Indian Government Issues Section 133(6) Notices in India Crypto Market

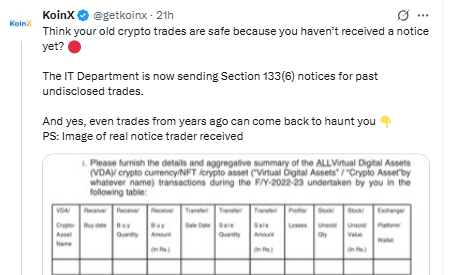

Many traders assumed their past transactions were safe, but that’s no longer the case. The Indian Income Tax Department has started sending Section 133(6) notices to people who didn’t report earlier trades. Even transactions made years ago are being questioned.

This marks a big step in the government’s effort to bring the India Crypto market under strict compliance.

Source: X (Previously Twitter)

What Section 133(6) Really Means

Section 133(6) is a legal tool that gives tax officers the right to ask for almost any financial record.

This could be:

-

Bank Statements

-

Exchange Data

-

Wallet Histories

-

Detailed explanations for mismatches.

For those dealing in India Crypto Tax , it means the tax department now has the power to revisit trades you thought were long forgotten.

Why Are These Notices Being Sent?

The notices are not arbitrary. Officials are going after instances of mismatch between reported income and actual transactions.

Reasons include TDS deducted but no tax return, non-filing even where there is taxable income, and mismatches in Form 26AS or AIS.

In most instances, individuals concealed their cryptocurrencies transactions using decentralized exchanges or offshore wallets, which are currently being monitored. Wrong deduction claims have also set notices off.

The Cost of Ignoring a Notice

Not responding to the notice is risky. The tax department can impose daily penalties, reassess past returns, and fine up to 200% of the tax avoided.

In rare cases, ignoring could even lead to prosecution. For India Crypto traders, the message is clear silence won’t protect you, it only increases your trouble.

What to Do If You Receive One

If you’ve already received a Section 133(6) notice, the best step is to act quickly and carefully. Gather your transaction records, cross-check TDS entries, and be ready to explain any differences.

Because each case is unique, some traders are seeking the advice from experts. The situation is now being assisted by platforms such as KoinX, who guide the India Crypto investors through the process, so that they can adequately respond in line with it and avoid any further penalties.

Remaining Safe in the Future

For the ones who have not yet received a notice, prevention is the best option. Keep proper records of all trades, check Form 26AS and AIS for mismatches periodically, and disclose all wallets and exchanges in your return.

Filing timely with a correct Schedule VDA report has become obligatory for all active in the India Crypto market.

What It Means for India Crypto Traders?

This crackdown is an indicator of how seriously the government is taking crypto these days. By going back to past trades, it is clearly sending out a message that clandestine income will never remain clandestine.

For traders, this is a wake-up call. The Indian Cryptocurrency market is expanding rapidly, but with expansion comes accountability. Being rule-compliant is no longer a choice, it's the only choice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。