilizing big data and artificial intelligence technology, risk identification is advanced to before the transaction. The system analyzes transaction behavior patterns, fund flow paths, and account historical data to accurately capture potential abnormal factors that could lead to issues, thereby reducing risk exposure from the source.

To provide users with a safer and more convenient experience, the OKX C2C risk control team has also introduced machine learning algorithms to dynamically adjust risk control strategies, adapting to complex and changing trading scenarios. Once abnormal behavior is detected, they intervene immediately to reduce potential fraud risks.

OKX C2C not only provides free services to merchants but also offers comprehensive education and support to ensure merchants understand and comply with the rules.

"Compared to a rough approach to risk control, OKX focuses more on balancing user experience and safety. Their goal is to create a more transparent and trustworthy trading environment for users," said an OKX C2C merchant named Key (pseudonym). Key has earned recognition from users and peers for his steady business style. In an interview, he candidly stated that although the digital asset trading market is lucrative, he always adheres to one belief: "Safety first; I won't take any unreliable orders, no matter how much money is offered."

"Frozen Compensation" Merchants Launched, with a Maximum Compensation Ratio of 100%

To further preemptively hedge risks into the user experience and reduce the risk of card freezes, OKX C2C has officially launched a new "Frozen Compensation" system. In simple terms, from now on, when users trade with merchants marked with "Frozen Compensation" in the OKX C2C trading area, not only are there no transaction fees, but if their receiving account is frozen due to the other party's payment, they can receive corresponding fund compensation according to platform rules: a maximum compensation ratio of 100%, with a single transaction cap of up to 30,000 USDT. This compensation amount is significantly higher than the protections offered by other platforms previously, fully reflecting OKX's determination and capability to ensure user fund safety.

The compensation funds from OKX are jointly supported by the platform and merchants, rather than relying solely on merchant deposits. This means that even in the event of large compensations, the platform has sufficient funds to cover it, and users need not worry about merchants being unable to compensate. OKX's move aims to "create the most trustworthy trading environment, ensuring every transaction is safe and worry-free." For traders troubled by card freezes, OKX C2C is currently one of the safer and more reliable platforms for deposits and withdrawals.

Another pleasant surprise for users is that OKX promises not to charge any transaction fees for all C2C trading orders. Regardless of the order size, users can buy and sell cryptocurrencies through "Frozen Compensation" merchants without incurring any fees. In the current environment where most platforms charge OTC transaction fees, this significantly reduces users' trading costs, demonstrating OKX's sincerity in giving back to users with real value.

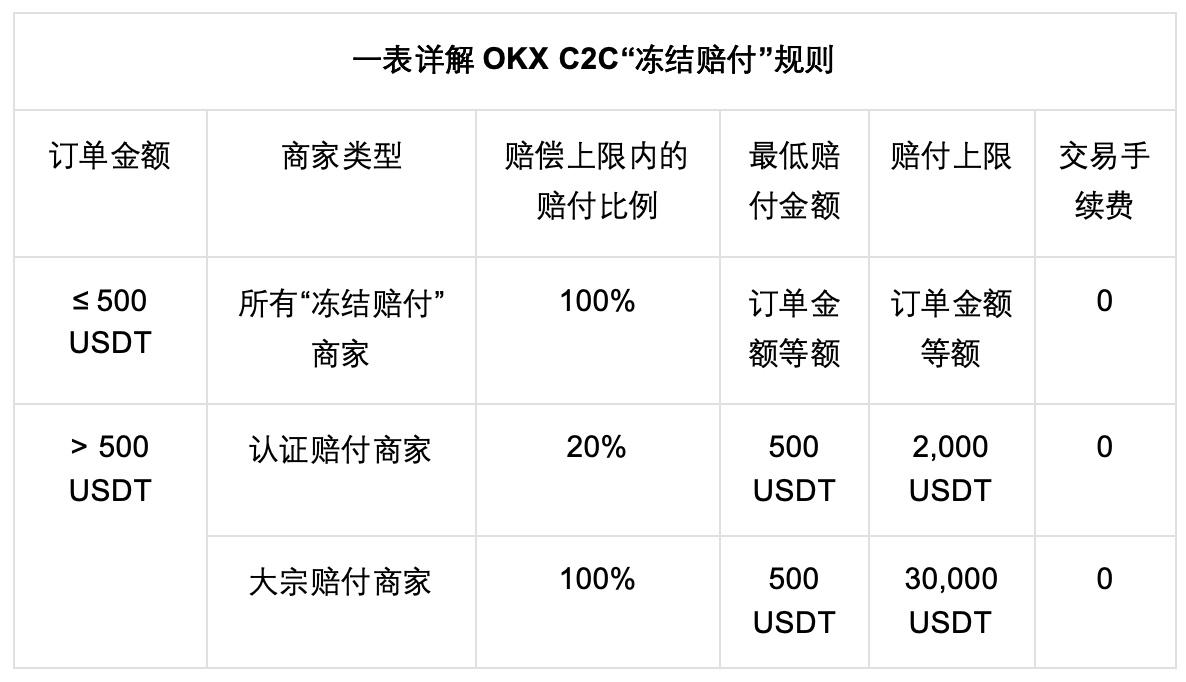

The "Frozen Compensation" rules announced by OKX are very detailed, striving for fairness and transparency. According to official explanations, the compensation amount will be calculated based on order size and merchant type (see table below). In simple terms:

Small Orders (≤500 USDT): Regardless of whether they are ordinary certified compensation merchants or large compensation merchants, all will compensate 100% based on the order amount, with no minimum compensation amount set. For example, if a 300 USDT transaction triggers compensation, the user can receive the full 300 USDT.

Large Orders (>500 USDT): Ordinary certified compensation merchants will compensate 20% for the portion exceeding 500 USDT, but the minimum compensation amount is 500 USDT, with a maximum compensation not exceeding 2,000 USDT. For example, if a 600 USDT transaction triggers compensation, the user can receive a total of 520 USDT (500 + (600 - 500) * 20%).

In contrast, large compensation merchants provide 100% compensation within the compensation cap for large orders, with a minimum of 500 USDT and a maximum compensation of 30,000 USDT. This means that if a user trades 10,000 USDT with a large compensation merchant and encounters a freeze, they can receive up to 10,000 USDT; even if the transaction amount is higher (for example, 50,000 USDT), the maximum compensation remains capped at 30,000 USDT. This amount essentially covers the common scale of a single withdrawal for ordinary traders, sufficient to handle most risk situations.

Of course, "Frozen Compensation" is not applicable unconditionally. Users can only enjoy this protection when trading with OKX officially certified "Frozen Compensation" merchants. These merchants have undergone strict multi-dimensional screening by the platform; they are either large compensation merchants with outstanding overall performance and high deposits or high-quality merchants who have been certified and committed to providing compensation according to the rules. They will have a prominent "Frozen Compensation" label on their accounts, making it clear to users when placing orders.

Additionally, to facilitate user selection, OKX has added a dedicated filtering function in the C2C trading interface. Users can also directly select to trade with "Frozen Compensation" merchants in the filtering function for a quicker and more secure experience.

Once merchants become compensation merchants, OKX will also conduct ongoing supervision. For example, merchants are required to adhere to the "Frozen Compensation" service guidelines and must not induce trades with false promises. If a user complaint is verified as the merchant's responsibility, the platform has the right to take measures against the merchant, including point deductions, fines, account freezes, or even cancellation of compensation qualifications, depending on the severity of the situation. For merchants who actively fulfill their compensation obligations and perform excellently, OKX offers rewards such as traffic incentives and exclusive rankings to encourage them to provide higher quality services.

Through this strict admission and management mechanism, OKX aims to establish "Frozen Compensation" merchants as the benchmark for C2C trading on the platform. They not only provide a good trading experience and quick transactions but, more importantly, offer users a form of insurance for their funds. For merchants, obtaining compensation qualifications also means higher credibility and platform support, helping to attract more users to trade with them.

At the same time, OKX reminds users: during the trading process, they must still comply with the platform's risk control rules, such as verifying receiving account information and promptly confirming payments, to avoid unnecessary disputes. If suspected fraud or abnormal funds occur, users should immediately request customer service intervention, and the platform will assist in handling the situation and take strict measures against violating merchants, including compensation.

Collaborating with the Risk Control Team, OKX C2C Provides 24/7 Complaint Channels and Locking Mechanisms

What to Do If Your Card is Frozen? How to Apply for Compensation?

When users find their accounts frozen, they should first contact their bank to confirm whether it is a judicial freeze and the duration of the freeze; if it is indeed a judicial freeze, users need to contact customer service to initiate a complaint and submit relevant materials for platform review; once the review is approved, the merchant must complete the compensation within 30 working days of receiving the notification. If the compensation is not completed within the deadline, the platform will directly deduct the compensation from the merchant's deposit upon receiving the user's complaint; if the merchant's deposit is forcibly deducted and not replenished within three calendar days, the platform will suspend their order publishing rights until the deposit is replenished.

What Should Users Do in Case of a Dispute?

User Alice encountered a situation where the merchant clicked the "Paid" button without completing the payment during her withdrawal from OKX C2C.

"My first reaction was to contact the other party, but they did not respond directly," Alice recalled. "Although I am an experienced user, I was still a bit flustered this time." Realizing something was wrong, she quickly used the 24/7 complaint channel provided by OKX C2C and submitted relevant transaction records and evidence.

Upon receiving Alice's complaint, the OKX C2C customer service team quickly initiated an investigation process, confirming through transaction records that the merchant had not uploaded valid payment proof. They contacted the merchant to verify the situation and urged them to complete the actual transfer as soon as possible, while freezing their account permissions to prevent similar situations from affecting other users' normal transactions.

The customer service team also collaborated with the risk control department to conduct an in-depth analysis of the transaction. Using the IM chat monitoring system, they reviewed the merchant's communication records and found that the merchant had repeatedly interrupted communication, and the language content was abnormal. Based on this, the OKX C2C risk control team utilized a big data analysis system to conduct a comprehensive investigation of the merchant and their associated accounts' fund flow. Although no connections to other risk accounts were found, the merchant's failure to provide effective payment proof further corroborated their violation.

However, since the merchant still failed to fulfill their payment obligations on time, OKX C2C utilized the locking transaction mechanism to promptly return the funds to Alice, ensuring her trading rights were not compromised. At the same time, OKX C2C froze the involved merchant's account based on the "OKX Platform Certified Merchant Trading Behavior Norms" to prevent similar situations from affecting other users' trading experiences.

Alice expressed her approval of the handling results and praised OKX C2C for its rapid response and thorough investigation at a critical moment.

The head of OKX C2C stated: "We always prioritize user rights, ensuring the safety of funds in every transaction through technical means, while also enforcing strict behavioral norms on certified merchants. In the future, we will continue to optimize service processes to create a safer and more efficient trading environment for users."

OKX C2C is continuously strengthening its risk control system. On one hand, through strict merchant control mechanisms, from application review to behavior monitoring, it comprehensively covers the entire trading process; on the other hand, OKX C2C actively encourages users to report suspicious behavior and provides rewards to incentivize participation. Additionally, OKX C2C will remind users of potential trading risks before each transaction and regularly conduct safety education activities to enhance users' risk prevention awareness.

Full-Chain Support and Product Innovation Upgrades

The C2C business team covers customer complaints, risk control, product modules, and has over a hundred dedicated personnel responsible for the safe operation and service of this product, providing round-the-clock support for merchants and users.

In addition to customer service, merchant operations, and risk control teams, OKX C2C has implemented a series of upgrades on the product side to provide users and merchants with a safer and more transparent trading environment. Key mentioned that he is not only an OKX C2C merchant but also a deep user of OKX options, earning coins, and other products, thus achieving better income and hedging risks.

Since its launch, OKX C2C has gradually expanded from providing basic digital asset trading services to a comprehensive trading product that supports various payment methods and currencies. Initially, the currencies supported by OKX C2C were limited, mainly including mainstream currencies such as USDT, BTC, and ETH. With the diversification of market demand, the supported currencies have further expanded to include stablecoins like USDC to meet the trading needs of different users. Additionally, the diversification of payment methods has enhanced trading flexibility, now supporting various common payment methods such as bank transfers.

As user experience demands continue to rise, OKX C2C has iteratively optimized its interface, operational processes, and response speed multiple times, striving to improve the convenience and efficiency of trading. It has also launched a price protection mechanism to address the impact of extreme market fluctuations on trading prices, ensuring that users can still obtain fair trading conditions in an unstable market. At the same time, OKX C2C has enhanced the user experience of its mobile application, allowing users to trade anytime and anywhere.

To improve trading efficiency, OKX C2C has introduced an intelligent matching system that automatically matches suitable buyers and sellers based on user demand, increasing the success rate of matching. For large transactions, a dedicated large transaction area has been set up, allowing approved merchants to conduct large trades and providing deep market liquidity. To help users better compare buy and sell order prices and trading depth, a market depth mode has been launched. Furthermore, OKX C2C offers a zero-fee trading policy, further attracting a large number of users to participate. To ensure the safety of trading funds, OKX C2C has also introduced a merchant "verification order" feature, allowing merchants to verify the payment flow of the other party to ensure stable fund movement.

Globally, digital asset trading is gradually transitioning from "disorderly expansion" to "safe regulation." The risk control strategy of OKX C2C is particularly significant in this trend, achieving full-process safety management through dynamic adjustments to merchant certification rules and the introduction of intelligent risk control algorithms, implementing "prevention before, monitoring during, and accountability after." More importantly, these measures not only protect ordinary users but also enhance the overall transparency and trustworthiness of the market.

Original Announcement Link:

“OKX C2C Frozen Compensation: Up to 100% Compensation, 30,000 USDT Cap”

“Frozen Compensation Merchant Service Guidelines”

Experience Now: https://www.okx.com/zh-hans/buy-crypto#sourceQuote=sgd&sourceBase=btc?channelid=AICOINAD

Join our community to discuss and grow stronger together!

Register for OKX: https://www.okx.com/zh-hans/join/aicoin20

Official Telegram Community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX Benefits Group: https://aicoin.com/link/chat?cid=l61eM4owQ

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。