Author: Arthur Hayes, Founder of BitMEX

Compiled by: AIMan, Golden Finance

U.S. Treasury Secretary Scott Bessent deserves a new nickname. I previously dubbed him BBC, which stands for Big Bessent Cock. Yes, his devastating "member" is destroying the status quo of the global financial ecosystem, but this nickname doesn't fully capture his characteristics. I believe he needs a more appropriate name to describe the pain he will bring to two very important components of the fiat (fugazi) financial system: the Eurodollar banking system and foreign central banks.

Like the serial killer in the movie "The Silence of the Lambs" (a classic worth a "Netflix and Chill" night for any uninitiated young person), Scott "Buffalo Bill" Bessent is about to eliminate the Eurodollar banking system and take control of foreign non-dollar deposits. Just as slaves and trained legions maintained the "Pax Romana," slaves and dollar hegemony maintain the "Pax Americana." The slavery aspect of "Pax Americana" is not just about the historical transportation of Africans to pick cotton; the modern whip is the "monthly payment," with generations of young people willingly burdened by crushing debt to obtain worthless certificates, hoping to work at Goldman Sachs, Sullivan & Cromwell, or McKinsey. This is a broader, more insidious, and ultimately more effective means of control. Unfortunately, now that the U.S. has artificial intelligence (AI), these debt beasts are about to become unemployed… Put on your blue-collar work clothes, buddy.

I digress.

This article will discuss the control of the global reserve currency—the dollar—under "Pax Americana." Successive U.S. Treasury Secretaries have wielded the dollar as a club with varying degrees of success. The most notable failure was allowing the emergence of the Eurodollar system.

The Eurodollar system emerged in the 1950s and 1960s to circumvent U.S. capital controls (like Regulation Q), evade economic sanctions (the Soviet Union needed a place to store its dollars), and provide banking services for non-U.S. trade flows during the post-World War II global economic recovery. At the time, monetary authorities could have recognized the necessity of supplying dollars to foreigners and allowed U.S. domestic monetary center banks to take control of this business, but domestic political and economic concerns required a hardline stance. As a result, the Eurodollar system developed to an unknown scale over the following decades, becoming a force that could not be ignored. It is estimated that between $10 trillion and $13 trillion of Eurodollars are flowing through various non-U.S. bank branches. The ebb and flow of this capital have led to various financial crises in the post-World War II era, which always required money printing to resolve. A paper titled "Offshore Dollars and U.S. Policy," written by the Atlanta Fed in August 2024, discusses this phenomenon.

For Bessent, there are two problems with the Eurodollar system. The first problem is that he has no idea how many Eurodollars exist and what these dollars are financing. The second problem, and the more important one, is that these Eurodollar deposits are not being used to purchase his junk bonds. Does Bessent have a way to solve these two problems? Keep this in mind as I quickly discuss the foreign currency holdings of non-U.S. retail savers.

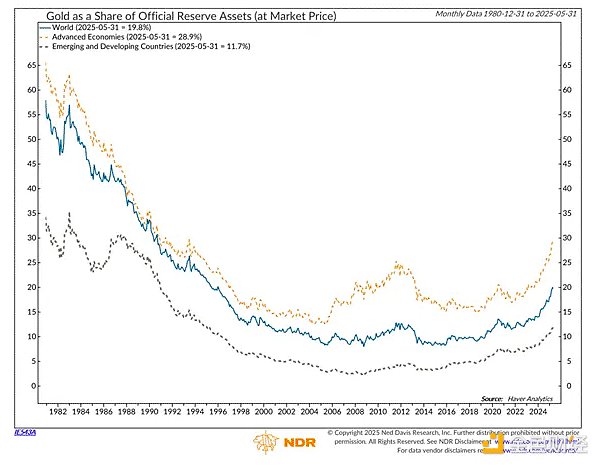

De-dollarization is real. It truly began in 2008 when the U.S. monetary overlords decided not to let banks and financial institutions fail due to their poor bets but instead rescued them by initiating unlimited quantitative easing (QE Infinity). A useful indicator of how global central banks holding trillions of dollars in assets reacted is the percentage of gold in their reserves. The higher the percentage of gold in a person's reserves, the less they trust the U.S. government.

As seen in the chart above, the percentage of gold in central bank reserves hit a low after 2008 and has been rising long-term.

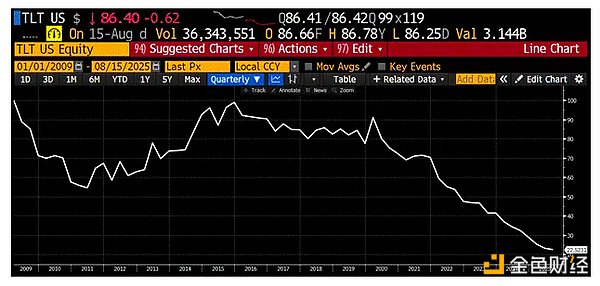

This is the TLT US ETF, which tracks the performance of U.S. Treasury bonds with maturities of 20 years or more divided by the price of gold. I set its index to 100 starting in 2009. Since 2009, Treasury bonds have depreciated by nearly 80% relative to gold. The U.S. government's monetary policy is to rescue its banking system while harming foreign and domestic debt holders. It's no wonder foreign central banks have begun to emulate Scrooge McDuck (the cartoon character known for hoarding gold). U.S. President Trump intended to follow a similar strategy, but aside from harming bondholders, he believed he could tax foreign capital and trade flows through tariffs, making America great again.

Bessent truly cannot do much to persuade central bank reserve managers to buy more Treasury bonds. However, from the dollar's perspective, there exists a vast, underbanked population in the Global South that is most eager to have a positive-yielding dollar currency account. As you know, all fiat currencies are garbage compared to Bitcoin and gold. That said, if you are within the fiat system, the best fiat currency is the dollar. Domestic regulators, who dominate most of the world's population, force their citizens to hold inferior currencies plagued by high inflation and restrict their access to the dollar financial system. These citizens would buy Treasury bonds (T-bills) at any yield Bessent offers, just to escape their terrible government bond markets. Does Bessent have a way to provide banking services to these people?

I first went to Argentina in 2018 and have been going regularly since. This is a chart of ARSUSD indexed to 100 starting in September 2018. The Argentine peso has depreciated by 97% against the dollar over seven years. Currently, when I go skiing there, I pay all my service providers in USDT.

Bessent has discovered a new tool to solve his problems. It's called stablecoins. Dollar-pegged stablecoins are now being promoted by the U.S. Treasury. The empire will support selected issuers as they siphon off Eurodollars and retail deposits from the Global South. To understand why, I will briefly introduce the structure of "acceptable" dollar-pegged stablecoins. Then, I will discuss the impact on the traditional financial (TradFi) banking system. Finally, and this is also why you degenerates are here, I will explain why the global adoption of dollar stablecoins supported by "Pax Americana" will drive the long-term growth of DeFi applications, particularly Ethena, Ether.fi, and Hyperliquid.

As you know, Maelstrom (the institution I am part of) does not work for free. We hold large, large, large positions.

If you are not yet familiar with stablecoins, I will preview a new stablecoin infrastructure project we are consulting on—Codex—I believe it will be the best-performing token from the upcoming token generation event (TGE) until the end of this cycle.

What are Acceptable Stablecoins?

Dollar-pegged stablecoins are similar to narrow banks. Stablecoin issuers accept dollars and invest those dollars in risk-free debt instruments. The only nominally risk-free debt instrument in dollars is Treasury bonds. Specifically, because issuers must be able to provide physical dollars on demand when holders redeem, stablecoin issuers will only invest in short-term Treasury bonds (T-bills). Short-term Treasury bonds have maturities of less than one year. Because they have little to no duration risk, they trade like cash.

Let’s look at the process.

To create one unit of stablecoin, I will use Tether USD (ticker: USDT) as an example:

An authorized participant (AP) wires dollars to Tether's bank account.

Tether creates 1 USDT for every dollar deposited.

To earn dollar yields, Tether purchases Treasury bonds.

If the AP wires $1,000,000, they will receive 1,000,000 USDT.

Tether purchases $1,000,000 worth of Treasury bonds.

USDT does not pay interest.

However,

The interest rate paid by Treasury bonds is essentially the federal funds rate, currently at 4.25% to 4.50%.

Tether's net interest margin (NIM) is 4.25% to 4.50%.

To attract deposits, Tether or affiliated financial institutions (like cryptocurrency exchanges) will pay a portion of the net interest margin when depositors stake their USDT. Staking simply means you lock up USDT for a period of time.

To redeem one unit of stablecoin:

The AP sends USDT to Tether's crypto wallet.

Tether sells Treasury bonds equivalent to the dollar amount of USDT.

Tether sends $1 to the AP's bank account for every 1 USDT.

Tether destroys USDT, removing it from circulation.

Tether's business model is very simple. Accept dollars, issue digital tokens that operate on public chains, invest dollars in Treasury bonds, and earn net interest margins. Bessent will ensure that issuers supported by legal acquiescence from the empire can only deposit dollars in chartered U.S. banks and/or hold Treasury bonds. No fancy stuff allowed.

Impact on Eurodollars

Before the emergence of stablecoins, when Eurodollar banking institutions encountered trouble, the U.S. Federal Reserve and the U.S. Treasury always stepped in to rescue them. A well-functioning Eurodollar market is crucial for the health of the empire. But now, there is a new tool for Bessent to absorb these funds. On a macro level, Bessent must provide a reason for Eurodollar deposits to move on-chain.

For example, during the 2008 global financial crisis, the Fed secretly provided billions of dollars in loans to foreign banks that were short on dollars due to the chain reaction of subprime mortgage and related derivatives collapse. As a result, Eurodollar depositors believed the U.S. government implicitly guaranteed their funds, even though technically they were outside the U.S. regulated financial system. Announcing that if another financial crisis occurs, non-U.S. bank branches will not receive any help from the Fed or the Treasury would redirect Eurodollar deposits into the arms of stablecoin issuers. If you think this is far-fetched, a strategist at Deutsche Bank wrote an article openly questioning whether the U.S. would weaponize dollar swap lines to force Europeans to do what the Trump administration wanted them to do. You better believe that Trump would love nothing more than to castrate the Eurodollar market by effectively canceling its banking services. These institutions canceled banking services for his family after his first term; now it’s time for payback. Karma.

Without guarantees, Eurodollar depositors will act in their own best interests and transfer their funds into dollar-pegged stablecoins like USDT. Tether holds all its assets as deposits in U.S. banks and/or Treasury bonds. By law, the U.S. government guarantees all deposits at eight "too big to fail" (TBTF) banks; after the regional bank crisis in 2023, the Federal Reserve and Treasury effectively guaranteed all deposits at any U.S. bank or branch. The default risk on Treasury bonds is also zero because the U.S. government will never voluntarily go bankrupt, as it can always print money to repay bondholders. Therefore, stablecoin deposits are risk-free in nominal dollars, but Eurodollar deposits are not anymore.

Soon, dollar-pegged stablecoin issuers will face an influx of $10 to $13 trillion, subsequently purchasing Treasury bonds. Stablecoin issuers become a large buyer of Bessent's junk paper that is insensitive to price!

Even if Federal Reserve Chairman Powell continues to obstruct Trump's monetary agenda by refusing to "cut rates, end quantitative tightening (QT), and restart quantitative easing (QE)," Bessent can issue Treasury bonds at rates below the federal funds rate. He can do this because stablecoin issuers must purchase anything he sells at the yields offered to be profitable. Through a few steps, Bessent gains control over the front end of the yield curve. The existence of the Federal Reserve has become meaningless. Perhaps a Bernini-style statue of "Perseus with the Head of Medusa" featuring Bessent will stand in some square in Washington, D.C., titled "Bessent and the Head of the Jekyll Island Monster (i.e., the Federal Reserve)."

Impact on the Global South

American social media companies will become the Trojan horse, destroying foreign central banks' ability to control their citizens' money supply. In the Global South, the penetration of Western social media platforms (Facebook, Instagram, WhatsApp, and X) is comprehensive.

I have spent half my life in the Asia-Pacific region. Converting local currency into dollars or dollar equivalents (like the Hong Kong dollar) to allow capital to earn dollar yields and invest in U.S. stocks constitutes a significant part of the investment banking business in the region.

Local monetary authorities play whack-a-mole with traditional financial institutions to shut down schemes that allow capital outflows. Governments need citizens' capital and, to some extent, isolate the capital of non-politically connected wealthy individuals so they can levy an inflation tax, support underperforming national champion companies, and provide low-interest loans to heavy industries. Even if Bessent wanted to use large U.S. monetary center banks as pioneers to provide banking services to these desperate individuals, local regulators prohibit such actions. But there is another, more effective way to capture this capital.

Except in mainland China, everyone uses Western social media companies. What if WhatsApp launched a crypto wallet for every user? Within the app, users could seamlessly send and receive approved stablecoins like USDT. With this WhatsApp stablecoin wallet, users could send money to any other wallet on various public blockchains.

Let’s illustrate how WhatsApp could provide digital dollar bank accounts to a billion members of the Global South through a fictional example.

Fernando is a Filipino who runs a click farm in rural Philippines. Essentially, he creates fake followers and false impressions for social media influencers. Since all his clients are outside the Philippines, he finds it both difficult and expensive to receive payments. WhatsApp has become his primary payment method because it provides a wallet that can send and receive USDT. His clients also all have WhatsApp and are very willing to stop using terrible banks. Both parties are happy with this arrangement, but it bypasses the local Philippine banking system.

After a while, the Central Bank of the Philippines notices a significant and growing outflow of bank funds. They realize that WhatsApp has spread dollar-pegged stablecoins throughout the economy. The central bank has effectively lost control over the money supply. However, they are powerless to stop it. The most effective way to prevent Filipinos from using WhatsApp would be to shut down the internet. Beyond that, even pressuring local Facebook executives (if any) would be futile. Mark Zuckerberg rules from his bunker in Hawaii. And he has the blessing of the Trump administration to roll out stablecoin features globally to Meta users. Any internet laws unfavorable to American tech companies would result in high tariffs imposed by the Trump administration. Trump has already threatened the EU with increased tariffs unless they abandon "discriminatory" internet legislation.

Even if the Philippine government could remove WhatsApp from the Android and iOS app stores, motivated users could easily bypass the blockade using a VPN. Of course, any form of friction would suppress the use of internet platforms, but social media is essentially an addictive drug. After more than a decade of continuous dopamine hits, citizens will find any workaround to continue destroying their brains.

Ultimately, Bessent can wield his sanctions weapon. Asian elites hide their money in offshore dollar bank centers. They clearly do not want their wealth eroded by inflation through their monetary policies. Do as I say, not as I do. Suppose Philippine President Bongbong Marcos threatens Meta. Bessent could immediately retaliate by sanctioning him and his associates, freezing their billions in offshore wealth unless they yield and allow stablecoins to spread domestically. His mother, Imelda, is well aware of how long the arm of U.S. law can be, as she defeated RICO charges stemming from accusations that she and her late husband, former dictator Ferdinand Marcos, misappropriated Philippine government funds to purchase real estate in New York City. I doubt Marcos would be eager for a second round.

If my argument is correct, and stablecoins are part of the U.S. hegemonic effort to expand the use of the dollar, then the empire will protect American tech giants from local regulatory retaliation as they provide dollar banking services to citizens. And these governments will be powerless to stop it. Assuming I am right, what is the total potential market for stablecoin deposits from the Global South? The most advanced group of countries in the Global South is the BRICS. We exclude China because Western social media companies are ineffective there. The question is, what is the best estimate for local currency bank deposits? I asked Perplexity, and its answer was $4 trillion. I know this may be controversial, but let’s also add the Euro-poor-eans to this group. I believe the euro is a dead man walking because Germany-first and then France-first economic policies will fracture the currency union. With capital controls coming, by the end of this century, the only use for the euro will be to pay the entrance fee to Berlin's famous electronic music club Berghain and the minimum spend at the Caribbean French St. Barts beach club Shellona. When we add the $16.74 trillion in European bank deposits, the total approaches about $34 trillion up for grabs.

Go Big or Go Home

Bessent has a choice: go big or become a Democrat. Does he want Team Red to win the 2026 midterms and, most importantly, the 2028 presidential election? I believe he does, and if so, the only way to victory is to fund Trump so he can provide more free stuff to citizens than the Mamdanis and AOCs (referring to radical leftists). Therefore, Bessent needs to find a price-insensitive buyer for Treasury bonds. Clearly, given his public support for this technology, he sees stablecoins as part of the solution. But he needs to go all in.

If Eurodollars and deposits from the Global South and Euro-poor-eans do not flow into stablecoins, he must Bismarck them with his star-studded "member" (referring to sanctions and other means). Either embrace dollarization or face sanctions again.

The purchasing power for $10 to $13 trillion in Treasury bonds comes from the collapse of the Eurodollar system.

The purchasing power for $21 trillion in Treasury bonds comes from retail deposits in the Global South and Euro-poor-eans.

Total = $34 trillion

Clearly, not all of this capital will flow into dollar-pegged stablecoins, but at least we have a massive total addressable market (TAM).

The real question is, how will the increase of up to $34 trillion in stablecoin deposits drive DeFi usage to new heights? If there is a credible argument that DeFi usage will increase, which shitcoins will skyrocket?

Stablecoins Flowing into DeFi

The first concept readers must understand is staking. Let’s imagine that a portion of that $34 trillion now exists in stablecoin form. For simplicity, let’s assume Tether’s USDT receives all the inflows. Due to fierce competition from other issuers like Circle and large TBTF banks, Tether must pass some of its net interest margin to holders. It achieves this by partnering with some exchanges, where USDT staked in associated exchange wallets generates some interest in the form of newly minted USDT units.

Let’s look at a simple example.

Fernando from the Philippines has 1,000 USDT. PDAX, a cryptocurrency exchange based in the Philippines, offers a 2% yield on staked USDT. PDAX creates a staking smart contract on Ethereum. Fernando stakes his 1,000 USDT by sending it to the smart contract address, and then a few things happen:

His 1,000 USDT becomes 1,000 psUSDT (PDAX Staked USDT; PDAX's liability). Initially, 1 USDT = 1 psUSDT, but each day psUSDT becomes more valuable than USDT due to accrued interest. For example, using a 2% annual interest rate and ACT/365 simple interest accounting, psUSDT gains about 0.00005 each day. After a year, 1 psUSDT = 1.02 USDT.

Fernando receives 1,000 psUSDT in his exchange wallet.

Something powerful has just happened. Fernando has locked his USDT in PDAX and received an interest-bearing asset in return. psUSDT can now serve as collateral in the DeFi ecosystem. This means he can trade it for another cryptocurrency; he can borrow against it; he can use it as leverage to trade derivatives on a DEX, and so on.

What happens when Fernando wants to redeem his psUSDT for USDT a year later?

Fernando goes to the PDAX platform to unstake by sending 1,000 psUSDT to his exchange wallet and/or connecting a third-party DeFi wallet (like Metamask) to the PDAX dApp.

The psUSDT is destroyed, and he receives 1,020 USDT.

Where does the extra 20 USDT in interest paid to Fernando come from? It comes from Tether's partnership with PDAX. Tether has a positive net interest margin, which is simply the interest income earned from its Treasury bond portfolio. Tether then creates additional USDT with these dollars and sends a portion to PDAX to fulfill its contractual obligations.

Both USDT (the base currency) and psUSDT (the interest-bearing currency) become acceptable collateral throughout the DeFi ecosystem. Therefore, a certain percentage of the total stablecoin flow will interact with DeFi dApps. Total Value Locked (TVL) measures this interaction. Whenever users interact with a DeFi dApp, they must lock their capital for a period, represented by TVL. TVL sits at the top of the funnel for transaction volume or other revenue-generating activities. Thus, TVL is a leading indicator of future cash flows for DeFi dApps.

Before we explore how TVL affects the future earnings of several projects, I want to explain the main assumptions in the financial model we will be using.

Model Assumptions

I will soon present three simple yet powerful financial models to estimate the target prices of Ethena (token: ENA), Ether.fi (token: ETHFI), and Hyperliquid (token: HYPE) by the end of 2028. I predict by the end of 2028 because that is when Trump will leave office. My basic assumption is that the likelihood of Team Blue (the Democrats) winning the presidency is slightly greater than that of Team Red (the Republicans). This is because Trump cannot successfully rectify the injustices inflicted on his base voters due to half a century of accumulated monetary, economic, and foreign policies in just four years. The rat poison on the cake is that no politician will fulfill all their campaign promises. Therefore, the voter turnout of ordinary Republican voters will decline.

Ordinary members of Team Red will be indifferent to any Trump successor running for president, and there will not be enough of them to vote to surpass those suffering from Trump Derangement Syndrome (TDS), such as childless cat ladies. TDS will plague any member of Team Blue who ascends to the throne, leading them to adopt a cut-off-their-nose-to-spite-their-face monetary policy just to prove they are different from Trump. But ultimately, no politician can resist the temptation to print money, and dollar-pegged stablecoins are one of the best price-insensitive buyers of short-term Treasury bonds. Therefore, they may not initially wholeheartedly support stablecoins, but the new emperor will find themselves naked without this capital and will eventually continue the policies I previously mentioned. This policy oscillation will burst the crypto bubble and lead to an epic bear market.

Finally, the numbers mentioned in my model are enormous. This is a once-in-a-century change in the global monetary framework. Most of us will likely never witness such an event again in our investment careers unless we intravenously inject stem cells for the rest of our lives… I predict the upside potential will be greater than SBF's (Sam Bankman-Fried) meth habit. You will never see a bull market like this again from the surge in dollar-pegged stablecoins profiting DeFi pillars.

Because I like to make predictions with decimal numbers ending in zero, I estimate that by 2028, the total amount of circulating dollar stablecoins will reach at least $10 trillion. This number is significant because the deficit Bessent must finance is enormous and growing exponentially. The more Bessent uses Treasury bonds to finance the government, the faster the debt pile grows, as he must roll over the debt every year.

The next key assumption is the level of the federal funds rate chosen by Bessent and the new Federal Reserve chair after May 2026. Bessent has publicly stated that the federal funds rate is too high by 1.50%, while Trump typically calls for a 2.00% cut. Considering that there is often an over-adjustment whether rates go up or down, I believe the federal funds rate will soon drop to around 2.00%. This number does not have real rigor, just as all establishment economists are equally clueless. We are all improvising, so my numbers are as good as theirs. The political and economic reality of a bankrupt empire requires cheaper funding, and a 2% federal funds rate provides just that.

Finally, where do I think the 10-year Treasury yield will land? Bessent's goal is to create 3% real growth. Adding the 2% federal funds rate (theoretically representing long-term inflation), we arrive at a 10-year yield of 5%. I will use this to calculate the present value of terminal earnings.

Using these assumptions, we derive the terminal value of cumulative cash flows. Since these cash flows can be offered as buybacks to token holders, we can use them as the fundamental value of specific projects. This is how I assess and predict the Fully Diluted Valuation (FDV). I then compare the future outputs of my model with the current value, and then, voila, the upside potential becomes clear.

All model inputs are in blue, and all outputs are in black.

Stablecoin Consumption

The most important behavior of new stablecoin users is the consumption of goods and services. So far, everyone is accustomed to tapping their phone or debit/credit card on some POS system to pay for things. Using stablecoins must be just as simple. Is there a project that allows users to deposit stablecoins into a dApp and consume like using a Visa debit/credit card? Of course, there is; it’s called Ether.fi Cash.

Users around the world can register in minutes, and after completing the registration process, they have their own Visa-supported stablecoin spending card. You can use it on your phone and/or through a physical card. After depositing stablecoins into your Ether.fi wallet, you can spend anywhere that accepts Visa. Ether.fi can even extend credit based on your stablecoin balance to turbocharge your spending.

I am an advisor and investor in the Ether.fi project, so I am obviously biased, but I have been waiting for a low-fee offline consumption crypto solution for over a decade. The customer experience is the same whether I use my American Express card or the Ether.fi cash card. This is important because, for the first time, many people in the Global South will use a payment method supported by stablecoins and Ether.fi to pay for goods and services anywhere in the world.

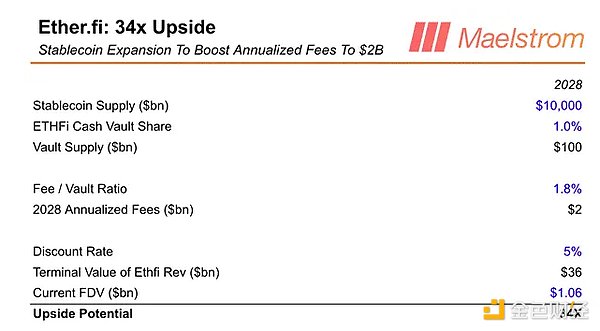

The real profit lies in becoming a financial supermarket that offers many traditional products provided by banks. Then, Ether.fi can offer additional products to savers. The key ratio I predict for calculating future cash flows is the Fee/Vault Ratio. How much revenue can Ether.fi earn for every dollar of stablecoin deposited? To arrive at a credible number, I looked at the latest annual documents from JPMorgan, the best-operating commercial bank in the world. On a deposit base of $1.0604 trillion, they earned $18.8 billion in revenue, resulting in a Fee/Value Ratio of 1.78%.

Ether.fi Cash Vault Percentage: This represents the percentage of stablecoin supply deposited into the cash vault. Currently, after only four months of existence, this percentage is 0.07%. Given that the product has just launched, I believe it is possible to grow this percentage to 1.00% by 2028.

I believe ETHFI can rise 34 times from its current level.

Now that citizens can spend their dollars, is there a way to earn a higher yield than the federal funds rate?

Stablecoin Lending

After millions of people can go out and spend stablecoins to buy coffee, they will want to earn interest. I have already discussed that I believe issuers like Tether will pay a portion of their net interest margin to holders. But this will not be a huge number; many savers will seek higher yields without taking on excessive additional risk. Is there endogenous yield within the crypto capital markets that new stablecoin users can capture? Certainly, Ethena offers opportunities for higher yields.

There are only two ways to safely lend funds within the crypto capital markets. Lend to speculators through derivatives or lend to crypto miners. Ethena focuses on lending funds to speculators who are long on crypto capital by shorting cryptocurrency/dollar futures and perpetual contracts. This is a strategy I promoted years ago at BitMEX, which I called "cash and carry." I subsequently wrote an article titled "Dust on Crust," in which I implored a brave entrepreneur to package this trade and offer it as a synthetic dollar, high-yield stablecoin. Ethena founder Guy Young read that article and then assembled an all-star team to tackle this daunting task and make it a reality. When we heard what Guy was building, Maelstrom joined as a founding advisor. Ethena's USDe stablecoin has become the fastest-growing stablecoin in history, accumulating about $13.5 billion in deposits in less than 18 months. By circulating supply, USDe is now the third-largest stablecoin, behind Circle's USDC and Tether's USDT. Ethena's growth is so strong that by next St. Patrick's Day, Circle CEO Jeremy Allaire will drown his sorrows in a pint of Guinness because Ethena will become the second-largest stablecoin issuer, just behind Tether.

Due to counterparty risk in exchanges, the interest rates for speculators borrowing dollars to go long on crypto payments are typically higher than Treasury bond rates. When I created perpetual contracts with the BitMEX team in 2016, I set a neutral rate of 10%. This means that if the perpetual contract price equals the spot price, the longs will pay the shorts an annualized yield (APY) of 10%. Given that every perpetual contract exchange has verbatim copied BitMEX's design, they all have a neutral rate of 10%. This is significant because 10% is far above the current upper limit of the federal funds rate at 4.50%. Therefore, the yield on staked USDe should almost always be higher than the federal funds rate. This provides an opportunity for new stablecoin savers willing to take on a bit of extra risk to earn an average of twice the yield offered by Bessent.

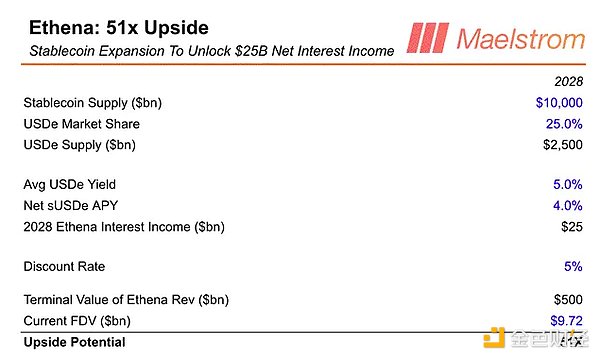

A portion of new stablecoin deposits (but certainly not all) will be saved using Ethena for higher yields. Ethena takes 20% of the interest income as a cut. Here’s a simple model:

USDe Market Share: Currently, Circle's USDC holds a 25% market share of the total circulating stablecoins. I believe Ethena will surpass Circle, and over time, we will see USDC lose deposits marginally as USDe gains deposits. Therefore, my long-term assumption is that USDe will achieve a 25% market share, just behind Tether's USDT.

Avg USDe Yield: Given that I predict a long-term USDe supply of $2.5 trillion, this will put downward pressure on the basis spread between derivatives and spot. As Hyperliquid becomes the largest derivatives exchange, they will lower the neutral rate to increase demand for leverage. This also means that open interest (OI) in the crypto derivatives market will grow significantly. If millions of DeFi users have trillions of dollars in stablecoin deposits available, it is reasonable to expect that open interest could rise to trillions of dollars.

I believe ENA can rise 51 times from its current level.

Now that ordinary people can earn more interest income, how can they trade their way out of poverty caused by inflation?

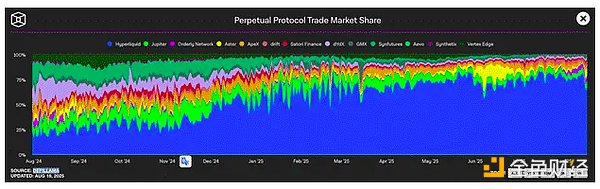

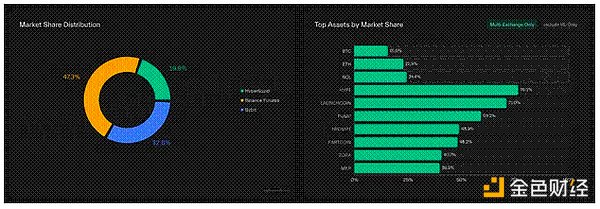

Trading Stablecoins

The most harmful effect of global currency devaluation is that it forces everyone, if they do not already possess a large amount of financial assets, to become speculators to maintain their standard of living. As more people around the world suffer from rampant fiat currency devaluation and now save on-chain through stablecoins, they will trade the only asset class that can help them speculate their way out of inevitable poverty—cryptocurrencies. The current preferred on-chain trading venue is Hyperliquid (token: HYPE), which holds a 67% market share of DEX. Hyperliquid is so transformative that it is rapidly competing against centralized exchanges (CEX) like Binance. By the end of this cycle, Hyperliquid will become the largest cryptocurrency exchange of any type, and Jeff Yan (founder of Hyperliquid) may be wealthier than Binance's founder and former CEO CZ. The old king is dead. Long live the new king!

The theory that DEX will consume all other types of exchanges is not new. What is new in the case of Hyperliquid is the execution capability of the team. Jeff Yan has built a team of about ten people, capable of delivering better products faster than any other centralized or decentralized team in the field.

The best way to understand Hyperliquid is to view it as a decentralized version of Binance. Since Tether and other stablecoins primarily power Binance's banking channels, we can consider Binance as the predecessor of Hyperliquid. Hyperliquid also relies entirely on stablecoin infrastructure to acquire deposits, but it offers an on-chain trading experience. With the launch of HIP-3, Hyperliquid is rapidly transforming into a permissionless giant for derivatives and spot trading. Any application that wants a liquidity central limit order book with real-time margining can integrate any derivatives market they desire through the HIP-3 infrastructure.

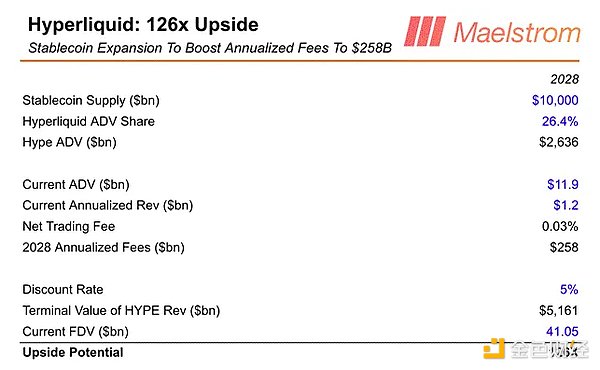

My prediction is that by the end of this cycle, Hyperliquid will become the largest cryptocurrency exchange of any type, and the growth of stablecoin circulation to $10 trillion will supercharge this growth. Using Binance as an example, we can predict Hyperliquid's average daily trading volume (ADV) given the current level of stablecoin supply.

Currently, Binance's average daily trading volume for perpetual contracts is $73 billion, with a total stablecoin supply of $277 billion; the ratio is 26.4%. You will see this represented in the model as Hyperliquid ADV Share.

I believe HYPE can rise 126 times from its current level.

Finally, I want to talk about my most exciting junk coin stablecoin project, as it is about to conduct a token issuance.

Collateralized Stablecoins

With millions, and possibly billions, of people using stablecoins, how will non-crypto businesses leverage this new form of payment? Most businesses in the world face payment issues. They are charged excessive fees by payment processors, and often banks are simply unwilling to deal with them. However, as stablecoins are held by more users, businesses can free themselves from the grasp of greedy traditional financial institutions. While this is a great aspiration, businesses need an easy-to-implement tech stack that enables them to accept stablecoin payments, pay suppliers and taxes in local currency, and accurately account for cash flow.

Codex is a dedicated blockchain project for stablecoins. They are not currently an issuer but provide the ability for businesses to process stablecoin-to-stablecoin, stablecoin-to-fiat, and fiat-to-stablecoin payments. Remember Fernando and his click farm. He needs to pay some of his employees in pesos to their local bank accounts. With Codex, Fernando can receive stablecoins from clients and convert a portion of those stablecoins into pesos, directly depositing them into local bank accounts. Codex has already launched this feature and achieved $100 million in transaction volume in its first month.

The reason I am so excited about Codex relates to the disintermediation of traditional financial global transaction banking. Yes, this is a massive total addressable market (TAM), but the more transformative and currently untapped business is providing credit to small and medium-sized enterprises (SMEs) that previously could not access working capital financing. Today, Codex only provides less than a day's worth of credit to the safest payment service providers (PSPs) and fintech companies, but tomorrow, Codex could offer longer-term loans to SMEs. If an SME operates entirely on-chain and uses Codex for stablecoin payments, it can implement triple-entry bookkeeping.

The improvement of triple-entry bookkeeping over double-entry bookkeeping is that, since all income and expenditure transactions are on-chain, Codex can calculate net income and cash flow statements for SMEs in real-time using incorruptible data. Based on this incorruptible data, Codex can confidently provide loans to SMEs, believing that the fundamentals of the business will enable it to repay the principal and interest on time. Currently, in most developing countries, and to some extent in developed countries, SMEs find it difficult or impossible to obtain bank loans. Banks understandably hesitate to take on risks because they fear that the retrospective accounting data they receive is fraudulent. Therefore, banks only lend to large corporations or politically connected elites.

In my vision, Codex will become the largest and most influential financial institution for the Global South by using stablecoin infrastructure to lend to SMEs, followed by developed countries outside the U.S. Codex will truly become the first real crypto bank.

Codex is still in its early stages, but if the founders succeed, they will make their users and token holders incredibly wealthy. Before Maelstrom took on this advisory role, I ensured that the founders were prepared to pursue a tokenomics strategy similar to Hyperliquid. From day one, the revenue earned will flow back to token holders. They may conduct a round of financing. But I want to ensure the world knows that there is already a real stablecoin infrastructure project that is processing real transaction volumes today and is about to conduct a token generation event (TGE). It’s time to board a faster-than-light (FTL) spaceship.

Bessent's Control

To what extent Bessent will intimidate Eurodollar and non-dollar bank depositors around the world depends on the spending trajectory of the U.S. government. I am confident that Bessent's boss, President Trump, has no intention of balancing the budget, cutting taxes, or reducing spending. I know this because Trump has told his Team Red Republican colleagues that they are too obsessed with cutting spending. He has more or less joked that they still need to win the 2026 election. Trump has no other ideology besides winning. In a late-stage capitalist democratic republic, political winners distribute benefits in exchange for votes. Therefore, Bessent will run rampant, with no Officer Starling around to stop him.

As government deficits continue to expand and U.S. hegemony declines, it will become unfeasible to significantly increase tax revenue. Therefore, Bessent will shove more and more debt down the market's throat. However, when the clear policy of the responsible party is to weaken a currency, the market does not want to hold debt denominated in that currency. Therefore, using stablecoins as a Treasury bond absorber, it is time to paint the skin with dollars; otherwise, sanctions will be imposed again.

Bessent will widely and fiercely wield his sanctions stick to ensure that stablecoins pegged to the dollar will isolate capital from Eurodollars and non-U.S. retail bank deposits back to the domestic market. He will enlist tech bros like Zuckerberg and Musk to spread the gospel to far-off uncivilized barbarian tribes. These broligarchs will be more than happy to don the flag and push dollar-pegged stablecoins to their non-U.S. users, regardless of local regulators' preferences, because they are patriots!

If I am correct, we will see news headlines involving these themes:

The necessity of regulating the offshore dollar market (i.e., Eurodollars)

Linking the use of Federal Reserve and/or Treasury central bank dollar swap lines to certain aspects of opening digital markets to U.S. tech companies.

Proposing regulations requiring stablecoin issuers to deposit dollars in U.S. bank branches and/or hold Treasury bonds.

Encouraging stablecoin issuers to list on U.S. stock markets

Major U.S. tech companies adding crypto wallets to their social media applications

Members of the Trump administration making generally positive statements about the use of stablecoins

Maelstrom will continue to be very optimistic about the stablecoin vertical, holding positions in ENA, ETHFI, and HYPE. We always look to the future; therefore, you will hear more about Codex, as I believe it will become the protagonist of stablecoin infrastructure.

Pass me that dollar lotion (referring to stablecoin inflows), I'm feeling a bit dry (referring to the need for capital inflows).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。